Money and Finance

Hello Guys/Gals,

I have been getting a lot of comments/emails about CORR and HASI. I wrote a novice analysis on Corr earlier in my blog and Brad Thomas recently wrote an interesting piece on Seeking Alpha HERE.

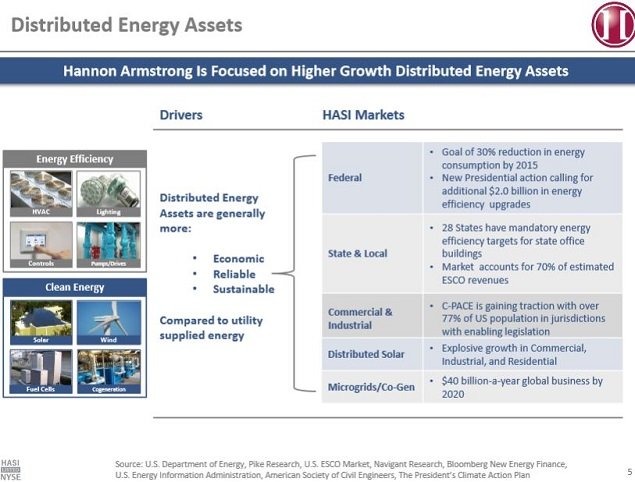

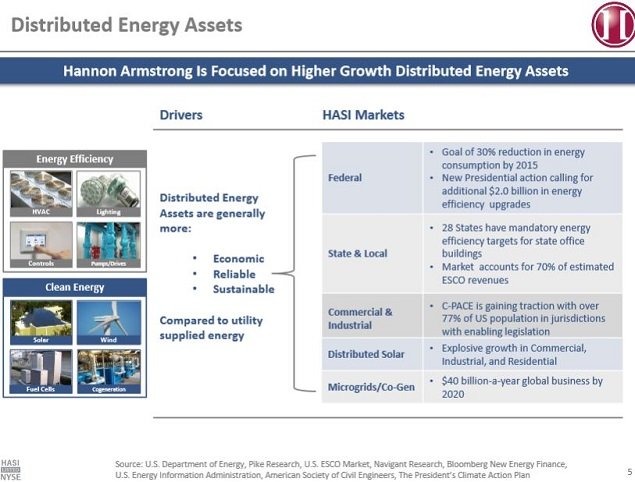

I just wanted to take a second and talk about my second REIT; Hannon Armstrong Sustainable Infrastructure (HASI). HASI is not Solyndra or a solar panel manufacturer. HASI is a reit that "makes debt and equity investments in profitable sustainable infrastructure projects that increase energy efficiency, provide cleaner energy or make more efficient use of natural resources." In other words; HASI is a bank. But for some reason many investors think HASI is an mreit (which it's not). HASI is more of a specialty Reit.

Their money making formula is as follows:

Buy land + put in renewable resources + sell the energy to places/people = profit.

