Money and Finance

You know who loves debt? BGS. In 2014 BGS had $1.03 billion in debt. In 2015, $1.76 billion. It currently stands at 8.8x leverage. To put that into perspective, BGS has a market cap of $1.97 billion. It would take 89% of its market cap to pay for its debt in a day.

- Mcdonald's Stock Analysis

It's about time for another stock analysis. This time I decided to take a look atMcDonalds (MCD). McDonalds closed on Thursday 5/17/12 at $89.62. Company Background: McDonalds Corporation, together with its subsidiaries, franchises and operates...

- Jnj Stock Analysis

I've started to try and consolidate my stock analysis spreadsheets to make it easier for myself to cruch numbers. I like JNJ and would love to get in but right now it seems that it's a little overvalued and there's just too many question marks...

- The Most Important Metric For Dividend Investors

While researching a dividend paying stock should be a holistic process and buying decisions shouldn't be based on any single metric, if there's one metric that every dividend investor should know, it's free cash flow cover. After all, an income...

- Flowers Foods: Wait For The Pullback

Flowers Foods produces and markets bakery products in the United States. It operates through two segments, Direct-Store-Delivery (DSD) and Warehouse Delivery. Take a look above. You might know some of these brands. My favorite is the tastykakes. As of...

- Recent Buy - Altria (mo)

Earlier this week I added to my position in the tobacco giant Altria (MO). I purchased 35 shares at $34.08 which brings my total position to 95 shares. Last year Altria had raised its dividend by 7.3% so I was pretty happy with the 9.1% dividend...

Money and Finance

B&G Foods, Inc: A risky food company

In my search for safety I found this interesting stock; BGS.

B&G Foods Inc & its subsidiaries manufacture, sell & distribute a portfolio of branded shelf-stable foods across the United States, Canada & Puerto Rico. The Company's brands include B&G, B&M, Brer Rabbit, Cream of Rice, & Cream of Wheat among others.

What does BGS do?

Investors often say BGS follows the harvest strategy. Other companies worked hard to market their brands (Green Giants, Mrs. Dash, Ortega, etc); however, these brands are now slow growth (if any) cash cows. Instead of paying for increasing advertising and manufacturing costs these companies simply sell them off. BGS buys these brands, strips off their manufacturing and advertisement costs, and make them permanent members of the BGS cash cow.

Simple explanation: The Green Giant buy.

General Mills Benefits | BGS Foods Benefits |

|

|

As of this article BGS is trading at $33.97, with a PE of 28.3x, and dividend yield of 4.84%, and EPS payout ratio of 113.11% FCF payout ratio of 71.13%, and has been a dividend increaser for five (5) years.

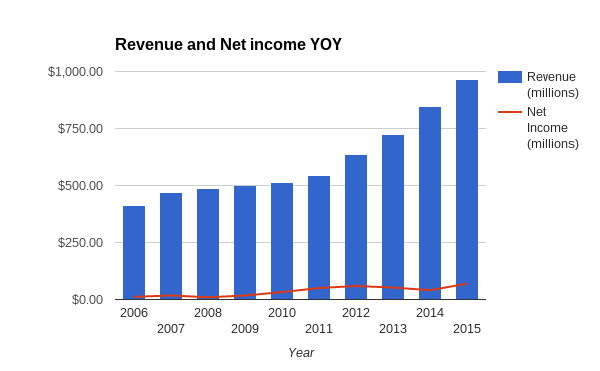

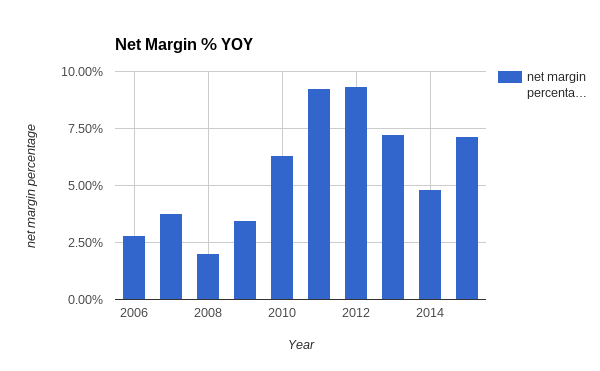

Revenue vs Net margins

As stated above, BGS collects cash cows. Every since IPOing in 2007, BGS has been collecting unwanted “orphan” products and increasing their revenue in kind. As you can see their net margin is very low.

