Money and Finance

Earlier this week I added to my position in the tobacco giant Altria (MO). I purchased 35 shares at $34.08 which brings my total position to 95 shares. Last year Altria had raised its dividend by 7.3% so I was pretty happy with the 9.1% dividend raise that was announced by Altria recently so I decided to make a purchase before the ex-div date next week. Altria was founded in 1919 and has increased it's dividend for 45 years straight making it a dividend champion. Altria also announced that it will expand its share buyback plan by $700 million to $1 billion in a year from the current annual buyback plan of $300 million.

Earlier this week I added to my position in the tobacco giant Altria (MO). I purchased 35 shares at $34.08 which brings my total position to 95 shares. Last year Altria had raised its dividend by 7.3% so I was pretty happy with the 9.1% dividend raise that was announced by Altria recently so I decided to make a purchase before the ex-div date next week. Altria was founded in 1919 and has increased it's dividend for 45 years straight making it a dividend champion. Altria also announced that it will expand its share buyback plan by $700 million to $1 billion in a year from the current annual buyback plan of $300 million.

Altria Group, Inc., through its subsidiaries, engages in the manufacture and sale of cigarettes, smokeless products, and wine in the United States and internationally. It offers cigarettes primarily under the Marlboro brand; smokeless tobacco products under the Copenhagen, Skoal, Red Seal, Husky, and Marlboro Snus brand names; cigars principally under the Black & Mild brand; and pipe tobacco.

Normally an 80% payout ratio is a bit above my screening criteria however during a recent conference call, the company stated that one of their goals is to payout about 80% of its adjusted EPS via dividends.

- Phillip Morris (pm) Dividend Stock Analysis

I'm surprised I haven't posted an analysis on Phillip Morris yet, but somehow it's slipped through the cracks. Phillip Morris is only a dividend challenger, but going back to the days of being part of the beast that included Kraft and Altria,...

- The Wine Cellar - The Remarkable True Story Of A $146,194-per-year Income Portfolio

Brian Richards reports on the science fiction writer Hayford Peirce's $146,194 per year Income portfolio. It is a concentrated high yield portfolio: Three common stocks (Altria, J&J, Philip Morris International)Nine master limited partnerships...

- October Dividend Update

October has come and gone (almost) and it's time for my monthly dividend update. This time around I suspected may be a light month because WMT not paying this month. WMT has a weird payout schedule where they pay twice in the first month of the quarter...

- Recent Buy - Philip Morris (pm)

I didn't think I would be making another purchase this month but one stock that's been on my watch list for some time had it's ex-div date this week so I couldn't resist. This time around I chose Philip Morris (PM). PM has been struggling...

- Recent Buy - Wgl Holdings (wgl)

Today I added to my position in WGL Holdings (WGL). I purchased 26 shares at $42.50 which brings my total position to 66 shares. WGL has a dividend yield of 3.90% and has raised it's dividend for 37 years straight making WGL a dividend champion. ...

Money and Finance

Recent Buy - Altria (MO)

Altria Group, Inc., through its subsidiaries, engages in the manufacture and sale of cigarettes, smokeless products, and wine in the United States and internationally. It offers cigarettes primarily under the Marlboro brand; smokeless tobacco products under the Copenhagen, Skoal, Red Seal, Husky, and Marlboro Snus brand names; cigars principally under the Black & Mild brand; and pipe tobacco.

Altria Stock Chart

Altria Basic Statistics

- Ticker Symbol: MO

- PE Ratio: 15.65

- Yield: 5.7%

- Dividend Growth 10yr: 11.4%

- Payout Ratio: 80%

- Market cap: $68 B

- Website: http://www.altria.com

Normally an 80% payout ratio is a bit above my screening criteria however during a recent conference call, the company stated that one of their goals is to payout about 80% of its adjusted EPS via dividends.

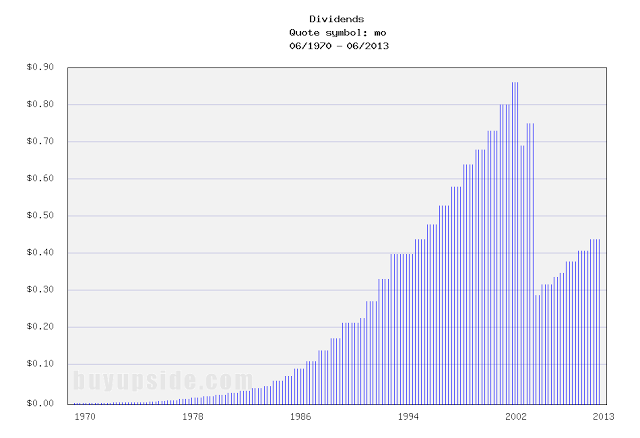

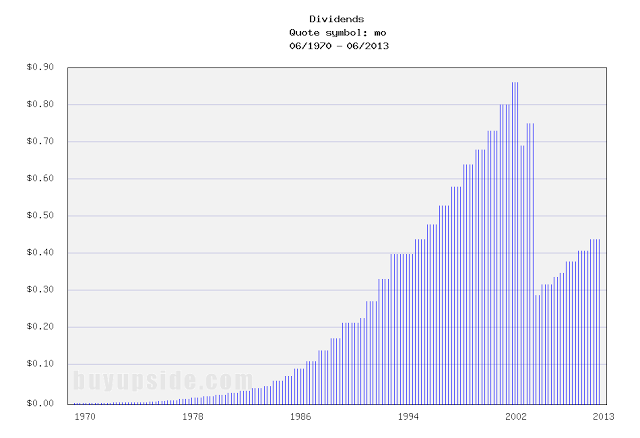

Altria Dividend History

- Phillip Morris (pm) Dividend Stock Analysis

I'm surprised I haven't posted an analysis on Phillip Morris yet, but somehow it's slipped through the cracks. Phillip Morris is only a dividend challenger, but going back to the days of being part of the beast that included Kraft and Altria,...

- The Wine Cellar - The Remarkable True Story Of A $146,194-per-year Income Portfolio

Brian Richards reports on the science fiction writer Hayford Peirce's $146,194 per year Income portfolio. It is a concentrated high yield portfolio: Three common stocks (Altria, J&J, Philip Morris International)Nine master limited partnerships...

- October Dividend Update

October has come and gone (almost) and it's time for my monthly dividend update. This time around I suspected may be a light month because WMT not paying this month. WMT has a weird payout schedule where they pay twice in the first month of the quarter...

- Recent Buy - Philip Morris (pm)

I didn't think I would be making another purchase this month but one stock that's been on my watch list for some time had it's ex-div date this week so I couldn't resist. This time around I chose Philip Morris (PM). PM has been struggling...

- Recent Buy - Wgl Holdings (wgl)

Today I added to my position in WGL Holdings (WGL). I purchased 26 shares at $42.50 which brings my total position to 66 shares. WGL has a dividend yield of 3.90% and has raised it's dividend for 37 years straight making WGL a dividend champion. ...