Money and Finance

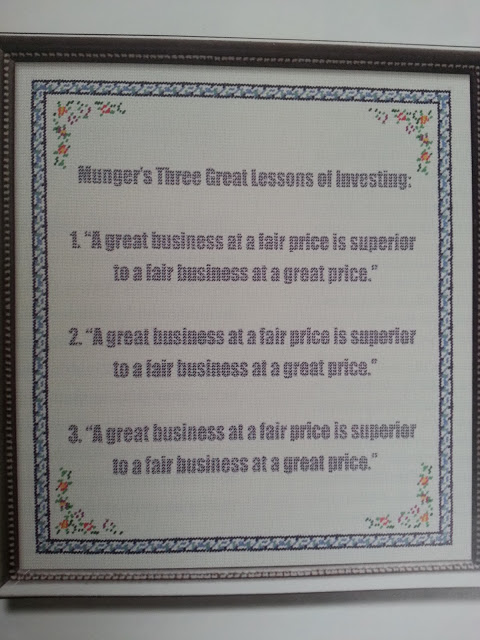

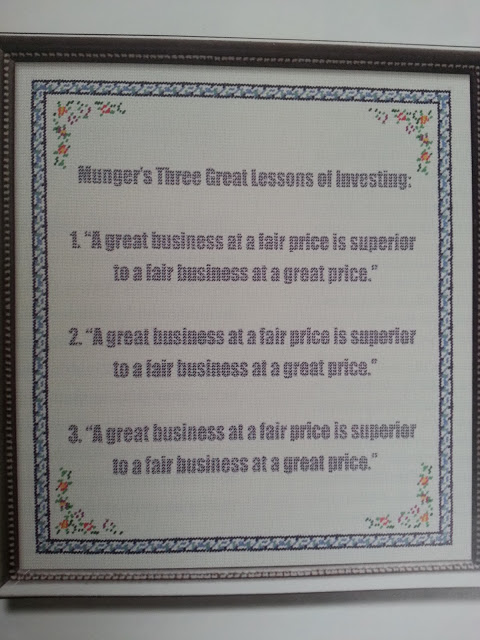

Samuel Lee's recent article discusses Warren Buffett and the Time Horizon Arbitrage. In it, he describes the implications of Buffett's conversion from a Graham-style deep value, bargain hunter to a Munger-style quality oriented approach. Since Graham pioneered value investing, this distinction is not trivial and some of the implications challenge the basic tenets that people associate with value investing, focusing on quality over price. This is distilled down to Munger's Three Great Lessons of Investing:

Focusing on business quality is something that is not that hard to understand, but the knock on effect here is that outside a global financial crisis, you are never going to get Coca Cola at a bargain basement price. That's where time horizon matters, in order for this strategy to work the investor has to think long term.

Overall, its got a lot overlap with dividend growth investing. After all, what do Buffett and Munger's largest holdings IBM, Coca Cola, Wells Fargo, and Exxon have in common? Excellent dividend growth track records:

(Source: Morningstar)

Samuel Lee gets to the heart of the quality at a reasonable price and why its so hard for institutional managers to follow this simple approach:

- Safal Niveshak: Value Investing, The Sanjay Bakshi Way 2.0 – Part 1

Link to interview: Value Investing, the Sanjay Bakshi Way 2.0 – Part 1 Excerpt: Safal Niveshak: Let me start with a question I have been waiting to ask you for some time now. Through a comment on a link I shared on FB and through a few of your...

- The Evidence For Dividend Growth Investing

This following post is written by Ben Reynolds, who runs the Sure Dividend site. Sure Dividend focuses on high quality dividend growth stocks suitable for long-term investing. Dividend growth stocks are an excellent vehicle to build passive income over...

- Second & Third Picks In Wmd Portfolio - Glaxosmithkline & Ibm

The more real they are, the more fun blogs are to follow. So in that spirit, rather than talking about ideas in the abstract I maintain a hypothetical portfolio to track ideas where I'll semi-regularly (and hypothetically) invest and track buying...

- Coke Versus Pepsi

The bull market continues to rage along, but while its certainly not leaving bargains lying around, there are some quality companies that have not fully participated in the upside. For different reasons, there could be something resembling a fair price...

- Dividends Aren't Evil

Matt Yglesias has a post called "Dividends Are Evil", he is right in some ways, but mostly wrong. Let's count the ways: 1. Yglesias begins by saying that dividends are a "triumph of short term thinking"; I could not disagree more. Dividend investing...

