Money and Finance

I received another email from a reader named Peishi. It goes as follows.

Hey there! :)

I am turning 17 in 2015.

Would you advise starters like me to save up for 1 lot of Nikko AM, or STI ETF for passive investment?

Also, I read off from your blog that you invested without your parent's knowledge, how did you do it?

Cheeers!

Hi Peishi! 17 is a very young age, but I'm happy that you are already ahead of your peers in terms of mental maturity.

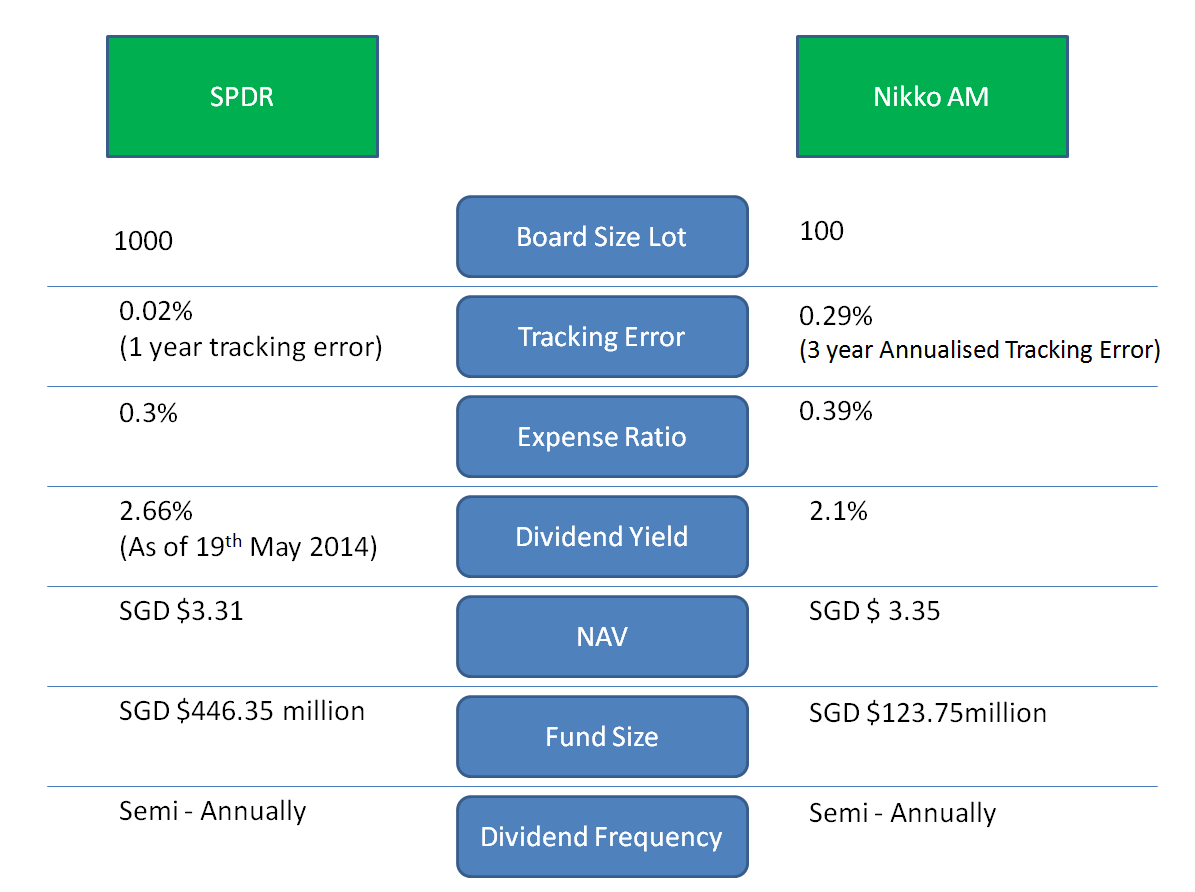

Nikko AM and STI ETF both track the Straits Times Index and aim to track it with minimal error.

While both may be similar in many ways, what makes them different is the total purchase price you would pay to purchase 1 lot. As of today, 1 board lot of SPDR contains 1000 shares while 1 board lot of Nikko AM contains 100 shares. This would mean a vast price difference.

Assuming 1 share of each ETF costs $3,

1 lot of SPDR would cost $3,000 while 1 lot Nikko AM would cost $300.

