Money and Finance

While researching a dividend paying stock should be a holistic process and buying decisions shouldn't be based on any single metric, if there's one metric that every dividend investor should know, it's free cash flow cover.

After all, an income investing strategy doesn't work without income, so before you purchase any dividend stock, it's absolutely critical to know whether or not the dividend is sustainable. That is, can the company afford its current dividend through cash flows from operations?

You also want to know whether or not the company can grow its dividend in the coming years.

Get to know free cash flow

Free cash flow cover can help you answer both in ways that other common dividend analysis metrics -- earnings cover, various balance sheet ratios, etc. -- cannot.

Many companies and investors primarily focus on earnings cover (earnings per share/dividends per share or net income/dividends paid). As such, earnings cover is also important to consider, but "earnings" are simply an accountant's opinion of the company's profits and not necessarily a good measure of cash flow. In fact, a company can have sufficient earnings cover but negative free cash flow cover.

Because dividends are paid in cash, we want to use a metric that helps us measure cash inflows and outflows. That's what the free cash flow cover metric can do.

Free cash flow is how much cash flow is left over each year after the company has reinvested in its business. Think of it as spare or surplus cash flow. It's from these surplus cash flows that dividends, buybacks, debt repayments, etc. are funded.

Measuring free cash flow cover

Fortunately, free cash flow cover is a very simple metric to calculate and you only need to look at the cash flow statement to figure it out:

To illustrate the concept, let's have a look at Johnson & Johnson's most recent cash flow statement.

Using the three highlighted line items, we can determine that the free cash flow cover over the last three years has been:

(Note that sometimes companies will call capital expenditures "Additions to Property, Plant & Equipment" or something similar. It's all the same thing.)

As we can see, since 2011 Johnson & Johnson's free cash flow cover has been between 1.85 and 1.9 times.

Great, but is this a good ratio? Indeed it is, for it's telling us that for each $1 Johnson & Johnson pays out in dividends, it generates between $1.85 and $1.90 in free cash flow.

Dividend margin of safety

Free cash flow cover can be thought of as your dividend "margin of safety" or "margin of error" -- and, all else equal, the higher the ratio, the more secure you can consider the current payout and the more likely the dividend can grow in the future.

Conversely, a firm with a free cash flow payout ratio near or below 1 times has very little margin for error if it aims to maintain its current dividend. If it falls on a rough year, the dividend might be on the chopping block.

A company with low or non-existent free cash flow cover could support the payout for a while using alternative financing (borrowing, selling assets, etc.), but that's an unsustainable solution. Eventually, the firm will need to generate free cash flow from operations to support the dividend.

A good rule-of-thumb is to look for free cash flow cover above 1.5 times. As with any rule, there are exceptions and much will depend on the company's stage in its lifecycle and the stability of its business. A smaller firm that's still reinvesting large amounts in the business may have a very high free cash flow cover while a utility firm might reasonably pay out close to all of its free cash flow each year.

Still, I think any free cash flow cover below 1.5 times is worth further investigation. Does the company have other financial resources (a good balance sheet, etc.) to support they payout in the event of a bad year? Is demand for the business's products stable enough to sustain such a high free cash flow payout?

Bottom line

As I noted earlier, free cash flow cover shouldn't be the only metric you consider before buying a dividend stock, but it's the most important one to consider as it tells you the most about the company's dividend policy and generates many additional questions that need answering before an investment is made.

For this reason, free cash flow cover has the highest weight in my Dividend Compass rating system. You can download a copy of my Dividend Compass spreadsheet completely free by clicking here.

Once you're in the Google Doc, click File>Download As>Excel and you can begin customizing it.

All you need to do is enter the simple financial information found on the company's most recent annual report, click on the inputs tab, and see the company's Dividend Compass rating (5 being the best, 1 being the worst).

My apologies for having to manually enter the data. One day I'll get a data feed and have it automatically load with a change in ticker!

If you have any questions about free cash flow cover, the Dividend Compass, or dividend investing in general, please post them in the comments section below.

Good reads this week:

Best,

Todd

Follow @ToddWenning

(I own shares of JNJ)

- Seth Klarman Ebitda Example

From Margin of Safety:EBITDA Analysis Obscures the Difference between Good and Bad BusinessesEBITDA, in addition to being a flawed measure of cash flow, also masks the relative importance of the several components of corporate cash flow. Pretax earnings...

- Using The Dividend Compass To Identify Troubling Trends

First off, thank you to everyone who has already taken a look at the Dividend Compass spreadsheet (which you can view and download for free by clicking here). If you haven't the faintest idea what I'm talking about -- a forgiveable oversight :)...

- Should More Companies Adopt Flexible Dividend Policies?

In the U.S. and U.K. markets, the most common form of dividend policy is one that aims to pay at least the same amount year after year, regardless of the company's performance that year. I'll call this the "consistent" dividend policy. In such...

- Introducing The Dividend Compass

When it comes to equity analysis, a lot of attention is paid to valuation -- and rightly so, as your investing career will likely be a short one if you consistently overpay for assets. Surprisingly, however, there's typically little attention paid...

