Money and Finance

While there are undoubtedly some companies making smart and opportunistic buyback decisions today, when the majority of companies are also buying back stock, it's not likely that companies on average are adding much long-term shareholder value with share repurchases.

Jim Chanos, in an interview with Barry Ritholtz, echoed these sentiments:

Let me know what you think in the comments below or on Twitter @toddwenning

Stay patient, stay focused.

Best,

Todd

- Share Repurchase From All Angles: Assessing Buybacks, No Matter Where You Sit - By Michael Mauboussin

In his latest strategy piece, Share Repurchase from All Angles: Assessing Buybacks, No Matter Where You Sit, Michael Mauboussin discusses the sometimes misused and misunderstood importance of share buybacks to maximize long-term value for shareholders...

- How Effective Are Those Share Buybacks?

Companies have a few options when it comes to creating shareholder value. The most important is the ability to improve the underlying operations of the company through growth. My favorite is through dividends and of course share buybacks are another...

- Can A Total Shareholder Yield Etf Work?

A rare mid-week post, but earlier today I read an interesting article on Forbes about the Cambria Shareholder Yield ETF (SYLD), which was based on an interview with the Cambria CIO. So I decided to dig into the story a little this evening. The SYLD...

- Should We Do Away With Dividend Yield?

We may not like it, but buybacks are here to stay. Management teams prefer buybacks for a number of reasons, even though those reasons may not always be in the best interests of their shareholders. So ingrained are buybacks in today's market that...

- Dividends Aren't Evil

Matt Yglesias has a post called "Dividends Are Evil", he is right in some ways, but mostly wrong. Let's count the ways: 1. Yglesias begins by saying that dividends are a "triumph of short term thinking"; I could not disagree more. Dividend investing...

Money and Finance

Buybacks Aren't Doing Much For Shareholders Right Now

"If everyone is doing (buybacks), there must be something wrong with them."

- Henry Singleton, former Teledyne CEO (profiled in The Outsiders)

