Money and Finance

What type of investing strategy do you follow?

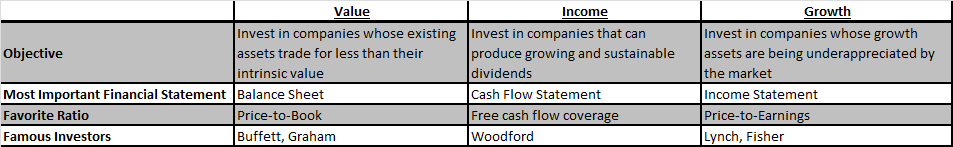

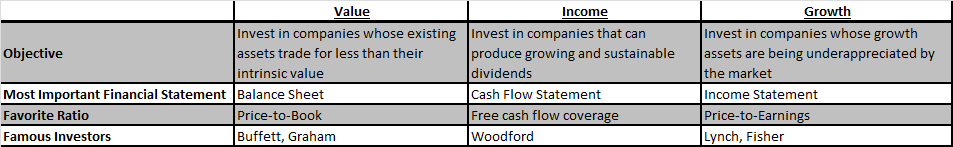

For years, the answer for investors has generally been limited to "value" or "growth" -- either you adhere to the value principles of Benjamin Graham and Warren Buffett or you follow the trails blazed by famous growth investors like Peter Lynch and Philip Fisher.

Now it's time for a third strategy to be fully recognized by the investing community -- income investing.

Distinct strategy

Plenty of academic research supports equity income investing as a distinct strategy, but to date it's been largely considered a sub-category of value investing.

This makes some sense, since a high yield can sometimes be indicative of an undervalued stock, but the objective of a pure income strategy differs from value investing in that its primary focus is to generate a growing and sustainable stream of dividends. Capital gains are an important, yet secondary concern. For value investing, the opposite is true -- indeed, companies don't necessarily need to pay a dividend to make it an attractive investment to a value investor.

Further, income investing has a distinct research process that focuses on a company's ability to sustain and increase its dividend. Where value research typically begins with a company's balance sheet and growth research starts with the income statement, dividend research commences on the cash flow statement.

From the cash flow statement, for instance, we can determine free cash flow coverage, earnings coverage, how the company approaches dividends versus buybacks, debt repayment trends, acquisition trends, and more.

This analysis is critical in determining a company's dividend health and therefore the cash flow statement is the necessary starting point for dividend research.

One thing that income investing doesn't have, however, is a pantheon of heroes like value and growth do. But I think that will change. The leading candidate for the income investing equivalent of Mt. Rushmore is perhaps Neil Woodford who runs a number of income-focused funds in the U.K. including Invesco Perpetual High Income and Edinburgh Investment Trust. Woodford recently celebrated 25 years at Invesco Perpetual High Income and his results have been nothing short of incredible (from ThisIsMoney.co.uk):

Woodford doesn't shy away from making dividend sustainability and growth a primary investing objective. For example, the objective of the Invesco Perpetual High Income fund is to "achieve a high level of income, together with capital growth" and one of the primary objectives of the Edinburgh Invetsment Trust is to grow "dividends per share by more than the rate of UK inflation." Surely these income-focused objectives are distinctly different from those of traditional value investing funds.

Why this matters

At this point you might be rightfully asking, "Isn't this just splitting hairs? Why does this matter now?"

With investors increasingly turning to dividend-paying stocks as a result of low interest rates and demographic changes, now is the ideal time to carve out income investing from the traditional value-growth spectrum.

True, interest rates will eventually increase, but the demographic change will be with us for some time. According to a 2009 study by David E. Bloom, David Canning, and Günther Fink at the Harvard School of Public Health, "The share of the population aged 60 and over is expected to increase dramatically in every country in the world between 2000 and 2050."

The 60+ cohort will increasingly turn toward income-generating securities such as fixed income and dividend-paying stocks. In addition, their investment objectives will shift to capital preservation and further away from capital growth. As such, investors seeking income may not find refuge in either the traditional value or growth strategies, so carving out the income strategy as a separate approach will be helpful to many.

