Money and Finance

I was planning for my next post to be about the CPF, especially as the increase in Minimum Sum has now been increased. I am not particularly worried about it, because as far as knowledge brings me, if I take the necessary steps, CPF will work out just fine for me.

What I am posting about today however, is going to be a summary of how I began my journey into Investing and how you can begin yours too.

Why did I invest? Because I'm interested in planning early for my future. And I'd rather give a chance for my money to grow for me with the risk than letting it sit in the bank and earn 0.05% interest. As time passes and inflation increases, the same 5k you may have in the bank is going to be worth less. What do I mean? Maybe with this 5k, you can buy 1000 $5 meals. When inflation hits again, the meal now costs $6. Similarly, you still have 5k. But this time it can only buy you 833 meals. That's 167 meals lost by inflation.

Now, before you plunge into the world of Investments and Stock Markets, know this. It requires a necessary amount of financial knowledge. I'm not saying you have to be taking a Diploma in Finance or studying Finance related courses. Heck, I'm from a Hospitality and Tourism Management Course and Accounting has always been my worse subject. What I'm saying is, you need to be comfortable with simple calculations and numbers.

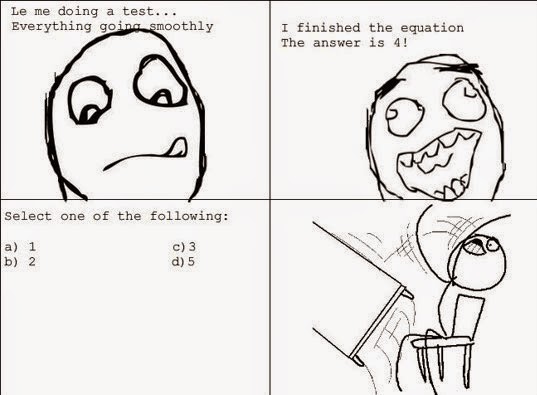

Let me ask you this, when you're learning a new skill (E.g Cycling, Rollerblading or Skiing), do you take your time to learn the basics and hone your techniques slowly or do you simply hurl yourself down the icy slope and hope for the best?

Investing is the same. You don't simply purchase a few stocks and try to imitate the "Buy Low, Sell High" concept because I can tell you unless you're incredibly lucky, you're only going to look like a fool, or worse hurt yourself in the process.

When I first began my journey into Investing, I was totally lost. It took time. I browsed hundreds of websites and each website encouraged a different thing. Heck, even the government websites was chock full of information that didn't make sense to a potential investor.

Imagine a Business student given several Engineering books to study and then ask him to sit for a Business exam.

To be honest, the financial education in Singapore is largely limited to those who plan to choose Finance as their major or interest of study.

What about the rest of us? We have to seek the information ourselves and make an effort to sieve through the countless information until you find the ones that make sense. Or make SOME sense at least. If you truly want to learn how, be prepared to invest first and foremost; TIME.

Now, after reading up till here, how do you feel? You have 2 steps from here.

1. Close this page, exit this blog. You'll figure this out another time. Or maybe never.

2. You made the decision and now you want to know how to begin your own journey.

From here onwards, what I will be talking about is based on my own experiences and my own knowledge gained from doing research.

Firstly, know what kind of Investor you're going to be. What do I mean by that?

1. Know the amount of risk you're willing to take. This depends largely on your age. If you're young, you can afford to take slightly higher risks as you have time to ride out the fluctuations in your investments. If you're older, chances are you won't want to lose your entire retirement savings if something goes wrong.

2. Your Investment Horizon

What are you investing for and how long are you planning to invest? Again, if you're 21 and you're investing for retirement it means you have a long horizon. Otherwise, if you're planning to invest for only the next few years, pick less risky assets.

3. What do you plan to invest in?

Do you plan to invest all your money in a single stock? Or do you plan to invest in several? As you sift through the various financial blogs one thing always appear. Diversification. Diversify. To cut a long story short, your portfolio should contain a mixture of assets. Example would be to have both stocks AND bonds. Should your stocks do badly, your bonds will help to stabilise. Even among your stocks, you need to diversify. There are so many companies out there and so many different type of shares.

4. Your Investment style

Do you

1) Plan to invest a fixed sum of money every month on every year? Or

2) Plan to buy your stocks at a price, and sell it for a profit when the market becomes favourable?

That's called 1) Dollar Cost Averaging & 2) Market Timing.

There are many styles and strategies that financial analysts use to time the market. Chances are, you won't be that free. Neither would I. We are teenagers, young adults at the most. We have our studies, our social life, our families and friends to tend to. Worse still guys, WE HAVE NS.

We simply won't have the time to sit by a computer and monitor the stock market every single day. Heck I'll go crazy first before I ever make a sale.

