Money and Finance

Last week, we set up a simple stock screen with an objective of "Identifying quality dividend-paying small- to mid-cap companies with sustainable competitive advantages and the potential for 7%+ annual dividend growth over the next 7-10 years." We then employed a five-minute "sniff" test to determine which of the companies deserved a closer look.

This week, I ran each of last week's six surviving stocks through my Dividend Compass* spreadsheet (free to use and download) in order to get a better feel for the companies' underlying dividend fundamentals. Of this group of six, I'll choose 2-3 for a deep-dive (competitive analysis, valuation, etc.) in next week's post. If they end up being good buys right now, I'll put some money into them. If not, I'll keep them on my watchlist.

The results, please...

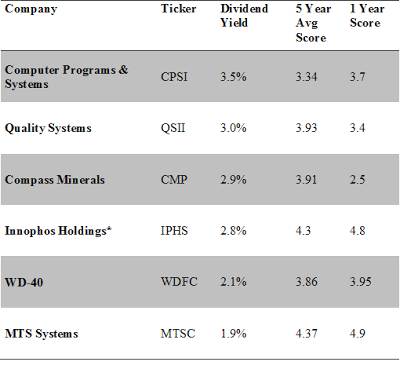

Here's how each of the six companies fared on the Dividend Compass (scores out of 5):

Computer Programs & Systems: CPSI has the highest yield of the lot and scored very well in most of the Dividend Compass categories. It fell short where it counted, however, particularly in the dividend cover categories. Over the last five years, for instance, CPSI scored either a 1 or 2 in free cash flow cover -- the highest-weighted factor. Earnings cover was just slightly better. CPSI also held its quarterly dividend at $0.36 per share between February 2006 and November 2011. Combine these findings and it seems like CPSI has generally lived on the edge with its dividend payout.

The debt-free balance sheet is attractive and I give the company credit for not cutting its dividend during the financial crisis, but the consistent lack of dividend cover makes me a little nervous for a high-yield stock, let alone a dividend growth stock. A year or two of bad results and the dividend could be at risk. At best it would be held steady, which isn't an ideal scenario for a dividend growth investment.

Quality Systems: QSII's stock is up nicely over the last two months, but it has dramatically underperformed the S&P 500 to the tune of 80+ percentage points over the last two years. The dividend has also been held at $0.175 per quarter since March 2011. In short, something isn't quite right here. Underlying dividend health has also deteriorated as margins and returns have suffered over the last eighteen months. Though the five-year average score is decent, recent results are reason for concern.

Compass Minerals: One of the reasons that I look at multi-year scores is that some companies are in cyclical industries and results in a given year may not be representative of the company's dividend health. Compass Minerals is one such company, as much depends on the severity of winter weather in North America (for the salt business) as well as potash pricing. In good years, the dividend is well-covered by free cash flow and the balance sheet looks pristine, but dividend health deteriorates a bit in down years. Over time, however, the 3.91 of 5 score on the Dividend Compass is pretty good. I have some concerns about the changing competitive dynamics within the potash industry, but as a current shareholder I have long-term confidence in the business's prospects.

Innophos Holdings: Having IPO'd in 2006, chemicals company Innophos has a fairly short dividend track record that begins in January 2007. Further, its quarterly payout was held steady at $0.17 per share from April 2007 to January 2011, but has since increased at a decent clip. The nearly four-year hiatus from dividend growth is a definite negative, but the other dividend health metrics have been consistently strong. Over the past twelve months, however, profit margins and returns on capital have been disappointing, so if Innophos passes onto the next round I'll need to figure out if this is a temporary issue or the start of a bad trend.

WD-40: As I mentioned in last week's post, WD-40 is a company that I've had my eye on for some time. I really like the corporate culture -- the company has near-perfect employee reviews on glassdoor.com -- and it has over 100,000 members in the WD-40 Fan Club. The company scored a little below what I had expected on the Dividend Compass, dragged a bit lower by underwhelming dividend growth over the last three years. Instead, the company has increased its buyback activity, which I'll need to look into further if I pass the company into the next round.

