Money and Finance

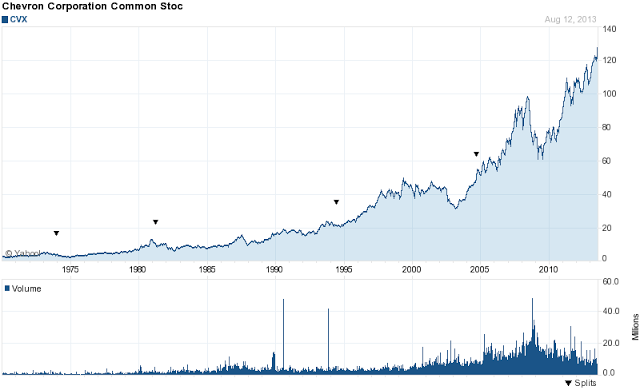

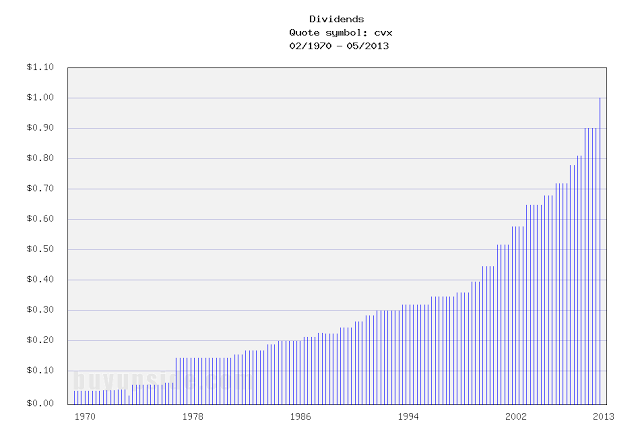

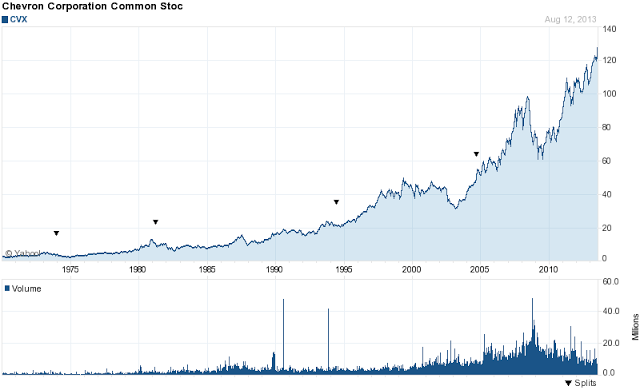

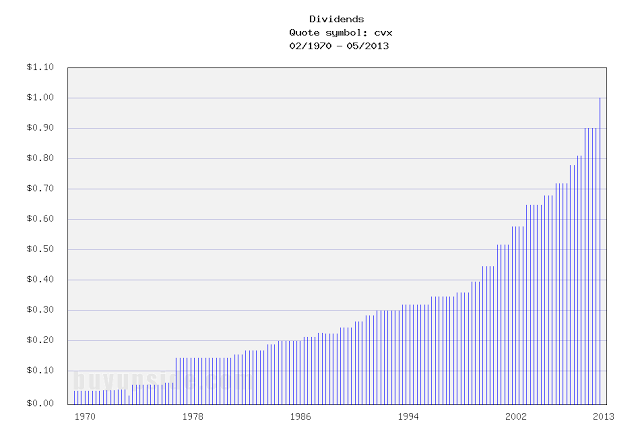

Today I opened a position in Chevron. I purchased 10 shares at $121.47 giving my portfolio it's 20th position. Chevron has been under some selling pressure as it approached their 2nd quarter earnings and continued to drop after a disappointing 2nd quarter due mostly from lower realized international liquids pricing. Since then the stock has dropped about $5 which doesn't exactly make it undervalued but I think it's fairly valued at this point and in this market that's not bad. Chevron has increased its dividend for 26 consecutive years, making it a dividend champion, i.e. more than 24 years of consecutive increases. It's strong companies that have a serious commitment to their dividend that I strive to hold in my portfolio and I think Chevron exemplifies that.

