Money and Finance

As I mentioned in my last update, this may be a slow month for me in terms of purchases. Not that I don't want to make more purchases, there are always opportunities out there that I'd like to take advantage of but I only have so much money. So this months purchase was in Kinder Morgan (KMI). KMI is down nearly 18% from it's highs earlier this year largely due to negative sentiment surrounding anything related to oil. Additionally a recent earnings miss has not helped the share price any either. I thought I'd put some money to work here.

As I mentioned in my last update, this may be a slow month for me in terms of purchases. Not that I don't want to make more purchases, there are always opportunities out there that I'd like to take advantage of but I only have so much money. So this months purchase was in Kinder Morgan (KMI). KMI is down nearly 18% from it's highs earlier this year largely due to negative sentiment surrounding anything related to oil. Additionally a recent earnings miss has not helped the share price any either. I thought I'd put some money to work here.

I purchased 31 shares of KMI at $36.50

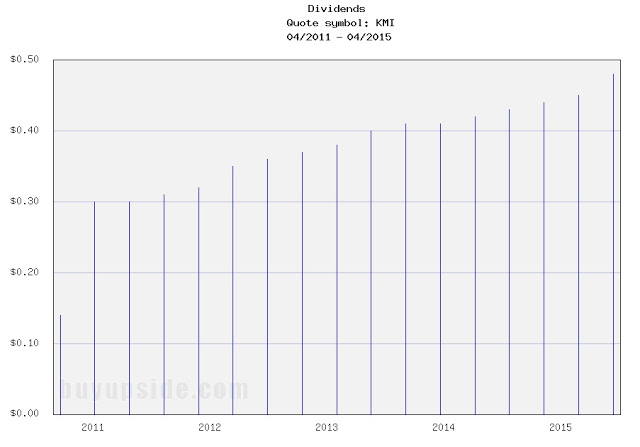

Recently the company announced another dividend raise to .49 and plans to meet the $2.00 goal by years end remain on track. This brings KMI's forward yield up to 5.3% ! Distributable Cash Flow (DCF) continues to outpace dividend growth as well which means the dividend can continue growing safely. KMI reaffirmed dividend growth of 10% per year for 2016 through 2020.

While oil prices have taken a beating natural gas growth in the US continues to expand as the country moves away from coal to natural gas. Kinder Morgan has the pipelines to move that natural gas to end users like utilities across the nation. The future looks bright for natural gas and KMI in the long term.

- Recent Buy

On Wednesday of this week I made another purchase. It was actually the first purchase I'd made in almost a month which is a bit longer than I prefer my purchases to be. Shares of Kinder Morgan, Inc. (KMI) have been under fire over the last month...

- August Dividend Update

It's time to report on my August dividends and I nearly had my highest dividend total ever at $227.68 which just barely missed beating my June number by 23 cents. My recent purchase of KMI (pre merger news) helped bolster my income as did a couple...

- Kinder Morgan To Combine Its Companies

NEW YORK (AP) — The group of oil and gas pipeline and storage companies controlled by Kinder Morgan but traded separately will combine and become the 4th biggest U.S. energy company by market value. The companies announced Sunday that Kinder Morgan...

- Recent Buy - Kinder Morgan Inc. (kmi)

It was a nice surprise when my boss gave us our bonus checks for the end of the year. I thought I'd put this money to work for me. So today I added to my position in Kinder Morgan Inc. (KMI). I purchased 31 shares at a price of $35.37 which gives...

- Recent Buy - Kinder Morgan Inc. (kmi)

Recently I initiated a new position in Kinder Morgan Inc. (KMI). I purchased 31 shares at a price of $35.40 which was $1097.40 total. There's been some weakness in the stock since July and it looked to be a good time to jump in at this point so I...

Money and Finance

Recent Buy - Kinder Morgan (KMI)

I purchased 31 shares of KMI at $36.50

Recently the company announced another dividend raise to .49 and plans to meet the $2.00 goal by years end remain on track. This brings KMI's forward yield up to 5.3% ! Distributable Cash Flow (DCF) continues to outpace dividend growth as well which means the dividend can continue growing safely. KMI reaffirmed dividend growth of 10% per year for 2016 through 2020.

While oil prices have taken a beating natural gas growth in the US continues to expand as the country moves away from coal to natural gas. Kinder Morgan has the pipelines to move that natural gas to end users like utilities across the nation. The future looks bright for natural gas and KMI in the long term.

KMI Stock Chart

KMI Basic Statistics

- Ticker Symbol: KMI

- Sector: Energy

- Yield: 5.3%

- Dividend Growth Rate:10%

- Market cap:$80 Billion

- Beta: .55

- Morningstar Fair Value: $43

- Value Line Target Price: $50

- Website: http://www.kindermorgan.com

KMI Dividend Growth

- Recent Buy

On Wednesday of this week I made another purchase. It was actually the first purchase I'd made in almost a month which is a bit longer than I prefer my purchases to be. Shares of Kinder Morgan, Inc. (KMI) have been under fire over the last month...

- August Dividend Update

It's time to report on my August dividends and I nearly had my highest dividend total ever at $227.68 which just barely missed beating my June number by 23 cents. My recent purchase of KMI (pre merger news) helped bolster my income as did a couple...

- Kinder Morgan To Combine Its Companies

NEW YORK (AP) — The group of oil and gas pipeline and storage companies controlled by Kinder Morgan but traded separately will combine and become the 4th biggest U.S. energy company by market value. The companies announced Sunday that Kinder Morgan...

- Recent Buy - Kinder Morgan Inc. (kmi)

It was a nice surprise when my boss gave us our bonus checks for the end of the year. I thought I'd put this money to work for me. So today I added to my position in Kinder Morgan Inc. (KMI). I purchased 31 shares at a price of $35.37 which gives...

- Recent Buy - Kinder Morgan Inc. (kmi)

Recently I initiated a new position in Kinder Morgan Inc. (KMI). I purchased 31 shares at a price of $35.40 which was $1097.40 total. There's been some weakness in the stock since July and it looked to be a good time to jump in at this point so I...