SPDR has a lower tracking error and expense ratio and has been around longer than Nikko AM has. But because of the price, you may want to consider purchasing Nikko AM first.

Since you're 17, you're not yet of legal age to open a brokerage account which I believe requires at least 21 years of age.

So since you have 3-4 years to start saving, when you reach 21 you may already have enough money to purchase 1 lot :)

Moving onto investing without my Parent's knowledge, I simply didn't mention it. When you're of legal age, opening a brokerage account does not require parental consent.

Of course, if your parents approve and some parents do of course. Many experienced financial bloggers are parents who are knowledgeable about the subject and will probably impart their knowledge to their children in the future.

If not, some may choose simply not to mention it now but do so in the future.

Let me know how it goes. :)

Signing off,

Teenage Investor

- How To Invest In Shares [part 1]

I've received a few emails from different readers of my blog. One thing I noticed about was a very common question. "How do I invest in Shares?" Well, I shall try to explain in a way that's as easy to understand as possible over the space of a...

- The Reductions In Board Lot. What It Means And Should It Affect You?

I'm sure many people are aware by now of this date. 19 January 2015. Singapore Exchange (SGX) will reduce the standard board lot size of securities listed on SGX from 1,000 to 100 units from 19 January 2015. A smaller board lot size will make it...

- My Investment Journey Update: September 2014 ; Survived Comex 2014!

So it's the 1st of September! Thankfully, I survived the past 4 days of Comex 2014. The income + the very VERY small commission will be very useful for my investments this month. Anyway, as I logged into my POSB eSavings Account today to check on...

- The Beginning Of Your Teenage Investing Journey

I was planning for my next post to be about the CPF, especially as the increase in Minimum Sum has now been increased. I am not particularly worried about it, because as far as knowledge brings me, if I take the necessary steps, CPF will work out just...

- Saving During Your Growing Years

Everyone wants to be rich, don't they? This is especially true in Singapore, where the gap between the upper and middle class are increasingly widening and the costs of living are absurdly high. Everyone wants money. Some are content with having enough,...

Money and Finance

Investing without your Parent's knowledge?

I received another email from a reader named Peishi. It goes as follows.

Hey there! :)

I am turning 17 in 2015.

Would you advise starters like me to save up for 1 lot of Nikko AM, or STI ETF for passive investment?

Also, I read off from your blog that you invested without your parent's knowledge, how did you do it?

Cheeers!

Hi Peishi! 17 is a very young age, but I'm happy that you are already ahead of your peers in terms of mental maturity.