Money and Finance

Samuel Lee on Quality at a Reasonable Price

Samuel Lee's recent article discusses Warren Buffett and the Time Horizon Arbitrage. In it, he describes the implications of Buffett's conversion from a Graham-style deep value, bargain hunter to a Munger-style quality oriented approach. Since Graham pioneered value investing, this distinction is not trivial and some of the implications challenge the basic tenets that people associate with value investing, focusing on quality over price. This is distilled down to Munger's Three Great Lessons of Investing:

Focusing on business quality is something that is not that hard to understand, but the knock on effect here is that outside a global financial crisis, you are never going to get Coca Cola at a bargain basement price. That's where time horizon matters, in order for this strategy to work the investor has to think long term.

Overall, its got a lot overlap with dividend growth investing. After all, what do Buffett and Munger's largest holdings IBM, Coca Cola, Wells Fargo, and Exxon have in common? Excellent dividend growth track records:

| Company | Fwd Yield | 1 Yr Div Growth | 3 Yr Div Growth | 5 Yr Div Growth |

| Coca Cola | 2.8% | 8.5% | 7.6% | 8.5% |

| Exxon Mobil | 2.7% | 17.8% | 9.5% | 9.7% |

| IBM | 2.1% | 13.8% | 15.4% | 17.1% |

| Wells Fargo | 2.7% | 90.2% | 16.7% | -7.9% |

Samuel Lee gets to the heart of the quality at a reasonable price and why its so hard for institutional managers to follow this simple approach:

Both Buffett and Munger declare their favorite holding period is forever. This seems to contradict the fact that at a high enough price, even the most wonderful business in the world will produce less-than-wonderful returns. No doubt part of their hesitance to sell wonderful businesses at any price reflects a philosophical aversion to "gin rummy" investing. I think, though, the main reason they hold on is because they truly believe wonderful businesses are persistently undervalued by the market, even when common valuation metrics suggest otherwise.

This suggests to me that much of Buffett and Munger's edge rests in the ability to engage in time-horizon arbitrage: buying assets with long-term value underappreciated by the market.

Of course, many managers claim they take the long view, shunning Wall Street's quarterly earnings game. It sounds great in theory, but the nature of the investment-management industry makes time-horizon arbitrage nearly impossible. Few managers can live through more than a few years of massive underperformance, but beyond 10 years? Forget it. You've long since been fired.

This is a critical flaw of the investment-management industry, because the real value of most firms is not in their next 10 years of earnings, but the 20 years after that. The real time arbitrage is beyond what most investors can stomach.

In dividend growth investing we see the same dynamic play out. Who cares about a 2.9% current yield? its a rounding error. But compound it at double digit rate over a decade plus and watch the yield on cost rise. Its practically impossible for Wall St firms to think in decades. Of course, what's impossible for institutions and funds creates a major opportunity for individual investors for high total returns at relatively low risk.

- Safal Niveshak: Value Investing, The Sanjay Bakshi Way 2.0 – Part 1

Link to interview: Value Investing, the Sanjay Bakshi Way 2.0 – Part 1 Excerpt: Safal Niveshak: Let me start with a question I have been waiting to ask you for some time now. Through a comment on a link I shared on FB and through a few of your...

- The Evidence For Dividend Growth Investing

This following post is written by Ben Reynolds, who runs the Sure Dividend site. Sure Dividend focuses on high quality dividend growth stocks suitable for long-term investing. Dividend growth stocks are an excellent vehicle to build passive income over...

- Second & Third Picks In Wmd Portfolio - Glaxosmithkline & Ibm

The more real they are, the more fun blogs are to follow. So in that spirit, rather than talking about ideas in the abstract I maintain a hypothetical portfolio to track ideas where I'll semi-regularly (and hypothetically) invest and track buying...

- Coke Versus Pepsi

The bull market continues to rage along, but while its certainly not leaving bargains lying around, there are some quality companies that have not fully participated in the upside. For different reasons, there could be something resembling a fair price...

- Dividends Aren't Evil

Matt Yglesias has a post called "Dividends Are Evil", he is right in some ways, but mostly wrong. Let's count the ways: 1. Yglesias begins by saying that dividends are a "triumph of short term thinking"; I could not disagree more. Dividend investing...