Stock Check: CORR (Corenergy) The ugly turtle

Hello Reader

Like I promised, it is time to analyze Corenergy Infrastructure Trust, Inc. Thanks for reading this blog.

1) History

Corr is a unique stock. It began as a BDC with minority equity investment in energy infrastructure. Somewhere along the line it became the first of its kind energy infrastructure REIT. Meaning that no matter how much profit it makes, at least 90% must be distributed to shareholders.2) How does it make money?

If you don't know what a company does, you can't understand how it makes money. That's just common sense. What does Corr do? According to its website"CorEnergy primarily owns midstream and downstream U.S. energy infrastructure assets subject to long-term triple net participating leases with energy companies. These assets include pipelines, storage tanks, transmission lines and gathering systems. The Company’s principal objective is to provide stockholders with an attractive risk-adjusted total return, with an emphasis on distributions and long-term distribution growth."

In other words, other companies drill for oil. Unless you're a large MLP, Exxon, COP, or Chevron; you have no money to move oil/natural gas to market. Drilling for oil and gas makes a lot more money than moving it and refining it. But hiring a third party to refine and move eats a large portion of your profit. CORR provides an alternative. Go ahead and drill all you want. How about we let you use our midstream and downstream property in a triple net lease with you paying for our leases and maintenance on our pipelines?

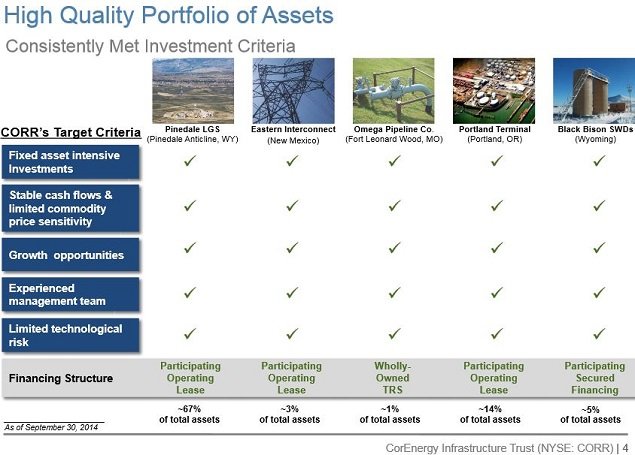

3) Property

OK, I understand how it makes money, just how much money will it make me? Let's take a look at Corr's properties. Note both pictures are from CORR website or its SEC filing.

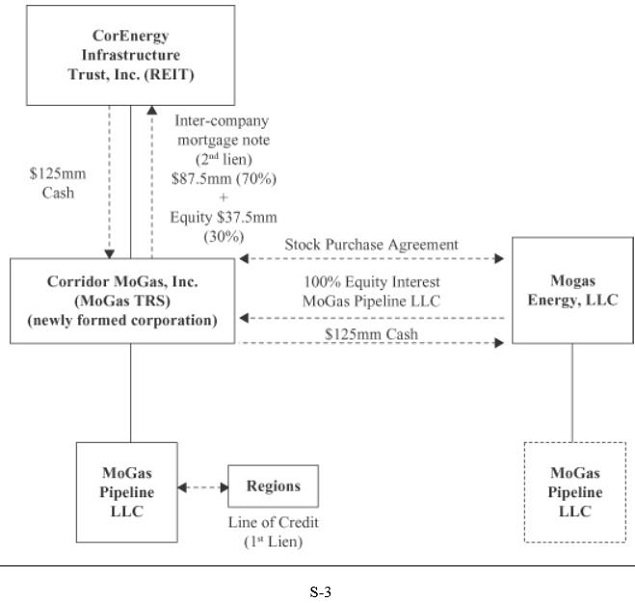

CORR has a market cap of $229 million with total assets of approximately $320~ish million. The MoGas acquisition is being purchased for $125 million dollar. In my opinion, there are plenty of assets to produce that sweet cash.