In 2008 BGS hit a 2% net margin and had to cut its dividends. BGS highest net margin was 2012 when it hit 9.35%. Over recent time it has dropped back down and improved again in 2015 with a margin of 7.15%. BGS margins depends on 1) how much they sell, 2) their cost of making such products, and 3) cost of recalls. Yes, this is a food company. Recalls tend to happen quickly and often.

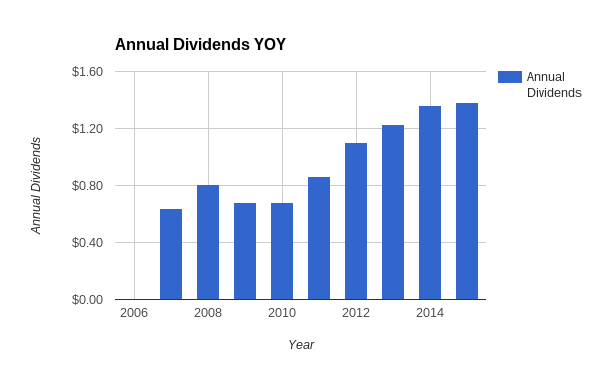

Dividend

BGS IPO’ed in 2007 and paid a heavy $0.212 per quarter for the last two quarters of 2007. In 2009 they cut their dividend and froze it for 2010. Since then they have been increasing their dividends ever so gently. For the first few years after the recession BGS increased their dividends twice per year. Recently they have gone back to the traditional one raise per year model. But just how safe are their dividends?

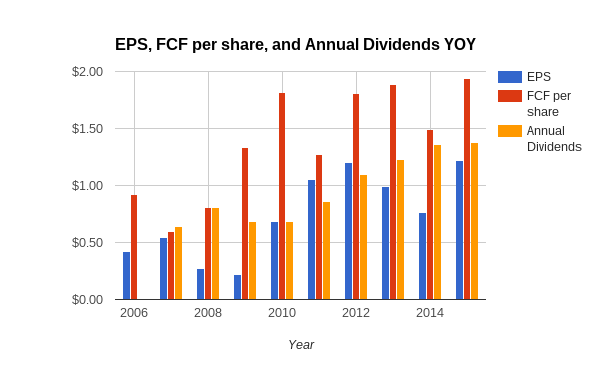

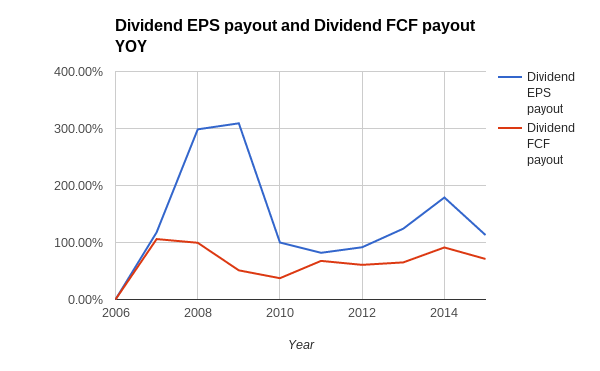

Companies can pay their dividends with earnings per share or they can pay with free-cash-flow per share. I rather prefer EPS payout because my dividends are paid by actual profits. Generating a large amount of free cash is great but the question is am I getting a dividend in benefit of the stock or in detriment of the stock as FCF is used to pay debt, expand, etc.

BGS annual dividend exceeds its EPS for the majority of its history (besides 2010 and 2012). Why? Because BGS acquires products by issuing mass amount of shares to pay down its debt. As of today, March 10, 2016, BGS has 57.98M outstanding shares. BGS just announced an additional 4 million shares to pay for its Green Giant debt and for future acquisitions. I am of the opinion BGS wants to grow fast and will dilute its EPS in the process. Maybe someday when it reaches midcap will we finally see dividends covered by EPS...

But for now BGS is only able to pay its dividend using FCF. But just how much?

