Money and Finance

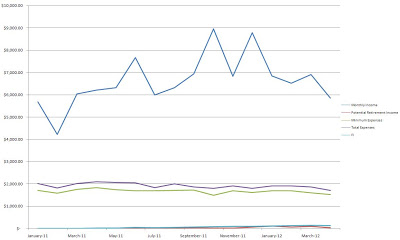

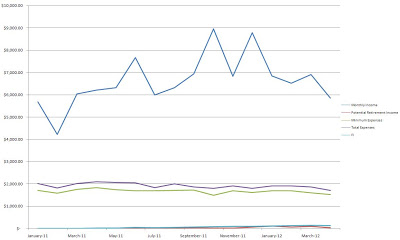

May was right in line with April as far as spending. My minimum expenses and total expenses were pretty much even over the month which is good since they didn't go up but I didn't make a lot of progress on lowering them more. My minimum expenses were $1,549.48 which includes costs related to rent, utilities, car, all food expenses, phone and minimum debt service payments. My total expenses did actually improve slightly over April by almost $30 but I consider that just noise and not anything related to actions I took to lower them. My potential retirement income for the month totaled $34.70 and my FI changed to $109.51. Most of the decrease in my FI was due to the 30 year treasury rate falling throughout May. My PRI would replace 2.24% of my minimum expenses in May and the FI would cover 7.07%.

Read more »

- Income Update - February 2013

February was a great month. I had a higher than normal income and put the difference to straight to savings. I did a pretty good job with controlling expenses for the month. Restaurants and groceries both overshot their budget, but by a combined $14 so...

- Income Update - January 2013

January was a truly awesome month. I ended up bringing home over $2,200 more than my average for 2012 and the best part is that all went straight to savings. I only overshot one category by a lot but that'll start getting in check beginning with...

- Income Update - November 2012

November's income was higher than my average so far for the year which is great because I'm still able tor reduce my expenses so every extra dollar of income gets to be converted into savings mainly dividend growth investing capital. Not only...

- Income Update - September 2012

September was an okay month for my spending. I let my expenses creep up higher than where I would like but I was still lower than my average for the year so far. My minimum expenses for September ended the month at $1,422.25. This brought my average...

- Income Update - July 2012

July was a pretty good month for my spending. My income was up higher than normal again which is great because it just adds to my savings amount. My minimum expenses for July went back up due to me forgetting that I'm paying my wife for things a month...

Money and Finance

Income Update - May 2012

May was right in line with April as far as spending. My minimum expenses and total expenses were pretty much even over the month which is good since they didn't go up but I didn't make a lot of progress on lowering them more. My minimum expenses were $1,549.48 which includes costs related to rent, utilities, car, all food expenses, phone and minimum debt service payments. My total expenses did actually improve slightly over April by almost $30 but I consider that just noise and not anything related to actions I took to lower them. My potential retirement income for the month totaled $34.70 and my FI changed to $109.51. Most of the decrease in my FI was due to the 30 year treasury rate falling throughout May. My PRI would replace 2.24% of my minimum expenses in May and the FI would cover 7.07%.

Read more »

- Income Update - February 2013

February was a great month. I had a higher than normal income and put the difference to straight to savings. I did a pretty good job with controlling expenses for the month. Restaurants and groceries both overshot their budget, but by a combined $14 so...

- Income Update - January 2013

January was a truly awesome month. I ended up bringing home over $2,200 more than my average for 2012 and the best part is that all went straight to savings. I only overshot one category by a lot but that'll start getting in check beginning with...

- Income Update - November 2012

November's income was higher than my average so far for the year which is great because I'm still able tor reduce my expenses so every extra dollar of income gets to be converted into savings mainly dividend growth investing capital. Not only...

- Income Update - September 2012

September was an okay month for my spending. I let my expenses creep up higher than where I would like but I was still lower than my average for the year so far. My minimum expenses for September ended the month at $1,422.25. This brought my average...

- Income Update - July 2012

July was a pretty good month for my spending. My income was up higher than normal again which is great because it just adds to my savings amount. My minimum expenses for July went back up due to me forgetting that I'm paying my wife for things a month...