Money and Finance

I ran Procter & Gamble (PG) through my screening process to see where it currently stands. PG closed on Tuesday 4/17/12 at $67.02.

Company Background:

The Procter & Gamble Company provides consumer packaged goods in the United States and internationally. The company offers beauty products, such as cosmetics, female antiperspirant and deodorant, female personal cleansing, female shave care, hair care, hair color, hair styling, pharmacy channel, prestige products, salon professional, and skin care products under the Head & Shoulders, Olay, Pantene, and Wella brands; and grooming products, including electronic hair removal devices, home small appliances, male blades and razors, and male personal care products under the Braun, Fusion, Gillette, and Mach3 brands. It also provides health care products comprising feminine care, gastrointestinal, incontinence, rapid diagnostics, respiratory, toothbrush, toothpaste, water filtration, and other oral care products under the Always, Crest, and Oral-B brands; snacks and pet care products under the Iams and Pringles brands; fabric care and home care products consisting of laundry additives, air care, batteries, dish care, fabric enhancers, laundry detergents, and surface care products under the Ace, Ariel, Dawn, Downy, Duracell, Gain, Tide, and Febreze brands; and baby care and family care products, such as baby wipes, diapers, paper towels, tissues, and toilet paper products under Bounty, Charmin, and Pampers brands. The company sells its products in approximately 180 countries through retail operations, including mass merchandisers, grocery stores, membership club stores, drug stores, department stores, salons, and high-frequency stores.

DCF Valuation:

Analysts expect PG to be able to grow at 8.67% per year for the next five years and I've assumed they can continue to grow at 3.50% per year thereafter. Running these numbers through a DCF analysis with a 10% discount rate yields a fair value price of $70.21. This means that at $67.02 the shares are undervalued by 4.5%.

Graham Number:

Over the last 12 months, PG's EPS were $3.40 and it's current book value per share is $22.90. The Graham Number is calculated to be $41.86 which means that at $67.02 the shares are over valued. If you calculate the Graham Number based off the expected EPS, $3.96, for the fiscal year ending in June and keep the book value per share constant you arrive at a fair value price of $45.68. Either way PG is overvalued quite a bit according to the Graham Number calculation.

Average High Dividend Yield:

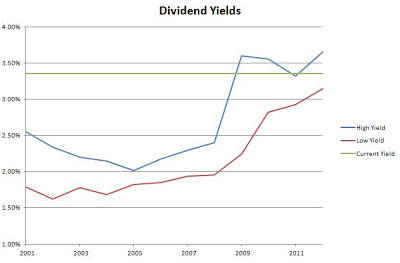

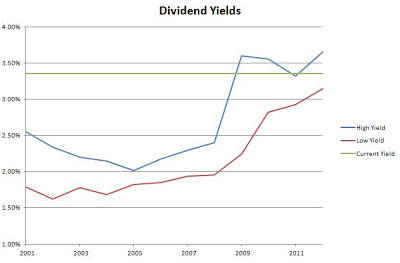

PG's average high dividend yield for the past 10 years is 2.63% and for the past 5 years is 2.50%. These are fairly reasonable barometers since PG has been a quality dividend growth company for a long time. Using the 5 year rate, PG's fair value price would be $89.92 and the 10 year rate would be give a price of $85.37. Therefore shares are undervalued by approximately 25% and 21%, respectively. The following chart shows the historical high and low dividend yield as well as the current yield.

Average Low PE Ratio:

PG's average low PE ratio for the past 5 years is 15.42 and for the past 10 year is 17.62. This would correspond to a price per share of $62.46 and $71.35, respectively. The 5 year and 10 year low PE price targets are overvalued by 7% and undervalued by 6%. Based off the low PE ratio it seems that PG is currently fairly valued.

