Money and Finance

Due to this demand, a common question you’ll read on various dividend-focused message boards is some variant of:

Due to this demand, a common question you’ll read on various dividend-focused message boards is some variant of:

Stay patient, stay focused.

Best,

Todd

@toddwenning on Twitter

- The Evidence For Dividend Growth Investing

This following post is written by Ben Reynolds, who runs the Sure Dividend site. Sure Dividend focuses on high quality dividend growth stocks suitable for long-term investing. Dividend growth stocks are an excellent vehicle to build passive income over...

- The Ten Points Of Income Investing

1. Income investing is a separate and distinct strategy It's not growth, it's not value -- income comes first. (See: The Income Investor's Manifesto) 2. Discipline and patience are behavioral prerequisites Great dividend-producing...

- Ultra High Yield = Ultra High Risk

The first rule of dividend investing (or at least it should be the first rule) is: If the yield is too good to be true, it probably is. In an article I wrote last May, I looked into the highest-yielding stocks on the UK FTSE All-Share and found that...

- Cloning Woodford

Cloning is a great American tradition. Specifically, there's a long history of Americans successfully cloning British ideas, think about "The Office." Who was better David Brent or Michael Scott? Who cares, they were both great. In that spirit let's...

- Wmd Portfolio

For tracking purposes, I am launching the WMD Portfolio - a journey in search of Wide Moat Dividends. This is an idea tracking portfolio, rather than just tracking ideas as tickers its more interesting to simulate the process to see weight and growth...

Money and Finance

The Danger of Having an Absolute Dividend Yield Target

I think it is possible to deliver a 4 per cent yield and to deliver dividend growth, going forward, but as I say, you must never allow an income target to dictate what you own. - Neil Woodford (UK fund manager)

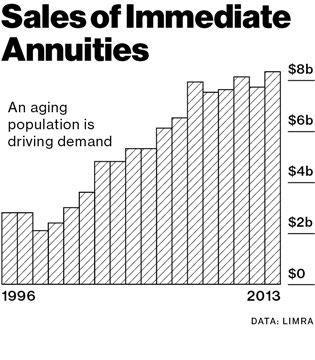

In this low interest rate era, the demand for current income remains strong -- particularly among those living on a fixed income.

Indeed, sales of immediate annuities recently hit a record, even though the buyers are effectively locking in low rates for the life of the contract.

“I need to construct a dividend portfolio that yields (some unreasonable %). What stocks should I buy to achieve this?”

At first glance, it might seem a reasonable approach -- simply buy a few stocks with yields that meet your target yield, and then sit back and watch the cash flow in.

Putting the cart before the horse

As Woodford noted in the aforementioned quote, however, it’s never a good idea to start with an income target - especially a high one - and work backward as it can open up a number of longer-term risks.

To see why, let's say you wanted to build a portfolio with a current yield of 6% today...

1. Increased sector concentration: To achieve such a high yield right now, you'd need to anchor the portfolio in investments like royalty trusts, energy MLPs, and REITs -- and speculative ones at that. The market’s higher-yielding stocks are typically clustered in a few slower-growth (e.g. utilities), troubled, or speculative sectors. For example, such a strategy would have put you into a lot of bank stocks pre-financial crisis. If one thing goes wrong in the sector, your portfolio could be wiped out.

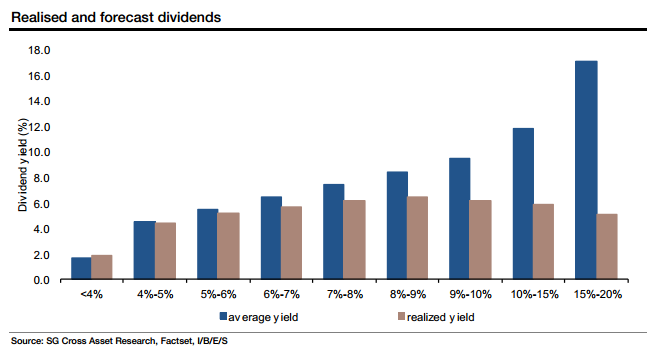

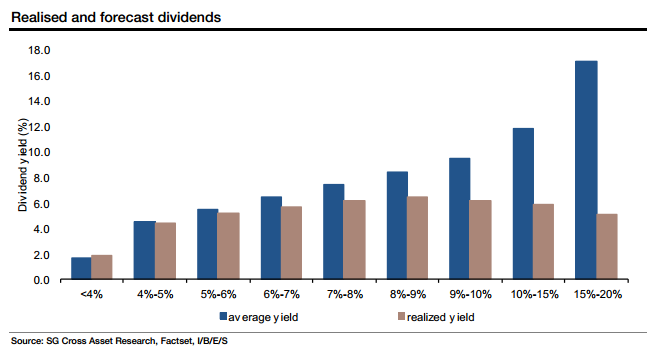

2. Increased risk: At present, the average yield on the S&P 500 is about 2%. When a stock is yielding more than 2x this average - particularly in a period of strong demand for dividend stocks - the market isn't likely pricing in much growth. For ultra-high yields, the market might even price in a dividend cut.

3. Skews your selection process: When you've set an absolute dividend yield target that's far above the market average, you're no longer focused on doing thorough research and building a portfolio of good (and well-bought) companies that can sustain and raise their payouts over time. Instead, your sole focus is on dividend yield and the other important factors are rationalized away.

What to do instead

A better alternative to setting a high and absolute yield target is to set up a relative one like, "at least 25% above the market average." In addition, establish a target dividend growth rate such as, "grow annual income more than 3 percentage points above inflation."

That way you aren't fighting the market while getting above average income, you'll find more quality companies to consider, and you can maintain a longer-term focus (i.e. balancing current and future income).

Stay patient, stay focused.

Best,

Todd

@toddwenning on Twitter

- The Evidence For Dividend Growth Investing

This following post is written by Ben Reynolds, who runs the Sure Dividend site. Sure Dividend focuses on high quality dividend growth stocks suitable for long-term investing. Dividend growth stocks are an excellent vehicle to build passive income over...

- The Ten Points Of Income Investing

1. Income investing is a separate and distinct strategy It's not growth, it's not value -- income comes first. (See: The Income Investor's Manifesto) 2. Discipline and patience are behavioral prerequisites Great dividend-producing...

- Ultra High Yield = Ultra High Risk

The first rule of dividend investing (or at least it should be the first rule) is: If the yield is too good to be true, it probably is. In an article I wrote last May, I looked into the highest-yielding stocks on the UK FTSE All-Share and found that...

- Cloning Woodford

Cloning is a great American tradition. Specifically, there's a long history of Americans successfully cloning British ideas, think about "The Office." Who was better David Brent or Michael Scott? Who cares, they were both great. In that spirit let's...

- Wmd Portfolio

For tracking purposes, I am launching the WMD Portfolio - a journey in search of Wide Moat Dividends. This is an idea tracking portfolio, rather than just tracking ideas as tickers its more interesting to simulate the process to see weight and growth...