Money and Finance

Since certain financial regulations were loosened by the U.S. Congress in 1982 (rule 10b-18, to be specific), company stock repurchases -- commonly known as buybacks -- have rapidly become a preferred means of returning cash to shareholders. With buybacks, companies use cash on hand to purchase their own stock in either the open market or via tender offer. This reduces the company's share count and effectively increases ongoing shareholders' percentage ownership of the company. To put it another way, your slice of the pie stays the same while the pie itself gets smaller.

Sounds innocuous enough, right? Who doesn't like pie?

From the company's perspective, there's really a lot to like about buybacks -- for one, they're more flexible than dividends (less commitment), they can be used to manage EPS (a figure Wall Street loves to focus on), adjust the firm's financial leverage, offset share dilution from employee stock options and grants, and provide a "signal" to the market that management thinks the stock is undervalued.

But from the individual investor's perspective, the benefits of buybacks aren't quite as clear.

The good, the bad, and the ugly

Stock buybacks, when used appropriately, can be a long-term shareholder's best friend if -- and only if -- the stock is undervalued when repurchased by the company and there are no better investment options. It's really that simple. When this is the case, there's a wealth transfer from former shareholders to ongoing shareholders.

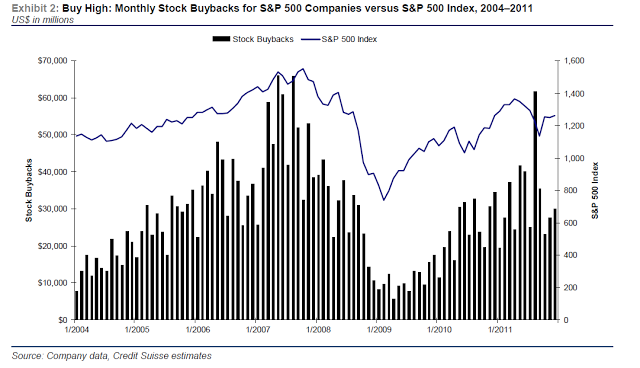

The problem is that executives don't have a great track record buying their own stock, at least when it comes to investing shareholder money (investing their own money is a different story) and frequently overpay. This excellent paper by Credit Suisse, for example, found that "It looks like most of the buybacks by the S&P 500 over the past eight years have not yet added much value for remaining shareholders."

Long-term buy high and hold

So why do companies consistently buyback their stock at elevated levels? I think there are two prevailing reasons.

First, when business is good, companies have more spare cash to put to work, but most companies' good years are positively correlated with good years in the market. As a result, not only is their own share price higher, but acquisition opportunities are also more expensive. Holding too much cash can be a bad thing, too. So what to do? Because raising a regular dividend is seen as a commitment to pay that amount or more going forward and investors don't like dividend cuts, companies don't want to over-commit to a higher payout if they aren't sure they can afford it when business dries up. Buybacks are an easy and typically well-received decision from the investor base, so they've become the default option when there's extra cash on hand

The second reason is that, in aggregate, there appears to be a lack of due diligence and proper valuation work being done in the executive suite. Even if we assume that all executive teams intend on repurchasing stock only when they consider it undervalued (and not for another reason), based on the studies we've seen, they're clearly not doing a good job of assessing their intrinsic value.

Any company (or investor) can adjust its valuation model to show that the stock is undervalued. A little lower discount rate here, a touch higher growth assumption there (model garnishing, as it's called in the industry) and voila -- your stock is undervalued. Indeed, this recent article in the Harvard Business Review illustrates quite nicely the quixotic valuation assumptions used by companies when making investment decisions. It's unlikely that you'll find a corporate finance team that wants to report to the CFO that the stock is overvalued.

At the risk of adding to the investing hagiography of Buffett (to which I've already contributed a great deal), I thought this passage from his latest annual letter to Berkshire Hathaway shareholders explained proper usage of buybacks quite well.

Some buyback proponents argue that if you own the stock, you are doing so because you also believe the stock is undervalued and therefore you should be fine with the company buying it, too. Not necessarily. For one, long-term shareholders are generally not interested in selling a stock if it's slightly overvalued, particularly if they're receiving a good dividend from the stock or if they'll have a large tax bill if they sell the full position. In addition, even if the stock is just slightly undervalued, there may be better opportunities elsewhere and ongoing investors should prefer to have the cash back to reallocate to those opportunities.

Others argue that if you want a dividend, simply sell a proportionate number of shares after the buyback. This might be fine for institutional investors with large positions, but for individual investors with smaller positions, this is less feasible due to transaction costs.

