Money and Finance

- Links

Warren Buffett: The Oracle of Nebraska Shares His Wit and Wisdom With Business Students [H/T Linc] (LINK) Vegas Casinos Can Fire Buffett's Utility -- for $127 Million [H/T Linc] (LINK) An excerpt from Michael Lewitt's The Credit Strategist (via...

- Fight The Fed Model: The Relationship Between Stock Market Yields, Bond Market Yields, And Future Returns - By Cliff Asness (december 2002)

Abstract: The "Fed Model" has become a very popular yardstick for judging whether the U.S. stock market is fairly valued. The Fed Model compares the stock market's earnings yield (E/P) to the yield on long-term government bonds. In contrast, traditional...

- Little Logic To Bond World Amid Current Risk Phobias - By Jim Grant

"There are no bad bonds, only bad prices," the traders used to say. They should say it again, only louder. In the spring of 1984, long-dated Treasuries went begging at yields of nearly 14 per cent in the context of an inflation rate of just 4 per cent....

- Building The Ideal Portfolio

If you're reading this article, chances are that you are interested in building your own investment portfolio but you have no idea how to begin. Well I'm attempting to assist you in that direction as far as I possibly can. When people are trying...

- How To Invest In Shares [part 2]

Hi, welcome to Part 2 of How to Invest In Shares :) Hopefully, Part 1 was relatively beneficial with around 200+ views so far. Well, today I would be touching more on the returns of Investing! Why do we want to invest in shares? Because historically,...

Money and Finance

John Mauldin: A Code Red World

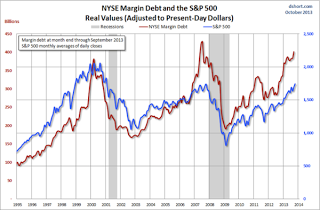

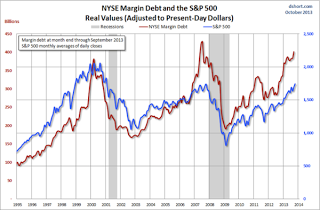

NYSE margin debt is showing the kind of rapid acceleration that often signals a draw down in the S&P 500. Are we there yet? Maybe not, as the level of investor complacency is just so (insert your favorite expletive) high.

The potential for bubbles building atop the monetary largesse being poured into our collective glasses is growing. As an example, the "high-yield" bond market is now huge. A study by Russell, a consultancy, estimated its total size at $1.7 trillion. These are supposed to be bonds,the sort of thing that produces safe income for retirees, yet almost half of all the corporate bonds rated by Standard & Poor's are once again classed as speculative, a polite term for junk.

- Links

Warren Buffett: The Oracle of Nebraska Shares His Wit and Wisdom With Business Students [H/T Linc] (LINK) Vegas Casinos Can Fire Buffett's Utility -- for $127 Million [H/T Linc] (LINK) An excerpt from Michael Lewitt's The Credit Strategist (via...

- Fight The Fed Model: The Relationship Between Stock Market Yields, Bond Market Yields, And Future Returns - By Cliff Asness (december 2002)

Abstract: The "Fed Model" has become a very popular yardstick for judging whether the U.S. stock market is fairly valued. The Fed Model compares the stock market's earnings yield (E/P) to the yield on long-term government bonds. In contrast, traditional...

- Little Logic To Bond World Amid Current Risk Phobias - By Jim Grant

"There are no bad bonds, only bad prices," the traders used to say. They should say it again, only louder. In the spring of 1984, long-dated Treasuries went begging at yields of nearly 14 per cent in the context of an inflation rate of just 4 per cent....

- Building The Ideal Portfolio

If you're reading this article, chances are that you are interested in building your own investment portfolio but you have no idea how to begin. Well I'm attempting to assist you in that direction as far as I possibly can. When people are trying...

- How To Invest In Shares [part 2]

Hi, welcome to Part 2 of How to Invest In Shares :) Hopefully, Part 1 was relatively beneficial with around 200+ views so far. Well, today I would be touching more on the returns of Investing! Why do we want to invest in shares? Because historically,...