Money and Finance

In Match 1 of the Dividend Compass Cup, we had Coca Cola narrowly defeating Pepsi.

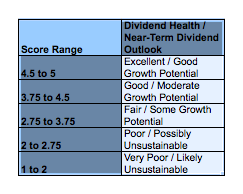

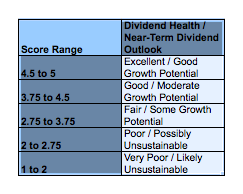

The Dividend Compass Cup rules are straightforward, we run the two quality, wide moat companies through the Dividend Compass to analyze which is the more interesting investing candidate. Todd Wenning's Dividend Compass scores them 1-5.

In Match 2, we have another class of the titans - Exxon Mobil (XOM) versus Royal Dutch Shell (RDS.B).

As the saying goes, the best investment is a well run oil company, the second best investment is a poorly run oil company.

Interesting to income investors? History of dividends? These two deliver. Exxon has paid a dividend continuously since 1882. It has increased its dividend for the last thirty years. Shell has paid dividends continuously since 1945. One note here for US investors is that Royal Dutch Shell has two listings, one in the Netherlands (RDS.A) and one in the UK (RDS.B), we look at the RDS.B listing since the ADRs are not subject to an extra foreign dividend tax for US investors.

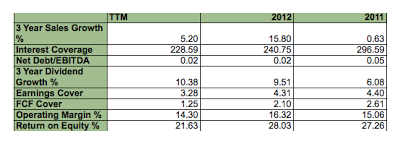

First up is Exxon Mobil. The picture here shows strong pluses including - negligible debt, excellent return on Equity. And there are some areas of concern in declining FCF cover and tepid dividend growth.

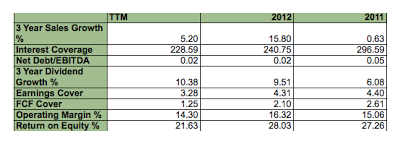

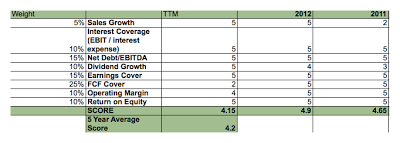

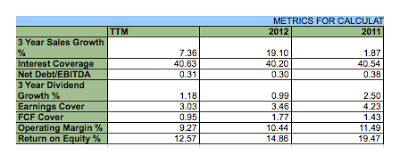

Exxon Mobil's metrics:

Exxon has until recently preferred share buybacks over double digit dividend raises. Good to see the latter getting in recent months.

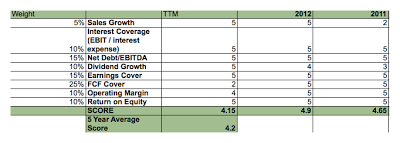

All of that is good for a solid 4.2 score from the Dividend Compass over a 5 year average, in fact 2012 was a near perfect 4.9.

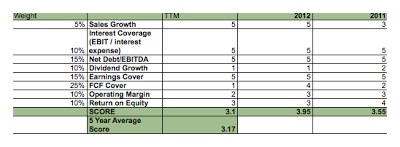

Exxon Mobil's Dividend Compass score:

A 4.2 is a tough number to beat, let's see if Royal Dutch Shell is up to the challenge.

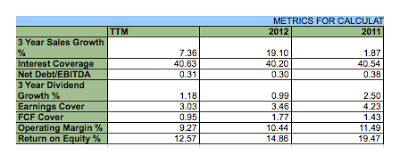

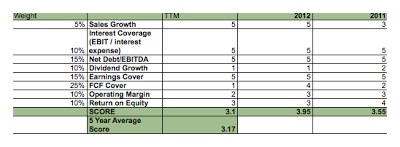

Unfortunately for Royal Dutch Shell, it struggles in two important areas - FCF cover and Dividend Growth. Royal Dutch Shell's metrics:

The overall metrics are probably good enough for Royal Dutch Shell to beat out most other dividend payers, but up against Exxon Mobil you cannot miss on very much, and together FCF Cover and Dividend growth account for 35% of the total Dividend Compass score.

