Money and Finance

Wow another purchase, that makes two this month after my Unilever buy. I had a standing order to purchase shares of XOM and it triggered my limit order the other day as the markets were tanking. I've had my eye on some energy stocks for some time as they have been taking a bit of a beating with oil dropping like a rock. I could have bought more Chevron as well but I'm fully invested in CVX right now. It is my largest holding and although I'd be averaging down I thought it might be a good idea to add some diversity and purchase Exxon instead.

Wow another purchase, that makes two this month after my Unilever buy. I had a standing order to purchase shares of XOM and it triggered my limit order the other day as the markets were tanking. I've had my eye on some energy stocks for some time as they have been taking a bit of a beating with oil dropping like a rock. I could have bought more Chevron as well but I'm fully invested in CVX right now. It is my largest holding and although I'd be averaging down I thought it might be a good idea to add some diversity and purchase Exxon instead.

I knew at the $90 mark XOM should be at a 3% yield and that's great for XOM which has an average 5 yr yield at 2.4% and has a 3yr dividend growth rate of 13.4% as well. Morningstar has set a $108 fair value target for Exxon. Exxon may continue to drop with oil so I may buy here and there if it falls. Stay tuned !

I purchased 14 shares of XOM at $90.00 for my initial position in the company.

Exxon Mobil Corporation is engaged in energy, involving exploration for, and production of, crude oil and natural gas, manufacture of petroleum products and transportation and sale of crude oil, natural gas and petroleum products.

- What Your Portfolio Can Learn From Beast Mode

Buffett famously has a "too hard" pile where most stock ideas wind up. One of the hallmarks of his approach is avoiding complex situations, he is not going to try and figure out the next Genentech or Google. On the other side, the polar opposite of "too...

- Dividend Compass Match 2 - Exxon Mobil Vs Royal Dutch Shell

In Match 1 of the Dividend Compass Cup, we had Coca Cola narrowly defeating Pepsi. The Dividend Compass Cup rules are straightforward, we run the two quality, wide moat companies through the Dividend Compass to analyze which is the more interesting investing...

- June Dividend Update

Happy 4th of July for those of you in the USA. Time for my June update. This months dividend total was a new record high for me at $288.03 which is up 14% from the $252.03 that I made last quarter in March. In comparison, last years June total was $227.91...

- Recent Buy - Kinder Morgan (kmi)

Today I purchased another 31 shares of Kinder Morgan (KMI) at $37.46 which now gives me a grand total of 93 shares. I would have loved to buy this at the prices we saw in April but KMI has been on a roll as the rest of the markets seem to have been. This...

- Recent Buy - Chevron (cvx)

I recently picked up another 10 shares of the energy giant Chevron after their recent dividend increase announcement. In an effort to balance my monthly dividend totals I had been trying to choose a stock to purchase for the end of the quarter. I already...

Money and Finance

Recent Buy - Exxon (XOM)

I knew at the $90 mark XOM should be at a 3% yield and that's great for XOM which has an average 5 yr yield at 2.4% and has a 3yr dividend growth rate of 13.4% as well. Morningstar has set a $108 fair value target for Exxon. Exxon may continue to drop with oil so I may buy here and there if it falls. Stay tuned !

I purchased 14 shares of XOM at $90.00 for my initial position in the company.

Exxon Mobil Corporation is engaged in energy, involving exploration for, and production of, crude oil and natural gas, manufacture of petroleum products and transportation and sale of crude oil, natural gas and petroleum products.

Exxon Chart

Exxon Basic Statistics

- Ticker Symbol: XOM

- PE Ratio: 11.30 (14.2 forward p/e)

