Money and Finance

Today I added to my position in WGL Holdings (WGL). I purchased 26 shares at $42.50 which brings my total position to 66 shares. WGL has a dividend yield of 3.90% and has raised it's dividend for 37 years straight making WGL a dividend champion.

Today I added to my position in WGL Holdings (WGL). I purchased 26 shares at $42.50 which brings my total position to 66 shares. WGL has a dividend yield of 3.90% and has raised it's dividend for 37 years straight making WGL a dividend champion.

WGL Holdings, Inc., through its subsidiaries, sells and delivers natural gas, and provides energy-related products and services. The company operates in four segments: Regulated Utility, Retail Energy-Marketing, Commercial Energy Systems, and Wholesale Energy Solutions.

Going in to this purchase I was specifically looking for a stock that has a dividend payout in the month of November (Feb,May,Aug,Nov). Which narrowed down my screening results considerably. On top of that some of the large cap stocks for that month like PG and CLX just look expensive in comparison. I like the fact that the dividend growth has been growing faster lately than it has historically. The last dividend increase was a 5% hike which isn't super but it's a good sign of things to come. With a 3.9% yield and 5% dividend growth WGL is under the chowder rule, however the chowder rule is only one of the criteria I consider when screening stocks. Honestly these days as the markets continue to rise it's very difficult to find any stocks that meet all of my screening criteria. WGL was close so it was my pick for this weeks purchase.

- Recent Purchase - Piedmont Natural Gas (pny)

I think that most dividend investors try and seek out the most undervalued dividend stocks to add to their portfolios when the money becomes available. While I think that is a fantastic idea I'm a bit different in that I like to keep my payments balanced...

- Recent Buy - Kinder Morgan (kmi)

Today I purchased another 31 shares of Kinder Morgan (KMI) at $37.46 which now gives me a grand total of 93 shares. I would have loved to buy this at the prices we saw in April but KMI has been on a roll as the rest of the markets seem to have been. This...

- Recent Buy - Chevron (cvx)

I recently picked up another 10 shares of the energy giant Chevron after their recent dividend increase announcement. In an effort to balance my monthly dividend totals I had been trying to choose a stock to purchase for the end of the quarter. I already...

- Recent Buy - Chevron (cvx)

Recently added to my position in Chevron. I purchased another 9 shares at $120.90 giving me a total of 19 shares. The stock has been dropping a little recently from the $125 range on some earnings and productivity concerns and in this market I'm happy...

- Recent Buy - Altria (mo)

Earlier this week I added to my position in the tobacco giant Altria (MO). I purchased 35 shares at $34.08 which brings my total position to 95 shares. Last year Altria had raised its dividend by 7.3% so I was pretty happy with the 9.1% dividend...

Money and Finance

Recent Buy - WGL Holdings (WGL)

WGL Holdings, Inc., through its subsidiaries, sells and delivers natural gas, and provides energy-related products and services. The company operates in four segments: Regulated Utility, Retail Energy-Marketing, Commercial Energy Systems, and Wholesale Energy Solutions.

Going in to this purchase I was specifically looking for a stock that has a dividend payout in the month of November (Feb,May,Aug,Nov). Which narrowed down my screening results considerably. On top of that some of the large cap stocks for that month like PG and CLX just look expensive in comparison. I like the fact that the dividend growth has been growing faster lately than it has historically. The last dividend increase was a 5% hike which isn't super but it's a good sign of things to come. With a 3.9% yield and 5% dividend growth WGL is under the chowder rule, however the chowder rule is only one of the criteria I consider when screening stocks. Honestly these days as the markets continue to rise it's very difficult to find any stocks that meet all of my screening criteria. WGL was close so it was my pick for this weeks purchase.

