Money and Finance

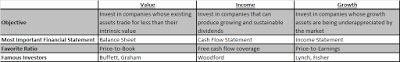

Neil Woodford does not get covered all that much in the US, but there is a lot to like about his approach. Todd Wenning's excellent Income Investor Manifesto post really gets at the heart of the subtle yet crucial difference in the Income investor approach compared to value investing and growth investing schools.

Todd's post clarifies the strategic difference very well. I would add one other factor - its a far easier approach for investors aka humans, to use. A colleague whose work I admire set up his portfolio to invest in very boring, yet essential dividend growth companies. The companies performed well and he has beaten S&P for several years. But the true value revealed itself recently when sadly there was a major family event and he was unable to closely monitor his portfolio. Yet the companies plugged away just fine. This point is lost on a lot of people - there are many things way more important than investing. Your personal and work lives will intervene, and you will very often not have time or inclination to process random events. Tesla may be a great company, but do you want to have to dig through the car fire issues when work is crazy or a major personal event comes along?

In general, a simple hedge against all that is to go for patient quality. Find companies that do not require a twitchy sell finger, hovering over every monthly report, and are unlikely to produce a lot of unclear decision sets.

Woodford's fund just completed its first year, and it thumped the market with a 21% return. The old school ways still work. Its worth noting that US investors can easily clone Woodford's approach.

Recently, Woodford was interviewed on BBC HardTalk here are some snippets:

[Buffett says if you don’t feel comfortable owning something for ten years, then don’t even hold it for ten minutes]

Woodford: I couldn’t agree more, that’s the right philosophy. My investment holding period in my old firm was way beyond ten years. It was as high as fifteen years at one stage…My discipline is to focus on the long term

[So that’s the enemy of faddishness in investing then, because if you are thinking in those 15-20 year chunks of time, then what is hot today is really irrelevant to what you are doing]

Woodford: Yes. And having a very clear discipline on valuation. Making sure you don’t overpay for an investment. I think there are plenty of very good companies that will make very bad investments because the valuation reflects that they’re very good companies. My philosophy is to marry a very strong investment discipline of focusing on valuation with that long term approach.

[Where are the best places to put money today?]

Woodford: 70% of the earnings of UK companies come from non-UK sources. So where the companies are located doesn’t necessarily guide you to where the earnings and cash flows accrue from. So you can get a very internationally exposed portfolio by just investing in the UK. So to some extent I think more about what are the industries and the companies rather than do want to be in emerging markets or Latin America or North America or Europe or whatever. That’s always been my approach.

--

Woodford points out one of the key risks in Income Investing - overpaying.To build on Todd Wenning's manifesto that distinguishes income investing from value and growth:

I suggest to add another row- Key Risk

- The Danger Of Having An Absolute Dividend Yield Target

I think it is possible to deliver a 4 per cent yield and to deliver dividend growth, going forward, but as I say, you must never allow an income target to dictate what you own. - Neil Woodford (UK fund manager) In this low interest rate era, the demand...

- An Easy Mistake Made By Dividend Investors

Dividend investing can seem deceptively easy. If you want to generate, say, a 5% yield from your dividend portfolio, you only need to buy a group of stocks that provide a weighted average yield of 5%. Then just sit back and watch the money roll in. Or...

- The Income Investor's Manifesto

What type of investing strategy do you follow? For years, the answer for investors has generally been limited to "value" or "growth" -- either you adhere to the value principles of Benjamin Graham and Warren Buffett or you follow the trails blazed by...

- Cloning Woodford

Cloning is a great American tradition. Specifically, there's a long history of Americans successfully cloning British ideas, think about "The Office." Who was better David Brent or Michael Scott? Who cares, they were both great. In that spirit let's...

- Three Wise Men On Quality Income Investing

Charlie Munger is a guy who knows how to get to the point. I came to investing for dividends via value investing. It took me a long time to appreciate what the important differences are. Charlie Munger managed to sum it up in on paragraph: "If you buy...

Money and Finance

Neil Woodford BBC Interview

Neil Woodford does not get covered all that much in the US, but there is a lot to like about his approach. Todd Wenning's excellent Income Investor Manifesto post really gets at the heart of the subtle yet crucial difference in the Income investor approach compared to value investing and growth investing schools.