The overall metrics are probably good enough for Royal Dutch Shell to beat out most other dividend payers, but up against Exxon Mobil you cannot miss on very much, and together FCF Cover and Dividend growth account for 35% of the total Dividend Compass score.

Royal Dutch Shell's Dividend Compass score:

Like Exxon Mobil, Royal Dutch Shell operates with very low leverage. However it struggles on FCF coverage and dividend growth rate categories. The result is 3.17 five year average, Royal Dutch Shell's best year is a 3.95 which is stil below Exxon Mobil's average year. This puts Exxon Mobil through to the next round to face the winner of McCormick and Wal-Mart.

Note that this is not to say that Royal Dutch Shell is a poorly run company. In fact, former Exxon Mobil CEO Lee Raymond listed Royal Dutch Shell as the competitor he most respected. For investors that prize current yield over all else, Royal Dutch Shell has for years been around 2 percentage points higher for current yield than Exxon. Still the Dividend Compass puts Exxon Mobil through to the Elite Eight.

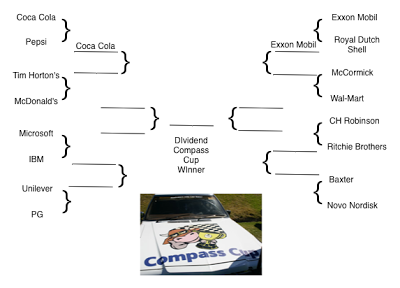

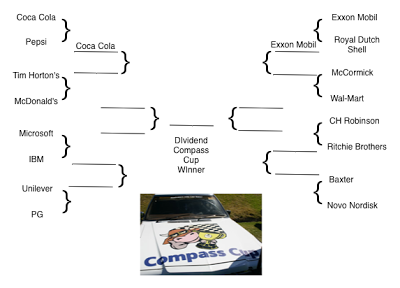

Here is the bracket through two matches:

Next up, Match 3 - tech showdown IBM versus Microsoft.

Next up, Match 3 - tech showdown IBM versus Microsoft.

- Dividend Compass Cup Match 10 - Exxon Mobil Vs Wal-mart

Here in match 10, we are in the second round of the Dividend Compass Up, the winner will go on to the Final four. We have two formidable companies, with real earnings power- a Texarkana border battle - Exxon Mobil vs Wal-mart. The Dividend Compass Cup...

- Dividend Compass Cup Match 7 - Procter & Gamble Versus Unilever

In the last match of the Dividend Compass Cup, Walmart eked out a win over McCormick Spice. In this match we are sticking with the store shelves theme - Procter & Gamble (PG) versus Unilever (UL). The Dividend Compass Cup rules are straightforward,...

- Dividend Compass Match 3- Ibm Vs Microsoft

In Match 2 of the Dividend Compass Cup, we had Exxon Mobil beating out Royal Dutch Shell. In Match 3, IBM squares off with Microsoft. The Dividend Compass Cup rules are straightforward, we run the two quality, wide moat companies through the Dividend...

- Dividend Compass Cup October 2013 - Sweet Sixteen

Thanks to DC shenanigans, deeply immoral and irresponsible though they may be, there's starting to be some better prices on interesting companies. This seems like a good time to run Todd Wenning's Dividend Compass. Todd explains the tool here,...

- Dividend Compass - Royal Dutch Shell

Todd Wenning's Dividend Compass is a diagnostic tool that covers the parts of fundamental analysis most useful to dividend investors. This is a pretty broad set of metrics, Todd describes them here: "Sales growth: Sales are the life-blood of a company....

Money and Finance

Dividend Compass Match 2 - Exxon Mobil vs Royal Dutch Shell

In Match 1 of the Dividend Compass Cup, we had Coca Cola narrowly defeating Pepsi.