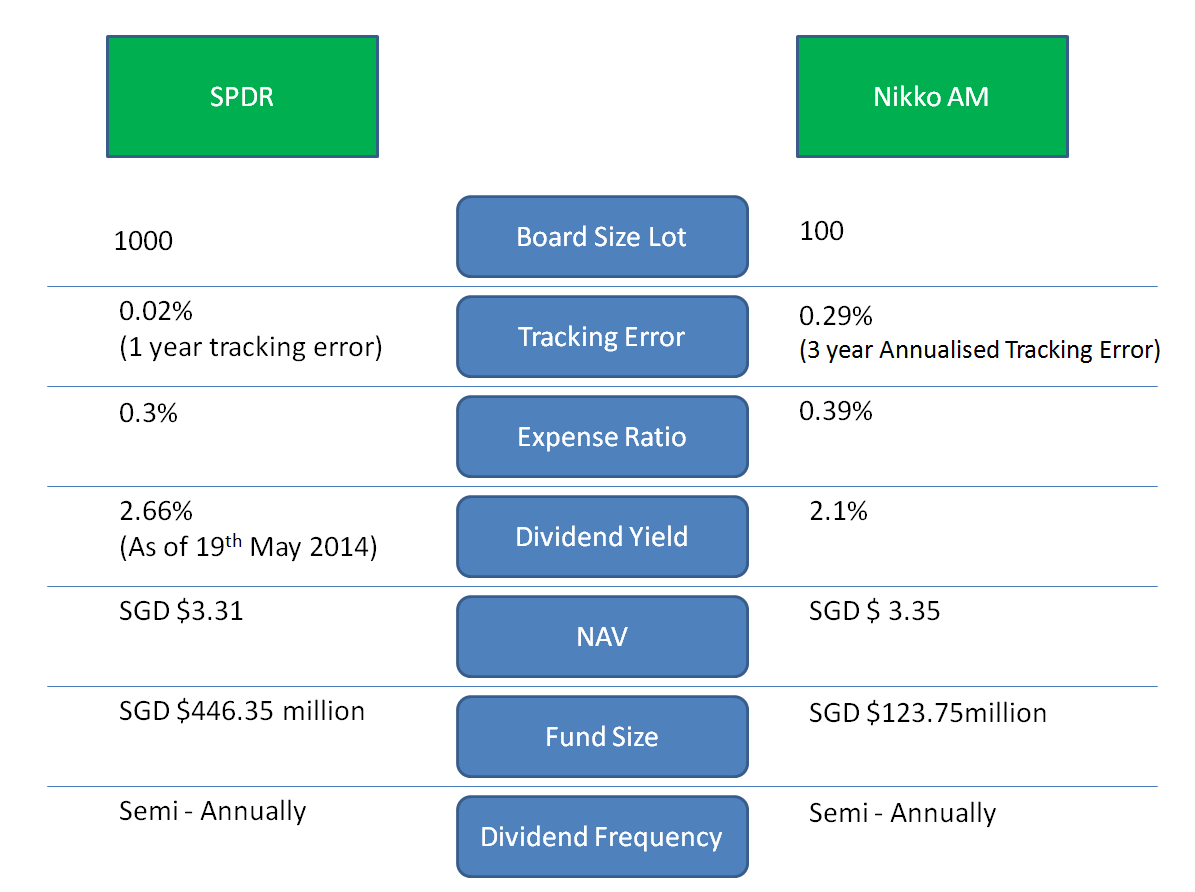

Nikko AM and STI ETF both track the Straits Times Index and aim to track it with minimal error.

Source: http://thefinance.sg/2014/05/21/nikko-am-sti-etf-v-s-spdr-sti-etf/

While both may be similar in many ways, what makes them different is the total purchase price you would pay to purchase 1 lot. As of today, 1 board lot of SPDR contains 1000 shares while 1 board lot of Nikko AM contains 100 shares. This would mean a vast price difference.

Assuming 1 share of each ETF costs $3,

1 lot of SPDR would cost $3,000 while 1 lot Nikko AM would cost $300.

SPDR has a lower tracking error and expense ratio and has been around longer than Nikko AM has. But because of the price, you may want to consider purchasing Nikko AM first.

Since you're 17, you're not yet of legal age to open a brokerage account which I believe requires at least 21 years of age.

So since you have 3-4 years to start saving, when you reach 21 you may already have enough money to purchase 1 lot :)

Moving onto investing without my Parent's knowledge, I simply didn't mention it. When you're of legal age, opening a brokerage account does not require parental consent.

Of course, if your parents approve and some parents do of course. Many experienced financial bloggers are parents who are knowledgeable about the subject and will probably impart their knowledge to their children in the future.

If not, some may choose simply not to mention it now but do so in the future.

Let me know how it goes. :)

Signing off,

Teenage Investor

- How To Invest In Shares [part 1]

I've received a few emails from different readers of my blog. One thing I noticed about was a very common question. "How do I invest in Shares?" Well, I shall try to explain in a way that's as easy to understand as possible over the space of a...

- The Reductions In Board Lot. What It Means And Should It Affect You?

I'm sure many people are aware by now of this date. 19 January 2015. Singapore Exchange (SGX) will reduce the standard board lot size of securities listed on SGX from 1,000 to 100 units from 19 January 2015. A smaller board lot size will make it...

- My Investment Journey Update: September 2014 ; Survived Comex 2014!

So it's the 1st of September! Thankfully, I survived the past 4 days of Comex 2014. The income + the very VERY small commission will be very useful for my investments this month. Anyway, as I logged into my POSB eSavings Account today to check on...

- The Beginning Of Your Teenage Investing Journey

I was planning for my next post to be about the CPF, especially as the increase in Minimum Sum has now been increased. I am not particularly worried about it, because as far as knowledge brings me, if I take the necessary steps, CPF will work out just...

- Saving During Your Growing Years

Everyone wants to be rich, don't they? This is especially true in Singapore, where the gap between the upper and middle class are increasingly widening and the costs of living are absurdly high. Everyone wants money. Some are content with having enough,...