Money and Finance

I ran Walmart through my screening process and was pretty intrigued by the results. Walmart is currently trading at $59.76.

DCF Valuation:

Analysts expect Walmart to grow 9.10% per year for the next 5 years and I've assumed that after that they will grow at 1.5%. Running those numbers through the DCF analysis with a 10% discount rate gives a value of $72.46. DCF valuation shows that Walmart is currently undervalued by 17.5%.

Graham Number:

Walmart's TTM EPS is $4.52 with a BVPS of $20.82. Using the Graham Number calculation you get a value of $46.02. The Graham Number says that Walmart is currently overvalued by 29.9%.

Average High Dividend Yield:

Walmart's average high dividend yield for the prior 10 years is 1.85% and for the previous 5 years it's 2.39%. I think that the 10 year average is artificially low due to the high valuation that Walmart was trading for in the early 2000's. Based on the 10 year yield Walmart should trade at $84.31. The price based on the 5 year yield is $65.37. This means that Walmart is undervalued by 29.1% and 8.6% respectively.

Average Low PE Ratio:

Much like the high dividend yield being skewed the Low PE ratio is also skewed due to the excessive valuations in the early 2000's. In 2001 you saw Walmart trade between a 30 and 48 PE ratio. Even in 2005 Walmart was trading between a 21 and 25 PE ratio. It's average low 10 year PE ratio is 16.27 and the 5 year PE is 12.41. Baed on the PE's Walmart should trade at $79.09 and $60.32 meaning that Walmart is undervalued by 24.4% and 0.9% respectively.

Dividend Discount Model:

For the DDM I assumed that Walmart will be able to grow dividends for the next 5 years at the minimum of 15% or the lowest of the 1, 3, 5 or 10 year growth rates. In this case that would be 15%. After that I assumed Walmart can continue to raise dividends by 2.5% and used a discount rate of 7.5%. Based on this Walmart is worth $49.22 meaning it's overvalued by 21.4%.

PE Ratios:

Walmart's trailing PE is 13.22 and it's forward PE is 12.30. The CAPE for the previous 10 years is 21.54. I feel the CAPE is a little overstated once again thanks to the high valuations afforded Walmart's shares in the early 2000's.

Fundamentals:

I usually look for a higher gross and net margin but Walmart is in the low margin retail business. For these I'll compare them to the industry to see how they stack up against their competitors. Their gross margin is 3.8% higher than the industry and the net profit margin is 8.1% higher than the industry. Since Walmart doesn't pass my minimum margin amounts due to their business it's nice to see that they are well above their competition in a low margin business. I would like for the cash to debt ratio to be better than the current 0.15.

Share Buyback:

Over the past year Walmart was able to decrease the shares outstanding by 2.60%.

Dividend Analysis:

The current yield is a little low for my entry price but a 2.44% yield is close to my entry yield of 2.50%. Especially since Walmart's dividend growth rates are great. The 1 year is 20.66%, 3 year 15.40%, 5 year 16.86% and the 10 year is 20.14%. I usually like to see the 10 year at least 10% but all four are at least 15%. And what's even better is that the payout ratio is only 32.3%. This means there's still plenty of room to increase the dividend for a long time.

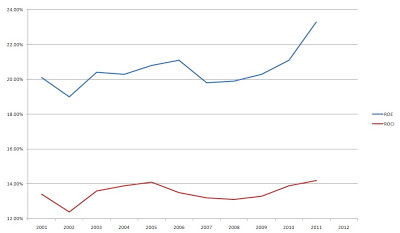

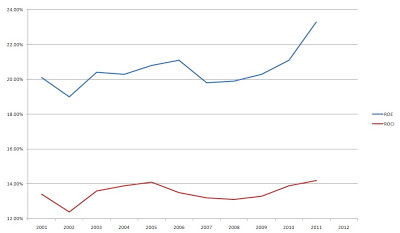

Return on Equity and Return on Capital Invested:

I don't normally look for a specific number but prefer to see fairly stable or increasing values for ROE and ROCI. The following graph shows Walmart's ROE and ROCI since 2001.

