Money and Finance

Earlier this month, I came across a great interview with one of my favorite investors, Chuck Akre of Akre Focus (disclosure: I own shares of his fund) -- thanks to Kevin Holloway (@kevin_holloway on Twitter) for pointing it out.

I've followed Akre for a while and have long been a fan of his "Compounding Machine" approach, which I think works particularly well with small caps. What I like most about his investing philosophy is it's a well-defined, cohesive, and repeatable framework for making investing decisions. Few investing gurus lay out their process in such detail.

You can watch the interview with WealthTrack below:

Here are a few of the key takeaways from the interview:

- Buybacks Aren't Doing Much For Shareholders Right Now

"If everyone is doing (buybacks), there must be something wrong with them." - Henry Singleton, former Teledyne CEO (profiled in The Outsiders) With the exception of 2009, gross buybacks have outpaced dividends paid by U.S. companies each year since...

- Markel Brunch Notes

I spend most of my time in investing looking for excellent dividend growth opportunities. However, there are two exceptions to this. One is Berkshire Hathaway, why should investors want a dividend from a company that has Warren and Charlie reinvesting...

- Three Wise Men On Quality Income Investing

Charlie Munger is a guy who knows how to get to the point. I came to investing for dividends via value investing. It took me a long time to appreciate what the important differences are. Charlie Munger managed to sum it up in on paragraph: "If you buy...

- High Yield Reads - 5/17/14

Summary of recents posts and pieces of interest, sometimes enduring, to investors: Consuelo Mack interviews Chuck Akre on the importance of compounding. He uses Markel as a case study. More compounding machines: Base Hit Investor mines the intersection...

- Lake Wobegon Investing

"Some luck lies in not getting what you thought you wanted but getting what you have, which once you have got it you may be smart enough to see is what you would have wanted had you known." - Garrison Keillor Tim McAleenan points to a great interview...

Money and Finance

The Best Investor You've (Probably) Never Heard Of

Earlier this month, I came across a great interview with one of my favorite investors, Chuck Akre of Akre Focus (disclosure: I own shares of his fund) -- thanks to Kevin Holloway (@kevin_holloway on Twitter) for pointing it out.

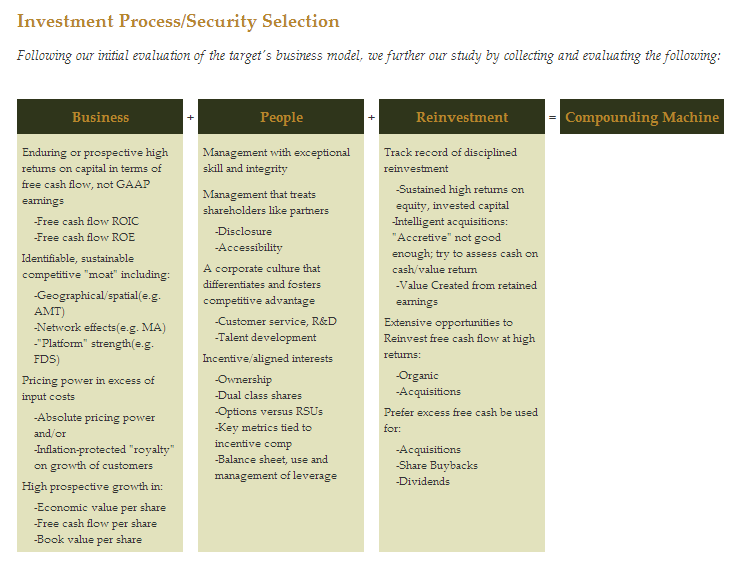

I've followed Akre for a while and have long been a fan of his "Compounding Machine" approach, which I think works particularly well with small caps. What I like most about his investing philosophy is it's a well-defined, cohesive, and repeatable framework for making investing decisions. Few investing gurus lay out their process in such detail.

|

| Source: Akre Focus Fund |

You can watch the interview with WealthTrack below:

Here are a few of the key takeaways from the interview:

- We want businesses that can reinvest their free cash flow back in the business to earn above average rates of return on capital.

- Average rates of return in the market are about 10%. We look for companies that can earn significantly more.

