Money and Finance

Today I decided to open a position in the food giant Kraft. I purchased 21 shares @ $52.74. I've had Kraft on a short list of potential buys and selected it for one of my monthly purchases. Typically I try to invest in stocks with a history of dividend growth over many years but I think Kraft has the makings of a future dividend champion. This purchase has pushed me past the $50,000 portfolio mark for the first time as well.

Today I decided to open a position in the food giant Kraft. I purchased 21 shares @ $52.74. I've had Kraft on a short list of potential buys and selected it for one of my monthly purchases. Typically I try to invest in stocks with a history of dividend growth over many years but I think Kraft has the makings of a future dividend champion. This purchase has pushed me past the $50,000 portfolio mark for the first time as well.

Kraft Foods Group, Inc. (Kraft Foods Group) operates food and beverage businesses in North America. The Company manufactures and markets food and beverage products, including convenient meals, refreshment beverages and coffee, cheese and other grocery products, in the United States and Canada, under a stable of iconic brands. Its product categories span breakfast, lunch and dinner meal occasions, both at home and in foodservice locations. The Company sells its products to supermarket chains, wholesalers, supercenters, club stores, mass merchandisers, distributors, convenience stores, drug stores, gasoline stations, value stores and other retail food outlets in the United States and Canada.

- Pepsico (pep) Dividend Stock Analysis

If you look at my portfolio you'll notice that it's lacking exposure to the food industry. Specifically those weekly repeat purchase foods such as potato chips and other snack foods. Coca-Cola is my only current exposure there and I'd...

- Starbucks (sbux) Dividend Stock Analysis

I've been trying to take a look at some of the next potential dividend growth champions that can string off a 40+ year record such as Johnson & Johnson or Coca-Cola or Proctor & Gamble. I want the core of my portfolio to be made up of the...

- General Mills Stock Analysis

It's about time for another stock analysis. This time I decided to take a look atGeneral Mills (GIS). General Mills closed on Wednesday 5/9/12 at $38.91. Company Background: General Mills, Inc. manufactures and markets branded consumer foods worldwide....

- Recent Buy - Mcdonalds (mcd)

Today I added to my position in McDonalds (MCD). I purchased 12 shares at $97. This is a bit cheaper than my first purchase at $98 I made back in July. MCD has increased its dividend for 36 consecutive years, making it a dividend champion, i.e. more than...

- Recent Buy - Mcdonalds (mcd)

Today I opened a new position in McDonalds (MCD). I purchased 11 shares at $98. McDonalds was under some selling pressure after last weeks earnings miss so I was lucky enough to get in under $100. MCD has increased its dividend for 36 consecutive years,...

Money and Finance

Recent Buy - Kraft (KRFT)

Kraft Foods Group, Inc. (Kraft Foods Group) operates food and beverage businesses in North America. The Company manufactures and markets food and beverage products, including convenient meals, refreshment beverages and coffee, cheese and other grocery products, in the United States and Canada, under a stable of iconic brands. Its product categories span breakfast, lunch and dinner meal occasions, both at home and in foodservice locations. The Company sells its products to supermarket chains, wholesalers, supercenters, club stores, mass merchandisers, distributors, convenience stores, drug stores, gasoline stations, value stores and other retail food outlets in the United States and Canada.

KRFT Basic Statistics

- Ticker Symbol: KRFT

- PE Ratio: 17.02

- Yield: 4%

- Dividend Growth 10yr: 6.4%

- Payout Ratio: 48%

- Market cap: $31 B

- Website: http://www.kraftfoodsgroup.com

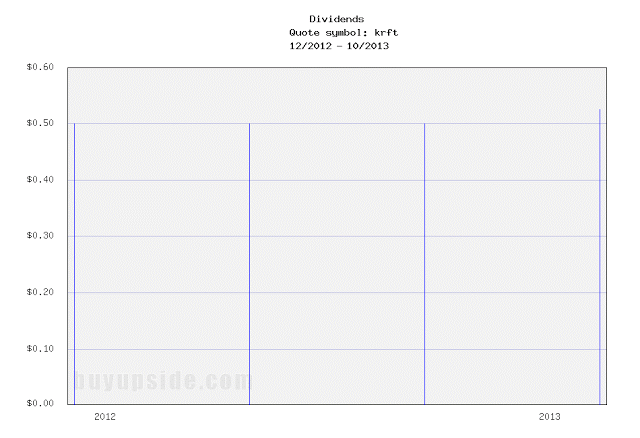

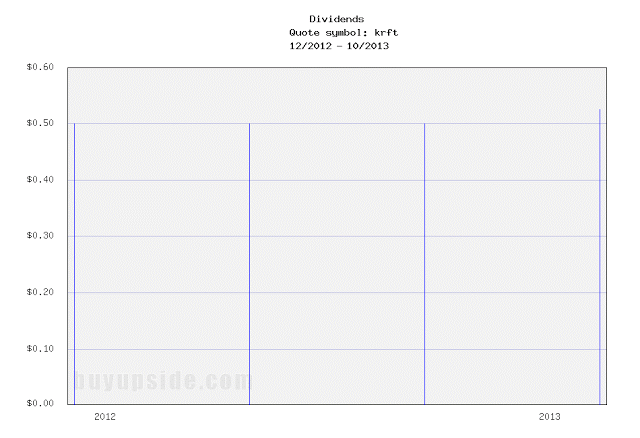

Dividend Growth Rate

- Pepsico (pep) Dividend Stock Analysis

If you look at my portfolio you'll notice that it's lacking exposure to the food industry. Specifically those weekly repeat purchase foods such as potato chips and other snack foods. Coca-Cola is my only current exposure there and I'd...

- Starbucks (sbux) Dividend Stock Analysis

I've been trying to take a look at some of the next potential dividend growth champions that can string off a 40+ year record such as Johnson & Johnson or Coca-Cola or Proctor & Gamble. I want the core of my portfolio to be made up of the...

- General Mills Stock Analysis

It's about time for another stock analysis. This time I decided to take a look atGeneral Mills (GIS). General Mills closed on Wednesday 5/9/12 at $38.91. Company Background: General Mills, Inc. manufactures and markets branded consumer foods worldwide....

- Recent Buy - Mcdonalds (mcd)

Today I added to my position in McDonalds (MCD). I purchased 12 shares at $97. This is a bit cheaper than my first purchase at $98 I made back in July. MCD has increased its dividend for 36 consecutive years, making it a dividend champion, i.e. more than...

- Recent Buy - Mcdonalds (mcd)

Today I opened a new position in McDonalds (MCD). I purchased 11 shares at $98. McDonalds was under some selling pressure after last weeks earnings miss so I was lucky enough to get in under $100. MCD has increased its dividend for 36 consecutive years,...