Money and Finance

Wow three purchases in June. I think this is the first time I can remember making 3 purchases in a month since the beginning of my dividend growth journey. Usually I make 1 or 2 purchases but the money from the RAI merger along with the proceeds from my subsequent sale of RAI shares pushed me to an additional purchase this month! What to do with all this money? Put it to work for me!

Wow three purchases in June. I think this is the first time I can remember making 3 purchases in a month since the beginning of my dividend growth journey. Usually I make 1 or 2 purchases but the money from the RAI merger along with the proceeds from my subsequent sale of RAI shares pushed me to an additional purchase this month! What to do with all this money? Put it to work for me!

Thanks to 'I Want To Retire Soon' and 'Dividend Empire' I recently discovered a gem of a company that most of you probably haven't heard of before and I like what I see. Compass Minerals International (CMP) has only been a publicly traded company since 2003 but it's true origins date back to the 1800's!

Compass Minerals International, Inc. is engaged in the business of producing minerals, including salt, sulfate of potash specialty fertilizer and magnesium chloride. It provides highway deicing salt to customers in North America and the United Kingdom and specialty fertilizer to growers and fertilizer distributors worldwide.

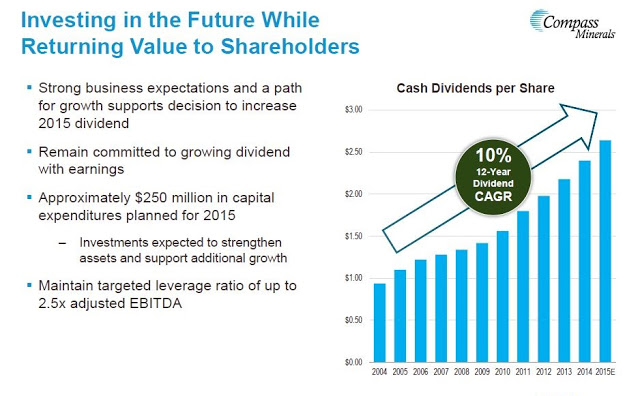

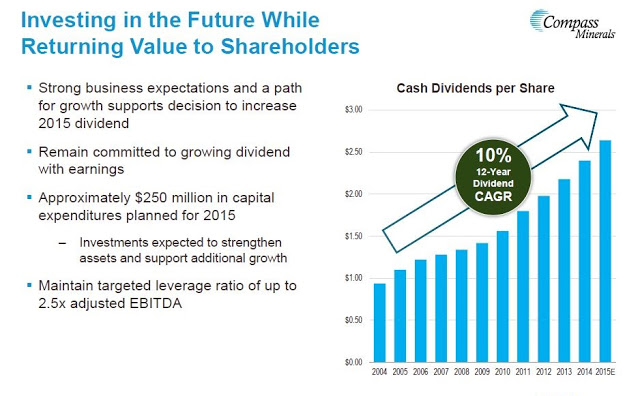

CMP has come down in price recently which has pushed the yield over 3% here. The dividend growth has been stellar with over 10 years of increases and a 5 year growth rate over 10%. EPS guidance looks strong and margins are expanding in the right direction.

I purchased 18 shares of CMP at $83.76.

- Analytical Toolbox

This page lists useful tools for finding and tracking Wide Moat Dividend stocks. Dividend Compass by Todd Wenning. Goes miles beyond the dividend payout ratio to give a nuanced view of the health and sustainability of a company's dividend. The...

- Recent Buy - Kinder Morgan (kmi)

As I mentioned in my last update, this may be a slow month for me in terms of purchases. Not that I don't want to make more purchases, there are always opportunities out there that I'd like to take advantage of but I only have so much money. So...

- June Dividend Update

Happy 4th of July for those of you in the USA. Time for my June update. This months dividend total was a new record high for me at $288.03 which is up 14% from the $252.03 that I made last quarter in March. In comparison, last years June total was $227.91...

- Recent Buy - Johnson & Johnson (jnj)

After spending the better part of last night watching the Star Wars trailer over and over I figured I'd better get around to posting about my latest purchase! This time around I was trying to decide which stock to purchase and it came down to three...

- Recent Buy - Philip Morris (pm)

I didn't think I would be making another purchase this month but one stock that's been on my watch list for some time had it's ex-div date this week so I couldn't resist. This time around I chose Philip Morris (PM). PM has been struggling...

Money and Finance

Recent Buy - Compass Minerals International (CMP)

Thanks to 'I Want To Retire Soon' and 'Dividend Empire' I recently discovered a gem of a company that most of you probably haven't heard of before and I like what I see. Compass Minerals International (CMP) has only been a publicly traded company since 2003 but it's true origins date back to the 1800's!

Compass Minerals International, Inc. is engaged in the business of producing minerals, including salt, sulfate of potash specialty fertilizer and magnesium chloride. It provides highway deicing salt to customers in North America and the United Kingdom and specialty fertilizer to growers and fertilizer distributors worldwide.

CMP has come down in price recently which has pushed the yield over 3% here. The dividend growth has been stellar with over 10 years of increases and a 5 year growth rate over 10%. EPS guidance looks strong and margins are expanding in the right direction.

I purchased 18 shares of CMP at $83.76.

CMP Stock Chart

CMP Basic Statistics

- Ticker Symbol: CMP

- P/E Ratio: 12.4

- Sector: Materials

- Yield: 3.2%

- Dividend Growth Rate: 11%

- Payout Ratio: 36%

- Market cap: $2.83 Billion

- Beta: .47

- Morningstar Fair Value: $94

- Value Line Target Price: $115

- Website: http://www.compassminerals.com

CMP Dividend Growth

- Analytical Toolbox

This page lists useful tools for finding and tracking Wide Moat Dividend stocks. Dividend Compass by Todd Wenning. Goes miles beyond the dividend payout ratio to give a nuanced view of the health and sustainability of a company's dividend. The...

- Recent Buy - Kinder Morgan (kmi)

As I mentioned in my last update, this may be a slow month for me in terms of purchases. Not that I don't want to make more purchases, there are always opportunities out there that I'd like to take advantage of but I only have so much money. So...

- June Dividend Update

Happy 4th of July for those of you in the USA. Time for my June update. This months dividend total was a new record high for me at $288.03 which is up 14% from the $252.03 that I made last quarter in March. In comparison, last years June total was $227.91...

- Recent Buy - Johnson & Johnson (jnj)

After spending the better part of last night watching the Star Wars trailer over and over I figured I'd better get around to posting about my latest purchase! This time around I was trying to decide which stock to purchase and it came down to three...

- Recent Buy - Philip Morris (pm)

I didn't think I would be making another purchase this month but one stock that's been on my watch list for some time had it's ex-div date this week so I couldn't resist. This time around I chose Philip Morris (PM). PM has been struggling...