Money and Finance

If you're reading this article, chances are that you are interested in building your own investment portfolio but you have no idea how to begin.

Well I'm attempting to assist you in that direction as far as I possibly can.

When people are trying to build their own portfolio, Asset Allocation is probably the number one thing in mind.

You read many financial blogs, books etc. You could have heard the age old maxim,

- Data Mining The Ccc List: Wrap Up

Company and sector allocation shouldn't be a concern for investors that are just starting out on their investment journey. However, once a portfolio reaches six figures I think allocation needs to start coming into play. Sector allocation shouldn't...

- What's Your Weight?

No I'm not asking you to divulge your body weight, although if that will help you with any weight loss goals you have feel free to do so. The weight I'm referring to has to do with your portfolio. I think we all understand the importance of...

- Wmd Portfolio

For tracking purposes, I am launching the WMD Portfolio - a journey in search of Wide Moat Dividends. This is an idea tracking portfolio, rather than just tracking ideas as tickers its more interesting to simulate the process to see weight and growth...

- How To Invest In Shares [part 2]

Hi, welcome to Part 2 of How to Invest In Shares :) Hopefully, Part 1 was relatively beneficial with around 200+ views so far. Well, today I would be touching more on the returns of Investing! Why do we want to invest in shares? Because historically,...

- Index Investing In The Singapore Stock Market, What Do I Buy?

Passive Investment Strategy to Index Investing When it comes to investing, most people are searching the web or mindlessly reading through blogpost after blogpost on a hundred different blogs in an attempt to search for the 1 Valuable Thing. The Best...

Money and Finance

Building The Ideal Portfolio

If you're reading this article, chances are that you are interested in building your own investment portfolio but you have no idea how to begin.

Well I'm attempting to assist you in that direction as far as I possibly can.

When people are trying to build their own portfolio, Asset Allocation is probably the number one thing in mind.

"Don't Put All Your Eggs in One Basket."

Why? Investments, any kind of investments carries risk. So it's better to spread your money around in various assets. So, if one investment fails or performs poorly, you don't damage your overall returns / investments. When you spread your money around, it's a form of diversification.

So we come to the second essential part of an ideal portfolio.

"Diversification"

Assets like ETFs, Bonds, Domestic and International Equities and cash should be a part of your portfolio. Higher returns ; Taking more risks. Being cautious? Having more bonds/cash etc would be a good idea.

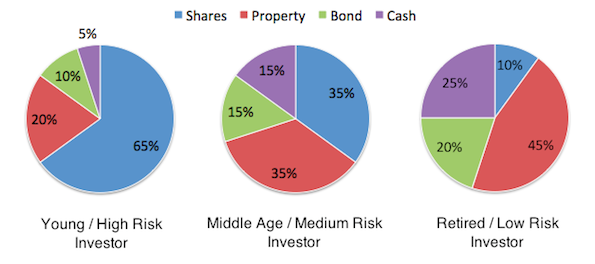

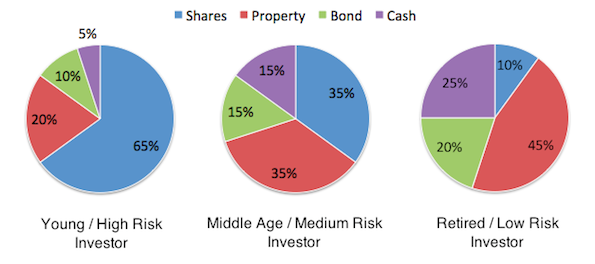

The way you allocate your assets will change over time as your needs changes. When you're young, your portfolio may have more stocks and equities. During retirement, your portfolio may have more bonds.

There are usually 3 different types of strategies.

1. High Risk.

You're willing to take on more risks for growth potential.

2. Balanced.

You're a mix of bold and cautious. You can't afford a huge setback.

3. Cautious

You like it safe. You're not willing to take high risks.

Limit your exposure to certain industries. Maybe you have too many shares in the oil industry. Or technology. One major change in the industry may leave you badly wounded.

It also depends on your goals. Dividend Stocks are a boost for investors who wish for good dividend yield.

Rebalancing is also important to achieve maximal returns.

See: http://teenageinvesting.blogspot.sg/2014/10/rebalancing-managing-your-portfolio.html

Signing off,

Teenage Investor

- Data Mining The Ccc List: Wrap Up

Company and sector allocation shouldn't be a concern for investors that are just starting out on their investment journey. However, once a portfolio reaches six figures I think allocation needs to start coming into play. Sector allocation shouldn't...

- What's Your Weight?

No I'm not asking you to divulge your body weight, although if that will help you with any weight loss goals you have feel free to do so. The weight I'm referring to has to do with your portfolio. I think we all understand the importance of...

- Wmd Portfolio

For tracking purposes, I am launching the WMD Portfolio - a journey in search of Wide Moat Dividends. This is an idea tracking portfolio, rather than just tracking ideas as tickers its more interesting to simulate the process to see weight and growth...

- How To Invest In Shares [part 2]

Hi, welcome to Part 2 of How to Invest In Shares :) Hopefully, Part 1 was relatively beneficial with around 200+ views so far. Well, today I would be touching more on the returns of Investing! Why do we want to invest in shares? Because historically,...

- Index Investing In The Singapore Stock Market, What Do I Buy?

Passive Investment Strategy to Index Investing When it comes to investing, most people are searching the web or mindlessly reading through blogpost after blogpost on a hundred different blogs in an attempt to search for the 1 Valuable Thing. The Best...