The thing is, you're here because you want to learn how to invest and prepare for your future WITHOUT sacrificing your time with your loved ones. How do you do that?

Welcome to the world of Index Investing. Quite honestly, nobody taught me about what this is. I stumbled upon this word one day, and did further research to figure out what it was. I'm not saying it does not have risks, I'm saying it's a hell lot better than sitting in front of the monitor day in day out.

By Index Investing, we are doing "Passive Investing". It means we invest maybe once a month, or if you prefer once every 4 months, 6 months, once a year if you wish.

The best way to diversify your portfolio is to invest in a fund that consists of different stocks. And in Singapore, the most common fund to invest in would be the STI ETF (Straits Times Index). It tracks the top 30 companies in Singapore, including several major banks, Singapore Airlines, Singapore Press Holdings, Starhub and many more.

So, by investing in an index fund, you'd essentially be investing into 30 different companies. How's that for diversification? *smirks*

Hold your horses, I'm not done yet. Believe me, I was as eager as some of you may be, and ready to immediately break my piggy bank and begin my investments. Oh how sadly mistaken I was...

Knowing which fund you will invest in is not the end. How are you going to buy it? It's not as simple as going to NTUC Fairprice or Giant Hypermarket and simply picking the stocks off the shelves. No it's a little more complicated than that.

And when you know how to buy it, then what? Did you know that there are 2 ETFs tracking the same Straits Times Index?

Yes! They are *drum rolls*

1) SPDR Straits Times Index ETF (SGX:ES3)

2) Nikko AM Singapore STI ETF (SGX:G3B)

What are the current prices of the shares? Well at the moment of this blogpost, SPDR costs $3.34/share and Nikko AM costs $3.39/share.

WOOHOO LET'S GO SHOPPING NOW. HERE'S A $100 GET 25 shares for me please!

Sorry, can't do that..

What? Why? Well, Singapore has this nasty little inconvenient law that dictates that shares must be sold in a board lot. That means the shares are sold in a set of 1000. Or 100. It depends on invididual ETFs. SPDR is sold in 1000 shares and Nikko AM is sold in 100 shares/lot. That means your SPDR would cost $3340 at the very least to purchase and Nikko AM would cost you $339.

Yeah, it's absolutely annoying. But there are ways of purchasing stocks nevertheless, but that will be another blogpost where I will share the ways you can purchase your first stock with just $100/month. Meanwhile, start saving. The best estimate to begin would be to have a fund of AT LEAST SGD$1000. All the best.

Got a question? Or perhaps you feel my information is incorrect? Email me :) Always willing to learn more.

Signing off,

Teenage Investor

Twitter: Teenageinvestor

- Investments, Money + Teenage Investor's Q & A

Hello, recently I received emails from new readers of my blog after my post was shared on Facebook. Honestly, I was quite shocked and a little gratified that readers found my blog post interesting and relatable enough to share on their Facebook page....

- How To Invest In The Stock Market With Just $100 Every Month?

As passive investors, many of us including myself invest regularly on a monthly basis. Additionally, some of us are investing for long term goals that includes retirement. However, how much can most of us afford to invest every month? The numbers may...

- How To Invest In Shares [part 1]

I've received a few emails from different readers of my blog. One thing I noticed about was a very common question. "How do I invest in Shares?" Well, I shall try to explain in a way that's as easy to understand as possible over the space of a...

- The Reductions In Board Lot. What It Means And Should It Affect You?

I'm sure many people are aware by now of this date. 19 January 2015. Singapore Exchange (SGX) will reduce the standard board lot size of securities listed on SGX from 1,000 to 100 units from 19 January 2015. A smaller board lot size will make it...

- Investing In Actively Managed Funds

I've been reading a couple of Finance blogs mostly by Singaporeans, and I noticed that one of them (name shall not be mentioned) has chosen to invest with OCBC Blue Chip Investment Plan (BCIP) I did also talk about OCBC BCIP on a previous blogpost, http://teenageinvesting.blogspot.sg/2014/08/the-beginning-of-your-investment.html...

Money and Finance

The Beginning of YOUR Teenage Investing Journey

I was planning for my next post to be about the CPF, especially as the increase in Minimum Sum has now been increased. I am not particularly worried about it, because as far as knowledge brings me, if I take the necessary steps, CPF will work out just fine for me.

What I am posting about today however, is going to be a summary of how I began my journey into Investing and how you can begin yours too.

Why did I invest? Because I'm interested in planning early for my future. And I'd rather give a chance for my money to grow for me with the risk than letting it sit in the bank and earn 0.05% interest. As time passes and inflation increases, the same 5k you may have in the bank is going to be worth less. What do I mean? Maybe with this 5k, you can buy 1000 $5 meals. When inflation hits again, the meal now costs $6. Similarly, you still have 5k. But this time it can only buy you 833 meals. That's 167 meals lost by inflation.