MTS Systems: Of the six companies that made it to this round, MTS Systems had the highest Dividend Compass marks including an almost perfect score in calendar year 2012. The 1.9% dividend yield is a bit pedestrian, but the balance sheet is very strong and the company has generally produced more than enough free cash flow to cover the dividend while increasing its payout over time. I do have a few concerns about recent performance that will need to be addressed if MTS Systems proceeds to the final round.

Who made the cut?

The Dividend Compass revealed a lot about each stock in about 10-20 minutes, which I think saved a good deal of time by not needing to spend an hour-plus reading through each company's annual reports. By not having to conduct a deep-dive on six companies, I can now focus on 2-3 names in the next round.

I'm not putting CPSI through to the next round. Even though CPSI had the highest yield of the group, I simply can't get past the consistently-low dividend cover.

CMP is a very well-run company and I believe it is an attractive candidate for further research, but because I already have a position in the company and want to learn more about recent developments in the potash industry, I'm going to hold off on doubling-down on it.

QSII might be a really interesting research subject from a value/turnaround opportunity standpoint, but the fall-off in margins and returns over the last eighteen months makes me concerned that there's been a significant change to the competitive dynamics within the industry. The recently-stalled dividend growth also gives me pause. As such, I'm not putting QSII through to the next round.

I'm also not moving forward with IPHS on account of its relatively short and unproven dividend track record, but its DC numbers were good and I'd definitely consider looking into it down the road.

I started out thinking that WDFC would be a sure-thing to make it into the final round, but I was disappointed with its score on the DC. I went back-and-forth on this one a bit, but decided to pass it through to the next round as I think it's a fascinating company to discuss. One of the key research topics will be why dividend growth hasn't been as robust as it perhaps could have been in recent years.

MTSC's strong DC scores were a nice surprise and I'm also going to put it through to the final round. Results have been a little shaky recently, but we'll figure out next week if those are temporary issues or not.

Low yields

Both companies' yields are around 2%, which isn't much to write home about, but the yields are comfortably above the Russell 2000 yield of 1.4%, and at first glance, both businesses appear to have the potential for 7%-plus dividend growth over the next decade. At the very least, they're worthy of further research.

In the concluding post of this three-part series, we'll take a much closer look at WDFC's and MTSC's businesses and do some valuation work on them, as well.

Thanks for reading and please post any comments, questions, or criticisms below. You can also contact me on Twitter @toddwenning or by email here.

Other posts in this series:

How to Find a Good Dividend Growth Stock: Part 1

Best,

Todd

@toddwenning

*Frequent users of the Dividend Compass will note that I have recently blocked out a few of the input categories from 2004-2006. Those data points don't have an effect on the Dividend Compass scoring system and I wanted to eliminate some of unnecessary fields. Please let me know if you have feedback on this.

- How To Find A Good Dividend Growth Stock - Part 1

Thought I'd try something different here on the Clear Eyes Investing blog. I was planning to add a few dividend growth stocks to my watchlist -- maybe even buy one or two if they're trading at a good price -- and figured I'd share my research...

- Centurylink's Dividend Cut Provides Many Valuable Lessons

A brief post this evening, but I wanted to quickly comment on today's big dividend news -- U.S. telecom & broadband company CenturyLink making a "surprise" dividend cut of 26%. The stock fell sharply on the news, making it clear that...

- Analytical Toolbox

This page lists useful tools for finding and tracking Wide Moat Dividend stocks. Dividend Compass by Todd Wenning. Goes miles beyond the dividend payout ratio to give a nuanced view of the health and sustainability of a company's dividend. The...

- Dividend Compass Cup Match 8- Baxter Vs Novo Nordisk

In the last match, Procter & Gamble beat out Unilever to advance in the Dividend Compass Cup. This match in the healthcare division is between two heavyweights - Baxter and Novo Nordisk. The Dividend Compass Cup rules are straightforward, we run the...