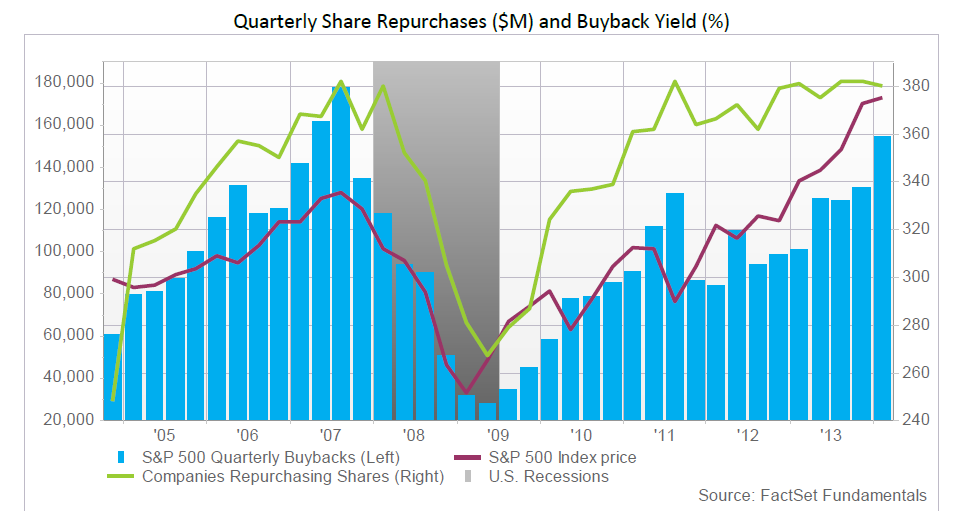

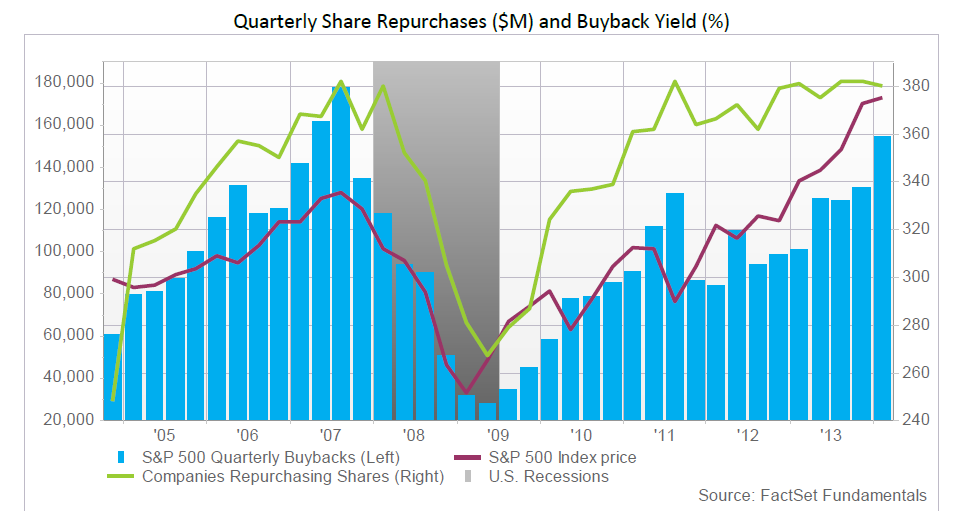

With the exception of 2009, gross buybacks have outpaced dividends paid by U.S. companies each year since 1997. As such, it's absolutely critical that investors -- even dividend investors -- take buybacks into consideration when evaluating companies.

But as Michael Mauboussin points out in a recent study on capital allocation, unlike dividends, which treat all shareholders equally:

In a buyback, selling shareholders benefit at the expense of ongoing shareholders if the stock is overvalued, and ongoing shareholders benefit at the expense of selling shareholders if the stock is undervalued. All shareholders are treated uniformly only if the stock price is at fair value.

In other words, when a company repurchases its shares at a discount to fair value, it's a good use of shareholder capital and ongoing shareholders make out quite well. However, relatively few management teams consistently buyback stock at opportunistic prices.

Indeed, the number of S&P 500 companies repurchasing shares and the amount spent on buybacks tends to follow the market.

While there are undoubtedly some companies making smart and opportunistic buyback decisions today, when the majority of companies are also buying back stock, it's not likely that companies on average are adding much long-term shareholder value with share repurchases.

Jim Chanos, in an interview with Barry Ritholtz, echoed these sentiments:

And when corporations embarked on massive buybacks across all industries and all companies, in effect these CEOs are buying the stock market. So what they’re telling you then, is unequivocally that they think that either they’re happy to earn the stock market rate of return or maybe something hopefully better. Or their rate of return on the margin of any new capital project is much much lower, in fact half or less of what is stated. And that does not bode well for the future of profits, or for the quality of earnings reported as current profits.Any investor can earn the market rate of return on their own using low-cost index funds. We certainly don't need companies doing it on our behalf. If companies can't find projects (including their own stocks) that generate long-term value, that cash should be returned to shareholders via dividends. Let the shareholders decide how to reinvest the cash as they see fit.

Let me know what you think in the comments below or on Twitter @toddwenning

Stay patient, stay focused.

Best,

Todd

- Share Repurchase From All Angles: Assessing Buybacks, No Matter Where You Sit - By Michael Mauboussin

In his latest strategy piece, Share Repurchase from All Angles: Assessing Buybacks, No Matter Where You Sit, Michael Mauboussin discusses the sometimes misused and misunderstood importance of share buybacks to maximize long-term value for shareholders...

- How Effective Are Those Share Buybacks?

Companies have a few options when it comes to creating shareholder value. The most important is the ability to improve the underlying operations of the company through growth. My favorite is through dividends and of course share buybacks are another...

- Can A Total Shareholder Yield Etf Work?

A rare mid-week post, but earlier today I read an interesting article on Forbes about the Cambria Shareholder Yield ETF (SYLD), which was based on an interview with the Cambria CIO. So I decided to dig into the story a little this evening. The SYLD...

- Should We Do Away With Dividend Yield?

We may not like it, but buybacks are here to stay. Management teams prefer buybacks for a number of reasons, even though those reasons may not always be in the best interests of their shareholders. So ingrained are buybacks in today's market that...

- Dividends Aren't Evil

Matt Yglesias has a post called "Dividends Are Evil", he is right in some ways, but mostly wrong. Let's count the ways: 1. Yglesias begins by saying that dividends are a "triumph of short term thinking"; I could not disagree more. Dividend investing...