Dividend Discount Model:

For the DDM I assumed that PG will be able to grow dividends for the next 5 years at the minimum of 15% or the lowest of the 1, 3, 5 or 10 year growth rates. In this case that would be 8.48%. After that I assumed PG can continue to raise dividends by 3.50% and used a discount rate of 7.5%. Based on this PG is worth $61.36 meaning it's overvalued by 2%. I am fairly conservative in my DDM valuation by assuming they can only continue to grow at the elevated rate for 5 years, personally I feel that you will see a slightly higher 5 year growth rate over a longer period but being conservative in your assumptions allows room for errors.

PE Ratios:

PG's trailing PE is 19.71 and it's forward PE is 15.57. The CAPE for the previous 10 years is 23.32. Compared to it's industry, PG seems to be slightly overvalued versus their behemoth counterparts JNJ (18.42) and KMB (18.92) but slightly undervalued versus the industry as a whole (21.46). All industry and competitor comparisons are on a TTM EPS basis.

Fundamentals:

PG's gross margin for FY 2009/10 and FY 2010/11 were 52.04% and 50.62% respectively. The gross margin is a little low for where I traditionally would like to see it but it is at least remaining flat and not falling significantly which is good to see. Their net income margin for the same years were 16.13% and 14.29% respectively. I like the net income margin to be at least 10% and preferably rising. PG is well above the 10% threshold but it's net income margin has fallen. I would check to see how this value stands based on a TTM basis for more assurance. The cash-to-debt ratio for the same years were both 0.13. I would definitely like to see PG make some progress on their high debt load.

Share Buyback:

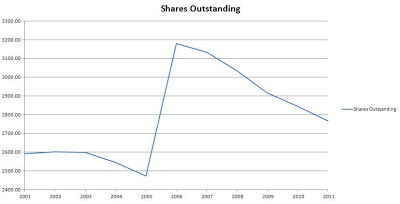

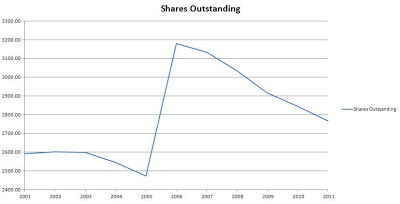

PG's shares outstanding have been falling thanks to a significant buyback program, save for the stock split in 2006.

Dividend Analysis:

PG's dividend growth rate for has had a great run thus far in the 2000's. Its growth rates for the past 1 year, 3 year, 5 year and 10 year are 9.1%, 9.9%, 11.2% and 10.9% respectively. There's a reason that PG is considered a stable dividend growth company, and to see that they've raised dividends every year for the past 55 years is amazing. The payout ratio has been fairly stable around the 50% mark. I would like for it to be a little lower to allow for further increases but 50% is still low enough for me.

It's FCF payout ratio had seemed to settle in around the 70% mark until the last fiscal year. I would definitely like to see where they stand for this fiscal year ending in June.

Return on Equity and Return on Capital: Invested

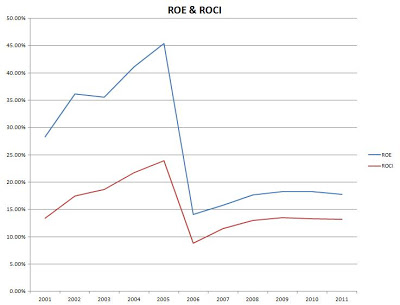

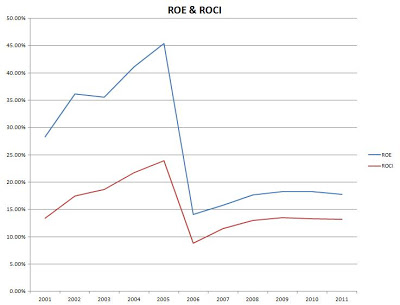

PG's ROE and ROCI have been trending upwards since 2001. I assuming the big dropoff in ROE and ROCI is due to the stock split in 2006. I'm still fairly new to investing and haven't been able to get deep into the study of accounting. I like to see a stable or increasing value for both.

