Money and Finance

I didn't think I would be making another purchase this month but one stock that's been on my watch list for some time had it's ex-div date this week so I couldn't resist. This time around I chose Philip Morris (PM). PM has been struggling recently battling a strong US dollar and analyst downgrades. I believe that there is a good buying opportunity here with the stock currently yielding over 5%. These are yields the company has not seen since 2010. The strong yield coupled with a 5 year dividend growth rate of 12% makes it hard to resist for any dividend investor.

I didn't think I would be making another purchase this month but one stock that's been on my watch list for some time had it's ex-div date this week so I couldn't resist. This time around I chose Philip Morris (PM). PM has been struggling recently battling a strong US dollar and analyst downgrades. I believe that there is a good buying opportunity here with the stock currently yielding over 5%. These are yields the company has not seen since 2010. The strong yield coupled with a 5 year dividend growth rate of 12% makes it hard to resist for any dividend investor.

I purchased 14 shares of Philip Morris (PM) at $79.50

PM is not without it's troubles though. The increasing regulations, lawsuits, and taxes can spell serious trouble for the company going forward. Volume declines continue to be a concern as well as plain packaging legislation.

Philip Morris International, Inc. is a Virginia holding company incorporated in 1987. The Company's subsidiaries and affiliates and their licensees are engaged in the manufacture and sale of cigarettes and other tobacco products in markets outside the United States of America. Its portfolio comprises both international and local brands. Its portfolio of international and local brands is led by Marlboro.

- Weekly Roundup - September 15, 2012

Well another week is in the books so that means it's time for another weekly roundup of blog links and articles that got me thinking. So here goes. Trading Vs. Investing Dividend Mantra wrote about the difference between trading and investing...

- The Wine Cellar - The Remarkable True Story Of A $146,194-per-year Income Portfolio

Brian Richards reports on the science fiction writer Hayford Peirce's $146,194 per year Income portfolio. It is a concentrated high yield portfolio: Three common stocks (Altria, J&J, Philip Morris International)Nine master limited partnerships...

- Recent Purchase - Cisco

I've been looking around for another stock this past week as I knew I'd have the money to make another purchase. I wanted to buy a stock which pays in April so that limited my choices a bit. The first thing I look at are the names that I already...

- Recent Purchase - Piedmont Natural Gas (pny)

I think that most dividend investors try and seek out the most undervalued dividend stocks to add to their portfolios when the money becomes available. While I think that is a fantastic idea I'm a bit different in that I like to keep my payments balanced...

- Recent Dividend Increases

Dividend investors would be wise to focus not just on a stock's current yield, but also on the long-term growth potential of its dividends. That's because strong businesses that consistently raise their dividend payouts reward shareholders with...

Money and Finance

Recent Buy - Philip Morris (PM)

I purchased 14 shares of Philip Morris (PM) at $79.50

PM is not without it's troubles though. The increasing regulations, lawsuits, and taxes can spell serious trouble for the company going forward. Volume declines continue to be a concern as well as plain packaging legislation.

Philip Morris International, Inc. is a Virginia holding company incorporated in 1987. The Company's subsidiaries and affiliates and their licensees are engaged in the manufacture and sale of cigarettes and other tobacco products in markets outside the United States of America. Its portfolio comprises both international and local brands. Its portfolio of international and local brands is led by Marlboro.

Philip Morris (PM) Stock Chart

Philip Morris (PM) Basic Statistics

- Ticker Symbol: PM

- PE Ratio: 20 (17 forward p/e)

- Sector: Consumer Goods

- Yield: 5%

- Dividend Growth: 7 years

- 5 Year Dividend Growth Rate: 12.2%

- Payout Ratio: 82 %

- Market cap: $119b

- Beta: 1.03

- Website: http://www.pmi.com

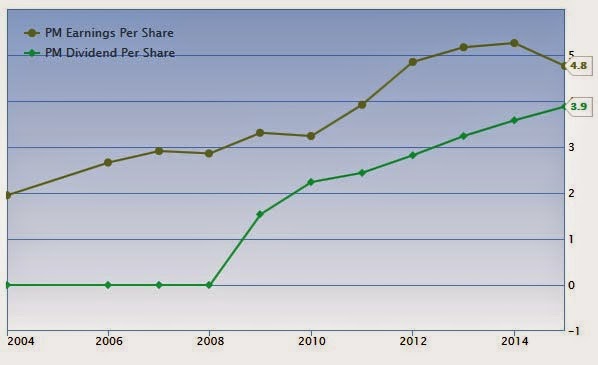

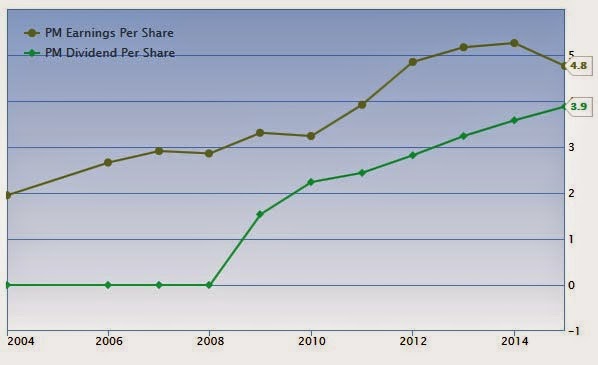

Philip Morris (PM) Dividend Growth Chart

Philip Morris (PM) EPS Growth Chart

- Weekly Roundup - September 15, 2012

Well another week is in the books so that means it's time for another weekly roundup of blog links and articles that got me thinking. So here goes. Trading Vs. Investing Dividend Mantra wrote about the difference between trading and investing...

- The Wine Cellar - The Remarkable True Story Of A $146,194-per-year Income Portfolio

Brian Richards reports on the science fiction writer Hayford Peirce's $146,194 per year Income portfolio. It is a concentrated high yield portfolio: Three common stocks (Altria, J&J, Philip Morris International)Nine master limited partnerships...

- Recent Purchase - Cisco

I've been looking around for another stock this past week as I knew I'd have the money to make another purchase. I wanted to buy a stock which pays in April so that limited my choices a bit. The first thing I look at are the names that I already...

- Recent Purchase - Piedmont Natural Gas (pny)

I think that most dividend investors try and seek out the most undervalued dividend stocks to add to their portfolios when the money becomes available. While I think that is a fantastic idea I'm a bit different in that I like to keep my payments balanced...

- Recent Dividend Increases

Dividend investors would be wise to focus not just on a stock's current yield, but also on the long-term growth potential of its dividends. That's because strong businesses that consistently raise their dividend payouts reward shareholders with...