Money and Finance

It's been 2 days ever since I created my blog and already have gotten slightly over a thousand viewers.

I'm quite happy that people actually do find my blogposts worth reading. However, I also noticed a few emails asking me what are my plans for the future.

Therefore, I would like to say that like any average Singaporean male I have relatively simple requests from life. Note that simple does not mean little! :)

1. I would like to be released from the obligation of serving the nation.

(Yeah, highly doubt that...)

Don't get me wrong, I fully understand the reason that every Singaporean son have to train to defend our country from invaders more imaginary than your CPF money.

The problem I have, and I'm sure many others have is the timing of NS. We are in the prime of our lives between the age 18-23. We just graduated from the various colleges, (Polytechnics, Junior Colleges, Institute of Technical Education) These are the best times that we are supposed to find jobs or further our education all in an effort to brighten our bleak futures. But, sadly we do not have that chance. But enough about that, Ah Boys to Men yeah?

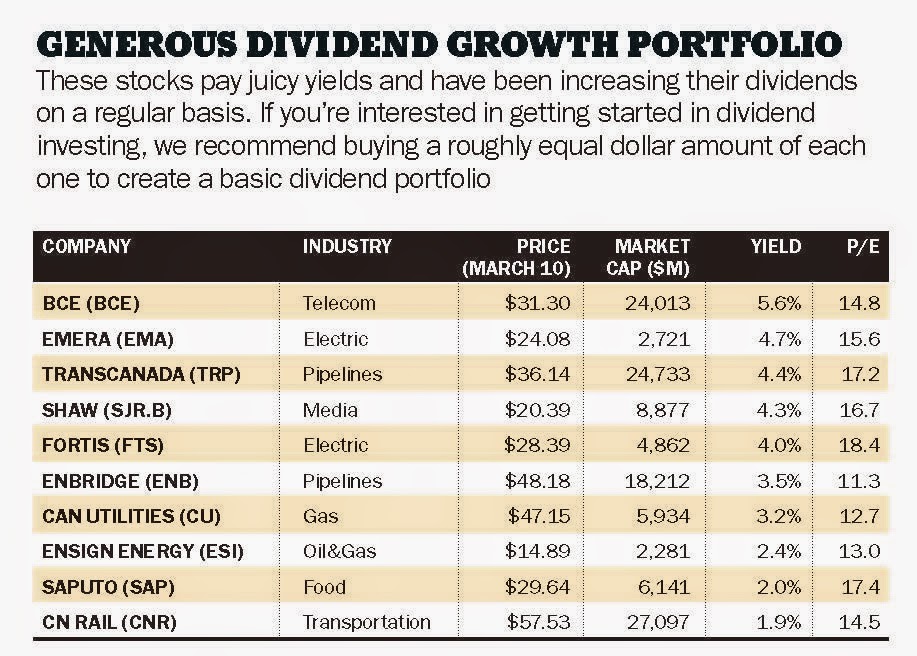

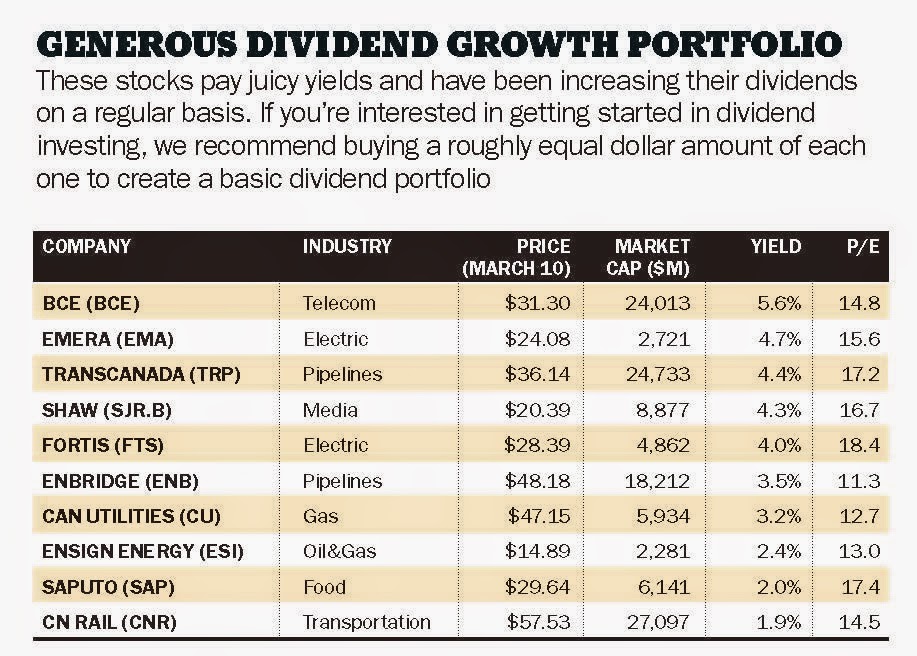

2. I would like to broaden my knowledge on investments and build a portfolio that pays regular dividends.

What does that mean? Simply put, I do not want my regular job after my army days to be my ONLY source of income. And investing for dividends is my main priority. As such, I would appreciate each and every person / book that can educate me on this. Learning is a lifelong journey after all.

3. I would love to meet the love of my life, get married and set up a home with her.

Again, that means having to start saving NOW for your wedding and home. As a Singaporean male we are at a huge disadvantage. 2 years of your life are spent serving the nation. As a result, you just effectively lost 2 years that you could have used to further your studies and graduate with a higher basic pay or 2 years that you could have began your full time job and start saving for the future.

4. I would like to be financially secure.