Principles of income investing

The tenets of income investing might be considered to be:

1. Income first: Naturally. The most important difference between income and the value and growth strategies is that its primary focus is on income generation, with capital gains being a secondary concern. More specifically, the focus is on generating a sustainable and growing stream of cash flow (at least the rate of inflation) and avoiding dividend cuts. If this can be accomplished, capital gains should take care of themselves over time.

2. Conservative stock selection: Because capital gains are secondary in the income strategy, adherents have little need to swing for the fences with each investment. A stock doesn't necessarily need to be substantially undervalued (as is the case with value) or have considerable growth potential (as is the case with growth) to be a suitable investment in the income strategy. This doesn't excuse income investors from doing due diligence and valuation work -- far from it! -- but a modestly undervalued stock with moderate growth potential can make for a fine income investment even if it may not pass traditional value and growth screens.

3. Management matters: The income strategy seeks out companies with management teams (and boards) that are committed to sharing the company's prosperity with shareholders via regular and growing dividend payments. While buybacks and acquisitions can be reasonable alternative uses of free cash flow, they too often reward former shareholders (buybacks) and other companies' shareholders (acquisitions) at the expense of ongoing shareholders (dividends). Ideally, the company will strike a good balance between dividends, buybacks, and acquisitions -- one that enhances the company's long-term value.

(Some income investors may disagree with me on this last point, arguing that companies should pay out all extra cash as dividends. Perhaps, and I would like to see more flexible dividend policies, but I don't think a full distribution policy is ideal in all circumstances nor do I consider it completely necessary to achieve the strategy's objectives. Further, from a practical standpoint, few companies follow this tactic and you'd have only a handful of companies to choose from.)

4. Patience: The benefits from steady dividend income are fully realized with time and patience. Accordingly, there's little reason to trade or make short-term decisions in an income portfolio. Where a strict value investor might sell a stock once it reaches its intrinsic value, income investors are under no such pressure as the focus is on the cash flow stream provided by the stock's dividend. Certainly there are still good reasons to sell a stock -- the investment thesis is broken, the company's financial health is worsening, there are better opportunities elsewhere in the market -- but these reasons aren't exclusive to any investing strategy.

5. Low costs: Since taxes and trading commissions reduce realized returns, it's essential to minimize the effects both in the income strategy. The tax treatment of dividends varies by country, and in some cases dividends may be tax disadvantaged relative to capital gains -- that is, where the tax rate on dividends is greater than on long-term capital gains. And because dividends are typically paid on a semi-annual or quarterly basis, they create more frequent taxable events than a long-term capital gain that can be deferred until the shares are sold. As a result, it's important for income investors to practice proper asset location by holding dividend-paying shares in tax-deferred plans to the extent possible. Excessive trading also increases costs as commissions and stamp duties (where applicable) create a drag on results and should thus be practiced only when necessary.

Bottom line

It's time for income investing to take its rightful place alongside the growth and value investing strategies and be recognized as a separate school of thought with its own set of guidelines.

What do you think? Please post your comments below.

Best,

Todd

@toddwenning on Twitter

---

Income investors might also be interested in...

- Plans For Financial Independence

Most of those that visit my blog are working towards a specific end goal, I know I am. That goal for the majority of us is financial independence. Financial independence can mean different things to different people. To me financial independence...

- Dividend Update - April 2014

Somehow April is already in the books and now it's time again for my favorite monthly update, my dividend update. These dividend updates reflect all dividends that I receive through my investing pursuits and I hope can help inspire you to take...

- An Easy Mistake Made By Dividend Investors

Dividend investing can seem deceptively easy. If you want to generate, say, a 5% yield from your dividend portfolio, you only need to buy a group of stocks that provide a weighted average yield of 5%. Then just sit back and watch the money roll in. Or...

- The Ten Points Of Income Investing

1. Income investing is a separate and distinct strategy It's not growth, it's not value -- income comes first. (See: The Income Investor's Manifesto) 2. Discipline and patience are behavioral prerequisites Great dividend-producing...