Now, before you plunge into the world of Investments and Stock Markets, know this. It requires a necessary amount of financial knowledge. I'm not saying you have to be taking a Diploma in Finance or studying Finance related courses. Heck, I'm from a Hospitality and Tourism Management Course and Accounting has always been my worse subject. What I'm saying is, you need to be comfortable with simple calculations and numbers.

Let me ask you this, when you're learning a new skill (E.g Cycling, Rollerblading or Skiing), do you take your time to learn the basics and hone your techniques slowly or do you simply hurl yourself down the icy slope and hope for the best?

See? He's not rushing. Neither should you.

Investing is the same. You don't simply purchase a few stocks and try to imitate the "Buy Low, Sell High" concept because I can tell you unless you're incredibly lucky, you're only going to look like a fool, or worse hurt yourself in the process.

When I first began my journey into Investing, I was totally lost. It took time. I browsed hundreds of websites and each website encouraged a different thing. Heck, even the government websites was chock full of information that didn't make sense to a potential investor.

Imagine a Business student given several Engineering books to study and then ask him to sit for a Business exam.

He may get lucky the first few questions, but chances are he would fail the exam.

To be honest, the financial education in Singapore is largely limited to those who plan to choose Finance as their major or interest of study.

What about the rest of us? We have to seek the information ourselves and make an effort to sieve through the countless information until you find the ones that make sense. Or make SOME sense at least. If you truly want to learn how, be prepared to invest first and foremost; TIME.

Now, after reading up till here, how do you feel? You have 2 steps from here.

1. Close this page, exit this blog. You'll figure this out another time. Or maybe never.

2. You made the decision and now you want to know how to begin your own journey.

From here onwards, what I will be talking about is based on my own experiences and my own knowledge gained from doing research.

Firstly, know what kind of Investor you're going to be. What do I mean by that?

1. Know the amount of risk you're willing to take. This depends largely on your age. If you're young, you can afford to take slightly higher risks as you have time to ride out the fluctuations in your investments. If you're older, chances are you won't want to lose your entire retirement savings if something goes wrong.

2. Your Investment Horizon

What are you investing for and how long are you planning to invest? Again, if you're 21 and you're investing for retirement it means you have a long horizon. Otherwise, if you're planning to invest for only the next few years, pick less risky assets.

3. What do you plan to invest in?

Do you plan to invest all your money in a single stock? Or do you plan to invest in several? As you sift through the various financial blogs one thing always appear. Diversification. Diversify. To cut a long story short, your portfolio should contain a mixture of assets. Example would be to have both stocks AND bonds. Should your stocks do badly, your bonds will help to stabilise. Even among your stocks, you need to diversify. There are so many companies out there and so many different type of shares.

4. Your Investment style

Do you

1) Plan to invest a fixed sum of money every month on every year? Or

2) Plan to buy your stocks at a price, and sell it for a profit when the market becomes favourable?

That's called 1) Dollar Cost Averaging & 2) Market Timing.

There are many styles and strategies that financial analysts use to time the market. Chances are, you won't be that free. Neither would I. We are teenagers, young adults at the most. We have our studies, our social life, our families and friends to tend to. Worse still guys, WE HAVE NS.

We simply won't have the time to sit by a computer and monitor the stock market every single day. Heck I'll go crazy first before I ever make a sale.

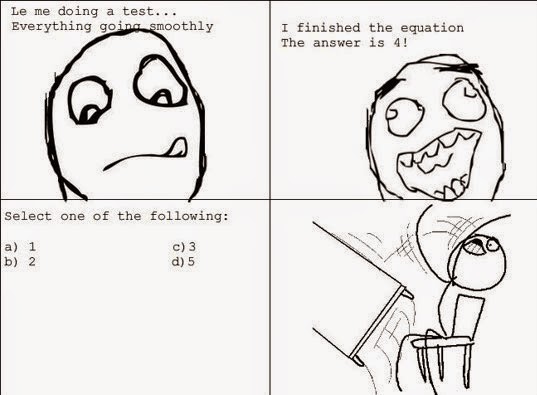

The thing is, you're here because you want to learn how to invest and prepare for your future WITHOUT sacrificing your time with your loved ones. How do you do that?

Welcome to the world of Index Investing. Quite honestly, nobody taught me about what this is. I stumbled upon this word one day, and did further research to figure out what it was. I'm not saying it does not have risks, I'm saying it's a hell lot better than sitting in front of the monitor day in day out.

Ain't nobody got the time for that!

By Index Investing, we are doing "Passive Investing". It means we invest maybe once a month, or if you prefer once every 4 months, 6 months, once a year if you wish.

The best way to diversify your portfolio is to invest in a fund that consists of different stocks. And in Singapore, the most common fund to invest in would be the STI ETF (Straits Times Index). It tracks the top 30 companies in Singapore, including several major banks, Singapore Airlines, Singapore Press Holdings, Starhub and many more.

