Money and Finance

We may not like it, but buybacks are here to stay. Management teams prefer buybacks for a number of reasons, even though those reasons may not always be in the best interests of their shareholders.

So ingrained are buybacks in today's market that some have called for an end to the classic definition of dividend yield (dividends per share / share price) to be replaced with a "modified" or "total" yield that includes buybacks ( (dividends + buybacks per share) / share price).

Indeed, Standard & Poors now includes a "dividend & buyback yield" column in its quarterly update on S&P 500 distributions. Ready or not, it's becoming a more commonly-used metric.

The game has changed...

The total yield approach is somewhat instructive as it helps explain a number of things that we've seen in the 30 years since Congress (via rule 10b-18) allowed companies to make greater use of buybacks.

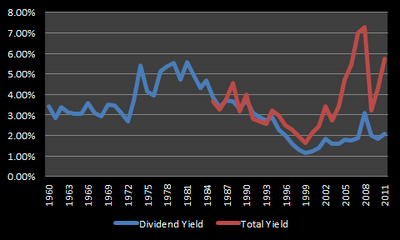

The major thing total yield helps explain is why dividend yields over the past 30 years remain well-off historical averages. The chart below shows the dividend yield of the S&P 500 between 1960 and 2011 and compares it with the total yield of all U.S. companies since 1985 when buybacks started becoming a meaningful way of returning shareholder cash.

Recognizing there's only a slight difference between the 1960-2011 and 1985-2011 data, the major difference between the red and blue lines is buyback yield. Put in this perspective, the decline in dividend yield can be rationalized as a paradigm shift toward alternative ways of returning shareholder cash.

In fact, it shows that companies have become even more generous with distributions than in the past.

(Don't break out the party hats just yet...)

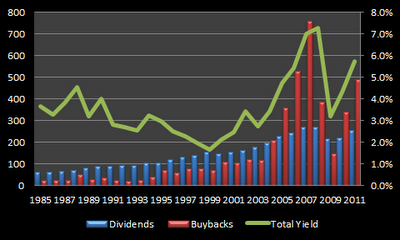

The next chart provides more granularity for the total yield period and shows the rise of buybacks as the primary means of returning shareholder cash between 1985 and 2011.

As you can see from these two charts, buybacks have only recently become a truly driving force in the total yield equation. Until 2004, dividends had accounted for the majority of distributions -- even during the dotcom boom.

Predictably, the buyback trend since 2004 has largely followed the market. When the market has been good and companies feel flush, buybacks have increased, and vice versa. Curiously -- and sadly -- as Michael Mauboussin points out here, M&A activity has generally followed this path, as well:

Its current market cap is $28 billion.

Long-term HPQ shareholders certainly don't feel any richer despite the $36 billion buybacks that should have been used to enhance shareholder value -- or in part distributed to shareholders as special cash dividends. Worse, most of the buybacks were fueled by borrowings and HPQ's debt/equity ratio increased from 13% in 2007 to 76% in the most recent quarter.

...but common sense remains common sense

There are companies that make prudent use of buybacks and no, I'm not completely opposed to them; however, general market data shows that, on average, buybacks are value destructive.

For this reason alone, I cannot accept the idea that we should do away with dividend yield and replace it with a total yield metric that includes buybacks. The two types of returning shareholder cash are simply not apples-to-apples.

The total yield metric is certainly instructive, but given the differences between dividends and buybacks and the track record of companies destroying value using buybacks, it's critical to keep dividend yield and buyback yield separate.

Hope you're having a great weekend! Thanks for reading.

Best,

Todd

- Exxon Mobil's Dividend Could Be In Danger

Earlier this month, Exxon Mobil (NYSE:XOM) reported Q4 2015 earnings which, as expected, looked ugly considering the large decline in the price of oil over the last one and a half years. Exxon Mobil has long been one of the largest repurchasers of shares,...

- Buybacks Aren't Doing Much For Shareholders Right Now

"If everyone is doing (buybacks), there must be something wrong with them." - Henry Singleton, former Teledyne CEO (profiled in The Outsiders) With the exception of 2009, gross buybacks have outpaced dividends paid by U.S. companies each year since...

- Can A Total Shareholder Yield Etf Work?

A rare mid-week post, but earlier today I read an interesting article on Forbes about the Cambria Shareholder Yield ETF (SYLD), which was based on an interview with the Cambria CIO. So I decided to dig into the story a little this evening. The SYLD...

- Should More Companies Adopt Flexible Dividend Policies?

In the U.S. and U.K. markets, the most common form of dividend policy is one that aims to pay at least the same amount year after year, regardless of the company's performance that year. I'll call this the "consistent" dividend policy. In such...

