Money and Finance

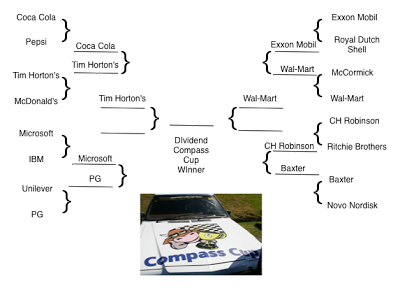

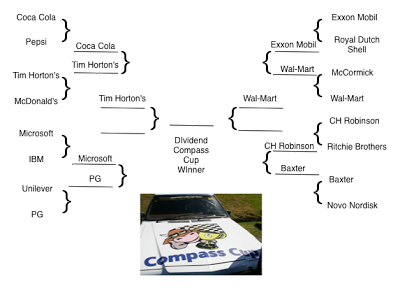

Here in match 10, we are in the second round of the Dividend Compass Up, the winner will go on to the Final four. We have two formidable companies, with real earnings power- a Texarkana border battle - Exxon Mobil vs Wal-mart.

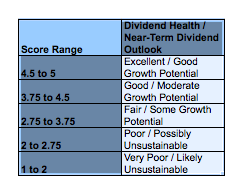

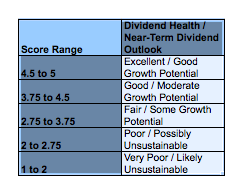

The Dividend Compass Cup rules are straightforward, we run the two quality, wide moat companies through the Dividend Compass to analyze which is the more interesting investing candidate. Todd Wenning's Dividend Compass scores them 1-5.

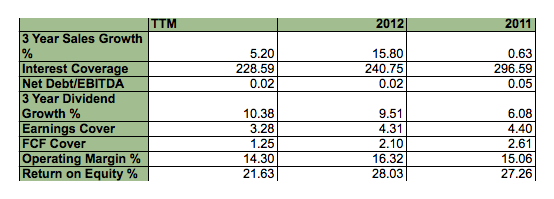

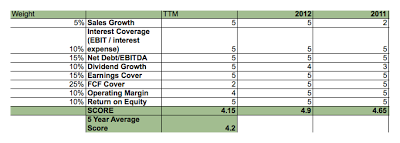

First up Exxon Mobil, basically no debt, increasing dividend growth and solid ROE.

Exxon Mobil Metrics

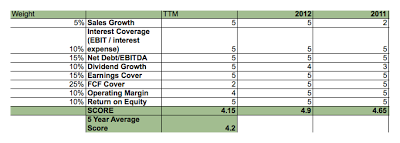

Biggest worrying sign for Exxon is the slowing FCF cover which is a big concern for income investors and so counts for a lot in the Dividend Compass. A solid 4.3 five year average, is a respectable outing for Exxon.

Biggest worrying sign for Exxon is the slowing FCF cover which is a big concern for income investors and so counts for a lot in the Dividend Compass. A solid 4.3 five year average, is a respectable outing for Exxon.

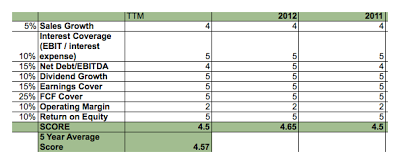

Exxon Mobil scores

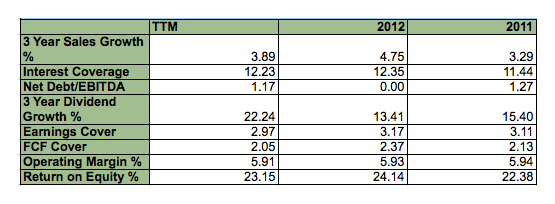

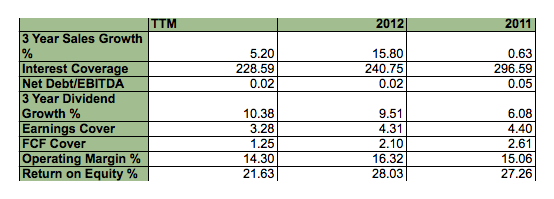

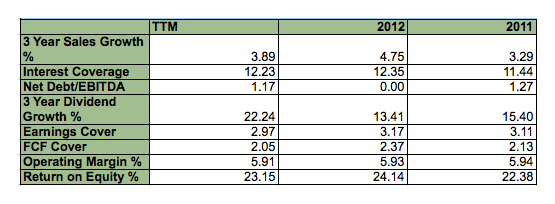

Wal-mart is no dividend slouch. Its dividend is double covered both on FCF and Earnings. Plenty of room to grow and/or absorb slowdown. On the plus side, there is still slow but steady growth, and excellent dividend growth.

Wal-mart metrics

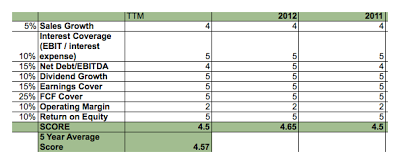

Put it all together and you get a sizzling 4.57 five year averages. About the only area Wal-mart struggles is margins, and frankly - how concerned should we be about that? After all, its the Bentonville business model.