- A Dozen Things I Learned From Todd Wenning About Investing

Todd Wenning is leaving Morningstar for another post in the investing world. Not sure if he will be able to post as much going forward, so this seems a good time to summarize the lessons I, and I am sure many others, have learned from his work. 1. Importance...

Money and Finance

The Income Investor's Manifesto

What type of investing strategy do you follow?

For years, the answer for investors has generally been limited to "value" or "growth" -- either you adhere to the value principles of Benjamin Graham and Warren Buffett or you follow the trails blazed by famous growth investors like Peter Lynch and Philip Fisher.

Now it's time for a third strategy to be fully recognized by the investing community -- income investing.

Distinct strategy

Plenty of academic research supports equity income investing as a distinct strategy, but to date it's been largely considered a sub-category of value investing.

This makes some sense, since a high yield can sometimes be indicative of an undervalued stock, but the objective of a pure income strategy differs from value investing in that its primary focus is to generate a growing and sustainable stream of dividends. Capital gains are an important, yet secondary concern. For value investing, the opposite is true -- indeed, companies don't necessarily need to pay a dividend to make it an attractive investment to a value investor.

Further, income investing has a distinct research process that focuses on a company's ability to sustain and increase its dividend. Where value research typically begins with a company's balance sheet and growth research starts with the income statement, dividend research commences on the cash flow statement.

From the cash flow statement, for instance, we can determine free cash flow coverage, earnings coverage, how the company approaches dividends versus buybacks, debt repayment trends, acquisition trends, and more.

This analysis is critical in determining a company's dividend health and therefore the cash flow statement is the necessary starting point for dividend research.

One thing that income investing doesn't have, however, is a pantheon of heroes like value and growth do. But I think that will change. The leading candidate for the income investing equivalent of Mt. Rushmore is perhaps Neil Woodford who runs a number of income-focused funds in the U.K. including Invesco Perpetual High Income and Edinburgh Investment Trust. Woodford recently celebrated 25 years at Invesco Perpetual High Income and his results have been nothing short of incredible (from ThisIsMoney.co.uk):

For an initial £10,000, you will have received £36,135.50 in income and be sitting on an investment in the fund worth £71,155 today. That would make the total return more than £107,000 if you did not reinvest income - but around £190,000 if you did....(The fund) has paid out £3.255 billion in dividends since 1994.

Woodford doesn't shy away from making dividend sustainability and growth a primary investing objective. For example, the objective of the Invesco Perpetual High Income fund is to "achieve a high level of income, together with capital growth" and one of the primary objectives of the Edinburgh Invetsment Trust is to grow "dividends per share by more than the rate of UK inflation." Surely these income-focused objectives are distinctly different from those of traditional value investing funds.

Why this matters

At this point you might be rightfully asking, "Isn't this just splitting hairs? Why does this matter now?"

With investors increasingly turning to dividend-paying stocks as a result of low interest rates and demographic changes, now is the ideal time to carve out income investing from the traditional value-growth spectrum.

True, interest rates will eventually increase, but the demographic change will be with us for some time. According to a 2009 study by David E. Bloom, David Canning, and Günther Fink at the Harvard School of Public Health, "The share of the population aged 60 and over is expected to increase dramatically in every country in the world between 2000 and 2050."

The 60+ cohort will increasingly turn toward income-generating securities such as fixed income and dividend-paying stocks. In addition, their investment objectives will shift to capital preservation and further away from capital growth. As such, investors seeking income may not find refuge in either the traditional value or growth strategies, so carving out the income strategy as a separate approach will be helpful to many.

Principles of income investing

The tenets of income investing might be considered to be:

1. Income first: Naturally. The most important difference between income and the value and growth strategies is that its primary focus is on income generation, with capital gains being a secondary concern. More specifically, the focus is on generating a sustainable and growing stream of cash flow (at least the rate of inflation) and avoiding dividend cuts. If this can be accomplished, capital gains should take care of themselves over time.

