Money and Finance

Thought I'd try something different here on the Clear Eyes Investing blog. I was planning to add a few dividend growth stocks to my watchlist -- maybe even buy one or two if they're trading at a good price -- and figured I'd share my research process over the course of three blog posts.

Step 1: Set an objective

Identify quality dividend-paying small- to mid-cap companies with sustainable competitive advantages and the potential for 7%+ annual dividend growth over the next 7-10 years.

Step 2: Screen for ideas

To focus my search on a few promising names, I used Yahoo! Finance's free screening tool and set up four parameters:

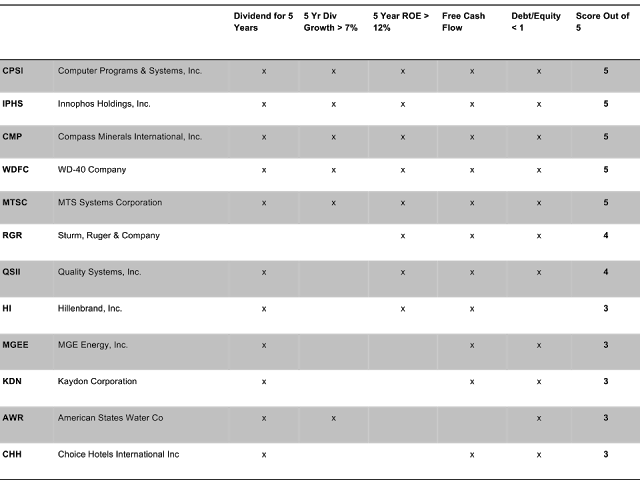

Here are the results (click to enlarge):

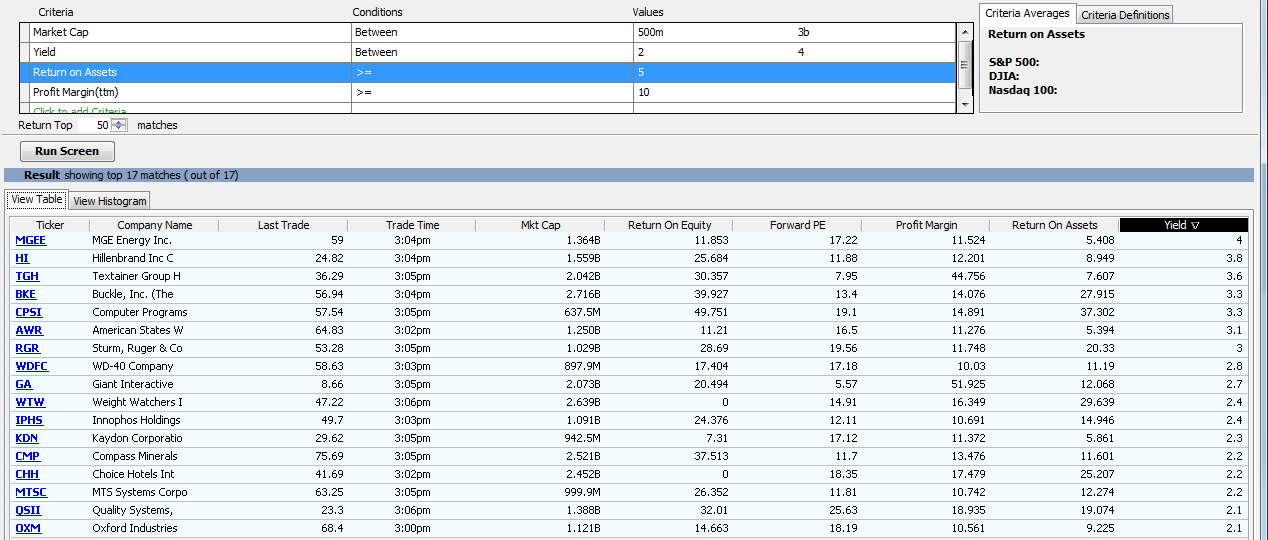

First, I need to double-check the screen result data to make sure its accurate. This is a good practice even with premium screeners, but errors are much more frequent with free screeners. Lo and behold, there are some inconsistencies with the dividend yields. Here are the corrected figures (click to enlarge):

Right off the bat, then, we can eliminate a few names as their yields fall outside my desired range. Textainer Group and Giant Interactive have yields that are too high for an ideal dividend growth investment. Perhaps they're good value or even high yield investments, but from a dividend growth perspective, you have to wonder why they're trading with such high yields in a bullish market like we have today. You would think that if the companies had strong growth prospects that the stocks would be bid up to the point where the yields better approximated the Russell 2000 Index average yield of 1.4%.

I'm also going to eliminate Weight Watchers International, The Buckle, and Oxford Industries. Good companies perhaps, but their yields fall well below the 2% minimum. MTS Systems and Choice Hotels are right on the border, but we'll hang onto them for now.