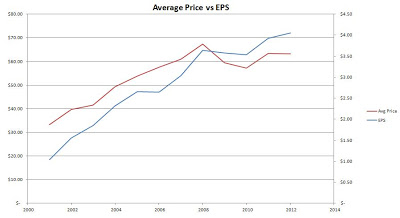

Average Price and EPS:

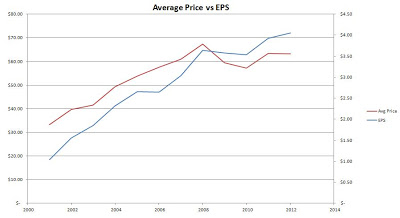

PG's average share price tracked their EPS fairly closely until the beginning of the financial crisis in 2008. Since then the average price and EPS have continued to growth around the same amount each year. Much different than how Walmart's share price behaved in the same time.

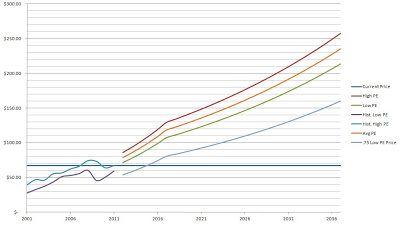

Forecast:

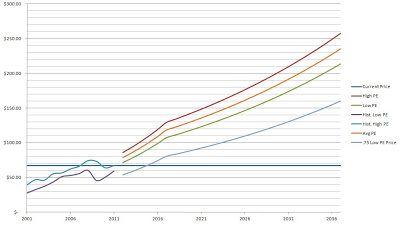

The chart shows the historical prices for the previous 10 years and the forecast based on the average PE ratios and the expected EPS values. I have also included a forecast based off a PE ratio that is only 75% of the average low PE ratio for the previous 10 years. I like to the look to buy at the 75% Low PE price or lower to provide for additional margin of safety. Currently Procter & Gamble is trading $14.70 higher than this value.

Conclusion:

The average of all the valuation models gives a value of $68.49 which means that PG is currently trading at a 2% discount to the fair value.

Overall I think that PG is fairly valued at today's prices. If I had targeted PG as a necessary stock for my portfolio I would look to sell puts that would allow me to get at least a 10% CAGR if they expire and purchase no more higher than the $62.50 price. Tomorrow I will make a post discussing some of the put option possibilities.

- Mattel Stock Analysis

After seeing a few articles about Mattel after selling off due to a weak 1st quarter, which is fairly typical seeing as how they sell toys and after the Christmas season spending is usually light, I decided to run Mattel (MAT) through my screening process...

- Medtronic Stock Analysis

I ran Medtronic (MDT) through my screening process to see where it currently stands. MDT closed on Friday 4/20/12 at $37.61. Company Background: Medtronic, Inc. manufactures and sells device-based medical therapies worldwide. It provides implantable cardioverter-defibrillators,...

- Harris Corporation Stock Analysis

I ran Harris Corporation (HRS) through my screening process to see where it currently stands. HRS closed on Wednesday 4/11/12 at $43.81. Company Background: Harris Corporation, together with its subsidiaries, operates as a communications and information...

- At&t Stock Analysis

I ran AT&T through my screening process to see where it currently stands. AT&T is closed on Friday 3/23/12 at $31.52. DCF Valuation: Analysts expect AT&T to grow 7.78% per year for the next 5 years and I've assumed that after that they will grow at...

- Walmart Stock Analysis

I ran Walmart through my screening process and was pretty intrigued by the results. Walmart is currently trading at $59.76. DCF Valuation: Analysts expect Walmart to grow 9.10% per year for the next 5 years and I've assumed that after that they will...

Money and Finance

Procter & Gamble Stock Analysis

I ran Procter & Gamble (PG) through my screening process to see where it currently stands. PG closed on Tuesday 4/17/12 at $67.02.