Is there no other way?

Few companies have consistently bought back their stock only when it was genuinely undervalued. As such, it would be great to see more companies adopt a "special dividend" policy in which they pay out all spare cash to ongoing shareholders each year after all capital investment needs have been made. Here are a few reasons why this is a worthwhile policy for companies to consider:

- Berkshire's Book Value And Share Repurchases

At the end of Q3, Berkshire Hathaway’s book value stood at $111,718 per Class A equivalent share, or $74.48 per B share. Remember that Mr. Buffett can buy back stock at 110% of book value, a price he believes significantly undervalues Berkshire. So...

- When Companies Aren't Committed To Dividends

Prior to 1982, when large-scale share repurchases became viable after Congress enacted rule 10b-18, nearly all shareholder distributions were returned via cash dividends. As such, companies with longer operating histories tend to have a tradition...

- Can A Total Shareholder Yield Etf Work?

A rare mid-week post, but earlier today I read an interesting article on Forbes about the Cambria Shareholder Yield ETF (SYLD), which was based on an interview with the Cambria CIO. So I decided to dig into the story a little this evening. The SYLD...

- Should We Do Away With Dividend Yield?

We may not like it, but buybacks are here to stay. Management teams prefer buybacks for a number of reasons, even though those reasons may not always be in the best interests of their shareholders. So ingrained are buybacks in today's market that...

- Should More Companies Adopt Flexible Dividend Policies?

In the U.S. and U.K. markets, the most common form of dividend policy is one that aims to pay at least the same amount year after year, regardless of the company's performance that year. I'll call this the "consistent" dividend policy. In such...

Money and Finance

Why Fewer Buybacks and More Dividends Would Be a Good Thing

Since certain financial regulations were loosened by the U.S. Congress in 1982 (rule 10b-18, to be specific), company stock repurchases -- commonly known as buybacks -- have rapidly become a preferred means of returning cash to shareholders. With buybacks, companies use cash on hand to purchase their own stock in either the open market or via tender offer. This reduces the company's share count and effectively increases ongoing shareholders' percentage ownership of the company. To put it another way, your slice of the pie stays the same while the pie itself gets smaller.

Sounds innocuous enough, right? Who doesn't like pie?

From the company's perspective, there's really a lot to like about buybacks -- for one, they're more flexible than dividends (less commitment), they can be used to manage EPS (a figure Wall Street loves to focus on), adjust the firm's financial leverage, offset share dilution from employee stock options and grants, and provide a "signal" to the market that management thinks the stock is undervalued.

But from the individual investor's perspective, the benefits of buybacks aren't quite as clear.

The good, the bad, and the ugly

Stock buybacks, when used appropriately, can be a long-term shareholder's best friend if -- and only if -- the stock is undervalued when repurchased by the company and there are no better investment options. It's really that simple. When this is the case, there's a wealth transfer from former shareholders to ongoing shareholders.

The problem is that executives don't have a great track record buying their own stock, at least when it comes to investing shareholder money (investing their own money is a different story) and frequently overpay. This excellent paper by Credit Suisse, for example, found that "It looks like most of the buybacks by the S&P 500 over the past eight years have not yet added much value for remaining shareholders."

|

| Source: Credit Suisse |

So why do companies consistently buyback their stock at elevated levels? I think there are two prevailing reasons.

First, when business is good, companies have more spare cash to put to work, but most companies' good years are positively correlated with good years in the market. As a result, not only is their own share price higher, but acquisition opportunities are also more expensive. Holding too much cash can be a bad thing, too. So what to do? Because raising a regular dividend is seen as a commitment to pay that amount or more going forward and investors don't like dividend cuts, companies don't want to over-commit to a higher payout if they aren't sure they can afford it when business dries up. Buybacks are an easy and typically well-received decision from the investor base, so they've become the default option when there's extra cash on hand

The second reason is that, in aggregate, there appears to be a lack of due diligence and proper valuation work being done in the executive suite. Even if we assume that all executive teams intend on repurchasing stock only when they consider it undervalued (and not for another reason), based on the studies we've seen, they're clearly not doing a good job of assessing their intrinsic value.

Any company (or investor) can adjust its valuation model to show that the stock is undervalued. A little lower discount rate here, a touch higher growth assumption there (model garnishing, as it's called in the industry) and voila -- your stock is undervalued. Indeed, this recent article in the Harvard Business Review illustrates quite nicely the quixotic valuation assumptions used by companies when making investment decisions. It's unlikely that you'll find a corporate finance team that wants to report to the CFO that the stock is overvalued.

