Money and Finance

Dividend investing can seem deceptively easy. If you want to generate, say, a 5% yield from your dividend portfolio, you only need to buy a group of stocks that provide a weighted average yield of 5%. Then just sit back and watch the money roll in.

Or so the thinking goes.

And, yes, you may indeed receive your desired dividend income if you follow this strategy, but constructing a portfolio in this manner without attention to valuation could end up costing you in the longer-term.

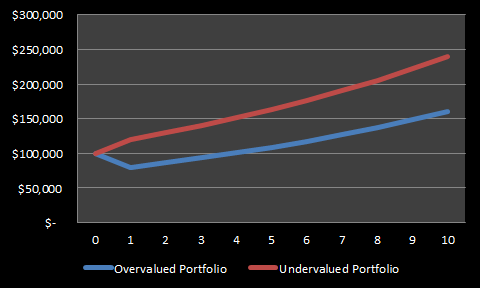

Consider two investors that each invested $100,000 in dividend portfolios with 5% starting yields. Over the course of ten years each investor realizes annual dividend growth of 3%. The first investor (blue line) bought stocks that were considerably overvalued and subsequently lost 20% in capital value in year one; alternatively, the other (red line) invested in stocks that were undervalued and gained 20% in capital value in year one.

After the year one corrections to fair value, both portfolios grow at 8% per year through year 10.

At the end of ten years, both portfolios generated the same amount of dividend income ($57,319), but their ending capital values are nearly $80,000 apart ($159,920 vs. $239,880). It's hard to imagine that the two investors would feel equally good about their performance even though they realized equal dividend income over the ten year period.

To further my point, if both investors decided to liquidate their dividend portfolios in year 10 and invested their capital in bonds with 5% coupons, the first investor would receive annual payments of $7,996 while the second investor would receive $11,994 per year until maturity.

This is an admittedly simple example, but it illustrates an important point about the hidden costs of not paying attention to valuation in income investing. Ultimately, capital growth matters.

Whether you use relative valuation methods (i.e. comparing P/E ratios, etc.) or absolute valuation methods (i.e. dividend discount models, discounted cash flow models, etc.), the important thing is to fully consider the price you're paying and the value you're getting from each investment. Get to know the businesses you'd like to invest in, understand what drives their performance, and don't rely on a single metric -- in this case, dividend yield -- to guide your buying decisions.

Good dividend investing eschews complexity, but that doesn't mean it's supposed to be easy.

Good reads this week

Best,

Todd

@toddwenning

- Weekly Roundup - September 15, 2012

Well another week is in the books so that means it's time for another weekly roundup of blog links and articles that got me thinking. So here goes. Trading Vs. Investing Dividend Mantra wrote about the difference between trading and investing...

- Neil Woodford Is Going His Own Way

There was big news today in the income investing world as UK fund manager Neil Woodford announced he will leave Invesco Perpetual in 2014, after managing money there for 25 years. When I first saw the headline, I thought he might be pulling...

- The Ten Points Of Income Investing

1. Income investing is a separate and distinct strategy It's not growth, it's not value -- income comes first. (See: The Income Investor's Manifesto) 2. Discipline and patience are behavioral prerequisites Great dividend-producing...

- 5 Keys To Reinvesting Dividends

Once you've decided to build a dividend-based portfolio, it's essential to know what you're going to do with the income generated by your investments. There are three basic options -- spend the dividend, save it, or reinvest it. Sounds...

- How Much To Invest In Your Dividend Paying Stocks

How much you choose to invest in the stocks in your dividend portfolio may be just as important -- if not more important -- as which stocks you choose to include in your portfolio. There are two primary strategies for asset allocation -- passive (equal...

Money and Finance

An Easy Mistake Made by Dividend Investors

Dividend investing can seem deceptively easy. If you want to generate, say, a 5% yield from your dividend portfolio, you only need to buy a group of stocks that provide a weighted average yield of 5%. Then just sit back and watch the money roll in.

Or so the thinking goes.

And, yes, you may indeed receive your desired dividend income if you follow this strategy, but constructing a portfolio in this manner without attention to valuation could end up costing you in the longer-term.

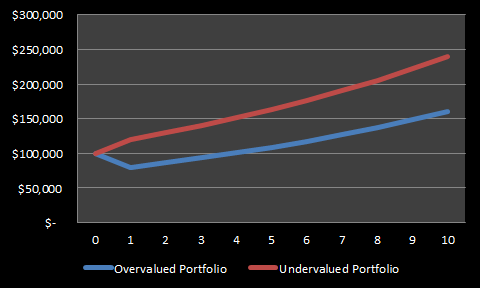

Consider two investors that each invested $100,000 in dividend portfolios with 5% starting yields. Over the course of ten years each investor realizes annual dividend growth of 3%. The first investor (blue line) bought stocks that were considerably overvalued and subsequently lost 20% in capital value in year one; alternatively, the other (red line) invested in stocks that were undervalued and gained 20% in capital value in year one.

After the year one corrections to fair value, both portfolios grow at 8% per year through year 10.

At the end of ten years, both portfolios generated the same amount of dividend income ($57,319), but their ending capital values are nearly $80,000 apart ($159,920 vs. $239,880). It's hard to imagine that the two investors would feel equally good about their performance even though they realized equal dividend income over the ten year period.

To further my point, if both investors decided to liquidate their dividend portfolios in year 10 and invested their capital in bonds with 5% coupons, the first investor would receive annual payments of $7,996 while the second investor would receive $11,994 per year until maturity.

This is an admittedly simple example, but it illustrates an important point about the hidden costs of not paying attention to valuation in income investing. Ultimately, capital growth matters.

|

| Valuation avoidance (Photobucket) |

Good dividend investing eschews complexity, but that doesn't mean it's supposed to be easy.

Good reads this week

- Warren Buffett's 1975 letter to Katharine Graham about pensions and investing

- "How I'm Betting Against Neil Woodford" - Monevator

- "Outcome Bias and the Interpreter" - Credit Suisse (Michael Mauboussin & Dan Callahan, CFA)

- The Dividend Compass Cup continues at Total Return Investor

A mildly non-conventional investment approach, emphasizing a business approach to security selection, gives some opportunity for long-term results slightly above average without corresponding increase in investment risk. - Warren BuffettIf you think this article may be of interest to a friend or colleague, feel free to forward it, and let me know if you have any questions about topics discussed.

Best,

Todd

@toddwenning

- Weekly Roundup - September 15, 2012

Well another week is in the books so that means it's time for another weekly roundup of blog links and articles that got me thinking. So here goes. Trading Vs. Investing Dividend Mantra wrote about the difference between trading and investing...

- Neil Woodford Is Going His Own Way

There was big news today in the income investing world as UK fund manager Neil Woodford announced he will leave Invesco Perpetual in 2014, after managing money there for 25 years. When I first saw the headline, I thought he might be pulling...

- The Ten Points Of Income Investing

1. Income investing is a separate and distinct strategy It's not growth, it's not value -- income comes first. (See: The Income Investor's Manifesto) 2. Discipline and patience are behavioral prerequisites Great dividend-producing...

- 5 Keys To Reinvesting Dividends

Once you've decided to build a dividend-based portfolio, it's essential to know what you're going to do with the income generated by your investments. There are three basic options -- spend the dividend, save it, or reinvest it. Sounds...

- How Much To Invest In Your Dividend Paying Stocks

How much you choose to invest in the stocks in your dividend portfolio may be just as important -- if not more important -- as which stocks you choose to include in your portfolio. There are two primary strategies for asset allocation -- passive (equal...