Money and Finance

Prior to 1982, when large-scale share repurchases became viable after Congress enacted rule 10b-18, nearly all shareholder distributions were returned via cash dividends.

As such, companies with longer operating histories tend to have a tradition of paying dividends and their shareholders have naturally come to expect them to continue.

If given the chance, however, I suspect some of them would elect for a diminished dividend program in favor of buybacks, which offer substantially more financial flexibility and tend to benefit management and short-term investors.

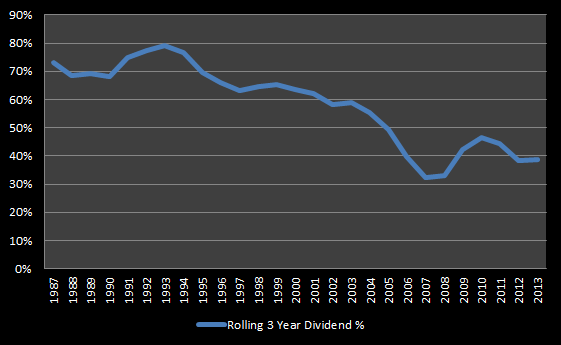

Consider the following chart, which shows the rolling three-year percentage of U.S. shareholder distributions made via cash dividends versus buybacks.

What's particularly notable is that this trend developed despite equal tax rates on dividends and long-term capital gains since 2003, an increasing number of retiring baby boomers seeking income over growth, and strong demand for higher-yielding stocks in a low rate environment.

All of these factors should have encouraged a larger share of shareholder distributions going to cash dividends, but that's not happening. Some companies are clearly not comfortable with making a larger commitment to their dividend program.

We can discuss the reasons this might be the case in the comments section below, but you might be rightly wondering at this point, "Why does this even matter?"

As you're building a dividend portfolio, you want to stock it with companies that want to pay dividends. You don't want to own companies that feel burdened by their current payout, as these are the companies most likely to cut their payouts if given the opportunity.

Here are five red flags that a company may not be comfortable with its dividend policy:

- Buybacks Aren't Doing Much For Shareholders Right Now

"If everyone is doing (buybacks), there must be something wrong with them." - Henry Singleton, former Teledyne CEO (profiled in The Outsiders) With the exception of 2009, gross buybacks have outpaced dividends paid by U.S. companies each year since...

- Can A Total Shareholder Yield Etf Work?

A rare mid-week post, but earlier today I read an interesting article on Forbes about the Cambria Shareholder Yield ETF (SYLD), which was based on an interview with the Cambria CIO. So I decided to dig into the story a little this evening. The SYLD...

- Why Tax Increases Could Lead To More Buybacks

(Note: Since this article was published, dividend tax rates were increased as expected, but in-line with long-term capital gains. This is a more positive outcome than the one described in the article where dividends and capital gains were taxed at different...

- Should We Do Away With Dividend Yield?

We may not like it, but buybacks are here to stay. Management teams prefer buybacks for a number of reasons, even though those reasons may not always be in the best interests of their shareholders. So ingrained are buybacks in today's market that...

- 10 Point Checklist For Dividend Ideas

The number of free stock screening tools has increased significantly in recent years. And while some screens are certainly better than others, investors often remain overwhelmed by the number of stocks these screens spit out, requiring yet further sorting...

Money and Finance

When Companies Aren't Committed to Dividends

Prior to 1982, when large-scale share repurchases became viable after Congress enacted rule 10b-18, nearly all shareholder distributions were returned via cash dividends.

As such, companies with longer operating histories tend to have a tradition of paying dividends and their shareholders have naturally come to expect them to continue.

If given the chance, however, I suspect some of them would elect for a diminished dividend program in favor of buybacks, which offer substantially more financial flexibility and tend to benefit management and short-term investors.