With the list whittled down, let's put the remaining 12 names through the five-minute sniff test.

Step 3: The Five-Minute Sniff Test

With so many stocks to sort through in a typical screening exercise, it helps to have a "sniff test" process in order to make the most of your time.

A few things I check before moving forward with a dividend growth stock idea are:

- Dividend Growth Checkup

As part of my annual review process for my portfolio, I read through the latest quarterly or annual reports for the companies I own, as well as checked up on the organic dividend growth for each position and for the portfolio as a whole. The dividend...

- Centurylink's Dividend Cut Provides Many Valuable Lessons

A brief post this evening, but I wanted to quickly comment on today's big dividend news -- U.S. telecom & broadband company CenturyLink making a "surprise" dividend cut of 26%. The stock fell sharply on the news, making it clear that...

- Analytical Toolbox

This page lists useful tools for finding and tracking Wide Moat Dividend stocks. Dividend Compass by Todd Wenning. Goes miles beyond the dividend payout ratio to give a nuanced view of the health and sustainability of a company's dividend. The...

- Todd Wenning On Finding Differentiated Dividend Ideas

One of the good things about dividend investing is also a challenge. Dividend investing forces you to screen out many stocks, because they do not pay a dividend at all. And really, for most dividend investors, you are going to want at least a 2 or 3%...

- Top 35 Dividend Growth Stocks E-book Realeased

Dan Mac over at Dividend Stock Investing has released his new E-book on Amazon and is available for FREE for the next 3 days (June 16,17 and 18)! It's definitely worth a look. The book is available in Kindle format. Don't have a Kindle ? Don't...

Money and Finance

How to Find a Good Dividend Growth Stock - Part 1

Thought I'd try something different here on the Clear Eyes Investing blog. I was planning to add a few dividend growth stocks to my watchlist -- maybe even buy one or two if they're trading at a good price -- and figured I'd share my research process over the course of three blog posts.

- In today's post, I'll establish a research objective, screen for ideas, and put each of the ideas through a "five-minute sniff test" to determine whether or not they're worthy of further research.

- In next week's post, I'll put the handful of remaining stocks through the Dividend Compass spreadsheet in order to learn a little more about the companies and the dividends' sustainability and growth potential.

- In the final installment, I'll hopefully have two or three good ideas that have passed the initial tests. I'll do more detailed research on the select names, consider their valuations, and potentially invest in them.

Step 1: Set an objective

Identify quality dividend-paying small- to mid-cap companies with sustainable competitive advantages and the potential for 7%+ annual dividend growth over the next 7-10 years.

Step 2: Screen for ideas

To focus my search on a few promising names, I used Yahoo! Finance's free screening tool and set up four parameters:

- Market cap: Between $500 million and $3 billion

- Yield: Between 2% and 4%

- Return on assets: >= 5%

- Profit margin: >= 10%

Here are the results (click to enlarge):

|

| Yahoo! Finance |

|

| *a triple-check revealed AWR's ttm yield is 2.6%...amazing how inconsistent data can be across providers |

Right off the bat, then, we can eliminate a few names as their yields fall outside my desired range. Textainer Group and Giant Interactive have yields that are too high for an ideal dividend growth investment. Perhaps they're good value or even high yield investments, but from a dividend growth perspective, you have to wonder why they're trading with such high yields in a bullish market like we have today. You would think that if the companies had strong growth prospects that the stocks would be bid up to the point where the yields better approximated the Russell 2000 Index average yield of 1.4%.

I'm also going to eliminate Weight Watchers International, The Buckle, and Oxford Industries. Good companies perhaps, but their yields fall well below the 2% minimum. MTS Systems and Choice Hotels are right on the border, but we'll hang onto them for now.

With the list whittled down, let's put the remaining 12 names through the five-minute sniff test.

Step 3: The Five-Minute Sniff Test

With so many stocks to sort through in a typical screening exercise, it helps to have a "sniff test" process in order to make the most of your time.

A few things I check before moving forward with a dividend growth stock idea are:

- Has the company paid a dividend for at least five consecutive years without dividend cuts?

- Has the dividend been increased by at least 7% on average over the last five years?

- Is the five-year average return on equity/capital over 12%?

- Has the company generated free cash flow in at least four of the past five years?

- Is the debt/equity below one?

Fortunately, this information is also fairly easy to find using free sources and public filings. Morningstar*, for example, lists key ratios going back 10 years and financials going back five years. I also consulted Yahoo! Finance dividend history for each company.

