4 Things to Know About Dividend Investing

Earlier this week, Fidelity posted an interesting article on Morningstar.com that discussed the importance of considering dividends from both a historical and forward-looking perspective.

Here are my four key takeaways from the article:

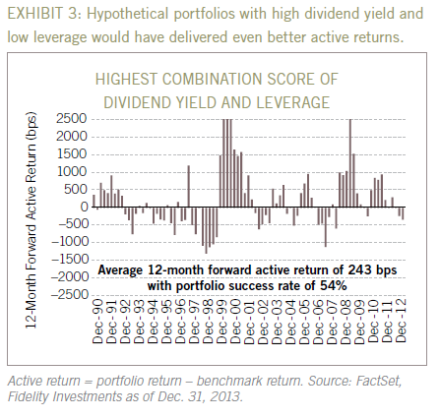

1. Screen for companies with high yields and low leverage

While equity-related metrics like FCF cover are absolutely critical in dividend analysis, we simply cannot afford to overlook a company’s balance sheet and its ability to repay its creditors.

After all, a company can’t consistently direct undue amounts of cash flow toward common shareholders at the expense of creditors; otherwise, the firm risks a credit downgrade and higher borrowing costs, which, all else equal, will eventually trickle down to the bottom line. Specifically, firms with particularly high dividend yields could be under pressure from creditors to redirect more cash flow toward repaying debt.

As such, you want to look for companies that strike a healthy balance between satisfying creditors and rewarding shareholders, as they’ll be more able to obtain favorable borrowing terms without harming their ability to pay dividends. This is one reason why why the Dividend Compass spreadsheet places a 25% weighting on leverage and interest coverage ratios.

As such, you want to look for companies that strike a healthy balance between satisfying creditors and rewarding shareholders, as they’ll be more able to obtain favorable borrowing terms without harming their ability to pay dividends. This is one reason why why the Dividend Compass spreadsheet places a 25% weighting on leverage and interest coverage ratios. One strategy is to look for firms with investment grade credit ratings, being particularly careful with high dividend yield firms with credit ratings right on the border between investment-grade and junk ratings (BBB- or Baa3) as they may be more prone to cut the dividend to preserve their investment-grade credit rating.

Even if a firm has a published credit rating, you don’t want to blindly take the rating agencies’ word for it. Consider the company’s debt/equity, net debt/equity, and interest coverage ratios and compare them to their peer and market averages.

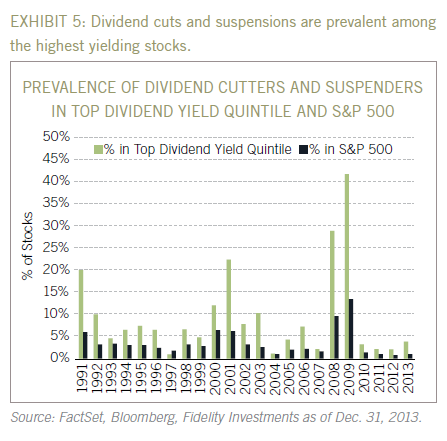

2. Ultra-high yield = ultra-high risk

In the movie Elf, Santa gives Buddy some advice before he heads to New York City: “You see gum on the street, leave it there. It isn’t free candy.”

The same could be said for stocks with ultra-high dividend yields. There’s always a catch. Rarely will a stock’s dividend yield approach the top quintile due to dividend growth. Rather, high yields are almost always due to a depressed share price. Because of this, it shouldn’t be surprising that dividend cuts typically come from the top yield quintile.

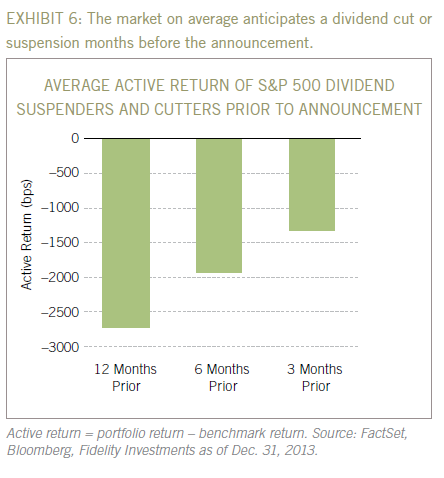

3. The market is good at sniffing out dividend cuts well ahead of time

If someone can point me to a case where a company cut its dividend after its stock outperformed the market over the trailing twelve months, I’d love to learn about it because I can’t recall coming across such a scenario.