- Dividends reduce a company's ability to compound.

- We seek above average returns with below market risk. Key is to own businesses with more growth and higher ROIC opportunities, have higher quality balance sheets, and pay good prices for them. That will provide below market risk. (See: A Simple Equation for Investing Success)

- Akre has held some portfolio stocks for decades

- Great business, great people, great history of reinvestment = Compounding machine

- Business models get better or worse, people's behavior will get better or worse, reinvesting opportunities get better or worse. You need to stay up on these changes.

- Hard to find companies with those three characteristics.

- Akre has owned Markel for over 20 years. The growth in book value was about 14% compounded over that period. BVPS growth will fluctuate with time, pricing cycles, interest rates, etc. We didn't sell during down times. We look at things at Markel differently than the sell-side. In 2013, growth in BVPS was over $70 per share and the stock price was in $620 range -- still less than 10x the real economic earnings in 2013. The change in BVPS is the real economic earnings.

- American businesses have single digit net margins on average. ROE, ROOC in low teens. We research companies with returns significantly greater than that. Then we get curious.

- We may not know precisely why the company has a moat, but that's okay. The company may not want to share its secret.

- American Tower -- more towers, more tenants per tower, more rent per tenant. Contracts have annual price escalators of 3-4%. The 3G>4G progression requires denser tower network. Growing outside the U.S.

- MasterCard & Visa -- much harder to determine why the companies earn such high ROICs. Generate enormous free cash flow and have almost too much cash on hand, which can reduce compounding opportunities. They get paid a percentage of the amount of currency -- inflation hedge.

- Workbench companies -- Start with a small investment while investigating whether or not to invest more. Colfax started out this way and is now a top holding.

- In management, you want to know how they measure their own success in the business. Avoid those managers who are too focused on the stock price as a measuring stick of success.

- Ultimately, investing isn't about punching numbers. Quants are trading against prices in their models; we're investors in businesses.

- Not enough investors/fund managers are striving to think long-term. You attract the shareholders/following you deserve.

- Late 2008 and early 2009 felt terrible. The shareholders who knew what we were about have done wonderfully as a result of sticking with the program. We want to make sure shareholders know what we're about.

- Markel will benefit from rising rates, better industry pricing, recent acquisition, more opportunistic balance sheet management, and Markel Ventures program that moves business away from insurance.

That's a lot of information in a twenty minute interview. If you're interested in screening for "Compounding Machine" ideas, I'd start with the following criteria:

- Market Cap >$100m, <$10b

- ROE >15% (ideally, screen for average five year ROE >15%)

- Payout ratio <30%

- Book value per share growth >10% CAGR (5-10 year period)

- P/E ratio <20x or free cash flow yield > 5%

What did you think about the interview? Let me know in the comments section below or on Twitter.

Stay patient, stay focused.

Best,

Todd

@toddwenning on Twitter

- Buybacks Aren't Doing Much For Shareholders Right Now

"If everyone is doing (buybacks), there must be something wrong with them." - Henry Singleton, former Teledyne CEO (profiled in The Outsiders) With the exception of 2009, gross buybacks have outpaced dividends paid by U.S. companies each year since...

- Markel Brunch Notes

I spend most of my time in investing looking for excellent dividend growth opportunities. However, there are two exceptions to this. One is Berkshire Hathaway, why should investors want a dividend from a company that has Warren and Charlie reinvesting...

- Three Wise Men On Quality Income Investing

Charlie Munger is a guy who knows how to get to the point. I came to investing for dividends via value investing. It took me a long time to appreciate what the important differences are. Charlie Munger managed to sum it up in on paragraph: "If you buy...

- High Yield Reads - 5/17/14

Summary of recents posts and pieces of interest, sometimes enduring, to investors: Consuelo Mack interviews Chuck Akre on the importance of compounding. He uses Markel as a case study. More compounding machines: Base Hit Investor mines the intersection...

- Lake Wobegon Investing

"Some luck lies in not getting what you thought you wanted but getting what you have, which once you have got it you may be smart enough to see is what you would have wanted had you known." - Garrison Keillor Tim McAleenan points to a great interview...