Money and Finance

The more real they are, the more fun blogs are to follow. So in that spirit, rather than talking about ideas in the abstract I maintain a hypothetical portfolio to track ideas where I'll semi-regularly (and hypothetically) invest and track buying (and where required selling) shares.

For tracking purposes I will use $1,000 to keep it nice and simple. The overall goal is long run income and dividend growth. Portfolio page with goals and tracking is here.

With all the churn in energy prices, prices reverting back to long term lows, there will be winners and losers. We are already starting to see losers shake out of the process. But what about winners? The big integrated companies like Exxon and Chevron are weathering the storm pretty well. I would like to add one of these type of companies to the WMD portfolio at some point, but at the same time the fact they are weathering the storm means the shares are not as cheap relative to the rest of energy. What about smaller E&P? These are pretty risky and while I am sure there are bargains, I am also sure I am not smart enough to know which ones are the right ones to pick.

But whether through ETFs or bots or other reasons, there does seem to be interesting knock on effects in many parts of the energy space. Pipeline operators are also getting blown away, but some of these have limited direct exposure to the price of oil or gas at any given time. One of these is Spectra Energy, which is mainly in natural gas, not oil.

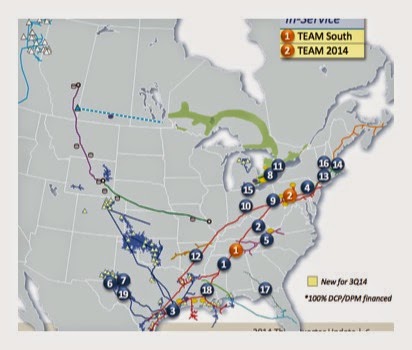

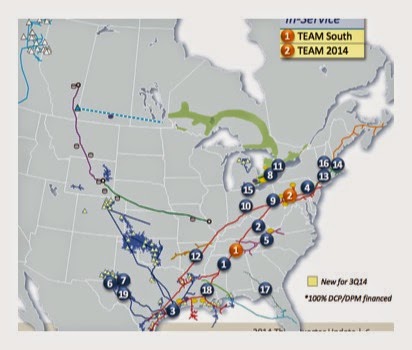

Spectra's pipelines give it the ability to move natural gas across most of the eastern US and beyond.

Spectra's yield is at 3.7%, the company announced a 10.5% dividend increase for Q4. The company has a long list of projects in motion and a well covered distribution so it should be able to deliver double digit dividend growth for near to mid term. I am sure there are better bargain prices in energy than Spectra. But Spectra's 3.7% yield offers a fair deal for quality income over the long haul.

- Ninth Pick In The Wmd Portfolio - Rolls-royce Holdings

The more real they are, the more fun blogs are to follow. So in that spirit, rather than talking about ideas in the abstract I maintain a hypothetical portfolio to track ideas where I'll semi-regularly (and hypothetically) invest and track buying...

- Eighth Pick In The Wmd Portfolio - Diageo

The more real they are, the more fun blogs are to follow. So in that spirit, rather than talking about ideas in the abstract I maintain a hypothetical portfolio to track ideas where I'll semi-regularly (and hypothetically) invest and track buying...

- Second & Third Picks In Wmd Portfolio - Glaxosmithkline & Ibm

The more real they are, the more fun blogs are to follow. So in that spirit, rather than talking about ideas in the abstract I maintain a hypothetical portfolio to track ideas where I'll semi-regularly (and hypothetically) invest and track buying...

- First Pick In Wmd Portfolio - Coca Cola

The more real they are, the more fun blogs are to follow. So in that spirit, rather than talking about ideas in the abstract I am launching a hypothetical portfolio to track ideas where I'll semi-regularly (and hypothetically) invest and track buying...

- Wmd Portfolio

For tracking purposes, I am launching the WMD Portfolio - a journey in search of Wide Moat Dividends. This is an idea tracking portfolio, rather than just tracking ideas as tickers its more interesting to simulate the process to see weight and growth...

Money and Finance

Sixth Pick in the WMD Portfolio - Spectra Energy

The more real they are, the more fun blogs are to follow. So in that spirit, rather than talking about ideas in the abstract I maintain a hypothetical portfolio to track ideas where I'll semi-regularly (and hypothetically) invest and track buying (and where required selling) shares.

For tracking purposes I will use $1,000 to keep it nice and simple. The overall goal is long run income and dividend growth. Portfolio page with goals and tracking is here.

With all the churn in energy prices, prices reverting back to long term lows, there will be winners and losers. We are already starting to see losers shake out of the process. But what about winners? The big integrated companies like Exxon and Chevron are weathering the storm pretty well. I would like to add one of these type of companies to the WMD portfolio at some point, but at the same time the fact they are weathering the storm means the shares are not as cheap relative to the rest of energy. What about smaller E&P? These are pretty risky and while I am sure there are bargains, I am also sure I am not smart enough to know which ones are the right ones to pick.

But whether through ETFs or bots or other reasons, there does seem to be interesting knock on effects in many parts of the energy space. Pipeline operators are also getting blown away, but some of these have limited direct exposure to the price of oil or gas at any given time. One of these is Spectra Energy, which is mainly in natural gas, not oil.

Spectra's pipelines give it the ability to move natural gas across most of the eastern US and beyond.

Spectra's yield is at 3.7%, the company announced a 10.5% dividend increase for Q4. The company has a long list of projects in motion and a well covered distribution so it should be able to deliver double digit dividend growth for near to mid term. I am sure there are better bargain prices in energy than Spectra. But Spectra's 3.7% yield offers a fair deal for quality income over the long haul.

- Ninth Pick In The Wmd Portfolio - Rolls-royce Holdings

The more real they are, the more fun blogs are to follow. So in that spirit, rather than talking about ideas in the abstract I maintain a hypothetical portfolio to track ideas where I'll semi-regularly (and hypothetically) invest and track buying...

- Eighth Pick In The Wmd Portfolio - Diageo

The more real they are, the more fun blogs are to follow. So in that spirit, rather than talking about ideas in the abstract I maintain a hypothetical portfolio to track ideas where I'll semi-regularly (and hypothetically) invest and track buying...

- Second & Third Picks In Wmd Portfolio - Glaxosmithkline & Ibm

The more real they are, the more fun blogs are to follow. So in that spirit, rather than talking about ideas in the abstract I maintain a hypothetical portfolio to track ideas where I'll semi-regularly (and hypothetically) invest and track buying...

- First Pick In Wmd Portfolio - Coca Cola

The more real they are, the more fun blogs are to follow. So in that spirit, rather than talking about ideas in the abstract I am launching a hypothetical portfolio to track ideas where I'll semi-regularly (and hypothetically) invest and track buying...

- Wmd Portfolio

For tracking purposes, I am launching the WMD Portfolio - a journey in search of Wide Moat Dividends. This is an idea tracking portfolio, rather than just tracking ideas as tickers its more interesting to simulate the process to see weight and growth...