Money and Finance

Hi, welcome to Part 2 of How to Invest In Shares :)

Hopefully, Part 1 was relatively beneficial with around 200+ views so far.

Well, today I would be touching more on the returns of Investing!

Why do we want to invest in shares? Because historically, most of them offer better chances of returns compared to if you were to park your money into your savings account. Why? Because it comes with a level of risk not commonly associated with a savings account.

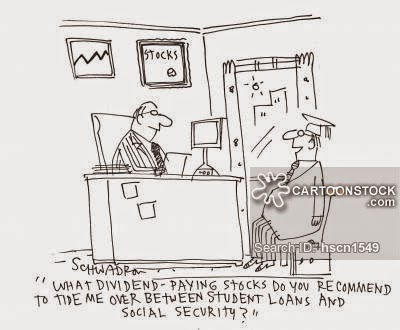

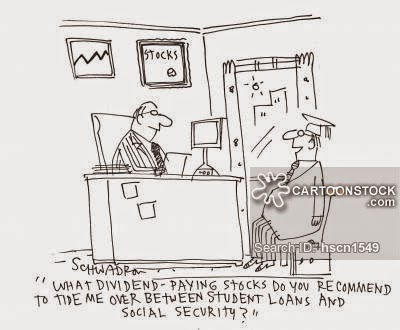

By investing in any company, you are entitled to receive dividends which can be considered as the company's profits. When the company does well, they pay out higher dividends. Shares pay a higher amount of dividends compared to bonds. Note that some companies do not pay dividends! Eg: Berkshire (Credits to La Papillion)

Think of shares & bonds as your weapons in your journey. Shares are the high powered rifles, machine guns and so on. They are the highlight of your arsenal. With them, you can easily get a higher success rate because of the enormous firepower. Bonds however, are the complete opposite. Visualize them as your handguns, pistols, knives and so on. If your firepower from the shares take a huge hit, it wouldn't be a complete loss. You can still defend yourself with your pistols and knives.

That's why most investors and advisors usually recommend a mix of both in your portfolio.

Imagine a scenario with mostly shares. You would get higher dividends. But one major hit in the market, would leave you powerless overnight. With mostly bonds, it's a very safe bet, well safer than stocks anyway. You wouldn't get very high dividends, but risk is significantly lower. Don't get me wrong. Bonds are not completely safe. Knives rust, and pistols have limited ammunition.

"If you want higher returns, you have to be prepared for a higher level of risk."

What do I mean? I'm sure many teenagers are familiar with ASOS. An online fashion retailer.

Back in the past, it was a young company. If you had invested in them then, chances are the share value would be significantly higher now. Young companies bring high chance of returns with a high level of risk as well. If something goes wrong, your investment goes down the drain. Are you prepared for that level of risk?

Diversification is key here. You want a mix of shares in your portfolio. The theory is, don't have all your eggs in one basket. Don't put all your money into a single share.

Imagine that you have $1000 each into 3 shares from Company X, Y and Z for a total of $3000.

Another investor invested $3000 in Company X alone.

Company X pays out dividends of $0.10 or a total of $100 for 1 board lot. You would receive $100.

Investor would receive $300.

Good? But let's say Company X fails and declares bankruptcy. Your $1000 is lost. But Company Y and Z is doing well. You minimised your loss. Investor has been completely wiped out. I hope this scenario helps to explain better.

For Part 3 and the final part of this mini trilogy, I would be touching more on tips on how to choose your first share. Also, what questions should you ask of yourself before making any investment? Lastly, I would be trying to identify common mistakes made.

See you soon :)

Signing off,

Teenage Investor

Posts you may be interested in:

1. Rebalancing & Managing your Portfolio

2. The First Step is Always the Hardest

3. Journey of a Budding Investor

4. The Post for All Investors

5. How to Invest in Shares [Part 1]

- Building The Ideal Portfolio

If you're reading this article, chances are that you are interested in building your own investment portfolio but you have no idea how to begin. Well I'm attempting to assist you in that direction as far as I possibly can. When people are trying...

- How To Invest In Shares [part 3]

In the previous two posts, I've talked about the first steps. I've also mentioned about the dividends and various returns and risk of various forms of investments! Today I would be focusing more on the last few things to take note! Let's say...

- Having Too Much Expectations On Your Dividends

So just today, I've received an email from a reader i shall refer to as Reader A. He asked and I quote: Hi TI! Good blog! I enjoy reading it. However I have one question, I have also been investing in the ABF SG Bond and am looking forward to the...