- Flowers Foods: Wait For The Pullback

Flowers Foods produces and markets bakery products in the United States. It operates through two segments, Direct-Store-Delivery (DSD) and Warehouse Delivery. Take a look above. You might know some of these brands. My favorite is the tastykakes. As of...

Money and Finance

The Most Important Metric for Dividend Investors

While researching a dividend paying stock should be a holistic process and buying decisions shouldn't be based on any single metric, if there's one metric that every dividend investor should know, it's free cash flow cover.

After all, an income investing strategy doesn't work without income, so before you purchase any dividend stock, it's absolutely critical to know whether or not the dividend is sustainable. That is, can the company afford its current dividend through cash flows from operations?

You also want to know whether or not the company can grow its dividend in the coming years.

Get to know free cash flow

Free cash flow cover can help you answer both in ways that other common dividend analysis metrics -- earnings cover, various balance sheet ratios, etc. -- cannot.

Many companies and investors primarily focus on earnings cover (earnings per share/dividends per share or net income/dividends paid). As such, earnings cover is also important to consider, but "earnings" are simply an accountant's opinion of the company's profits and not necessarily a good measure of cash flow. In fact, a company can have sufficient earnings cover but negative free cash flow cover.

Because dividends are paid in cash, we want to use a metric that helps us measure cash inflows and outflows. That's what the free cash flow cover metric can do.

Free cash flow is how much cash flow is left over each year after the company has reinvested in its business. Think of it as spare or surplus cash flow. It's from these surplus cash flows that dividends, buybacks, debt repayments, etc. are funded.

Measuring free cash flow cover

Fortunately, free cash flow cover is a very simple metric to calculate and you only need to look at the cash flow statement to figure it out:

Free cash flow cover = (Cash from Operations - Capital Expenditures) / Dividends Paid

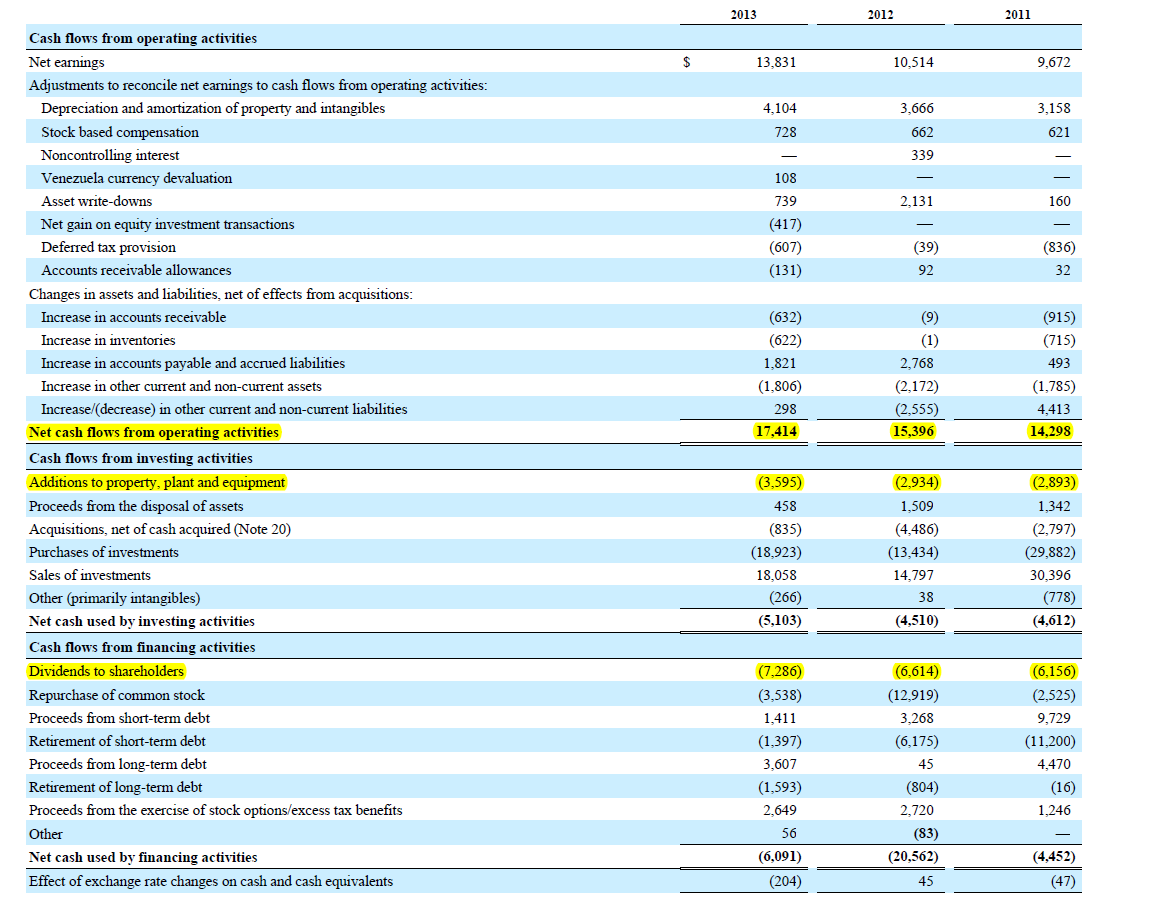

To illustrate the concept, let's have a look at Johnson & Johnson's most recent cash flow statement.