What is an ETF (Exchange Traded Fund) ?

Exchange traded funds (ETFs) are open-ended investment funds listed and traded on a stock exchange. Your money is pooled with money from other investors and invested according to the ETF’s stated investment objective.

An ETF’s objective is to produce a return that tracks or replicates a specific index such as a stock or commodity index. ETFs are passively managed by ETF managers and do not try to outperform the underlying index. Hence, ETFs have fees and charges that are usually lower than those of actively managed investment funds.

ETFs may have complex structures. They may be structured as cash-based ETFs or as synthetic ETFs, which involve the use of derivatives.

(http://www.moneysense.gov.sg/Understanding-Financial-Products/Investments/Types-of-Investments/Exchange-Traded-Funds.aspx)

Now, WHY Invest in ETF?

Or the question should be why invest in an index fund? The reason is an index fund offers a good diversification of stocks. For example, the STI (Straits Times Index) is comprised of the 30 largest companies listed in the Singapore stock market. If you invest in an index fund, you do not have to pick stocks individually. The best thing is component stocks in an index are changed periodically. Bad companies are removed and replaced with another company. Indices all over the world have been rising for the past 50 years. An exceptional case is Japan which has seen its Nikkei index fall in the past 10 years. Japan has been in a deflationary economy which is a reason for its sluggish economy and stock market. Elsewhere in the world, we’re still seeing growth in the past 10 years.

(http://www.imoney.sg/articles/low-cost-index-fund-investing-passive-investing-guest-post/)

So, by investing in an index fund, you'd essentially be investing into 30 different companies. How's that for diversification? *smirks*

Hold your horses, I'm not done yet. Believe me, I was as eager as some of you may be, and ready to immediately break my piggy bank and begin my investments. Oh how sadly mistaken I was...

Knowing which fund you will invest in is not the end. How are you going to buy it? It's not as simple as going to NTUC Fairprice or Giant Hypermarket and simply picking the stocks off the shelves. No it's a little more complicated than that.

And when you know how to buy it, then what? Did you know that there are 2 ETFs tracking the same Straits Times Index?

Yes! They are *drum rolls*

1) SPDR Straits Times Index ETF (SGX:ES3)

2) Nikko AM Singapore STI ETF (SGX:G3B)

What are the current prices of the shares? Well at the moment of this blogpost, SPDR costs $3.34/share and Nikko AM costs $3.39/share.

WOOHOO LET'S GO SHOPPING NOW. HERE'S A $100 GET 25 shares for me please!

Sorry, can't do that..

What? Why? Well, Singapore has this nasty little inconvenient law that dictates that shares must be sold in a board lot. That means the shares are sold in a set of 1000. Or 100. It depends on invididual ETFs. SPDR is sold in 1000 shares and Nikko AM is sold in 100 shares/lot. That means your SPDR would cost $3340 at the very least to purchase and Nikko AM would cost you $339.

Yeah, it's absolutely annoying. But there are ways of purchasing stocks nevertheless, but that will be another blogpost where I will share the ways you can purchase your first stock with just $100/month. Meanwhile, start saving. The best estimate to begin would be to have a fund of AT LEAST SGD$1000. All the best.

Got a question? Or perhaps you feel my information is incorrect? Email me :) Always willing to learn more.

Signing off,

Teenage Investor

Twitter: Teenageinvestor

- Investments, Money + Teenage Investor's Q & A

Hello, recently I received emails from new readers of my blog after my post was shared on Facebook. Honestly, I was quite shocked and a little gratified that readers found my blog post interesting and relatable enough to share on their Facebook page....

- How To Invest In The Stock Market With Just $100 Every Month?

As passive investors, many of us including myself invest regularly on a monthly basis. Additionally, some of us are investing for long term goals that includes retirement. However, how much can most of us afford to invest every month? The numbers may...

- How To Invest In Shares [part 1]

I've received a few emails from different readers of my blog. One thing I noticed about was a very common question. "How do I invest in Shares?" Well, I shall try to explain in a way that's as easy to understand as possible over the space of a...

- The Reductions In Board Lot. What It Means And Should It Affect You?

I'm sure many people are aware by now of this date. 19 January 2015. Singapore Exchange (SGX) will reduce the standard board lot size of securities listed on SGX from 1,000 to 100 units from 19 January 2015. A smaller board lot size will make it...

- Investing In Actively Managed Funds

I've been reading a couple of Finance blogs mostly by Singaporeans, and I noticed that one of them (name shall not be mentioned) has chosen to invest with OCBC Blue Chip Investment Plan (BCIP) I did also talk about OCBC BCIP on a previous blogpost, http://teenageinvesting.blogspot.sg/2014/08/the-beginning-of-your-investment.html...