Money and Finance

- John Mauldin: Forecast 2014: The Capes Of Hope

Link to: Forecast 2014: The CAPEs of HopeLast week's letter focused on my 2014 outlook for the US stock market and highlighted an important, but controversial, measure for long-term valuations: Robert Shiller's cyclically adjusted price-to-earnings...

- Hussman Weekly Market Comment: Declaring Victory At Halftime

Last week, the S&P 500 came within 1% of reprising a syndrome that we’ve characterized as a Who’s Who of Awful Times to Invest, featuring a Shiller P/E over 18 (S&P 500 divided by the 10-year average of inflation-adjusted earnings), the S&P...

- John Mauldin's Outside The Box: Game Changer - By Ed Easterling

Investors are confronting the reality of the current secular bear market. It is both the consequence of the previous secular bull market and the precursor to the next secular bull. The duration of the current secular bear period is uncertain. Should inflation...

- Hussman Weekly Market Comment From May 21, 2007: How Much Do Interest Rates Affect The Fair Value Of Stocks?

In recent months, I've used a wide variety of analytical methods (discounted cash flows, normalized earnings, price/peak earnings calculations, etc) to show that stocks are currently priced to deliver unusually poor long-term returns – stated simply,...

- 15% Capital Gains Tax Myth

Just for a little perspective I made a quick graph showing the true capital gains tax rate adjusted for inflation. To make the math simple let's assume you invested $100 in a stock and it doubled in value to $200 so the capital gains taxes owed would...

Money and Finance

Ed Easterling on fair value

From Probable Outcomes:

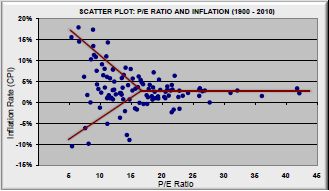

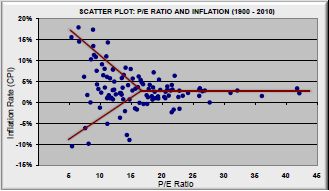

“The concept of fair value relates to the appropriate value for the stock market given existing economic and market conditions. For example, when the inflation rate is in the mid-range, then bond yields should be in the mid-range to compensate for that level of inflation. Likewise, since stocks are financial assets, the stock market’s valuation level should reflect the conditions of inflation. As a result, fair value is a relative concept, not an absolute one. Valuation is relative to the inflation rate; it is not a level that is arbitrarily anchored to a long-term average.”

And a graph from Crestmont’s site showing the relationship:

- John Mauldin: Forecast 2014: The Capes Of Hope

Link to: Forecast 2014: The CAPEs of HopeLast week's letter focused on my 2014 outlook for the US stock market and highlighted an important, but controversial, measure for long-term valuations: Robert Shiller's cyclically adjusted price-to-earnings...

- Hussman Weekly Market Comment: Declaring Victory At Halftime

Last week, the S&P 500 came within 1% of reprising a syndrome that we’ve characterized as a Who’s Who of Awful Times to Invest, featuring a Shiller P/E over 18 (S&P 500 divided by the 10-year average of inflation-adjusted earnings), the S&P...

- John Mauldin's Outside The Box: Game Changer - By Ed Easterling

Investors are confronting the reality of the current secular bear market. It is both the consequence of the previous secular bull market and the precursor to the next secular bull. The duration of the current secular bear period is uncertain. Should inflation...

- Hussman Weekly Market Comment From May 21, 2007: How Much Do Interest Rates Affect The Fair Value Of Stocks?

In recent months, I've used a wide variety of analytical methods (discounted cash flows, normalized earnings, price/peak earnings calculations, etc) to show that stocks are currently priced to deliver unusually poor long-term returns – stated simply,...

- 15% Capital Gains Tax Myth

Just for a little perspective I made a quick graph showing the true capital gains tax rate adjusted for inflation. To make the math simple let's assume you invested $100 in a stock and it doubled in value to $200 so the capital gains taxes owed would...