|

| Source: Johnson & Johnson 2013 10-K filing (my highlights) |

2013: (17,414 - 3,595) / 7,286 = 1.90 times

2012: (15,396 - 2,934) / 6,614 = 1.88 times

2011: (14,298 - 2,893) / 6,156 = 1.85 times

(Note that sometimes companies will call capital expenditures "Additions to Property, Plant & Equipment" or something similar. It's all the same thing.)

As we can see, since 2011 Johnson & Johnson's free cash flow cover has been between 1.85 and 1.9 times.

Great, but is this a good ratio? Indeed it is, for it's telling us that for each $1 Johnson & Johnson pays out in dividends, it generates between $1.85 and $1.90 in free cash flow.

Dividend margin of safety

Free cash flow cover can be thought of as your dividend "margin of safety" or "margin of error" -- and, all else equal, the higher the ratio, the more secure you can consider the current payout and the more likely the dividend can grow in the future.

Conversely, a firm with a free cash flow payout ratio near or below 1 times has very little margin for error if it aims to maintain its current dividend. If it falls on a rough year, the dividend might be on the chopping block.

A company with low or non-existent free cash flow cover could support the payout for a while using alternative financing (borrowing, selling assets, etc.), but that's an unsustainable solution. Eventually, the firm will need to generate free cash flow from operations to support the dividend.

A good rule-of-thumb is to look for free cash flow cover above 1.5 times. As with any rule, there are exceptions and much will depend on the company's stage in its lifecycle and the stability of its business. A smaller firm that's still reinvesting large amounts in the business may have a very high free cash flow cover while a utility firm might reasonably pay out close to all of its free cash flow each year.

Still, I think any free cash flow cover below 1.5 times is worth further investigation. Does the company have other financial resources (a good balance sheet, etc.) to support they payout in the event of a bad year? Is demand for the business's products stable enough to sustain such a high free cash flow payout?

Bottom line

As I noted earlier, free cash flow cover shouldn't be the only metric you consider before buying a dividend stock, but it's the most important one to consider as it tells you the most about the company's dividend policy and generates many additional questions that need answering before an investment is made.

For this reason, free cash flow cover has the highest weight in my Dividend Compass rating system. You can download a copy of my Dividend Compass spreadsheet completely free by clicking here.

Once you're in the Google Doc, click File>Download As>Excel and you can begin customizing it.

All you need to do is enter the simple financial information found on the company's most recent annual report, click on the inputs tab, and see the company's Dividend Compass rating (5 being the best, 1 being the worst).

My apologies for having to manually enter the data. One day I'll get a data feed and have it automatically load with a change in ticker!

If you have any questions about free cash flow cover, the Dividend Compass, or dividend investing in general, please post them in the comments section below.

Good reads this week:

- Why bank preference shares could pop - Monevator

- The value of Seth Klarman - Institutional Investor

- Why we're awful at assessing risk - Morgan Housel

- Is it time to sell your Morrisons shares? - UK Value Investor

- What if long-term thinking really catches on? - A Wealth of Common Sense

- How China fooled the world - A long but good video on China's credit bubble from the BBC

- Brands matter more, not less - Total Return Investor

Do not wait to strike till the iron is hot, but make it hot by striking. - William Butler YeatsStay patient, stay focused.

Best,

Todd

Follow @ToddWenning

(I own shares of JNJ)

- Seth Klarman Ebitda Example

From Margin of Safety:EBITDA Analysis Obscures the Difference between Good and Bad BusinessesEBITDA, in addition to being a flawed measure of cash flow, also masks the relative importance of the several components of corporate cash flow. Pretax earnings...

- Using The Dividend Compass To Identify Troubling Trends

First off, thank you to everyone who has already taken a look at the Dividend Compass spreadsheet (which you can view and download for free by clicking here). If you haven't the faintest idea what I'm talking about -- a forgiveable oversight :)...

- Should More Companies Adopt Flexible Dividend Policies?

In the U.S. and U.K. markets, the most common form of dividend policy is one that aims to pay at least the same amount year after year, regardless of the company's performance that year. I'll call this the "consistent" dividend policy. In such...

- Introducing The Dividend Compass

When it comes to equity analysis, a lot of attention is paid to valuation -- and rightly so, as your investing career will likely be a short one if you consistently overpay for assets. Surprisingly, however, there's typically little attention paid...

- Flowers Foods: Wait For The Pullback

Flowers Foods produces and markets bakery products in the United States. It operates through two segments, Direct-Store-Delivery (DSD) and Warehouse Delivery. Take a look above. You might know some of these brands. My favorite is the tastykakes. As of...