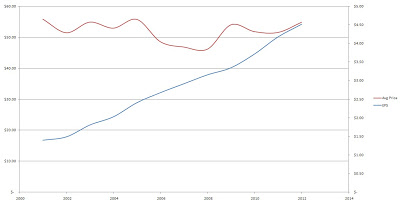

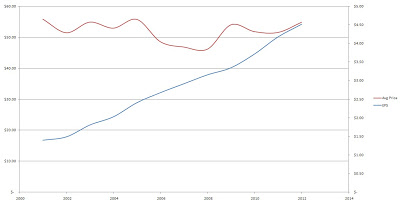

Average Price and EPS:

Due to the high valuation that Walmart had in the early 2000's the share price has been relatively flat to allow for the EPS to catch up to justify the valuation.

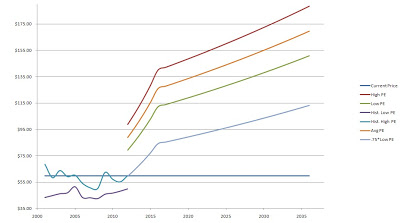

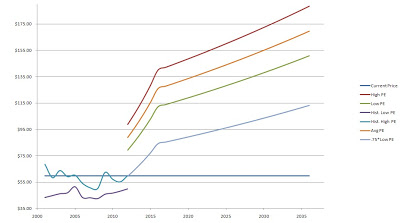

Forecast:

The chart shows the historical prices for the previous 10 years and the forecast based on the average PE ratios and the expected EPS values. I have also included a forecast based off a PE ratio that is only 75% of the average low PE ratio for the previous 10 years. I like to the look to buy at the 75% Low PE price or lower to provide for additional margin of safety. Currently Walmart is trading only $0.44 higher than this value.

The average of all the valuation models gives a value of $66.22 which means that Walmart is currently trading at a 9.7% discount to the fair value.

Overall I think that Walmart is on the border of hitting my entry criteria. I would probably start accumulating at any price below $59 and buy on the way down. A $59 entry price would start your position at an approximate 11% discount to the average fair value. The other option is to sell puts to guarantee a entry price that you seek. With Walmart being a large and stable company I'm not sure you could get adequate premium yield from the puts to make it worth tying your money up.

- Position Decision

I'm a little torn on what to do with my small position in Walmart (WMT). I originally purchased the shares back in late April after the Mexico bribery scandal became news. At the time Walmart had dropped a lot over a few short days and I was able...

- Recent Buy

Yesterday I bought 9 shares in Walmart at a price of $57.71 in my Roth IRA. Recently, reports of Walmart bribing officials in Mexico for preferential treatment have been released. While this is concerning, it's one of those situations where everyone...

- Harris Corporation Stock Analysis

I ran Harris Corporation (HRS) through my screening process to see where it currently stands. HRS closed on Wednesday 4/11/12 at $43.81. Company Background: Harris Corporation, together with its subsidiaries, operates as a communications and information...

- Jnj Stock Analysis

I've started to try and consolidate my stock analysis spreadsheets to make it easier for myself to cruch numbers. I like JNJ and would love to get in but right now it seems that it's a little overvalued and there's just too many question marks...

- Recent Buy - Walmart

Today I made another purchase as the markets took a beating. This time I picked up some more shares of retail giant Walmart (WMT). This allowed me to average down a bit. Sadly I was a couple weeks removed from the ex-dividend date so I'll miss next...

Money and Finance

Walmart Stock Analysis

I ran Walmart through my screening process and was pretty intrigued by the results. Walmart is currently trading at $59.76.

DCF Valuation:

Analysts expect Walmart to grow 9.10% per year for the next 5 years and I've assumed that after that they will grow at 1.5%. Running those numbers through the DCF analysis with a 10% discount rate gives a value of $72.46. DCF valuation shows that Walmart is currently undervalued by 17.5%.

Graham Number:

Walmart's TTM EPS is $4.52 with a BVPS of $20.82. Using the Graham Number calculation you get a value of $46.02. The Graham Number says that Walmart is currently overvalued by 29.9%.

Average High Dividend Yield:

Walmart's average high dividend yield for the prior 10 years is 1.85% and for the previous 5 years it's 2.39%. I think that the 10 year average is artificially low due to the high valuation that Walmart was trading for in the early 2000's. Based on the 10 year yield Walmart should trade at $84.31. The price based on the 5 year yield is $65.37. This means that Walmart is undervalued by 29.1% and 8.6% respectively.

