Money and Finance

Buffett famously has a "too hard" pile where most stock ideas wind up. One of the hallmarks of his approach is avoiding complex situations, he is not going to try and figure out the next Genentech or Google.

Buffett famously has a "too hard" pile where most stock ideas wind up. One of the hallmarks of his approach is avoiding complex situations, he is not going to try and figure out the next Genentech or Google.

On the other side, the polar opposite of "too hard" is Beast Mode - if you have the ball on the one yard line, hand the ball to Marshawn Lynch (disclosure: I am a Pats fan and glad that this did not happen). The point is that just like buying things that are too complex can you get you into trouble, and why you need a "too hard" pile. You can also miss good ideas by overthinking things, and that's where beast mode applies.

A good example here in my view is Exxon Mobil. Its impossible to consider all of the things that drive energy prices. But its very possible to look at Exxon's long history and see that Exxon yielding 3+% just does not happen that often and when it does its been a good bargain.

This is not to say that big picture complexity doesn't matter. It does and will in the short term, but Exxon has next to no debt (0.1 Debt/Equity) so they have the strength to see it through to the other side. Plus, Exxon has raised its dividend 9.8% on an annualized basis over the last ten years. The yield has not been this attractive in the last decade even including the crisis. Generally speaking, buying companies at crisis prices has worked out well.

Given that plus the fact that Exxon lowest ROE in the last ten years is 17%, and a 33% payout ratio that leaves plenty of room to grow the dividend, taken together this makes Exxon a solid pick for the 10th pick in the WMD portfolio.

As much as investors cheered on Apple's record quarter, from a defensive standpoint Exxon's is just as remarkable. Consider the smaller companies and drillers are cutting dividends, but Exxon has scale and refineries to generate cash in a downturn. There are other big integrated players, but Royal Dutch Shell has no way to grow its dividend because its payout ratio is north of 70% and are cutting capex. Chevron is in better shape but they had to suspend buy backs. That leaves Exxon who did not do layoffs, still plans to buy back $1B of shares in Q1, and has a very safe dividend. There are lots of ways that investors can make money from the energy downturn, but from defensive standpoint, Exxon stands alone.

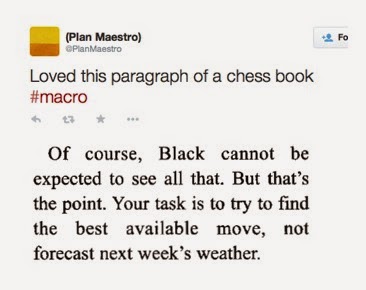

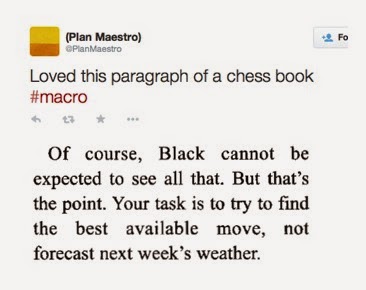

Bottom line is that overthinking the macro environment can cause investors to miss simple, effective ideas. That's not to say investing is simple, the safety and quality checks must be in place. It is important to remember where the individual investor's advantage lies, which is patience and longer time horizon; trying to establish an edge of near term oil prices is not a path to paydirt.

- Sixth Pick In The Wmd Portfolio - Spectra Energy

The more real they are, the more fun blogs are to follow. So in that spirit, rather than talking about ideas in the abstract I maintain a hypothetical portfolio to track ideas where I'll semi-regularly (and hypothetically) invest and track buying...

- Dividend Compass Cup Match 10 - Exxon Mobil Vs Wal-mart

Here in match 10, we are in the second round of the Dividend Compass Up, the winner will go on to the Final four. We have two formidable companies, with real earnings power- a Texarkana border battle - Exxon Mobil vs Wal-mart. The Dividend Compass Cup...

- The Wine Cellar - The Remarkable True Story Of A $146,194-per-year Income Portfolio

Brian Richards reports on the science fiction writer Hayford Peirce's $146,194 per year Income portfolio. It is a concentrated high yield portfolio: Three common stocks (Altria, J&J, Philip Morris International)Nine master limited partnerships...