Let’s look at the recession. In 2008 and 2009, BGS paid out over 300% of its EPS; 99.51% and 51.13% of its free cash flow. Fearful of exceeding its FCF BGS cut its dividend in 2009 from $0.212 to $0.17 saving ~45% of its FCF. My interpretation is to be careful of that FCF payout ratio. If another recession occurs and the FCF payout reaches 100% or in the high 90%, expect another dividend cut. In 2014 BGS touched 91.28% and fell back down in 2015 to 71.13%. BGS goal is to return 60% of its FCF to investors as a form of dividend.

Risk

- DEBT!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

You know who loves debt? BGS. In 2014 BGS had $1.03 billion in debt. In 2015, $1.76 billion. It currently stands at 8.8x leverage. To put that into perspective, BGS has a market cap of $1.97 billion. It would take 89% of its market cap to pay for its debt in a day.

- Integration

BGS makes it money on product integration...unfortunately BGS has a history of bad product integration. For example the Rickland orchards integration. Rickland was started in 2012 and bought by BGS in 2013 for $57.5 million. At the time Rickland was already producing $50 million in revenue per year. In the first half of 2014, Rickland made $15 million…and BGS wrote it off...

For BGS size at the time a $50 million integration was a huge deal. The Green Giant deal is supposed to produce 50%+ of its current sales. Will this be done quickly or will this become another Rickland Orchard?

- Currency issues

Green giant manufacturing plant is in Mexico. BGS sells a bunch of its product in Canada. In Q4 the Canadian dollar crashed verse the US dollar. The maple syrup division increased its revenue but the currency exchange made it look like BGS lost revenue.

- Free Cash Flow

Live by the free cash flow die by the free cash flow. As stated above, BGS pays its dividends exclusively on FCF. Many people will argue that this is a food company there is no way a defensive stock could lose its FCF. Never say never. Competition, recession, recalls, or agriculture cost could easily derail BGS' FCF. Compound by its high leverage I wonder how BGS will manage paying both its dividends and matured debt during tough times.

Fair value

Yahoo

- High Target: $45.00

- Mean target: $39.63

- Medium target: $38.50

- Low target: $37.00

Voodoo target

Every four years or so BGS dips to 20-21x PE. Using the TTM EPS of $1.22 gives me $24.40~25.62. If you don’t want to wait another four year BGS is currently trading to its peers at 28x PE.

Thompson Reuters give BGS a neutral rating of 5 with the targets

- High: $45.00

- Mean: $39.60

- Low: $37.00

My non-professional opinion: If BGS goes down to $30 and the market is not crashing it comes an interesting buy. If it reaches $28.00 then I think I have enough cushion for a speculative play. I like BGS strategy and its products; but, my question is how will it handle integrating something as big as Green Giant. At a price of $28.00 or below I would feel comfortable investing in this company but I would not buy this company as a buy and hold. If integration fails this company could literally go into bankruptcy.

*As you know I’m not an expert on anything. Don’t trust this article. I’m just some guy on the interweb.

- Mcdonald's Stock Analysis

It's about time for another stock analysis. This time I decided to take a look atMcDonalds (MCD). McDonalds closed on Thursday 5/17/12 at $89.62. Company Background: McDonalds Corporation, together with its subsidiaries, franchises and operates...

- Jnj Stock Analysis

I've started to try and consolidate my stock analysis spreadsheets to make it easier for myself to cruch numbers. I like JNJ and would love to get in but right now it seems that it's a little overvalued and there's just too many question marks...

- The Most Important Metric For Dividend Investors

While researching a dividend paying stock should be a holistic process and buying decisions shouldn't be based on any single metric, if there's one metric that every dividend investor should know, it's free cash flow cover. After all, an income...

- Flowers Foods: Wait For The Pullback

Flowers Foods produces and markets bakery products in the United States. It operates through two segments, Direct-Store-Delivery (DSD) and Warehouse Delivery. Take a look above. You might know some of these brands. My favorite is the tastykakes. As of...

- Recent Buy - Altria (mo)

Earlier this week I added to my position in the tobacco giant Altria (MO). I purchased 35 shares at $34.08 which brings my total position to 95 shares. Last year Altria had raised its dividend by 7.3% so I was pretty happy with the 9.1% dividend...