Money and Finance

Great recommendation from Harold Pollack that your investing goals should fit on a standard 4x6 index card. Simplicity has a quality all its own.

One of my investing mantras is based on an old Peter Lynch quote, invest in businesses that any idiot can run, because one day one will. This nugget of investing wisdom has kept me out of a lot of trouble. Not that there are not great managers out there, obviously there are. For example the highly enjoyable book "The Outsiders" describes the huge gains investors enjoyed from the managerial feats and capital allocation wizardry of the likes of Buffett, John Malone, Dick Smith, and others. What investor wouldn't want to have those kinds of managers working for them?

Well one problem is that very often you only know who the great managers are after they have been wildly successful. That means two things, first many of the gains are in the rear view, and second that the manager however good they may be, now operates with a larger base which equals less opportunities.

Another problem with seeking great managers and many of the ones described in The Outsiders, is the techniques that they use are indistinguishable a priori from incompetents and crooks. For example, John Malone built one of the great track records in history, however he did it based on massive debt loads and continuous M&A. If you built a portfolio that focused on finding companies that have huge debts and lots of acquisitions, you may find a Malone, but you probably end up with HP and worse. That's my basic problem with looking to invest in great managers, the chain saw, in the hands of a skilled professional, is a great tool for clearing forest. In the hands of a newbie you lose (your own) limbs.

So my twist on the Lynch rule is that individuals should use an investing strategy that any idiot can use, because one day one will.

My index card starts with four elements taken from Charlie Munger, who is clearly not an idiot (6 min mark):

Because I am not as smart as Munger, I use a few more checks to further idiot proof my process

- Charlie Munger On High Quality Businesses And Management

This is from Munger's speech "A Lesson on Elementary, Worldly Wisdom As It Relates To Investment Management & Business". A couple of things that stood out to me reading it this time around, that maybe I didn't pay enough attention to before,...

- The Ten Points Of Income Investing

1. Income investing is a separate and distinct strategy It's not growth, it's not value -- income comes first. (See: The Income Investor's Manifesto) 2. Discipline and patience are behavioral prerequisites Great dividend-producing...

- Three Wise Men On Quality Income Investing

Charlie Munger is a guy who knows how to get to the point. I came to investing for dividends via value investing. It took me a long time to appreciate what the important differences are. Charlie Munger managed to sum it up in on paragraph: "If you buy...

- Lake Wobegon Investing

"Some luck lies in not getting what you thought you wanted but getting what you have, which once you have got it you may be smart enough to see is what you would have wanted had you known." - Garrison Keillor Tim McAleenan points to a great interview...

- Samuel Lee On Quality At A Reasonable Price

Samuel Lee's recent article discusses Warren Buffett and the Time Horizon Arbitrage. In it, he describes the implications of Buffett's conversion from a Graham-style deep value, bargain hunter to a Munger-style quality oriented approach. Since...

Money and Finance

Use an Investing Strategy that Any Idiot Can Use

Great recommendation from Harold Pollack that your investing goals should fit on a standard 4x6 index card. Simplicity has a quality all its own.

One of my investing mantras is based on an old Peter Lynch quote, invest in businesses that any idiot can run, because one day one will. This nugget of investing wisdom has kept me out of a lot of trouble. Not that there are not great managers out there, obviously there are. For example the highly enjoyable book "The Outsiders" describes the huge gains investors enjoyed from the managerial feats and capital allocation wizardry of the likes of Buffett, John Malone, Dick Smith, and others. What investor wouldn't want to have those kinds of managers working for them?

Well one problem is that very often you only know who the great managers are after they have been wildly successful. That means two things, first many of the gains are in the rear view, and second that the manager however good they may be, now operates with a larger base which equals less opportunities.

Another problem with seeking great managers and many of the ones described in The Outsiders, is the techniques that they use are indistinguishable a priori from incompetents and crooks. For example, John Malone built one of the great track records in history, however he did it based on massive debt loads and continuous M&A. If you built a portfolio that focused on finding companies that have huge debts and lots of acquisitions, you may find a Malone, but you probably end up with HP and worse. That's my basic problem with looking to invest in great managers, the chain saw, in the hands of a skilled professional, is a great tool for clearing forest. In the hands of a newbie you lose (your own) limbs.

So my twist on the Lynch rule is that individuals should use an investing strategy that any idiot can use, because one day one will.

My index card starts with four elements taken from Charlie Munger, who is clearly not an idiot (6 min mark):

1. Buy things you understand

2. Moat - Ensure there is a durable competitive advantage

3. Management integrity and ability

4. Price matters, don’t overpay

Because I am not as smart as Munger, I use a few more checks to further idiot proof my process

5. Safety - Balance Sheet, earnings cyclicality

6. Quality Income - Free Cash Flow, dividend yield

7. Dividend Growth - ability to grow dividend over time

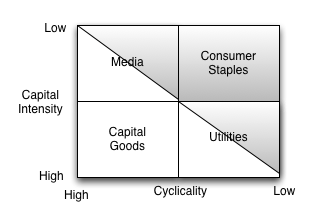

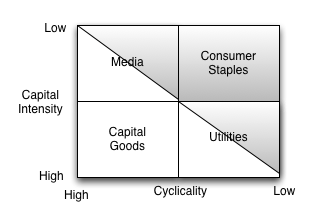

I think that leaves me enough room on the index card for a small drawing. Don Yacktman's recent talk at Google described a useful, simple concept to use forward rates of return so that you analyze a stock similar to a bond. The process identifies investing candidates with low capital requirements and low cyclicality as the best starting place.

The other quadrants like Low Capital plus high Cyclical or Low Cyclical plus High Capital can house interesting opportunities, but must account for these risks. I think this sums it up well. Don Yacktman is clearly not an idiot either, he has one of the best track records of performance of any big mutual fund manager over multiple decades, and stacks up well next most any other manager. But the key distinction is that however skilled Yacktman is following his basic process does not require any particular genius insight to buy PG, Coke, and Pepsi and hold them for 20 years.

Now I just need an index card! What is on your index card?

- Charlie Munger On High Quality Businesses And Management

This is from Munger's speech "A Lesson on Elementary, Worldly Wisdom As It Relates To Investment Management & Business". A couple of things that stood out to me reading it this time around, that maybe I didn't pay enough attention to before,...

- The Ten Points Of Income Investing

1. Income investing is a separate and distinct strategy It's not growth, it's not value -- income comes first. (See: The Income Investor's Manifesto) 2. Discipline and patience are behavioral prerequisites Great dividend-producing...

- Three Wise Men On Quality Income Investing

Charlie Munger is a guy who knows how to get to the point. I came to investing for dividends via value investing. It took me a long time to appreciate what the important differences are. Charlie Munger managed to sum it up in on paragraph: "If you buy...

- Lake Wobegon Investing

"Some luck lies in not getting what you thought you wanted but getting what you have, which once you have got it you may be smart enough to see is what you would have wanted had you known." - Garrison Keillor Tim McAleenan points to a great interview...

- Samuel Lee On Quality At A Reasonable Price

Samuel Lee's recent article discusses Warren Buffett and the Time Horizon Arbitrage. In it, he describes the implications of Buffett's conversion from a Graham-style deep value, bargain hunter to a Munger-style quality oriented approach. Since...