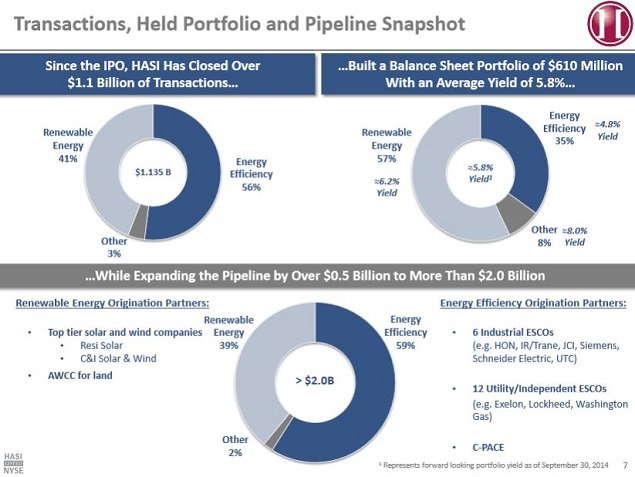

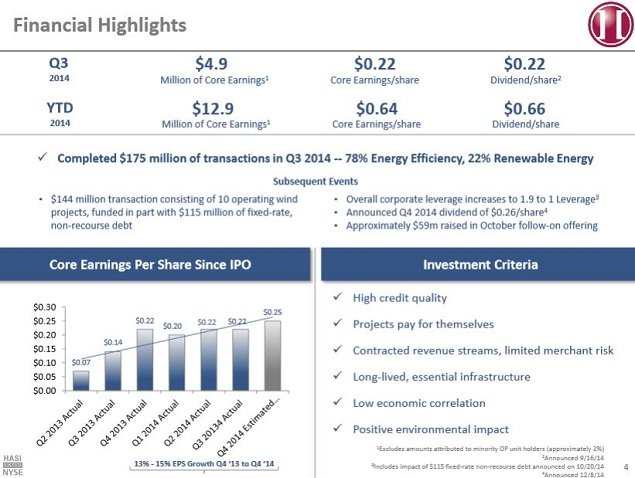

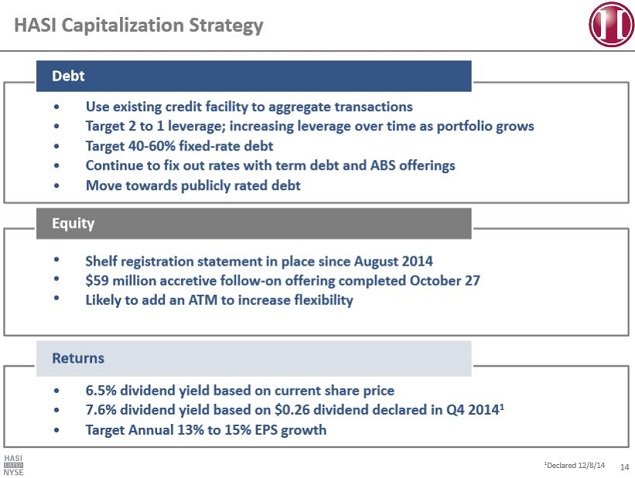

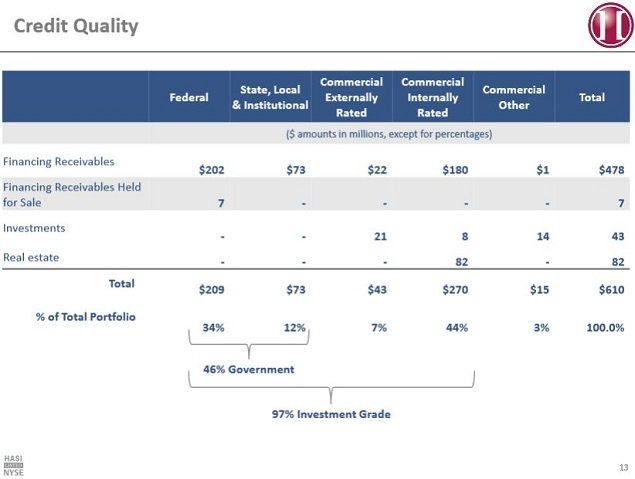

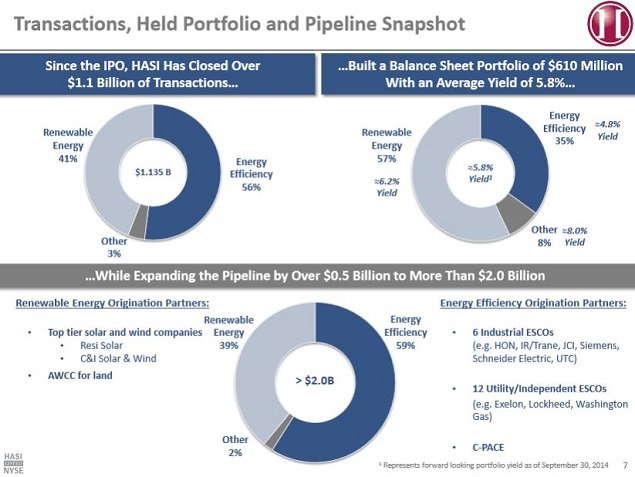

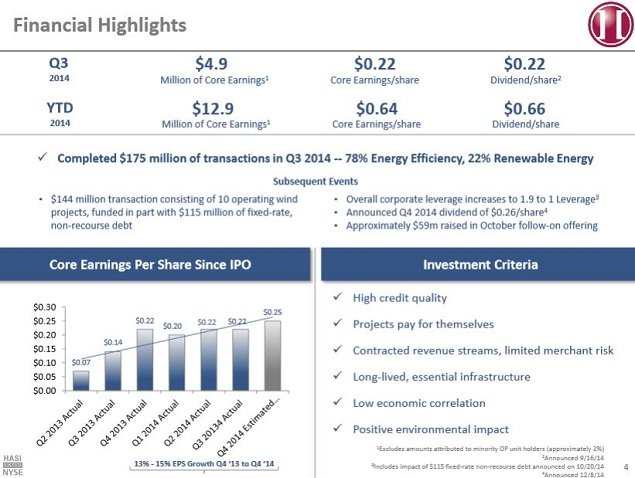

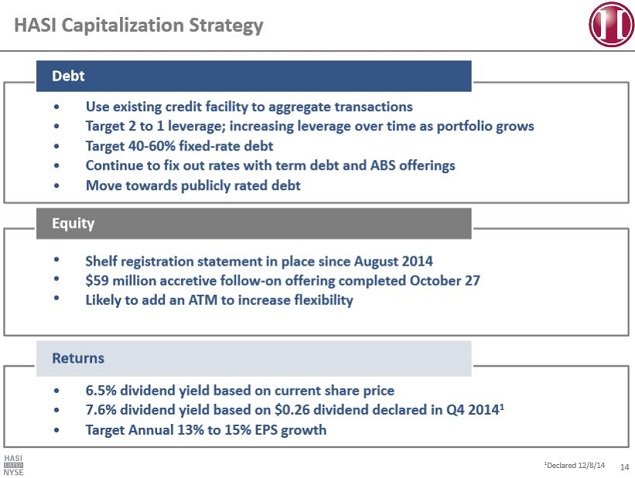

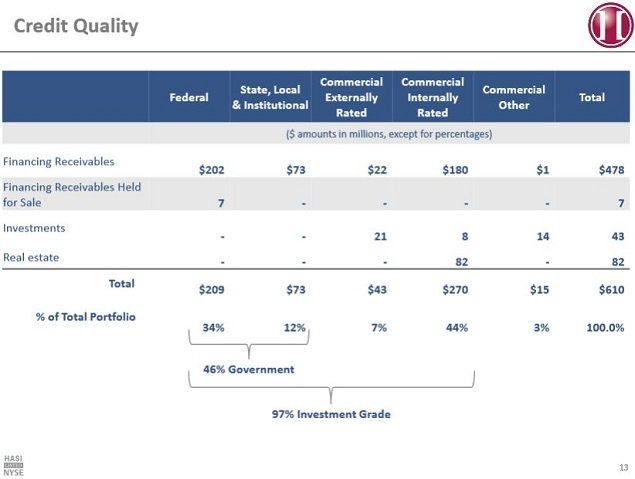

Lets look at their strategy. The attached pictures were taken from HASI presentation at the Wells Fargo Energy symposium.

Conclusion

TBDI, you just gave me a bunch of data but what does any of this mean? I'm glad you asked random reader.

Pro:

1) high risk high reward.

2) Management has 30+ years of running renewable energy companies.

3) Management has clear goals and means of achieving their goals.

4) Dividend friendly management.

