Money and Finance

- The Q Ratio And Market Valuation: Monthly Update – By Doug Short

Based on the latest Flow of Funds data, the Q Ratio at the end of the first quarter was 0.96. Now, five months later, the broad market is up about 1.0%. My latest estimate would put the ratio about 38% above its arithmetic mean and 48% above its geometric...

- Hussman Weekly Market Comment: Run, Don't Walk

Wall Street continues to focus on the idea that stocks are "cheap" on the basis of forward price/earnings multiples. I can't emphasize enough how badly standard P/E metrics are being distorted by record (but reliably cyclical) profit margins, which...

- Ed Easterling On Fair Value

From Probable Outcomes: “The concept of fair value relates to the appropriate value for the stock market given existing economic and market conditions. For example, when the inflation rate is in the mid-range, then bond yields should be in the mid-range...

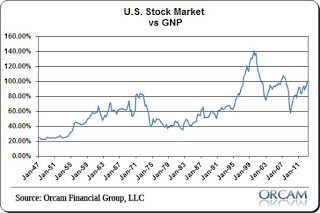

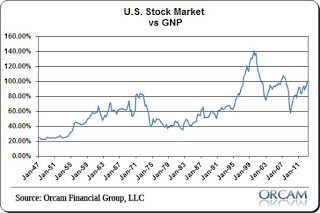

- Fortune: Loomis, Burke - Buffett's Metric Says It's Time To Buy

Looks like Carol Loomis, Doris Burke and me (and Will, who emailed me about this months ago) are all on the same page. - - According to investing guru Warren Buffett, U.S. stocks are a logical investment when their total market value equals 70% to 80%...

- Stock Valuation Method - Graham Number

This is the first of my series on different valuation methods for analyzing stocks. If you have a commonly used metric named after yourself you must be doing something right. And it doesn't hurt that you also taught Warren Buffet, who happens...

Money and Finance

Buffett’s Favorite Valuation Metric Surges Over the 100% Level

Thanks to Bill for passing this along.

For the first time since the recovery began, Warren Buffett’s favorite valuation metric has breached the 100% level. That, of course, is the Wilshire 5,000 total market cap index relative to GNP. See the chart below for historical reference.

- The Q Ratio And Market Valuation: Monthly Update – By Doug Short

Based on the latest Flow of Funds data, the Q Ratio at the end of the first quarter was 0.96. Now, five months later, the broad market is up about 1.0%. My latest estimate would put the ratio about 38% above its arithmetic mean and 48% above its geometric...

- Hussman Weekly Market Comment: Run, Don't Walk

Wall Street continues to focus on the idea that stocks are "cheap" on the basis of forward price/earnings multiples. I can't emphasize enough how badly standard P/E metrics are being distorted by record (but reliably cyclical) profit margins, which...

- Ed Easterling On Fair Value

From Probable Outcomes: “The concept of fair value relates to the appropriate value for the stock market given existing economic and market conditions. For example, when the inflation rate is in the mid-range, then bond yields should be in the mid-range...

- Fortune: Loomis, Burke - Buffett's Metric Says It's Time To Buy

Looks like Carol Loomis, Doris Burke and me (and Will, who emailed me about this months ago) are all on the same page. - - According to investing guru Warren Buffett, U.S. stocks are a logical investment when their total market value equals 70% to 80%...

- Stock Valuation Method - Graham Number

This is the first of my series on different valuation methods for analyzing stocks. If you have a commonly used metric named after yourself you must be doing something right. And it doesn't hurt that you also taught Warren Buffet, who happens...