How do I achieve that? By having several things. My Emergency Funds, My Portfolio of Dividends and decent Savings. As many people know, when your passive income from dividends exceed your expenses you are financially secure in other words. Don't get me wrong though, I am not going to quit my job if that happens but it'd be nice to have the choice to do so.... *cries*

This are my simple long term plans for now. Of course my plans may change as I grow older. I still vaguely recall my long term plan 8-10 years ago was to be the Green Power Ranger and protect the universe.

Things change. People change. Stay true to yourself and know what you want out from life. Nobody owes you a living, you owe yourself that.

Signing off,

Teenage Investor

- Investments, Money + Teenage Investor's Q & A

Hello, recently I received emails from new readers of my blog after my post was shared on Facebook. Honestly, I was quite shocked and a little gratified that readers found my blog post interesting and relatable enough to share on their Facebook page....

- Life Goes On In The World's Most Expensive Country

Hello everyone, it's been quite some time since my last post. Have been catching up with my studies, going for army check-ups and everything else that goes on in a life of a polytechnic student. I recently received an email from Hady, who found...

- Living Without Money: Nearly Half Of Singaporean Households Living From Paycheck To Paycheck

I refer to this link, Living without money: Nearly half of Singaporean households subsisting from paycheck to pay check Quoted: "Savings rates are way too low across the island." "Here’s an uncomfortable truth about Singaporean households: a report...

- Why 90% Of Young Singaporeans Are Worried About Their Financial Future ; Singapore Is The Most Expensive Country To Live In

It's pretty simple. I refer to a post from The Real Singapore (TRS) http://therealsingapore.com/content/survey-90-young-singaporeans-are-worried-about-their-future-finances 90% of 1000+ youths is an alarming number of over 900+ teenagers and...

- 80% Of Young Singaporeans Have Little To No Savings At All ; Are You One Of Them?

According to this link (http://sbr.com.sg/financial-services/news/disaster-in-making-4-out-5-young-singaporeans-have-no-savings) 4 out of 5 Singaporeans have little to no savings at all! True? Source: Singapore Business Review Now, firstly I would not...