Wal-mart score:

Exxon Mobil has a great track record, but Wal-mart is simply playing at a different level here, even their negatives, in my view, are not really that negative and their positives are super impressive. Todd Wenning highlighted a great quote from Neil Woodford - "In the short-term, share prices are buffeted by all sorts of influences, but over longer-time periods fundamentals shine through. Dividend growth is the key determinant of long-term share price movements, the rest is sentiment." Based on their cover, and their commitment to raises, looks like plenty of dividend growth ahead for Wal-mart. They are through to the Final Four where they await the winner of Baxter and CH Robinson

- Dividend Compass Final Four- Walmart V Baxter

We are down to the second to last match, the second Final Four matchup. In the first match, Microsoft beat out Tim Horton's. Next up, its Walmart versus Baxter. The Dividend Compass Cup rules are straightforward, we run the two quality, wide moat...

- Dividend Compass Cup Match 12- Ch Robinson Vs Baxter

For the final match to determine our Final Four its CH Robinson versus Baxter. The Dividend Compass Cup rules are straightforward, we run the two quality, wide moat companies through the Dividend Compass to analyze which is the more interesting...

- Dividend Compass Cup Match 11- Microsoft Vs Procter & Gamble

Last match, we had dueling blue chip behemoths Exxon Mobil falling to Wal-mart. This match is old economy versus new economy. Soap versus SOAP. Detergent versus databases. Can Procter & Gamble's heritage which dates to the 19th century fend...

- Dividend Compass Match 6- Mccormick Spice Vs Wal-mart

In Match 5 is TIm Horton's squeaked by McDonald's. In Match 6, we have to answer the question - is it better to invest in a company with products sold at Wal-mart or invest in Wal-mart directly? The answer will determine who goes on to the next...

- Dividend Compass Cup October 2013 - Sweet Sixteen

Thanks to DC shenanigans, deeply immoral and irresponsible though they may be, there's starting to be some better prices on interesting companies. This seems like a good time to run Todd Wenning's Dividend Compass. Todd explains the tool here,...

Money and Finance

Dividend Compass Cup Match 10 - Exxon Mobil vs Wal-mart

Here in match 10, we are in the second round of the Dividend Compass Up, the winner will go on to the Final four. We have two formidable companies, with real earnings power- a Texarkana border battle - Exxon Mobil vs Wal-mart.

The Dividend Compass Cup rules are straightforward, we run the two quality, wide moat companies through the Dividend Compass to analyze which is the more interesting investing candidate. Todd Wenning's Dividend Compass scores them 1-5.

First up Exxon Mobil, basically no debt, increasing dividend growth and solid ROE.

Exxon Mobil Metrics

Exxon Mobil scores

Wal-mart metrics

Put it all together and you get a sizzling 4.57 five year averages. About the only area Wal-mart struggles is margins, and frankly - how concerned should we be about that? After all, its the Bentonville business model.

Wal-mart score:

Exxon Mobil has a great track record, but Wal-mart is simply playing at a different level here, even their negatives, in my view, are not really that negative and their positives are super impressive. Todd Wenning highlighted a great quote from Neil Woodford - "In the short-term, share prices are buffeted by all sorts of influences, but over longer-time periods fundamentals shine through. Dividend growth is the key determinant of long-term share price movements, the rest is sentiment." Based on their cover, and their commitment to raises, looks like plenty of dividend growth ahead for Wal-mart. They are through to the Final Four where they await the winner of Baxter and CH Robinson

- Dividend Compass Final Four- Walmart V Baxter

We are down to the second to last match, the second Final Four matchup. In the first match, Microsoft beat out Tim Horton's. Next up, its Walmart versus Baxter. The Dividend Compass Cup rules are straightforward, we run the two quality, wide moat...

- Dividend Compass Cup Match 12- Ch Robinson Vs Baxter

For the final match to determine our Final Four its CH Robinson versus Baxter. The Dividend Compass Cup rules are straightforward, we run the two quality, wide moat companies through the Dividend Compass to analyze which is the more interesting...

- Dividend Compass Cup Match 11- Microsoft Vs Procter & Gamble

Last match, we had dueling blue chip behemoths Exxon Mobil falling to Wal-mart. This match is old economy versus new economy. Soap versus SOAP. Detergent versus databases. Can Procter & Gamble's heritage which dates to the 19th century fend...

- Dividend Compass Match 6- Mccormick Spice Vs Wal-mart

In Match 5 is TIm Horton's squeaked by McDonald's. In Match 6, we have to answer the question - is it better to invest in a company with products sold at Wal-mart or invest in Wal-mart directly? The answer will determine who goes on to the next...

- Dividend Compass Cup October 2013 - Sweet Sixteen

Thanks to DC shenanigans, deeply immoral and irresponsible though they may be, there's starting to be some better prices on interesting companies. This seems like a good time to run Todd Wenning's Dividend Compass. Todd explains the tool here,...