Money and Finance

When it comes to equity analysis, a lot of attention is paid to valuation -- and rightly so, as your investing career will likely be a short one if you consistently overpay for assets.

Surprisingly, however, there's typically little attention paid to dividend analysis, which usually begins and ends with a glance at the dividend payout ratio (or dividend cover). As long as the company is earning more than it's paying out, the thinking goes, all is well with the dividend; conversely, if the company is paying out about the same amount as (or more than) it's earning, the dividend is at risk.

There's more to it

While the payout ratio is important, in my experience, the main causes of a dividend cut are factors other than a high dividend payout ratio (or low dividend cover). Indeed, a high payout ratio is usually the result of past events and trends that have been in place for a number of years.

In fact, more times than not, the need to strengthen the balance sheet is the cited reason for a dividend cut -- creditors and ratings agencies get worried about a lack of cash flow and large dividends become an easy target for freeing up cash. In turn, a weak balance sheet is often the result of a deterioration in business strength over a number of years -- margins have contracted, growth has slowed, and free cash flow has dried up -- paired with over-borrowing or over-spending.

Early diagnosis is the key

So rather than just look at the dividend payout ratio, it seems prudent to take a more holistic approach to dividend analysis by considering other factors that contribute to dividend health, such as:

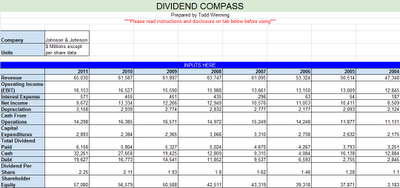

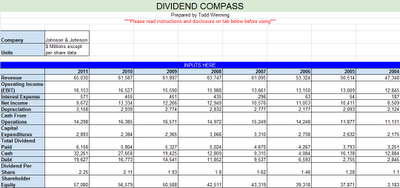

With this framework in mind, I tried my hand at a new (and hopefully improved) spreadsheet model for rating the health of a company's dividend. I'm calling it the Dividend Compass, and you can access and download it for free by clicking here.

(It's hosted on Google Docs for sharing purposes, but you can download it to Excel by clicking on File>Download As>Excel on the top left hand corner of the Google Docs page. Once you've downloaded it, you can make changes. If something doesn't work, please let me know in the comments section below.)

To get started, all you need to do is enter a few years' worth of key financial datapoints (sales, debt, etc.) -- all publicly available data -- on the Inputs tab and then click on the Dividend Compass tab.

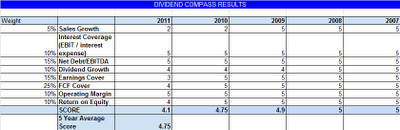

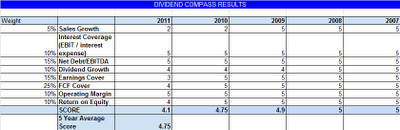

The Dividend Compass (DC) will rate the company's dividend health based on metrics derived from your entries, with a 5 being a perfect score and 1 being the lowest. The overall score is based on the weighted average scores of the eight metrics and the default weights are based on what I believe to be the most important metrics. You can change them to fit your approach as long as they sum to 100%.

The DC will also grade the dividend going back a few years and provide a 5-year average score that will help you identify trends in the dividend's health. A falling score in any of the categoreis, for instance, may indicate a trouble spot that's worth looking into.

A few things to remember

I can't stress enough that the DC should not be used as a buy/sell indicator nor is it meant to be the final word on any stock. It's simply a research tool to help you tell the difference between a healthy dividend from a risky one, using a more holistic approach than traditional methods. Further research is always necessary before making a trading decision.

Dividend yield is not included as a graded metric in the DC. All else equal, I would expect higher yielding names to have lower scores and vice versa.

Finally, the DC is still in early days, so if you notice a bug or see room for improvement, please post a comment below. Questions and criticisms are always welcomed, too.

Hope you had a nice weekend.

Best,

Todd

@toddwenning on Twitter

(long JNJ, the default example in the DC spreadsheet)

- The Most Important Metric For Dividend Investors

While researching a dividend paying stock should be a holistic process and buying decisions shouldn't be based on any single metric, if there's one metric that every dividend investor should know, it's free cash flow cover. After all, an income...

- Centurylink's Dividend Cut Provides Many Valuable Lessons

A brief post this evening, but I wanted to quickly comment on today's big dividend news -- U.S. telecom & broadband company CenturyLink making a "surprise" dividend cut of 26%. The stock fell sharply on the news, making it clear that...

- Using The Dividend Compass To Identify Troubling Trends

First off, thank you to everyone who has already taken a look at the Dividend Compass spreadsheet (which you can view and download for free by clicking here). If you haven't the faintest idea what I'm talking about -- a forgiveable oversight :)...

- Analytical Toolbox

This page lists useful tools for finding and tracking Wide Moat Dividend stocks. Dividend Compass by Todd Wenning. Goes miles beyond the dividend payout ratio to give a nuanced view of the health and sustainability of a company's dividend. The...

- Dividend Compass Match 6- Mccormick Spice Vs Wal-mart

In Match 5 is TIm Horton's squeaked by McDonald's. In Match 6, we have to answer the question - is it better to invest in a company with products sold at Wal-mart or invest in Wal-mart directly? The answer will determine who goes on to the next...

Money and Finance

Introducing the Dividend Compass

When it comes to equity analysis, a lot of attention is paid to valuation -- and rightly so, as your investing career will likely be a short one if you consistently overpay for assets.

Surprisingly, however, there's typically little attention paid to dividend analysis, which usually begins and ends with a glance at the dividend payout ratio (or dividend cover). As long as the company is earning more than it's paying out, the thinking goes, all is well with the dividend; conversely, if the company is paying out about the same amount as (or more than) it's earning, the dividend is at risk.

