Money and Finance

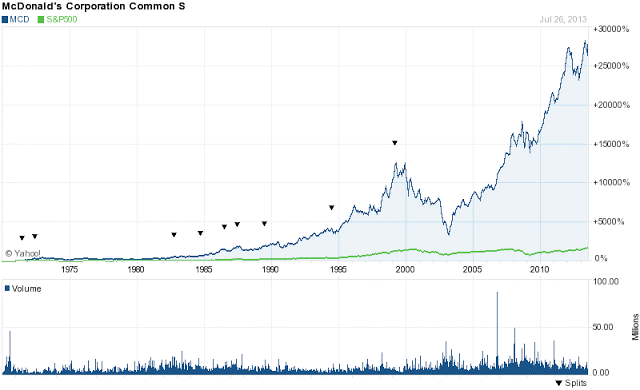

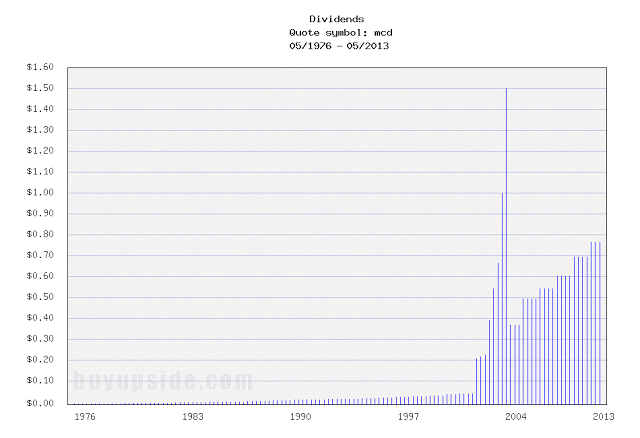

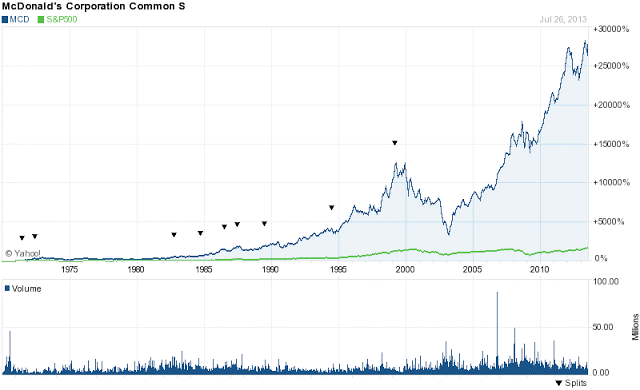

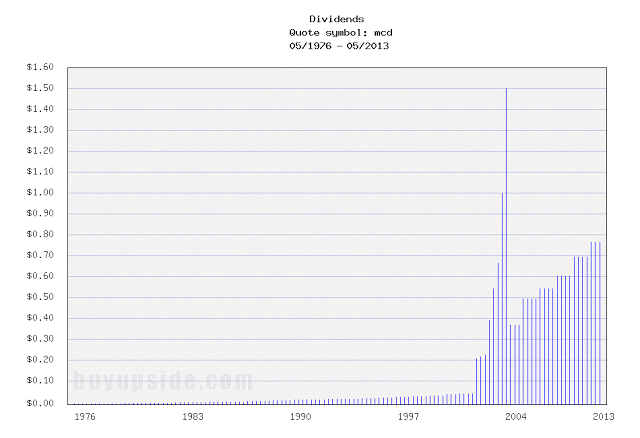

Today I opened a new position in McDonalds (MCD). I purchased 11 shares at $98. McDonalds was under some selling pressure after last weeks earnings miss so I was lucky enough to get in under $100. MCD has increased its dividend for 36 consecutive years, making it a dividend champion, i.e. more than 24 years of consecutive increases. It's because of this stellar record that McDonald's stock is held by so many dividend growth investors, and that's why I am adding it to my portfolio.