Todd's post clarifies the strategic difference very well. I would add one other factor - its a far easier approach for investors aka humans, to use. A colleague whose work I admire set up his portfolio to invest in very boring, yet essential dividend growth companies. The companies performed well and he has beaten S&P for several years. But the true value revealed itself recently when sadly there was a major family event and he was unable to closely monitor his portfolio. Yet the companies plugged away just fine. This point is lost on a lot of people - there are many things way more important than investing. Your personal and work lives will intervene, and you will very often not have time or inclination to process random events. Tesla may be a great company, but do you want to have to dig through the car fire issues when work is crazy or a major personal event comes along?

In general, a simple hedge against all that is to go for patient quality. Find companies that do not require a twitchy sell finger, hovering over every monthly report, and are unlikely to produce a lot of unclear decision sets.

Woodford's fund just completed its first year, and it thumped the market with a 21% return. The old school ways still work. Its worth noting that US investors can easily clone Woodford's approach.

Recently, Woodford was interviewed on BBC HardTalk here are some snippets:

[Buffett says if you don’t feel comfortable owning something for ten years, then don’t even hold it for ten minutes]

Woodford: I couldn’t agree more, that’s the right philosophy. My investment holding period in my old firm was way beyond ten years. It was as high as fifteen years at one stage…My discipline is to focus on the long term

[So that’s the enemy of faddishness in investing then, because if you are thinking in those 15-20 year chunks of time, then what is hot today is really irrelevant to what you are doing]

Woodford: Yes. And having a very clear discipline on valuation. Making sure you don’t overpay for an investment. I think there are plenty of very good companies that will make very bad investments because the valuation reflects that they’re very good companies. My philosophy is to marry a very strong investment discipline of focusing on valuation with that long term approach.

[Where are the best places to put money today?]

Woodford: 70% of the earnings of UK companies come from non-UK sources. So where the companies are located doesn’t necessarily guide you to where the earnings and cash flows accrue from. So you can get a very internationally exposed portfolio by just investing in the UK. So to some extent I think more about what are the industries and the companies rather than do want to be in emerging markets or Latin America or North America or Europe or whatever. That’s always been my approach.

--

Woodford points out one of the key risks in Income Investing - overpaying.To build on Todd Wenning's manifesto that distinguishes income investing from value and growth:

I suggest to add another row- Key Risk

- Value Investors

- Key Risk - Value Trap

- Income

- Key Risk - Overpaying for quality

- Growth

- Key Risks - insert litany...how much time do you have?

This further illuminates the appeal of patient income investing. Plenty of things can go wrong with growth investments and you have to watch closely how events unfold to tell the difference between a hot new thing and a flash in the pan. Value investing is filled with companies that could turnaround but for different reasons never do. The key downside in Income investing - overpaying - is one of the easier risks to avoid in that the earnings and cash flow based valuations based against historical norms can give investors very useful clues.

The Key Skills required show some variation too. For Growth investors, its about trendspotting. For value investors its contrarian insight or variant perception. For Income Investors its largely buy quality, i.e. don't overpay, and then sit on your ass for long periods (decades) of time.

The Key Skills required show some variation too. For Growth investors, its about trendspotting. For value investors its contrarian insight or variant perception. For Income Investors its largely buy quality, i.e. don't overpay, and then sit on your ass for long periods (decades) of time.

- The Danger Of Having An Absolute Dividend Yield Target

I think it is possible to deliver a 4 per cent yield and to deliver dividend growth, going forward, but as I say, you must never allow an income target to dictate what you own. - Neil Woodford (UK fund manager) In this low interest rate era, the demand...

- An Easy Mistake Made By Dividend Investors

Dividend investing can seem deceptively easy. If you want to generate, say, a 5% yield from your dividend portfolio, you only need to buy a group of stocks that provide a weighted average yield of 5%. Then just sit back and watch the money roll in. Or...

- The Income Investor's Manifesto

What type of investing strategy do you follow? For years, the answer for investors has generally been limited to "value" or "growth" -- either you adhere to the value principles of Benjamin Graham and Warren Buffett or you follow the trails blazed by...

- Cloning Woodford

Cloning is a great American tradition. Specifically, there's a long history of Americans successfully cloning British ideas, think about "The Office." Who was better David Brent or Michael Scott? Who cares, they were both great. In that spirit let's...

- Three Wise Men On Quality Income Investing

Charlie Munger is a guy who knows how to get to the point. I came to investing for dividends via value investing. It took me a long time to appreciate what the important differences are. Charlie Munger managed to sum it up in on paragraph: "If you buy...