- June Dividend Update

Happy 4th of July for those of you in the USA. Time for my June update. This months dividend total was a new record high for me at $288.03 which is up 14% from the $252.03 that I made last quarter in March. In comparison, last years June total was $227.91...

- Recent Buy - Exxon (xom)

Wow another purchase, that makes two this month after my Unilever buy. I had a standing order to purchase shares of XOM and it triggered my limit order the other day as the markets were tanking. I've had my eye on some energy stocks for some time...

Money and Finance

What Your Portfolio Can Learn from Beast Mode

On the other side, the polar opposite of "too hard" is Beast Mode - if you have the ball on the one yard line, hand the ball to Marshawn Lynch (disclosure: I am a Pats fan and glad that this did not happen). The point is that just like buying things that are too complex can you get you into trouble, and why you need a "too hard" pile. You can also miss good ideas by overthinking things, and that's where beast mode applies.

A good example here in my view is Exxon Mobil. Its impossible to consider all of the things that drive energy prices. But its very possible to look at Exxon's long history and see that Exxon yielding 3+% just does not happen that often and when it does its been a good bargain.

XOM Dividend Yield (TTM) data by YCharts

This is not to say that big picture complexity doesn't matter. It does and will in the short term, but Exxon has next to no debt (0.1 Debt/Equity) so they have the strength to see it through to the other side. Plus, Exxon has raised its dividend 9.8% on an annualized basis over the last ten years. The yield has not been this attractive in the last decade even including the crisis. Generally speaking, buying companies at crisis prices has worked out well.

Given that plus the fact that Exxon lowest ROE in the last ten years is 17%, and a 33% payout ratio that leaves plenty of room to grow the dividend, taken together this makes Exxon a solid pick for the 10th pick in the WMD portfolio.

As much as investors cheered on Apple's record quarter, from a defensive standpoint Exxon's is just as remarkable. Consider the smaller companies and drillers are cutting dividends, but Exxon has scale and refineries to generate cash in a downturn. There are other big integrated players, but Royal Dutch Shell has no way to grow its dividend because its payout ratio is north of 70% and are cutting capex. Chevron is in better shape but they had to suspend buy backs. That leaves Exxon who did not do layoffs, still plans to buy back $1B of shares in Q1, and has a very safe dividend. There are lots of ways that investors can make money from the energy downturn, but from defensive standpoint, Exxon stands alone.

Bottom line is that overthinking the macro environment can cause investors to miss simple, effective ideas. That's not to say investing is simple, the safety and quality checks must be in place. It is important to remember where the individual investor's advantage lies, which is patience and longer time horizon; trying to establish an edge of near term oil prices is not a path to paydirt.

- Sixth Pick In The Wmd Portfolio - Spectra Energy

The more real they are, the more fun blogs are to follow. So in that spirit, rather than talking about ideas in the abstract I maintain a hypothetical portfolio to track ideas where I'll semi-regularly (and hypothetically) invest and track buying...

- Dividend Compass Cup Match 10 - Exxon Mobil Vs Wal-mart

Here in match 10, we are in the second round of the Dividend Compass Up, the winner will go on to the Final four. We have two formidable companies, with real earnings power- a Texarkana border battle - Exxon Mobil vs Wal-mart. The Dividend Compass Cup...

- The Wine Cellar - The Remarkable True Story Of A $146,194-per-year Income Portfolio

Brian Richards reports on the science fiction writer Hayford Peirce's $146,194 per year Income portfolio. It is a concentrated high yield portfolio: Three common stocks (Altria, J&J, Philip Morris International)Nine master limited partnerships...

- June Dividend Update

Happy 4th of July for those of you in the USA. Time for my June update. This months dividend total was a new record high for me at $288.03 which is up 14% from the $252.03 that I made last quarter in March. In comparison, last years June total was $227.91...

- Recent Buy - Exxon (xom)

Wow another purchase, that makes two this month after my Unilever buy. I had a standing order to purchase shares of XOM and it triggered my limit order the other day as the markets were tanking. I've had my eye on some energy stocks for some time...