Today I opened a new position in McDonalds (MCD). I purchased 11 shares at $98. McDonalds was under some selling pressure after last weeks earnings miss so I was lucky enough to get in under $100. MCD has increased its dividend for 36 consecutive years, making it a dividend champion, i.e. more than 24 years of consecutive increases. It's because of this stellar record that McDonald's stock is held by so many dividend growth investors, and that's why I am adding it to my portfolio.

McDonalds Corporation franchises and operates McDonald's restaurants in the United States, Europe, the Asia/Pacific, the Middle East, Africa, Canada, and Latin America. Its restaurants offer various food items, soft drinks, coffee, and other beverages, as well as breakfast menus. As of December 31, 2012, the company operated 34,480 restaurants in 119 countries worldwide and serve 69 million customers each day.

- Dividend Increase - Mcdonald's

Today, McDonald's board of directors announced a 10% increase in the quarterly dividend from $0.70 per share to $0.77 per share. The new rate will be payable December 17th to shareholders of record on December 3rd. This brings the annual...

- Mcdonald's Stock Analysis

It's about time for another stock analysis. This time I decided to take a look atMcDonalds (MCD). McDonalds closed on Thursday 5/17/12 at $89.62. Company Background: McDonalds Corporation, together with its subsidiaries, franchises and operates...

- Recent Buy - Kraft (krft)

Today I decided to open a position in the food giant Kraft. I purchased 21 shares @ $52.74. I've had Kraft on a short list of potential buys and selected it for one of my monthly purchases. Typically I try to invest in stocks with a history of dividend...

- Recent Dividend Increases

Dividend investors would be wise to focus not just on a stock's current yield, but also on the long-term growth potential of its dividends. That's because strong businesses that consistently raise their dividend payouts reward shareholders with...

- Recent Buy - Chevron (cvx)

Today I opened a position in Chevron. I purchased 10 shares at $121.47 giving my portfolio it's 20th position. Chevron has been under some selling pressure as it approached their 2nd quarter earnings and continued to drop after a disappointing 2nd...

Money and Finance

Recent Buy - McDonalds (MCD)

McDonalds Corporation franchises and operates McDonald's restaurants in the United States, Europe, the Asia/Pacific, the Middle East, Africa, Canada, and Latin America. Its restaurants offer various food items, soft drinks, coffee, and other beverages, as well as breakfast menus. As of December 31, 2012, the company operated 34,480 restaurants in 119 countries worldwide and serve 69 million customers each day.

MCD Basic Statistics

- Ticker Symbol: MCD

- PE Ratio: 18.18

- Yield: 3.1%

- Dividend Growth 10yr: 9.2%

- Payout Ratio: 55%

- Market cap: $98 B

- Website: http://www.mcdonalds.com

- Dividend Increase - Mcdonald's

Today, McDonald's board of directors announced a 10% increase in the quarterly dividend from $0.70 per share to $0.77 per share. The new rate will be payable December 17th to shareholders of record on December 3rd. This brings the annual...

- Mcdonald's Stock Analysis

It's about time for another stock analysis. This time I decided to take a look atMcDonalds (MCD). McDonalds closed on Thursday 5/17/12 at $89.62. Company Background: McDonalds Corporation, together with its subsidiaries, franchises and operates...

- Recent Buy - Kraft (krft)

Today I decided to open a position in the food giant Kraft. I purchased 21 shares @ $52.74. I've had Kraft on a short list of potential buys and selected it for one of my monthly purchases. Typically I try to invest in stocks with a history of dividend...

- Recent Dividend Increases

Dividend investors would be wise to focus not just on a stock's current yield, but also on the long-term growth potential of its dividends. That's because strong businesses that consistently raise their dividend payouts reward shareholders with...

- Recent Buy - Chevron (cvx)

Today I opened a position in Chevron. I purchased 10 shares at $121.47 giving my portfolio it's 20th position. Chevron has been under some selling pressure as it approached their 2nd quarter earnings and continued to drop after a disappointing 2nd...