At the risk of adding to the investing hagiography of Buffett (to which I've already contributed a great deal), I thought this passage from his latest annual letter to Berkshire Hathaway shareholders explained proper usage of buybacks quite well.

Charlie and I favor repurchases when two conditions are met: first, a company has ample funds to take care of the operational and liquidity needs of its business; second, its stock is selling at a material discount to the company’s intrinsic business value, conservatively calculated.

We have witnessed many bouts of repurchasing that failed our second test. Sometimes, of course, infractions – even serious ones – are innocent; many CEOs never stop believing their stock is cheap. In other instances, a less benign conclusion seems warranted. It doesn’t suffice to say that repurchases are being made to offset the dilution from stock issuances or simply because a company has excess cash. Continuing shareholders are hurt unless shares are purchased below intrinsic value. The first law of capital allocation – whether the money is slated for acquisitions or share repurchases – is that what is smart at one price is dumb at another. (my emphasis)Notice that Buffett specified a material discount -- for buybacks to create substantial value for ongoing shareholders, the stock must offer a superior return to what investors could get from a market index fund. Otherwise, hand back the cash and let investors earn a lower-risk market return on their own.

Some buyback proponents argue that if you own the stock, you are doing so because you also believe the stock is undervalued and therefore you should be fine with the company buying it, too. Not necessarily. For one, long-term shareholders are generally not interested in selling a stock if it's slightly overvalued, particularly if they're receiving a good dividend from the stock or if they'll have a large tax bill if they sell the full position. In addition, even if the stock is just slightly undervalued, there may be better opportunities elsewhere and ongoing investors should prefer to have the cash back to reallocate to those opportunities.

Others argue that if you want a dividend, simply sell a proportionate number of shares after the buyback. This might be fine for institutional investors with large positions, but for individual investors with smaller positions, this is less feasible due to transaction costs.

Is there no other way?

Few companies have consistently bought back their stock only when it was genuinely undervalued. As such, it would be great to see more companies adopt a "special dividend" policy in which they pay out all spare cash to ongoing shareholders each year after all capital investment needs have been made. Here are a few reasons why this is a worthwhile policy for companies to consider:

- It consistently rewards ongoing shareholders rather than giving the cash to former shareholders; therefore, it might attract investors focused on the next 3-5+ years and not the next 3-5 months, giving management a little breathing room to make longer-term investments.

- It lets investors decide if the stock is undervalued. If it is, they'll reinvest the proceeds themselves.

- It still provides room for smart buybacks when a clear case can be made for them.

- It solves the "What are we going to do with this extra cash?" problem.

- It forces management to become more thoughtful about acquisitions. While investors shouldn't expect a special dividend to be held steady year-over-year like a normal dividend, they'd also feel the loss if their special dividend was squandered on a dumb acquisition.

Here's to hoping more companies consider special dividends as an alternative to buybacks, but I won't hold my breath. Buybacks, love them or hate them, are here to stay. Whether you're evaluating a new investment or an existing one, pay attention to management's track record of buybacks. If they've consistently bought back shares in bull markets and not in bear markets, it's fair to question the process behind their capital allocation decisions.

What do you think? Please post your comments below.

Enjoy the Olympics!

Best,

Todd

@toddwenning on Twitter

(long BRK-B)

- Berkshire's Book Value And Share Repurchases

At the end of Q3, Berkshire Hathaway’s book value stood at $111,718 per Class A equivalent share, or $74.48 per B share. Remember that Mr. Buffett can buy back stock at 110% of book value, a price he believes significantly undervalues Berkshire. So...

- When Companies Aren't Committed To Dividends

Prior to 1982, when large-scale share repurchases became viable after Congress enacted rule 10b-18, nearly all shareholder distributions were returned via cash dividends. As such, companies with longer operating histories tend to have a tradition...

- Can A Total Shareholder Yield Etf Work?

A rare mid-week post, but earlier today I read an interesting article on Forbes about the Cambria Shareholder Yield ETF (SYLD), which was based on an interview with the Cambria CIO. So I decided to dig into the story a little this evening. The SYLD...

- Should We Do Away With Dividend Yield?

We may not like it, but buybacks are here to stay. Management teams prefer buybacks for a number of reasons, even though those reasons may not always be in the best interests of their shareholders. So ingrained are buybacks in today's market that...

- Should More Companies Adopt Flexible Dividend Policies?

In the U.S. and U.K. markets, the most common form of dividend policy is one that aims to pay at least the same amount year after year, regardless of the company's performance that year. I'll call this the "consistent" dividend policy. In such...