- Yield: 3%

- Dividend Growth: 32 years

- Payout Ratio: 33%

- Market cap: $380b

- Beta: 1.08

- Website: http://www.exxonmobil.com

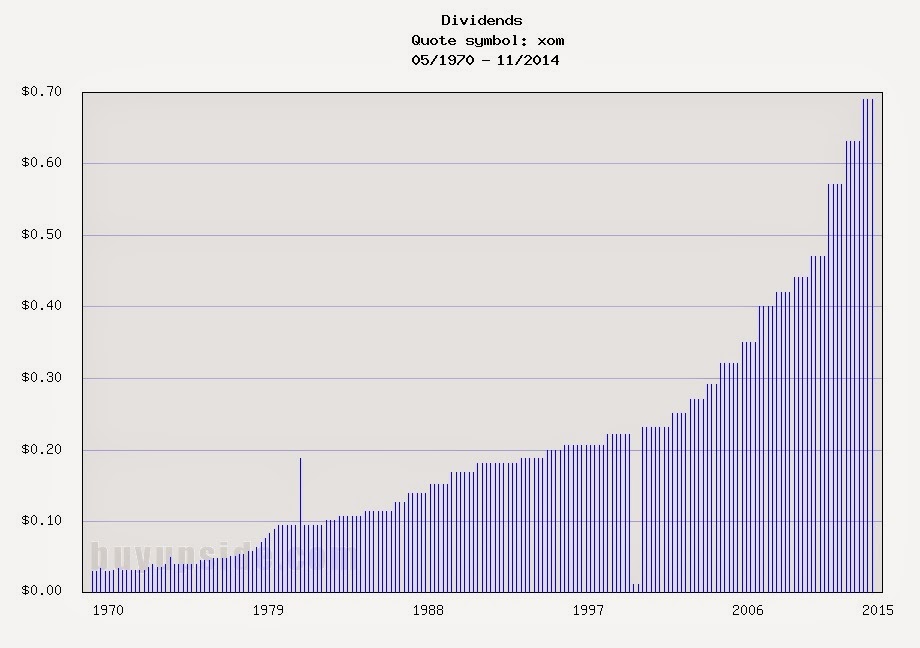

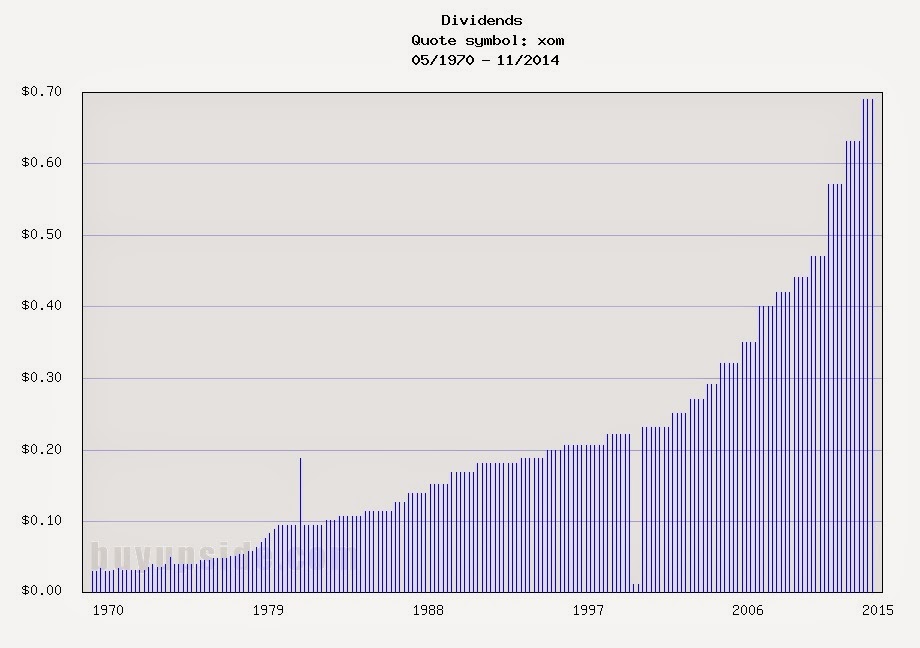

Exxon Dividend Growth Chart

- What Your Portfolio Can Learn From Beast Mode

Buffett famously has a "too hard" pile where most stock ideas wind up. One of the hallmarks of his approach is avoiding complex situations, he is not going to try and figure out the next Genentech or Google. On the other side, the polar opposite of "too...

- Dividend Compass Match 2 - Exxon Mobil Vs Royal Dutch Shell

In Match 1 of the Dividend Compass Cup, we had Coca Cola narrowly defeating Pepsi. The Dividend Compass Cup rules are straightforward, we run the two quality, wide moat companies through the Dividend Compass to analyze which is the more interesting investing...

- June Dividend Update

Happy 4th of July for those of you in the USA. Time for my June update. This months dividend total was a new record high for me at $288.03 which is up 14% from the $252.03 that I made last quarter in March. In comparison, last years June total was $227.91...

- Recent Buy - Kinder Morgan (kmi)

Today I purchased another 31 shares of Kinder Morgan (KMI) at $37.46 which now gives me a grand total of 93 shares. I would have loved to buy this at the prices we saw in April but KMI has been on a roll as the rest of the markets seem to have been. This...

- Recent Buy - Chevron (cvx)

I recently picked up another 10 shares of the energy giant Chevron after their recent dividend increase announcement. In an effort to balance my monthly dividend totals I had been trying to choose a stock to purchase for the end of the quarter. I already...