Consider the following chart, which shows the rolling three-year percentage of U.S. shareholder distributions made via cash dividends versus buybacks.

|

| Source: Birinyi Associates and FRB Z.1. (1985-87), S&P (2011-6/2013), author estimates |

All of these factors should have encouraged a larger share of shareholder distributions going to cash dividends, but that's not happening. Some companies are clearly not comfortable with making a larger commitment to their dividend program.

We can discuss the reasons this might be the case in the comments section below, but you might be rightly wondering at this point, "Why does this even matter?"

As you're building a dividend portfolio, you want to stock it with companies that want to pay dividends. You don't want to own companies that feel burdened by their current payout, as these are the companies most likely to cut their payouts if given the opportunity.

Here are five red flags that a company may not be comfortable with its dividend policy:

- Token dividend increases: If a company's raising its dividend by a small amount each year (less than 4% growth), it might mean that it is cautious about its prospects, or it could mean that the company is simply raising its payout by a token amount to maintain a tradition of raising payouts. In either case, this is not an encouraging track.

- High leverage and high payout ratio: Firms with high financial leverage that are also paying out the majority of free cash flow as dividends might be concerned about their ability to maintain the current payout. In the event of an economic downturn or a shock to their competitive environment, the dividend could come under fire. Keep an eye out for "token" dividend increases from such companies.

- Excessive stock options in management compensation: The expected value of stock options decreases with the payment of dividends, so if the company's executive compensation program is heavily-weighted toward stock options, management may have a disincentive to paying higher levels of dividends.

- Short-term focused ownership: If a friend or colleague offered you an opportunity to buy a small equity stake in a local business, one of the questions you'd surely ask is, "Who are the other owners?" You'd want to know how the other equity holders think about the business, are their interests aligned with yours, etc., yet it's amazing how infrequently this question is asked before investors purchase stocks. Take a look at the list of the company's largest shareholders (outlined in annual filings), check out the fund managers' websites, and try to determine if they're long-term and/or dividend-focused. If you see a bunch of hedge fund owners, you might want to walk away from the stock.

- An increasing preference for buybacks: Though buybacks properly employed can support dividend growth, you want to see a balance between dividends and buybacks over time. If the company is shifting from a balanced approach toward more preference for buybacks, it's a warning sign that the company is losing enthusiasm for its dividend program.

As long-term, patient, dividend-focused investors, we want to own companies whose interests are aligned with our own. Recognizing the early signs of companies that are less committed to their dividend programs can help us better build our portfolios around the right companies.

Good reads this week:

- "Filtering Nonsense" -- Farnam Street

- Understand All the Costs of Investing -- InvestmentMoats

- Investing in Lego - Monevator

Art of the Week:

|

| My friend Anna's still life "Occhioverde" |

Thanks for reading!

Best,

Todd

@toddwenning

- Buybacks Aren't Doing Much For Shareholders Right Now

"If everyone is doing (buybacks), there must be something wrong with them." - Henry Singleton, former Teledyne CEO (profiled in The Outsiders) With the exception of 2009, gross buybacks have outpaced dividends paid by U.S. companies each year since...

- Can A Total Shareholder Yield Etf Work?

A rare mid-week post, but earlier today I read an interesting article on Forbes about the Cambria Shareholder Yield ETF (SYLD), which was based on an interview with the Cambria CIO. So I decided to dig into the story a little this evening. The SYLD...

- Why Tax Increases Could Lead To More Buybacks

(Note: Since this article was published, dividend tax rates were increased as expected, but in-line with long-term capital gains. This is a more positive outcome than the one described in the article where dividends and capital gains were taxed at different...

- Should We Do Away With Dividend Yield?

We may not like it, but buybacks are here to stay. Management teams prefer buybacks for a number of reasons, even though those reasons may not always be in the best interests of their shareholders. So ingrained are buybacks in today's market that...

- 10 Point Checklist For Dividend Ideas

The number of free stock screening tools has increased significantly in recent years. And while some screens are certainly better than others, investors often remain overwhelmed by the number of stocks these screens spit out, requiring yet further sorting...