Average Low PE Ratio:

Much like the high dividend yield being skewed the Low PE ratio is also skewed due to the excessive valuations in the early 2000's. In 2001 you saw Walmart trade between a 30 and 48 PE ratio. Even in 2005 Walmart was trading between a 21 and 25 PE ratio. It's average low 10 year PE ratio is 16.27 and the 5 year PE is 12.41. Baed on the PE's Walmart should trade at $79.09 and $60.32 meaning that Walmart is undervalued by 24.4% and 0.9% respectively.

Dividend Discount Model:

For the DDM I assumed that Walmart will be able to grow dividends for the next 5 years at the minimum of 15% or the lowest of the 1, 3, 5 or 10 year growth rates. In this case that would be 15%. After that I assumed Walmart can continue to raise dividends by 2.5% and used a discount rate of 7.5%. Based on this Walmart is worth $49.22 meaning it's overvalued by 21.4%.

PE Ratios:

Walmart's trailing PE is 13.22 and it's forward PE is 12.30. The CAPE for the previous 10 years is 21.54. I feel the CAPE is a little overstated once again thanks to the high valuations afforded Walmart's shares in the early 2000's.

Fundamentals:

I usually look for a higher gross and net margin but Walmart is in the low margin retail business. For these I'll compare them to the industry to see how they stack up against their competitors. Their gross margin is 3.8% higher than the industry and the net profit margin is 8.1% higher than the industry. Since Walmart doesn't pass my minimum margin amounts due to their business it's nice to see that they are well above their competition in a low margin business. I would like for the cash to debt ratio to be better than the current 0.15.

Share Buyback:

Over the past year Walmart was able to decrease the shares outstanding by 2.60%.

Dividend Analysis:

The current yield is a little low for my entry price but a 2.44% yield is close to my entry yield of 2.50%. Especially since Walmart's dividend growth rates are great. The 1 year is 20.66%, 3 year 15.40%, 5 year 16.86% and the 10 year is 20.14%. I usually like to see the 10 year at least 10% but all four are at least 15%. And what's even better is that the payout ratio is only 32.3%. This means there's still plenty of room to increase the dividend for a long time.

Return on Equity and Return on Capital Invested:

I don't normally look for a specific number but prefer to see fairly stable or increasing values for ROE and ROCI. The following graph shows Walmart's ROE and ROCI since 2001.

Average Price and EPS:

Due to the high valuation that Walmart had in the early 2000's the share price has been relatively flat to allow for the EPS to catch up to justify the valuation.

Forecast:

The chart shows the historical prices for the previous 10 years and the forecast based on the average PE ratios and the expected EPS values. I have also included a forecast based off a PE ratio that is only 75% of the average low PE ratio for the previous 10 years. I like to the look to buy at the 75% Low PE price or lower to provide for additional margin of safety. Currently Walmart is trading only $0.44 higher than this value.

The average of all the valuation models gives a value of $66.22 which means that Walmart is currently trading at a 9.7% discount to the fair value.

Overall I think that Walmart is on the border of hitting my entry criteria. I would probably start accumulating at any price below $59 and buy on the way down. A $59 entry price would start your position at an approximate 11% discount to the average fair value. The other option is to sell puts to guarantee a entry price that you seek. With Walmart being a large and stable company I'm not sure you could get adequate premium yield from the puts to make it worth tying your money up.

- Position Decision

I'm a little torn on what to do with my small position in Walmart (WMT). I originally purchased the shares back in late April after the Mexico bribery scandal became news. At the time Walmart had dropped a lot over a few short days and I was able...

- Recent Buy

Yesterday I bought 9 shares in Walmart at a price of $57.71 in my Roth IRA. Recently, reports of Walmart bribing officials in Mexico for preferential treatment have been released. While this is concerning, it's one of those situations where everyone...

- Harris Corporation Stock Analysis

I ran Harris Corporation (HRS) through my screening process to see where it currently stands. HRS closed on Wednesday 4/11/12 at $43.81. Company Background: Harris Corporation, together with its subsidiaries, operates as a communications and information...

- Jnj Stock Analysis

I've started to try and consolidate my stock analysis spreadsheets to make it easier for myself to cruch numbers. I like JNJ and would love to get in but right now it seems that it's a little overvalued and there's just too many question marks...

- Recent Buy - Walmart

Today I made another purchase as the markets took a beating. This time I picked up some more shares of retail giant Walmart (WMT). This allowed me to average down a bit. Sadly I was a couple weeks removed from the ex-dividend date so I'll miss next...