- Dividend Compass Match 2 - Exxon Mobil Vs Royal Dutch Shell

In Match 1 of the Dividend Compass Cup, we had Coca Cola narrowly defeating Pepsi. The Dividend Compass Cup rules are straightforward, we run the two quality, wide moat companies through the Dividend Compass to analyze which is the more interesting investing...

Money and Finance

How to Find a Good Dividend Growth Stock - Part 2

Last week, we set up a simple stock screen with an objective of "Identifying quality dividend-paying small- to mid-cap companies with sustainable competitive advantages and the potential for 7%+ annual dividend growth over the next 7-10 years." We then employed a five-minute "sniff" test to determine which of the companies deserved a closer look.

This week, I ran each of last week's six surviving stocks through my Dividend Compass* spreadsheet (free to use and download) in order to get a better feel for the companies' underlying dividend fundamentals. Of this group of six, I'll choose 2-3 for a deep-dive (competitive analysis, valuation, etc.) in next week's post. If they end up being good buys right now, I'll put some money into them. If not, I'll keep them on my watchlist.

The results, please...

Here's how each of the six companies fared on the Dividend Compass (scores out of 5):

|

| *Used 3 year average due to shorter dividend history |

The debt-free balance sheet is attractive and I give the company credit for not cutting its dividend during the financial crisis, but the consistent lack of dividend cover makes me a little nervous for a high-yield stock, let alone a dividend growth stock. A year or two of bad results and the dividend could be at risk. At best it would be held steady, which isn't an ideal scenario for a dividend growth investment.

Quality Systems: QSII's stock is up nicely over the last two months, but it has dramatically underperformed the S&P 500 to the tune of 80+ percentage points over the last two years. The dividend has also been held at $0.175 per quarter since March 2011. In short, something isn't quite right here. Underlying dividend health has also deteriorated as margins and returns have suffered over the last eighteen months. Though the five-year average score is decent, recent results are reason for concern.

Compass Minerals: One of the reasons that I look at multi-year scores is that some companies are in cyclical industries and results in a given year may not be representative of the company's dividend health. Compass Minerals is one such company, as much depends on the severity of winter weather in North America (for the salt business) as well as potash pricing. In good years, the dividend is well-covered by free cash flow and the balance sheet looks pristine, but dividend health deteriorates a bit in down years. Over time, however, the 3.91 of 5 score on the Dividend Compass is pretty good. I have some concerns about the changing competitive dynamics within the potash industry, but as a current shareholder I have long-term confidence in the business's prospects.

Innophos Holdings: Having IPO'd in 2006, chemicals company Innophos has a fairly short dividend track record that begins in January 2007. Further, its quarterly payout was held steady at $0.17 per share from April 2007 to January 2011, but has since increased at a decent clip. The nearly four-year hiatus from dividend growth is a definite negative, but the other dividend health metrics have been consistently strong. Over the past twelve months, however, profit margins and returns on capital have been disappointing, so if Innophos passes onto the next round I'll need to figure out if this is a temporary issue or the start of a bad trend.

WD-40: As I mentioned in last week's post, WD-40 is a company that I've had my eye on for some time. I really like the corporate culture -- the company has near-perfect employee reviews on glassdoor.com -- and it has over 100,000 members in the WD-40 Fan Club. The company scored a little below what I had expected on the Dividend Compass, dragged a bit lower by underwhelming dividend growth over the last three years. Instead, the company has increased its buyback activity, which I'll need to look into further if I pass the company into the next round.

MTS Systems: Of the six companies that made it to this round, MTS Systems had the highest Dividend Compass marks including an almost perfect score in calendar year 2012. The 1.9% dividend yield is a bit pedestrian, but the balance sheet is very strong and the company has generally produced more than enough free cash flow to cover the dividend while increasing its payout over time. I do have a few concerns about recent performance that will need to be addressed if MTS Systems proceeds to the final round.