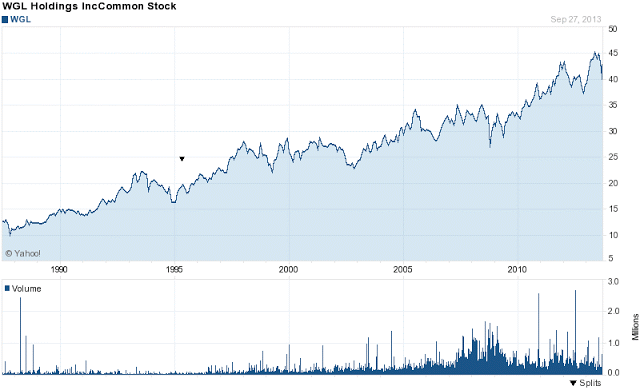

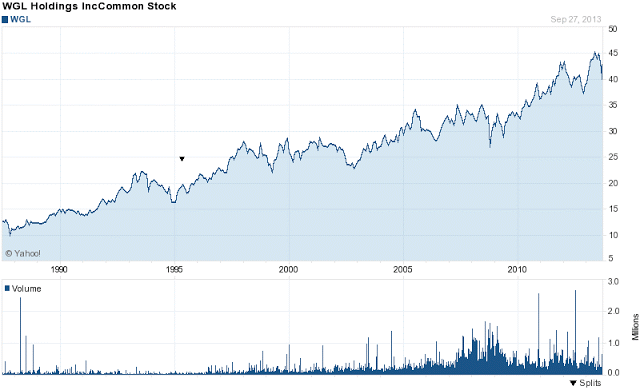

WGL Stock Chart

WGL Holdings Basic Statistics

- Ticker Symbol: WGL

- PE Ratio: 15.80

- Yield: 3.9%

- Dividend Growth 10yr: 2.3%

- Payout Ratio: 60%

- Market cap: $2.21 B

- Website: http://www.wglholdings.com

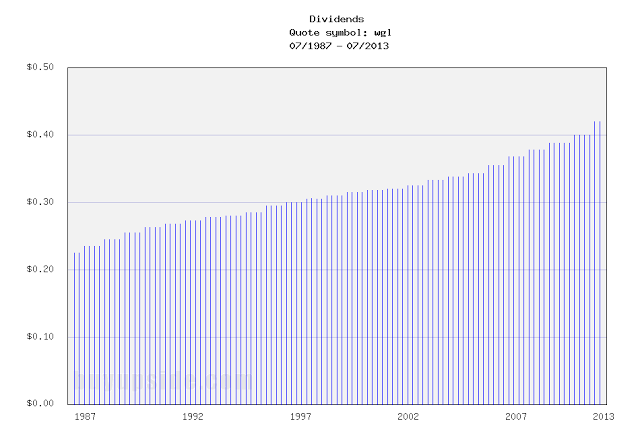

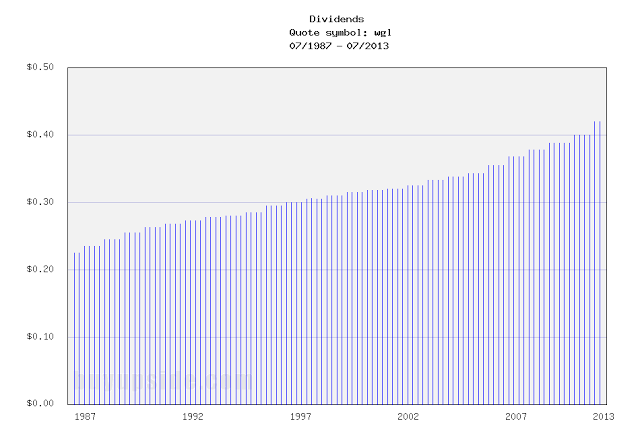

WGL Holdings Dividend History

- Recent Purchase - Piedmont Natural Gas (pny)

I think that most dividend investors try and seek out the most undervalued dividend stocks to add to their portfolios when the money becomes available. While I think that is a fantastic idea I'm a bit different in that I like to keep my payments balanced...

- Recent Buy - Kinder Morgan (kmi)

Today I purchased another 31 shares of Kinder Morgan (KMI) at $37.46 which now gives me a grand total of 93 shares. I would have loved to buy this at the prices we saw in April but KMI has been on a roll as the rest of the markets seem to have been. This...

- Recent Buy - Chevron (cvx)

I recently picked up another 10 shares of the energy giant Chevron after their recent dividend increase announcement. In an effort to balance my monthly dividend totals I had been trying to choose a stock to purchase for the end of the quarter. I already...

- Recent Buy - Chevron (cvx)

Recently added to my position in Chevron. I purchased another 9 shares at $120.90 giving me a total of 19 shares. The stock has been dropping a little recently from the $125 range on some earnings and productivity concerns and in this market I'm happy...

- Recent Buy - Altria (mo)

Earlier this week I added to my position in the tobacco giant Altria (MO). I purchased 35 shares at $34.08 which brings my total position to 95 shares. Last year Altria had raised its dividend by 7.3% so I was pretty happy with the 9.1% dividend...