Today I opened a position in Chevron. I purchased 10 shares at $121.47 giving my portfolio it's 20th position. Chevron has been under some selling pressure as it approached their 2nd quarter earnings and continued to drop after a disappointing 2nd quarter due mostly from lower realized international liquids pricing. Since then the stock has dropped about $5 which doesn't exactly make it undervalued but I think it's fairly valued at this point and in this market that's not bad. Chevron has increased its dividend for 26 consecutive years, making it a dividend champion, i.e. more than 24 years of consecutive increases. It's strong companies that have a serious commitment to their dividend that I strive to hold in my portfolio and I think Chevron exemplifies that.

Chevron is involved in virtually every facet of the energy industry. From exploration to production and transportation of crude oil and natural gas as well as refining , marketing and distribution of transportation fuels and lubricants. Chevron generates power, produces geothermal energy, provides renewable energy, manufactures and sells petrochemical products and energy efficiency solutions.

- Another Buy

Well the markets continued their difficult start to the year by selling off again to end January. They started off really bad to start the day with the DJIA dropping over 200 points before clawing it's way back to just a 100 point loss and closing...

- Chevron (cvx) Dividend Stock Analysis

I last wrote up a stock analysis on Chevron back in 2012. Really what happened to 2013? I've still updated the values on my stock analysis page, but I just didn't get a full updated write up out. Well, it's about time that I get an updated...

- Chevron Stock Analysis

As mentioned in my previous post, I'm going to try and have 1 stock analysis report for some popular dividend growth stocks come out prior to their latest earnings release this week. Today we'll look at Chevron Corporation (CVX). Chevron closed...

- Recent Buy - Exxon (xom)

Wow another purchase, that makes two this month after my Unilever buy. I had a standing order to purchase shares of XOM and it triggered my limit order the other day as the markets were tanking. I've had my eye on some energy stocks for some time...

- Recent Buy - Chevron (cvx)

I recently picked up another 10 shares of the energy giant Chevron after their recent dividend increase announcement. In an effort to balance my monthly dividend totals I had been trying to choose a stock to purchase for the end of the quarter. I already...

Money and Finance

Recent Buy - Chevron (CVX)

Chevron is involved in virtually every facet of the energy industry. From exploration to production and transportation of crude oil and natural gas as well as refining , marketing and distribution of transportation fuels and lubricants. Chevron generates power, produces geothermal energy, provides renewable energy, manufactures and sells petrochemical products and energy efficiency solutions.

CVX Basic Statistics

- Ticker Symbol: CVX

- PE Ratio: 9.93

- Yield: 3.3%

- Dividend Growth 10yr: 9.6%

- Payout Ratio: 30%

- Market cap: $237 B

- Website: http://www.chevron.com

- Another Buy

Well the markets continued their difficult start to the year by selling off again to end January. They started off really bad to start the day with the DJIA dropping over 200 points before clawing it's way back to just a 100 point loss and closing...

- Chevron (cvx) Dividend Stock Analysis

I last wrote up a stock analysis on Chevron back in 2012. Really what happened to 2013? I've still updated the values on my stock analysis page, but I just didn't get a full updated write up out. Well, it's about time that I get an updated...

- Chevron Stock Analysis

As mentioned in my previous post, I'm going to try and have 1 stock analysis report for some popular dividend growth stocks come out prior to their latest earnings release this week. Today we'll look at Chevron Corporation (CVX). Chevron closed...

- Recent Buy - Exxon (xom)

Wow another purchase, that makes two this month after my Unilever buy. I had a standing order to purchase shares of XOM and it triggered my limit order the other day as the markets were tanking. I've had my eye on some energy stocks for some time...

- Recent Buy - Chevron (cvx)

I recently picked up another 10 shares of the energy giant Chevron after their recent dividend increase announcement. In an effort to balance my monthly dividend totals I had been trying to choose a stock to purchase for the end of the quarter. I already...