Who made the cut?

The Dividend Compass revealed a lot about each stock in about 10-20 minutes, which I think saved a good deal of time by not needing to spend an hour-plus reading through each company's annual reports. By not having to conduct a deep-dive on six companies, I can now focus on 2-3 names in the next round.

I'm not putting CPSI through to the next round. Even though CPSI had the highest yield of the group, I simply can't get past the consistently-low dividend cover.

CMP is a very well-run company and I believe it is an attractive candidate for further research, but because I already have a position in the company and want to learn more about recent developments in the potash industry, I'm going to hold off on doubling-down on it.

QSII might be a really interesting research subject from a value/turnaround opportunity standpoint, but the fall-off in margins and returns over the last eighteen months makes me concerned that there's been a significant change to the competitive dynamics within the industry. The recently-stalled dividend growth also gives me pause. As such, I'm not putting QSII through to the next round.

I'm also not moving forward with IPHS on account of its relatively short and unproven dividend track record, but its DC numbers were good and I'd definitely consider looking into it down the road.

I started out thinking that WDFC would be a sure-thing to make it into the final round, but I was disappointed with its score on the DC. I went back-and-forth on this one a bit, but decided to pass it through to the next round as I think it's a fascinating company to discuss. One of the key research topics will be why dividend growth hasn't been as robust as it perhaps could have been in recent years.

MTSC's strong DC scores were a nice surprise and I'm also going to put it through to the final round. Results have been a little shaky recently, but we'll figure out next week if those are temporary issues or not.

Low yields

Both companies' yields are around 2%, which isn't much to write home about, but the yields are comfortably above the Russell 2000 yield of 1.4%, and at first glance, both businesses appear to have the potential for 7%-plus dividend growth over the next decade. At the very least, they're worthy of further research.

In the concluding post of this three-part series, we'll take a much closer look at WDFC's and MTSC's businesses and do some valuation work on them, as well.

Thanks for reading and please post any comments, questions, or criticisms below. You can also contact me on Twitter @toddwenning or by email here.

Other posts in this series:

How to Find a Good Dividend Growth Stock: Part 1

How to Find a Good Dividend Growth Stock: Part 2

How to Find a Good Dividend Growth Stock: Part 3

Best,

Todd

@toddwenning

*Frequent users of the Dividend Compass will note that I have recently blocked out a few of the input categories from 2004-2006. Those data points don't have an effect on the Dividend Compass scoring system and I wanted to eliminate some of unnecessary fields. Please let me know if you have feedback on this.

- How To Find A Good Dividend Growth Stock - Part 1

Thought I'd try something different here on the Clear Eyes Investing blog. I was planning to add a few dividend growth stocks to my watchlist -- maybe even buy one or two if they're trading at a good price -- and figured I'd share my research...

- Centurylink's Dividend Cut Provides Many Valuable Lessons

A brief post this evening, but I wanted to quickly comment on today's big dividend news -- U.S. telecom & broadband company CenturyLink making a "surprise" dividend cut of 26%. The stock fell sharply on the news, making it clear that...

- Analytical Toolbox

This page lists useful tools for finding and tracking Wide Moat Dividend stocks. Dividend Compass by Todd Wenning. Goes miles beyond the dividend payout ratio to give a nuanced view of the health and sustainability of a company's dividend. The...

- Dividend Compass Cup Match 8- Baxter Vs Novo Nordisk

In the last match, Procter & Gamble beat out Unilever to advance in the Dividend Compass Cup. This match in the healthcare division is between two heavyweights - Baxter and Novo Nordisk. The Dividend Compass Cup rules are straightforward, we run the...

- Dividend Compass Match 2 - Exxon Mobil Vs Royal Dutch Shell

In Match 1 of the Dividend Compass Cup, we had Coca Cola narrowly defeating Pepsi. The Dividend Compass Cup rules are straightforward, we run the two quality, wide moat companies through the Dividend Compass to analyze which is the more interesting investing...