Company Background:

The Procter & Gamble Company provides consumer packaged goods in the United States and internationally. The company offers beauty products, such as cosmetics, female antiperspirant and deodorant, female personal cleansing, female shave care, hair care, hair color, hair styling, pharmacy channel, prestige products, salon professional, and skin care products under the Head & Shoulders, Olay, Pantene, and Wella brands; and grooming products, including electronic hair removal devices, home small appliances, male blades and razors, and male personal care products under the Braun, Fusion, Gillette, and Mach3 brands. It also provides health care products comprising feminine care, gastrointestinal, incontinence, rapid diagnostics, respiratory, toothbrush, toothpaste, water filtration, and other oral care products under the Always, Crest, and Oral-B brands; snacks and pet care products under the Iams and Pringles brands; fabric care and home care products consisting of laundry additives, air care, batteries, dish care, fabric enhancers, laundry detergents, and surface care products under the Ace, Ariel, Dawn, Downy, Duracell, Gain, Tide, and Febreze brands; and baby care and family care products, such as baby wipes, diapers, paper towels, tissues, and toilet paper products under Bounty, Charmin, and Pampers brands. The company sells its products in approximately 180 countries through retail operations, including mass merchandisers, grocery stores, membership club stores, drug stores, department stores, salons, and high-frequency stores.

DCF Valuation:

Analysts expect PG to be able to grow at 8.67% per year for the next five years and I've assumed they can continue to grow at 3.50% per year thereafter. Running these numbers through a DCF analysis with a 10% discount rate yields a fair value price of $70.21. This means that at $67.02 the shares are undervalued by 4.5%.

Graham Number:

Over the last 12 months, PG's EPS were $3.40 and it's current book value per share is $22.90. The Graham Number is calculated to be $41.86 which means that at $67.02 the shares are over valued. If you calculate the Graham Number based off the expected EPS, $3.96, for the fiscal year ending in June and keep the book value per share constant you arrive at a fair value price of $45.68. Either way PG is overvalued quite a bit according to the Graham Number calculation.

Average High Dividend Yield:

PG's average high dividend yield for the past 10 years is 2.63% and for the past 5 years is 2.50%. These are fairly reasonable barometers since PG has been a quality dividend growth company for a long time. Using the 5 year rate, PG's fair value price would be $89.92 and the 10 year rate would be give a price of $85.37. Therefore shares are undervalued by approximately 25% and 21%, respectively. The following chart shows the historical high and low dividend yield as well as the current yield.

Average Low PE Ratio:

PG's average low PE ratio for the past 5 years is 15.42 and for the past 10 year is 17.62. This would correspond to a price per share of $62.46 and $71.35, respectively. The 5 year and 10 year low PE price targets are overvalued by 7% and undervalued by 6%. Based off the low PE ratio it seems that PG is currently fairly valued.

Dividend Discount Model:

For the DDM I assumed that PG will be able to grow dividends for the next 5 years at the minimum of 15% or the lowest of the 1, 3, 5 or 10 year growth rates. In this case that would be 8.48%. After that I assumed PG can continue to raise dividends by 3.50% and used a discount rate of 7.5%. Based on this PG is worth $61.36 meaning it's overvalued by 2%. I am fairly conservative in my DDM valuation by assuming they can only continue to grow at the elevated rate for 5 years, personally I feel that you will see a slightly higher 5 year growth rate over a longer period but being conservative in your assumptions allows room for errors.

PE Ratios:

PG's trailing PE is 19.71 and it's forward PE is 15.57. The CAPE for the previous 10 years is 23.32. Compared to it's industry, PG seems to be slightly overvalued versus their behemoth counterparts JNJ (18.42) and KMB (18.92) but slightly undervalued versus the industry as a whole (21.46). All industry and competitor comparisons are on a TTM EPS basis.