Money and Finance

Why NS might be Ruining your Chances of Getting Married & Building a Home ; What your average Singaporean really wants!

It's been 2 days ever since I created my blog and already have gotten slightly over a thousand viewers.

I'm quite happy that people actually do find my blogposts worth reading. However, I also noticed a few emails asking me what are my plans for the future.

Therefore, I would like to say that like any average Singaporean male I have relatively simple requests from life. Note that simple does not mean little! :)

1. I would like to be released from the obligation of serving the nation.

(Yeah, highly doubt that...)

Don't get me wrong, I fully understand the reason that every Singaporean son have to train to defend our country from invaders more imaginary than your CPF money.

The problem I have, and I'm sure many others have is the timing of NS. We are in the prime of our lives between the age 18-23. We just graduated from the various colleges, (Polytechnics, Junior Colleges, Institute of Technical Education) These are the best times that we are supposed to find jobs or further our education all in an effort to brighten our bleak futures. But, sadly we do not have that chance. But enough about that, Ah Boys to Men yeah?

2. I would like to broaden my knowledge on investments and build a portfolio that pays regular dividends.

What does that mean? Simply put, I do not want my regular job after my army days to be my ONLY source of income. And investing for dividends is my main priority. As such, I would appreciate each and every person / book that can educate me on this. Learning is a lifelong journey after all.

I'm going to educate myself. No doubt.

3. I would love to meet the love of my life, get married and set up a home with her.

Again, that means having to start saving NOW for your wedding and home. As a Singaporean male we are at a huge disadvantage. 2 years of your life are spent serving the nation. As a result, you just effectively lost 2 years that you could have used to further your studies and graduate with a higher basic pay or 2 years that you could have began your full time job and start saving for the future.

4. I would like to be financially secure.

How do I achieve that? By having several things. My Emergency Funds, My Portfolio of Dividends and decent Savings. As many people know, when your passive income from dividends exceed your expenses you are financially secure in other words. Don't get me wrong though, I am not going to quit my job if that happens but it'd be nice to have the choice to do so.... *cries*

This are my simple long term plans for now. Of course my plans may change as I grow older. I still vaguely recall my long term plan 8-10 years ago was to be the Green Power Ranger and protect the universe.

That was me, in the green suit about 8-10 years ago.

Things change. People change. Stay true to yourself and know what you want out from life. Nobody owes you a living, you owe yourself that.

Signing off,

Teenage Investor

- Investments, Money + Teenage Investor's Q & A

Hello, recently I received emails from new readers of my blog after my post was shared on Facebook. Honestly, I was quite shocked and a little gratified that readers found my blog post interesting and relatable enough to share on their Facebook page....

- Life Goes On In The World's Most Expensive Country

Hello everyone, it's been quite some time since my last post. Have been catching up with my studies, going for army check-ups and everything else that goes on in a life of a polytechnic student. I recently received an email from Hady, who found...

- Living Without Money: Nearly Half Of Singaporean Households Living From Paycheck To Paycheck

I refer to this link, Living without money: Nearly half of Singaporean households subsisting from paycheck to pay check Quoted: "Savings rates are way too low across the island." "Here’s an uncomfortable truth about Singaporean households: a report...

- Why 90% Of Young Singaporeans Are Worried About Their Financial Future ; Singapore Is The Most Expensive Country To Live In

It's pretty simple. I refer to a post from The Real Singapore (TRS) http://therealsingapore.com/content/survey-90-young-singaporeans-are-worried-about-their-future-finances 90% of 1000+ youths is an alarming number of over 900+ teenagers and...

- 80% Of Young Singaporeans Have Little To No Savings At All ; Are You One Of Them?

According to this link (http://sbr.com.sg/financial-services/news/disaster-in-making-4-out-5-young-singaporeans-have-no-savings) 4 out of 5 Singaporeans have little to no savings at all! True? Source: Singapore Business Review Now, firstly I would not...