Money and Finance

A brief post this evening, but I wanted to quickly comment on today's big dividend news -- U.S. telecom & broadband company CenturyLink making a "surprise" dividend cut of 26%.

The stock fell sharply on the news, making it clear that many of its shareholders owned the stock for the high yield alone. When we dig a little deeper, however, we see that the dividend cut shouldn't have been such a major surprise.

Prior to the cut, the stock was yielding 6.9%, or about 3.5 times more than the S&P 500 yield near 2%. This should have been the first red flag -- as we know, an ultra-high yield equals ultra-high risk. Moreover, ultra-high yields are even riskier in lofty markets like this one.

A second red flag was stalled dividend growth -- CTL hadn't raised its payout since early 2010, indicating that management and the board lacked confidence about future earnings and cash flow to support higher dividend payouts.

A third red flag was the company's frequent and sizable M&A activity, which maintained high leverage ratios and pressured the company's investment-grade credit rating.

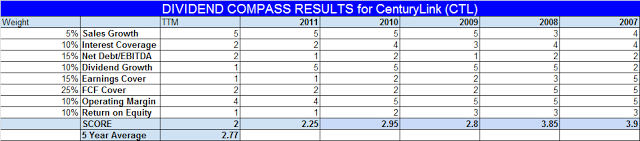

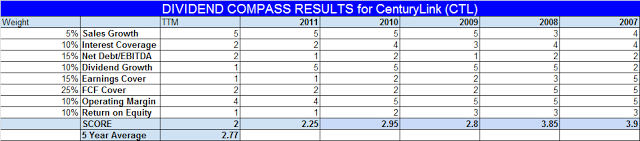

Out of curiosity, I ran CenturyLink's financials through the Dividend Compass, and it showed deteriorating dividend health fundamentals in recent years. (You can see CenturyLink's full Dividend Compass report by clicking here -- it's free.)

Even with the artificially-high sales growth rate fueled by M&A activity, CTL's Dividend Compass score had deteriorated from 2.95 in 2010 to 2.0 in September 2012. This low score was reason enough to be skeptical of CTL's ability to sustain the high payout.

CenturyLink's dividend cut is many lessons in one -- beware of ultra-high yields, stalled dividend growth, aggressive M&A activity, and high leverage ratios.

Best,

Todd

@toddwenning on Twitter

- Dividend Growth Checkup

As part of my annual review process for my portfolio, I read through the latest quarterly or annual reports for the companies I own, as well as checked up on the organic dividend growth for each position and for the portfolio as a whole. The dividend...

- 4 Things To Know About Dividend Investing

Earlier this week, Fidelity posted an interesting article on Morningstar.com that discussed the importance of considering dividends from both a historical and forward-looking perspective. Here are my four key takeaways from the article: 1. Screen for...

- The Ten Points Of Income Investing

1. Income investing is a separate and distinct strategy It's not growth, it's not value -- income comes first. (See: The Income Investor's Manifesto) 2. Discipline and patience are behavioral prerequisites Great dividend-producing...

- Analytical Toolbox

This page lists useful tools for finding and tracking Wide Moat Dividend stocks. Dividend Compass by Todd Wenning. Goes miles beyond the dividend payout ratio to give a nuanced view of the health and sustainability of a company's dividend. The...

- Captain's Picks

Captain's Picks is a collection of various articles that have caught my eye recently. I think you may find them interesting. Here's this weeks crop .... Intel - Why It's Poised For Rebound, And Why You Should Be There When It Does...

Money and Finance

CenturyLink's Dividend Cut Provides Many Valuable Lessons

A brief post this evening, but I wanted to quickly comment on today's big dividend news -- U.S. telecom & broadband company CenturyLink making a "surprise" dividend cut of 26%.

The stock fell sharply on the news, making it clear that many of its shareholders owned the stock for the high yield alone. When we dig a little deeper, however, we see that the dividend cut shouldn't have been such a major surprise.

Prior to the cut, the stock was yielding 6.9%, or about 3.5 times more than the S&P 500 yield near 2%. This should have been the first red flag -- as we know, an ultra-high yield equals ultra-high risk. Moreover, ultra-high yields are even riskier in lofty markets like this one.

A second red flag was stalled dividend growth -- CTL hadn't raised its payout since early 2010, indicating that management and the board lacked confidence about future earnings and cash flow to support higher dividend payouts.

A third red flag was the company's frequent and sizable M&A activity, which maintained high leverage ratios and pressured the company's investment-grade credit rating.

Out of curiosity, I ran CenturyLink's financials through the Dividend Compass, and it showed deteriorating dividend health fundamentals in recent years. (You can see CenturyLink's full Dividend Compass report by clicking here -- it's free.)

Even with the artificially-high sales growth rate fueled by M&A activity, CTL's Dividend Compass score had deteriorated from 2.95 in 2010 to 2.0 in September 2012. This low score was reason enough to be skeptical of CTL's ability to sustain the high payout.

CenturyLink's dividend cut is many lessons in one -- beware of ultra-high yields, stalled dividend growth, aggressive M&A activity, and high leverage ratios.

Best,

Todd

@toddwenning on Twitter

- Dividend Growth Checkup

As part of my annual review process for my portfolio, I read through the latest quarterly or annual reports for the companies I own, as well as checked up on the organic dividend growth for each position and for the portfolio as a whole. The dividend...

- 4 Things To Know About Dividend Investing

Earlier this week, Fidelity posted an interesting article on Morningstar.com that discussed the importance of considering dividends from both a historical and forward-looking perspective. Here are my four key takeaways from the article: 1. Screen for...

- The Ten Points Of Income Investing

1. Income investing is a separate and distinct strategy It's not growth, it's not value -- income comes first. (See: The Income Investor's Manifesto) 2. Discipline and patience are behavioral prerequisites Great dividend-producing...

- Analytical Toolbox

This page lists useful tools for finding and tracking Wide Moat Dividend stocks. Dividend Compass by Todd Wenning. Goes miles beyond the dividend payout ratio to give a nuanced view of the health and sustainability of a company's dividend. The...

- Captain's Picks

Captain's Picks is a collection of various articles that have caught my eye recently. I think you may find them interesting. Here's this weeks crop .... Intel - Why It's Poised For Rebound, And Why You Should Be There When It Does...