- Dividends Aren't Evil

Matt Yglesias has a post called "Dividends Are Evil", he is right in some ways, but mostly wrong. Let's count the ways: 1. Yglesias begins by saying that dividends are a "triumph of short term thinking"; I could not disagree more. Dividend investing...

Money and Finance

Should We Do Away With Dividend Yield?

We may not like it, but buybacks are here to stay. Management teams prefer buybacks for a number of reasons, even though those reasons may not always be in the best interests of their shareholders.

So ingrained are buybacks in today's market that some have called for an end to the classic definition of dividend yield (dividends per share / share price) to be replaced with a "modified" or "total" yield that includes buybacks ( (dividends + buybacks per share) / share price).

Indeed, Standard & Poors now includes a "dividend & buyback yield" column in its quarterly update on S&P 500 distributions. Ready or not, it's becoming a more commonly-used metric.

The game has changed...

The total yield approach is somewhat instructive as it helps explain a number of things that we've seen in the 30 years since Congress (via rule 10b-18) allowed companies to make greater use of buybacks.

The major thing total yield helps explain is why dividend yields over the past 30 years remain well-off historical averages. The chart below shows the dividend yield of the S&P 500 between 1960 and 2011 and compares it with the total yield of all U.S. companies since 1985 when buybacks started becoming a meaningful way of returning shareholder cash.

|

| Source: S&P (via Aswath Damodaran) and Birinyi Associates and FRB Z.1. (via Michael Mauboussin) |

Recognizing there's only a slight difference between the 1960-2011 and 1985-2011 data, the major difference between the red and blue lines is buyback yield. Put in this perspective, the decline in dividend yield can be rationalized as a paradigm shift toward alternative ways of returning shareholder cash.

In fact, it shows that companies have become even more generous with distributions than in the past.

(Don't break out the party hats just yet...)

The next chart provides more granularity for the total yield period and shows the rise of buybacks as the primary means of returning shareholder cash between 1985 and 2011.

|

| Source: Birinyi Associates and FRB Z.1. |

Predictably, the buyback trend since 2004 has largely followed the market. When the market has been good and companies feel flush, buybacks have increased, and vice versa. Curiously -- and sadly -- as Michael Mauboussin points out here, M&A activity has generally followed this path, as well:

One shining example of this principle in action has been Hewlett-Packard, which repurchased $36 billion of its stock between 2008 and 2011.Indeed, M&A and buybacks follow the economic cycle: Activity increases when the stock market is up and decreases when the market is down. This is the exact opposite pattern you’d expect if management’s primary goal is to build value. (His emphasis)

Its current market cap is $28 billion.

Long-term HPQ shareholders certainly don't feel any richer despite the $36 billion buybacks that should have been used to enhance shareholder value -- or in part distributed to shareholders as special cash dividends. Worse, most of the buybacks were fueled by borrowings and HPQ's debt/equity ratio increased from 13% in 2007 to 76% in the most recent quarter.

...but common sense remains common sense

There are companies that make prudent use of buybacks and no, I'm not completely opposed to them; however, general market data shows that, on average, buybacks are value destructive.

For this reason alone, I cannot accept the idea that we should do away with dividend yield and replace it with a total yield metric that includes buybacks. The two types of returning shareholder cash are simply not apples-to-apples.

The total yield metric is certainly instructive, but given the differences between dividends and buybacks and the track record of companies destroying value using buybacks, it's critical to keep dividend yield and buyback yield separate.

Hope you're having a great weekend! Thanks for reading.

Best,

Todd

- Exxon Mobil's Dividend Could Be In Danger

Earlier this month, Exxon Mobil (NYSE:XOM) reported Q4 2015 earnings which, as expected, looked ugly considering the large decline in the price of oil over the last one and a half years. Exxon Mobil has long been one of the largest repurchasers of shares,...

- Buybacks Aren't Doing Much For Shareholders Right Now

"If everyone is doing (buybacks), there must be something wrong with them." - Henry Singleton, former Teledyne CEO (profiled in The Outsiders) With the exception of 2009, gross buybacks have outpaced dividends paid by U.S. companies each year since...

- Can A Total Shareholder Yield Etf Work?

A rare mid-week post, but earlier today I read an interesting article on Forbes about the Cambria Shareholder Yield ETF (SYLD), which was based on an interview with the Cambria CIO. So I decided to dig into the story a little this evening. The SYLD...

- Should More Companies Adopt Flexible Dividend Policies?

In the U.S. and U.K. markets, the most common form of dividend policy is one that aims to pay at least the same amount year after year, regardless of the company's performance that year. I'll call this the "consistent" dividend policy. In such...

- Dividends Aren't Evil

Matt Yglesias has a post called "Dividends Are Evil", he is right in some ways, but mostly wrong. Let's count the ways: 1. Yglesias begins by saying that dividends are a "triumph of short term thinking"; I could not disagree more. Dividend investing...