2. Conservative stock selection: Because capital gains are secondary in the income strategy, adherents have little need to swing for the fences with each investment. A stock doesn't necessarily need to be substantially undervalued (as is the case with value) or have considerable growth potential (as is the case with growth) to be a suitable investment in the income strategy. This doesn't excuse income investors from doing due diligence and valuation work -- far from it! -- but a modestly undervalued stock with moderate growth potential can make for a fine income investment even if it may not pass traditional value and growth screens.

3. Management matters: The income strategy seeks out companies with management teams (and boards) that are committed to sharing the company's prosperity with shareholders via regular and growing dividend payments. While buybacks and acquisitions can be reasonable alternative uses of free cash flow, they too often reward former shareholders (buybacks) and other companies' shareholders (acquisitions) at the expense of ongoing shareholders (dividends). Ideally, the company will strike a good balance between dividends, buybacks, and acquisitions -- one that enhances the company's long-term value.

(Some income investors may disagree with me on this last point, arguing that companies should pay out all extra cash as dividends. Perhaps, and I would like to see more flexible dividend policies, but I don't think a full distribution policy is ideal in all circumstances nor do I consider it completely necessary to achieve the strategy's objectives. Further, from a practical standpoint, few companies follow this tactic and you'd have only a handful of companies to choose from.)

4. Patience: The benefits from steady dividend income are fully realized with time and patience. Accordingly, there's little reason to trade or make short-term decisions in an income portfolio. Where a strict value investor might sell a stock once it reaches its intrinsic value, income investors are under no such pressure as the focus is on the cash flow stream provided by the stock's dividend. Certainly there are still good reasons to sell a stock -- the investment thesis is broken, the company's financial health is worsening, there are better opportunities elsewhere in the market -- but these reasons aren't exclusive to any investing strategy.

5. Low costs: Since taxes and trading commissions reduce realized returns, it's essential to minimize the effects both in the income strategy. The tax treatment of dividends varies by country, and in some cases dividends may be tax disadvantaged relative to capital gains -- that is, where the tax rate on dividends is greater than on long-term capital gains. And because dividends are typically paid on a semi-annual or quarterly basis, they create more frequent taxable events than a long-term capital gain that can be deferred until the shares are sold. As a result, it's important for income investors to practice proper asset location by holding dividend-paying shares in tax-deferred plans to the extent possible. Excessive trading also increases costs as commissions and stamp duties (where applicable) create a drag on results and should thus be practiced only when necessary.

Bottom line

It's time for income investing to take its rightful place alongside the growth and value investing strategies and be recognized as a separate school of thought with its own set of guidelines.

What do you think? Please post your comments below.

Best,

Todd

@toddwenning on Twitter

---

Income investors might also be interested in...

- Global Dividend Investing Consortium (a LinkedIn Group I recently created)

- The Dividend Compass Scorecard (my online spreadsheet for evaluating dividend health)

- Monevator article series on dividend basics

- The Web's Best Dividend Resources (Stockopedia)

- Annual reports from Neil Woodford's Edinburgh Investment Trust

- Plans For Financial Independence

Most of those that visit my blog are working towards a specific end goal, I know I am. That goal for the majority of us is financial independence. Financial independence can mean different things to different people. To me financial independence...

- Dividend Update - April 2014

Somehow April is already in the books and now it's time again for my favorite monthly update, my dividend update. These dividend updates reflect all dividends that I receive through my investing pursuits and I hope can help inspire you to take...

- An Easy Mistake Made By Dividend Investors

Dividend investing can seem deceptively easy. If you want to generate, say, a 5% yield from your dividend portfolio, you only need to buy a group of stocks that provide a weighted average yield of 5%. Then just sit back and watch the money roll in. Or...

- The Ten Points Of Income Investing

1. Income investing is a separate and distinct strategy It's not growth, it's not value -- income comes first. (See: The Income Investor's Manifesto) 2. Discipline and patience are behavioral prerequisites Great dividend-producing...

- A Dozen Things I Learned From Todd Wenning About Investing

Todd Wenning is leaving Morningstar for another post in the investing world. Not sure if he will be able to post as much going forward, so this seems a good time to summarize the lessons I, and I am sure many others, have learned from his work. 1. Importance...