Unsurprisingly, Fidelity found in its research that a dividend cut typically follows a period of extended market underperformance.

Unsurprisingly, Fidelity found in its research that a dividend cut typically follows a period of extended market underperformance. While the market may not discount the stock price specifically because of diminishing dividend health, a declining price (particularly relative to the market) is usually indicative of an intensified competitive landscape or at least a departure from “business as usual” for the company.

What typically follows are contracting margins, greater uncertainty around net profits and free cash flow, and mounting pressure from creditors and the ratings agencies. None of this supports dividend health.

What typically follows are contracting margins, greater uncertainty around net profits and free cash flow, and mounting pressure from creditors and the ratings agencies. None of this supports dividend health.

This is why it’s so important to a) own firms with durable competitive advantages (i.e. economic moats) and b) keep tabs on how the firms’ competitive advantages are strengthening and weakening with time.

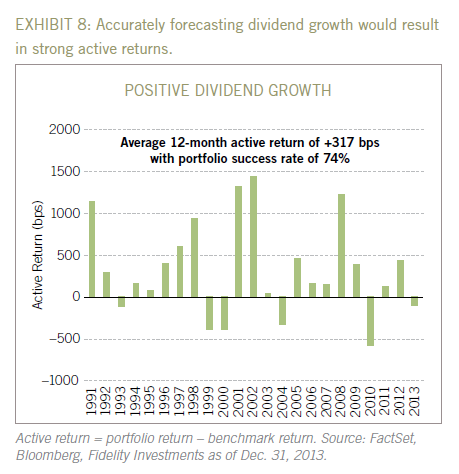

4. The importance of estimating dividend growth

Getting future dividend growth correct is more than half the battle; however, is easier said than done.

Still, it’s important to go through the process of determining a company’s dividend growth potential. At the very least it could save you from investing in a firm with deteriorating dividend health.

How can we go about doing this?

You can use historical data and trends as part of your forecast (this is what the Dividend Compass does), but we don’t want to make decisions solely on what’s happened in the rear-view mirror.

As Fidelity suggests, the best bet is to use a combination of historical perspective and forward-looking analysis.

Now, one school of dividend investing says, “Why bother making forecasts? It’s not like you know what’s going to happen.”

Fair enough, but any time you buy a stock you are already making an implicit forecast as the market’s outlook is baked into the current share price. Might as well make some explicit forecasts, I reckon, and hold yourself accountable for them.

If you’re really interested in learning how to make detailed forecasts, NYU professor Aswath Damodaran explains it much better than I can both here and in his books.

Good reads this week

- Why employers should encourage reading at work. - Shane Parrish

- When faced with big decisions, baseball umpires tend to play it safe. - Quartz

- Transcripts of Buffett speaking with Notre Dame business students in 1991 - Whitney Tilson

- Why moats matter in dividend investing - Total Return Investor

- There's no substitute for good judgement - Above the Market

- Why you don't need to worry about HFT - Monevator

Stay patient, stay focused.If the Chairman of the Federal Reserve called me tonight and said “I am really panicking and things are terrible,” I don’t care. We will do exactly what we were going to do tomorrow morning. The truth is, on balance, we will do more business when people are pessimistic. - Warren Buffett

Best,

Todd

Follow @ToddWenning

- The Most Important Metric For Dividend Investors

While researching a dividend paying stock should be a holistic process and buying decisions shouldn't be based on any single metric, if there's one metric that every dividend investor should know, it's free cash flow cover. After all, an income...

- The Ten Points Of Income Investing

1. Income investing is a separate and distinct strategy It's not growth, it's not value -- income comes first. (See: The Income Investor's Manifesto) 2. Discipline and patience are behavioral prerequisites Great dividend-producing...

- Introducing The Dividend Compass

When it comes to equity analysis, a lot of attention is paid to valuation -- and rightly so, as your investing career will likely be a short one if you consistently overpay for assets. Surprisingly, however, there's typically little attention paid...

- Ultra High Yield = Ultra High Risk

The first rule of dividend investing (or at least it should be the first rule) is: If the yield is too good to be true, it probably is. In an article I wrote last May, I looked into the highest-yielding stocks on the UK FTSE All-Share and found that...

- Dividend Compass - Royal Dutch Shell

Todd Wenning's Dividend Compass is a diagnostic tool that covers the parts of fundamental analysis most useful to dividend investors. This is a pretty broad set of metrics, Todd describes them here: "Sales growth: Sales are the life-blood of a company....