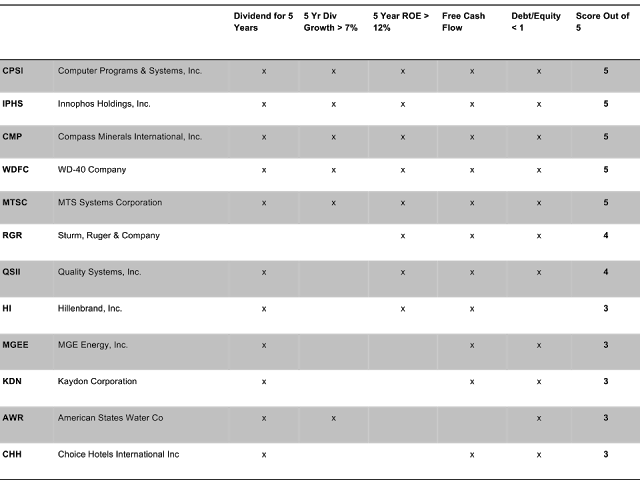

Here's how the remaining dozen companies fared (click image to enlarge):

After the sniff test, we have five companies that checked off all the boxes: Computer Programs & Systems, Innophos Holdings, Compass Minerals, WD-40, and MTS Systems. I'm also going to pass Quality Systems through to the next round on account of its five-year dividend growth rate being 6.96% -- just below the 7% threshold. It would have scored 5 of 5 had I rounded up 4 basis points...

Sturm, Ruger & Co also scored an impressive 4 of 5 and its recent dividend growth has been nice, but it reinstated its dividend less than five years ago in May 2009. I'm also going to discard the five companies that scored 3 of 5. They may make for good investments from a value or growth perspective, but I'm less convinced that they're attractive dividend growth candidates.

American States Water checked off the two dividend boxes, but its 10-year CAGR dividend growth is just 4.9%. It might be worth looking into if you have some spare time; however, for the purposes of this exercise I'm keeping the list of candidates as manageable as possible.

Next steps

This is a good list of companies to consider. I currently own Compass Minerals and have watched WD-40 for some time, so I'm looking forward to seeing how they score on the Dividend Compass in next week's post.

If you'd like to stay up-to-date with the posts in this series, you can subscribe by email or RSS using the tools in the right-hand column. Or just check back next weekend.

Again, please share your feedback and questions in the comments section below, or contact me on Twitter @toddwenning.

Thanks for reading.

Best,

Todd

@toddwenning on Twitter

*My employer

Sturm, Ruger & Co also scored an impressive 4 of 5 and its recent dividend growth has been nice, but it reinstated its dividend less than five years ago in May 2009. I'm also going to discard the five companies that scored 3 of 5. They may make for good investments from a value or growth perspective, but I'm less convinced that they're attractive dividend growth candidates.

American States Water checked off the two dividend boxes, but its 10-year CAGR dividend growth is just 4.9%. It might be worth looking into if you have some spare time; however, for the purposes of this exercise I'm keeping the list of candidates as manageable as possible.

Next steps

This is a good list of companies to consider. I currently own Compass Minerals and have watched WD-40 for some time, so I'm looking forward to seeing how they score on the Dividend Compass in next week's post.

If you'd like to stay up-to-date with the posts in this series, you can subscribe by email or RSS using the tools in the right-hand column. Or just check back next weekend.

Again, please share your feedback and questions in the comments section below, or contact me on Twitter @toddwenning.

Other posts in this series:

How to Find a Good Dividend Growth Stock: Part 1

How to Find a Good Dividend Growth Stock: Part 2

How to Find a Good Dividend Growth Stock: Part 2

How to Find a Good Dividend Growth Stock: Part 3

Thanks for reading.

Best,

Todd

@toddwenning on Twitter

*My employer

- Dividend Growth Checkup

As part of my annual review process for my portfolio, I read through the latest quarterly or annual reports for the companies I own, as well as checked up on the organic dividend growth for each position and for the portfolio as a whole. The dividend...

- Centurylink's Dividend Cut Provides Many Valuable Lessons

A brief post this evening, but I wanted to quickly comment on today's big dividend news -- U.S. telecom & broadband company CenturyLink making a "surprise" dividend cut of 26%. The stock fell sharply on the news, making it clear that...

- Analytical Toolbox

This page lists useful tools for finding and tracking Wide Moat Dividend stocks. Dividend Compass by Todd Wenning. Goes miles beyond the dividend payout ratio to give a nuanced view of the health and sustainability of a company's dividend. The...

- Todd Wenning On Finding Differentiated Dividend Ideas

One of the good things about dividend investing is also a challenge. Dividend investing forces you to screen out many stocks, because they do not pay a dividend at all. And really, for most dividend investors, you are going to want at least a 2 or 3%...

- Top 35 Dividend Growth Stocks E-book Realeased

Dan Mac over at Dividend Stock Investing has released his new E-book on Amazon and is available for FREE for the next 3 days (June 16,17 and 18)! It's definitely worth a look. The book is available in Kindle format. Don't have a Kindle ? Don't...