Fundamentals:

PG's gross margin for FY 2009/10 and FY 2010/11 were 52.04% and 50.62% respectively. The gross margin is a little low for where I traditionally would like to see it but it is at least remaining flat and not falling significantly which is good to see. Their net income margin for the same years were 16.13% and 14.29% respectively. I like the net income margin to be at least 10% and preferably rising. PG is well above the 10% threshold but it's net income margin has fallen. I would check to see how this value stands based on a TTM basis for more assurance. The cash-to-debt ratio for the same years were both 0.13. I would definitely like to see PG make some progress on their high debt load.

Share Buyback:

PG's shares outstanding have been falling thanks to a significant buyback program, save for the stock split in 2006.

Dividend Analysis:

PG's dividend growth rate for has had a great run thus far in the 2000's. Its growth rates for the past 1 year, 3 year, 5 year and 10 year are 9.1%, 9.9%, 11.2% and 10.9% respectively. There's a reason that PG is considered a stable dividend growth company, and to see that they've raised dividends every year for the past 55 years is amazing. The payout ratio has been fairly stable around the 50% mark. I would like for it to be a little lower to allow for further increases but 50% is still low enough for me.

It's FCF payout ratio had seemed to settle in around the 70% mark until the last fiscal year. I would definitely like to see where they stand for this fiscal year ending in June.

Return on Equity and Return on Capital: Invested

PG's ROE and ROCI have been trending upwards since 2001. I assuming the big dropoff in ROE and ROCI is due to the stock split in 2006. I'm still fairly new to investing and haven't been able to get deep into the study of accounting. I like to see a stable or increasing value for both.

Average Price and EPS:

PG's average share price tracked their EPS fairly closely until the beginning of the financial crisis in 2008. Since then the average price and EPS have continued to growth around the same amount each year. Much different than how Walmart's share price behaved in the same time.

Forecast:

The chart shows the historical prices for the previous 10 years and the forecast based on the average PE ratios and the expected EPS values. I have also included a forecast based off a PE ratio that is only 75% of the average low PE ratio for the previous 10 years. I like to the look to buy at the 75% Low PE price or lower to provide for additional margin of safety. Currently Procter & Gamble is trading $14.70 higher than this value.

Conclusion:

The average of all the valuation models gives a value of $68.49 which means that PG is currently trading at a 2% discount to the fair value.

Overall I think that PG is fairly valued at today's prices. If I had targeted PG as a necessary stock for my portfolio I would look to sell puts that would allow me to get at least a 10% CAGR if they expire and purchase no more higher than the $62.50 price. Tomorrow I will make a post discussing some of the put option possibilities.

- Mattel Stock Analysis

After seeing a few articles about Mattel after selling off due to a weak 1st quarter, which is fairly typical seeing as how they sell toys and after the Christmas season spending is usually light, I decided to run Mattel (MAT) through my screening process...

- Medtronic Stock Analysis

I ran Medtronic (MDT) through my screening process to see where it currently stands. MDT closed on Friday 4/20/12 at $37.61. Company Background: Medtronic, Inc. manufactures and sells device-based medical therapies worldwide. It provides implantable cardioverter-defibrillators,...

- Harris Corporation Stock Analysis

I ran Harris Corporation (HRS) through my screening process to see where it currently stands. HRS closed on Wednesday 4/11/12 at $43.81. Company Background: Harris Corporation, together with its subsidiaries, operates as a communications and information...

- At&t Stock Analysis

I ran AT&T through my screening process to see where it currently stands. AT&T is closed on Friday 3/23/12 at $31.52. DCF Valuation: Analysts expect AT&T to grow 7.78% per year for the next 5 years and I've assumed that after that they will grow at...

- Walmart Stock Analysis

I ran Walmart through my screening process and was pretty intrigued by the results. Walmart is currently trading at $59.76. DCF Valuation: Analysts expect Walmart to grow 9.10% per year for the next 5 years and I've assumed that after that they will...