There's more to it

While the payout ratio is important, in my experience, the main causes of a dividend cut are factors other than a high dividend payout ratio (or low dividend cover). Indeed, a high payout ratio is usually the result of past events and trends that have been in place for a number of years.

In fact, more times than not, the need to strengthen the balance sheet is the cited reason for a dividend cut -- creditors and ratings agencies get worried about a lack of cash flow and large dividends become an easy target for freeing up cash. In turn, a weak balance sheet is often the result of a deterioration in business strength over a number of years -- margins have contracted, growth has slowed, and free cash flow has dried up -- paired with over-borrowing or over-spending.

Early diagnosis is the key

So rather than just look at the dividend payout ratio, it seems prudent to take a more holistic approach to dividend analysis by considering other factors that contribute to dividend health, such as:

- Sales growth: Sales are the life-blood of a company. If sales are drying up, that puts added pressure on profits and cash flows and thus the dividend, too.

- Interest coverage (EBIT/interest expense): If a company is having trouble paying the interest on its debt, there's a greater chance that its creditors will get worried and raise the company's cost of borrowing, which could reduce net income. In a worst-case scenario, the dividend could be cut to accelerate the repayment of principal.

- Net debt/EBITDA: This is a common measure ((Debt-Cash)/EBITDA) that creditors and ratings agencies use to determine credit quality and it's commonly used as a metric in debt covenants. A firm that has borrowed too much or is struggling to pay down its debt relative to its profitability is more likely to have a risky dividend.

- Dividend growth rate: A slowing dividend growth rate could be a sign that the company is less confident in its future growth potential. Eventually, all companies' dividend growth rates decline, but you want to see a steady decrease over many years and not a sharp drop.

- Earnings cover: Even though I don't think it's the best measure of dividend health, earnings cover (Net Income/Dividends Paid) remains the most common metric cited by both companies and investors alike, so it should be considered in any dividend analysis.

- Free cash flow cover: Free cash flow cover ((CFO-CapEx)/Dividends Paid) is a better measure of dividend health than earnings cover because companies don't pay out earnings -- they pay out cash. As such, I'd rather look at a company's cash flows than net income.

- Operating margin: A company whose margins are contracting could be facing increased competitive pressures or becoming less efficient. When this occurs, less money falls to the bottom line and to cash flows and the dividend can become riskier. Cyclical companies' margins will naturally ebb and flow. In those cases, use rolling 5-year margins to account for the business cycle.

- Return on equity: Companies that are unable to sustainably generate returns above their cost of equity are likely destroying shareholder value and usually have lower growth potential. Neither are good things from a dividend perspective.

With this framework in mind, I tried my hand at a new (and hopefully improved) spreadsheet model for rating the health of a company's dividend. I'm calling it the Dividend Compass, and you can access and download it for free by clicking here.

(It's hosted on Google Docs for sharing purposes, but you can download it to Excel by clicking on File>Download As>Excel on the top left hand corner of the Google Docs page. Once you've downloaded it, you can make changes. If something doesn't work, please let me know in the comments section below.)

To get started, all you need to do is enter a few years' worth of key financial datapoints (sales, debt, etc.) -- all publicly available data -- on the Inputs tab and then click on the Dividend Compass tab.

The Dividend Compass (DC) will rate the company's dividend health based on metrics derived from your entries, with a 5 being a perfect score and 1 being the lowest. The overall score is based on the weighted average scores of the eight metrics and the default weights are based on what I believe to be the most important metrics. You can change them to fit your approach as long as they sum to 100%.

The DC will also grade the dividend going back a few years and provide a 5-year average score that will help you identify trends in the dividend's health. A falling score in any of the categoreis, for instance, may indicate a trouble spot that's worth looking into.

A few things to remember

I can't stress enough that the DC should not be used as a buy/sell indicator nor is it meant to be the final word on any stock. It's simply a research tool to help you tell the difference between a healthy dividend from a risky one, using a more holistic approach than traditional methods. Further research is always necessary before making a trading decision.

Dividend yield is not included as a graded metric in the DC. All else equal, I would expect higher yielding names to have lower scores and vice versa.

Finally, the DC is still in early days, so if you notice a bug or see room for improvement, please post a comment below. Questions and criticisms are always welcomed, too.

Hope you had a nice weekend.

Best,

Todd

@toddwenning on Twitter

(long JNJ, the default example in the DC spreadsheet)

- The Most Important Metric For Dividend Investors

While researching a dividend paying stock should be a holistic process and buying decisions shouldn't be based on any single metric, if there's one metric that every dividend investor should know, it's free cash flow cover. After all, an income...

- Centurylink's Dividend Cut Provides Many Valuable Lessons

A brief post this evening, but I wanted to quickly comment on today's big dividend news -- U.S. telecom & broadband company CenturyLink making a "surprise" dividend cut of 26%. The stock fell sharply on the news, making it clear that...

- Using The Dividend Compass To Identify Troubling Trends

First off, thank you to everyone who has already taken a look at the Dividend Compass spreadsheet (which you can view and download for free by clicking here). If you haven't the faintest idea what I'm talking about -- a forgiveable oversight :)...

- Analytical Toolbox

This page lists useful tools for finding and tracking Wide Moat Dividend stocks. Dividend Compass by Todd Wenning. Goes miles beyond the dividend payout ratio to give a nuanced view of the health and sustainability of a company's dividend. The...

- Dividend Compass Match 6- Mccormick Spice Vs Wal-mart

In Match 5 is TIm Horton's squeaked by McDonald's. In Match 6, we have to answer the question - is it better to invest in a company with products sold at Wal-mart or invest in Wal-mart directly? The answer will determine who goes on to the next...