- Rebalancing & Managing Your Portfolio

Rebalancing is a basic part of every investor's journey. The process of buying ETFs, then subsequently adding to them is only one part of investing. I've come to realise that rebalancing is an important concept which I must learn. For example,...

- Index Investing In The Singapore Stock Market, What Do I Buy?

Passive Investment Strategy to Index Investing When it comes to investing, most people are searching the web or mindlessly reading through blogpost after blogpost on a hundred different blogs in an attempt to search for the 1 Valuable Thing. The Best...

Money and Finance

How To Invest in Shares [Part 2]

Hi, welcome to Part 2 of How to Invest In Shares :)

Hopefully, Part 1 was relatively beneficial with around 200+ views so far.

Well, today I would be touching more on the returns of Investing!

Why do we want to invest in shares? Because historically, most of them offer better chances of returns compared to if you were to park your money into your savings account. Why? Because it comes with a level of risk not commonly associated with a savings account.

By investing in any company, you are entitled to receive dividends which can be considered as the company's profits. When the company does well, they pay out higher dividends. Shares pay a higher amount of dividends compared to bonds. Note that some companies do not pay dividends! Eg: Berkshire (Credits to La Papillion)

Think of shares & bonds as your weapons in your journey. Shares are the high powered rifles, machine guns and so on. They are the highlight of your arsenal. With them, you can easily get a higher success rate because of the enormous firepower. Bonds however, are the complete opposite. Visualize them as your handguns, pistols, knives and so on. If your firepower from the shares take a huge hit, it wouldn't be a complete loss. You can still defend yourself with your pistols and knives.

That's why most investors and advisors usually recommend a mix of both in your portfolio.

Imagine a scenario with mostly shares. You would get higher dividends. But one major hit in the market, would leave you powerless overnight. With mostly bonds, it's a very safe bet, well safer than stocks anyway. You wouldn't get very high dividends, but risk is significantly lower. Don't get me wrong. Bonds are not completely safe. Knives rust, and pistols have limited ammunition.

"If you want higher returns, you have to be prepared for a higher level of risk."

What do I mean? I'm sure many teenagers are familiar with ASOS. An online fashion retailer.

Back in the past, it was a young company. If you had invested in them then, chances are the share value would be significantly higher now. Young companies bring high chance of returns with a high level of risk as well. If something goes wrong, your investment goes down the drain. Are you prepared for that level of risk?

Diversification is key here. You want a mix of shares in your portfolio. The theory is, don't have all your eggs in one basket. Don't put all your money into a single share.

Imagine that you have $1000 each into 3 shares from Company X, Y and Z for a total of $3000.

Another investor invested $3000 in Company X alone.

Company X pays out dividends of $0.10 or a total of $100 for 1 board lot. You would receive $100.

Investor would receive $300.

Good? But let's say Company X fails and declares bankruptcy. Your $1000 is lost. But Company Y and Z is doing well. You minimised your loss. Investor has been completely wiped out. I hope this scenario helps to explain better.

For Part 3 and the final part of this mini trilogy, I would be touching more on tips on how to choose your first share. Also, what questions should you ask of yourself before making any investment? Lastly, I would be trying to identify common mistakes made.

See you soon :)

Signing off,

Teenage Investor

Posts you may be interested in:

1. Rebalancing & Managing your Portfolio

2. The First Step is Always the Hardest

3. Journey of a Budding Investor

4. The Post for All Investors

5. How to Invest in Shares [Part 1]

- Building The Ideal Portfolio

If you're reading this article, chances are that you are interested in building your own investment portfolio but you have no idea how to begin. Well I'm attempting to assist you in that direction as far as I possibly can. When people are trying...

- How To Invest In Shares [part 3]

In the previous two posts, I've talked about the first steps. I've also mentioned about the dividends and various returns and risk of various forms of investments! Today I would be focusing more on the last few things to take note! Let's say...

- Having Too Much Expectations On Your Dividends

So just today, I've received an email from a reader i shall refer to as Reader A. He asked and I quote: Hi TI! Good blog! I enjoy reading it. However I have one question, I have also been investing in the ABF SG Bond and am looking forward to the...

- Rebalancing & Managing Your Portfolio

Rebalancing is a basic part of every investor's journey. The process of buying ETFs, then subsequently adding to them is only one part of investing. I've come to realise that rebalancing is an important concept which I must learn. For example,...

- Index Investing In The Singapore Stock Market, What Do I Buy?

Passive Investment Strategy to Index Investing When it comes to investing, most people are searching the web or mindlessly reading through blogpost after blogpost on a hundred different blogs in an attempt to search for the 1 Valuable Thing. The Best...