The Dividend Compass Cup rules are straightforward, we run the two quality, wide moat companies through the Dividend Compass to analyze which is the more interesting investing candidate. Todd Wenning's Dividend Compass scores them 1-5.

In Match 2, we have another class of the titans - Exxon Mobil (XOM) versus Royal Dutch Shell (RDS.B).

As the saying goes, the best investment is a well run oil company, the second best investment is a poorly run oil company.

Interesting to income investors? History of dividends? These two deliver. Exxon has paid a dividend continuously since 1882. It has increased its dividend for the last thirty years. Shell has paid dividends continuously since 1945. One note here for US investors is that Royal Dutch Shell has two listings, one in the Netherlands (RDS.A) and one in the UK (RDS.B), we look at the RDS.B listing since the ADRs are not subject to an extra foreign dividend tax for US investors.

First up is Exxon Mobil. The picture here shows strong pluses including - negligible debt, excellent return on Equity. And there are some areas of concern in declining FCF cover and tepid dividend growth.

Exxon Mobil's metrics:

Exxon has until recently preferred share buybacks over double digit dividend raises. Good to see the latter getting in recent months.

All of that is good for a solid 4.2 score from the Dividend Compass over a 5 year average, in fact 2012 was a near perfect 4.9.

Exxon Mobil's Dividend Compass score:

A 4.2 is a tough number to beat, let's see if Royal Dutch Shell is up to the challenge.

Unfortunately for Royal Dutch Shell, it struggles in two important areas - FCF cover and Dividend Growth. Royal Dutch Shell's metrics:

Royal Dutch Shell's Dividend Compass score:

Like Exxon Mobil, Royal Dutch Shell operates with very low leverage. However it struggles on FCF coverage and dividend growth rate categories. The result is 3.17 five year average, Royal Dutch Shell's best year is a 3.95 which is stil below Exxon Mobil's average year. This puts Exxon Mobil through to the next round to face the winner of McCormick and Wal-Mart.

Note that this is not to say that Royal Dutch Shell is a poorly run company. In fact, former Exxon Mobil CEO Lee Raymond listed Royal Dutch Shell as the competitor he most respected. For investors that prize current yield over all else, Royal Dutch Shell has for years been around 2 percentage points higher for current yield than Exxon. Still the Dividend Compass puts Exxon Mobil through to the Elite Eight.

Here is the bracket through two matches:

- Dividend Compass Cup Match 10 - Exxon Mobil Vs Wal-mart

Here in match 10, we are in the second round of the Dividend Compass Up, the winner will go on to the Final four. We have two formidable companies, with real earnings power- a Texarkana border battle - Exxon Mobil vs Wal-mart. The Dividend Compass Cup...

- Dividend Compass Cup Match 7 - Procter & Gamble Versus Unilever

In the last match of the Dividend Compass Cup, Walmart eked out a win over McCormick Spice. In this match we are sticking with the store shelves theme - Procter & Gamble (PG) versus Unilever (UL). The Dividend Compass Cup rules are straightforward,...

- Dividend Compass Match 3- Ibm Vs Microsoft

In Match 2 of the Dividend Compass Cup, we had Exxon Mobil beating out Royal Dutch Shell. In Match 3, IBM squares off with Microsoft. The Dividend Compass Cup rules are straightforward, we run the two quality, wide moat companies through the Dividend...

- Dividend Compass Cup October 2013 - Sweet Sixteen

Thanks to DC shenanigans, deeply immoral and irresponsible though they may be, there's starting to be some better prices on interesting companies. This seems like a good time to run Todd Wenning's Dividend Compass. Todd explains the tool here,...

- Dividend Compass - Royal Dutch Shell

Todd Wenning's Dividend Compass is a diagnostic tool that covers the parts of fundamental analysis most useful to dividend investors. This is a pretty broad set of metrics, Todd describes them here: "Sales growth: Sales are the life-blood of a company....