4) Dividends

Why should you invest in a reit? For the dividends. Let's take a look at Corr's sporadic dividend history. Link of NASDAQ HERE. It began playing great dividends as a BDC and slowly decreased upon becoming a REIT. It cut dividends in 2010 to buy business properties. Since 2010, it began increasing its dividend with the latest increase to $0.135 per quarter with an expected $0.54 per annual dividend. In 2014, Corr raised its dividend twice. This increase is the first dividend increase for 2015. If the MoGas acquisition merges seamlessly, I expect another increase in 2015. Probably to $0.139 or $0.14. Every dollar counts.5) Earnings-SHOW ME THE MONEY...or AFFO

| For the Three Months Ended | For the Nine Months Ended | |||||||||||||||

| September 30, 2014 | September 30, 2013 | September 30, 2014 | September 30, 2013 | |||||||||||||

| Weighted Average Shares | 31,641,851 | 24,151,700 | 31,090,370 | 24,147,163 | ||||||||||||

| FFO per share | $ | 0.16 | $ | 0.13 | $ | 0.46 | $ | 0.40 | ||||||||

| AFFO per share | $ | 0.16 | $ | 0.14 | $ | 0.44 | $ | 0.39 |

From Corr's SEC filings. As you can see, Mo money Mo FFO/AFFO. I wish we had more data but again, this is a relatively young REIT.

6) CEO, Board Members, and company's strategy.

CORR is externally managed. Wait say what? Who is it ran by? Oh, by Tortoise Capital the $18.7 billion dollar energy infrastructure investor. You can buy Tortoise stock as either CEFs, MLPs, etc. Too many confusing companies for me to go into. Just know that their motto is slow and steady wins the race. Their other stocks have proven that being slow isn't always a bad thing. If you don't believe me, look at their other stock dividends. Especially their CEF. You don't become a $18.7 company by pure luck.

CORR is the same. It's no crown winner. It's ugly and boring with an annual or biannual acquisition. It's small, slow, and ugly. My type of stock. With all the craziness in the world, it's nice to have a nice quiet reit we can rely upon not called O Realty Corp costing 45 dollars a share.

Conclusion:

CORR is a boring, slow, reliable stock. It will eventually make you rich (fingers crossed). It's relatively risky since it's the first of its kind and has a short history of existence. But I trust Tortoise to guide its future. I currently hold 190 shares in my taxable account. If you're not concerned with money now, a tax deferred account is always a great place to stick your REITs.

*I am not a professional lawyer, stock adviser, or any of those other people. I am an amateur. this is my amateur analysis. If you trust me without doing your own research, you must be insane.

If any CORR employee is reading this, remember to raise the dividends.

- Harris Corporation (hrs) Increases The Dividend

This morning Harris Corporation (HRS) announced an increase in the quarterly dividend. The payment increased from $0.42 to $0.47 or 11.9%. The new dividend rate is payable on September 23rd to shareholders of record as of September 9th. This...

- Loyal3 $500 Buy

In the past week I bought the following stocks in my Loyal3 account. Ticker $ invested Cost WalMart ...

- Recent Buy: 107 Shares Of Corr

On June 24, 2015, I bought 107 shares of Corenergy (CORR). 101 at $6.10 and I flipped 6 shares at $6.17. Rational 1) Corr has just reached an agreement to purchase all of EXXI Midstream and upstream facilities for $245 Million. 2) Corr will then lease...

- Roth Ira Buy: Wpc

On May 11, 2015, I added 15 shares of WPC at $63.99/share for a total of 966.85 into my ROTH IRA. My Roth IRA is now maxed out for 2015. This purchase increased by forward 12 month dividend by $57.15. If you haven't please read Dividend Mantra's...

- A Novice Analysis On Hasi

Hello Guys/Gals, I have been getting a lot of comments/emails about CORR and HASI. I wrote a novice analysis on Corr earlier in my blog and Brad Thomas recently wrote an interesting piece on Seeking Alpha HERE. I just wanted to take a second and talk...