5) Relatively increasing EPS except for Q1 2014.

Con:

1) HASI is a relatively new company with a sustainable plan...but it is very speculative.

2) Renewable energy stocks suffer from shorts and lack long term investors.

3) Low oil prices will decrease HASI market price.

4) High leverage. 2:1 ratio. If management fails to meet expectations, dividends WILL be cut.

5) Suffers from interest hike fears. Investors treat HASI as an mreit.

I currently 41 shares of HASI or 2% of my portfolio. I will eventually own 50 shares total.

If you are interested in owning or shorting HASI, the fair market value is $13.60; low $13.50; and high $15.00.

Disclaimer: I am not a financial broker, planner, lawyer, adviser, etc. LONG HASI.

Below is a copy of HASI revenue. I'm still learning excel.

- Roth Ira Buy: Wpc

On May 11, 2015, I added 15 shares of WPC at $63.99/share for a total of 966.85 into my ROTH IRA. My Roth IRA is now maxed out for 2015. This purchase increased by forward 12 month dividend by $57.15. If you haven't please read Dividend Mantra's...

- Flip-hasi

Crazy day. 335 points down but HASI WENT UP!!!! I bought 3 shares of HASI at $17.84 for a total of $53.32. My 27th paycheck increased by $3.12. A majority of dividend investor invest in "sin stocks" like MO, PM, LMT, etc. I like investing in "get out...

- Flip Buy And New Investment Strategies

Good news! I bought another share of GE at $24.56. This increases my forward annual dividend by $0.92. This brings my total share of GE to 49. One more share and I'll be satisfied. I also bought another share of HASI at $13.89. This increases my forward...

- Dividend Increase: Hasi

Good News Everybody, From Seeking Alpha Hannon Armstrong (NYSE:HASI) declares $0.26/share quarterly dividend, 18.2% increase from prior dividend of $0.22.Forward yield 7.70%Payable Jan 9; for shareholders of record Dec. 19; ex-div...

- November Dividend

Hello Reader(s), Time to report my November Dividend since everybody else is doing it. DE 10.20T 13.34AAPL 1.41ARCP 12.58KMI 9.24TIS 5.25LTC 3.57CORR 15.21Total:...

Money and Finance

A novice analysis on HASI

Hello Guys/Gals,

I have been getting a lot of comments/emails about CORR and HASI. I wrote a novice analysis on Corr earlier in my blog and Brad Thomas recently wrote an interesting piece on Seeking Alpha HERE.

I just wanted to take a second and talk about my second REIT; Hannon Armstrong Sustainable Infrastructure (HASI). HASI is not Solyndra or a solar panel manufacturer. HASI is a reit that "makes debt and equity investments in profitable sustainable infrastructure projects that increase energy efficiency, provide cleaner energy or make more efficient use of natural resources." In other words; HASI is a bank. But for some reason many investors think HASI is an mreit (which it's not). HASI is more of a specialty Reit.

Their money making formula is as follows:

Buy land + put in renewable resources + sell the energy to places/people = profit.

Lets look at their strategy. The attached pictures were taken from HASI presentation at the Wells Fargo Energy symposium.

Conclusion

TBDI, you just gave me a bunch of data but what does any of this mean? I'm glad you asked random reader.

Pro:

1) high risk high reward.

2) Management has 30+ years of running renewable energy companies.

3) Management has clear goals and means of achieving their goals.

4) Dividend friendly management.

5) Relatively increasing EPS except for Q1 2014.

Con:

1) HASI is a relatively new company with a sustainable plan...but it is very speculative.

2) Renewable energy stocks suffer from shorts and lack long term investors.

3) Low oil prices will decrease HASI market price.

4) High leverage. 2:1 ratio. If management fails to meet expectations, dividends WILL be cut.

5) Suffers from interest hike fears. Investors treat HASI as an mreit.

I currently 41 shares of HASI or 2% of my portfolio. I will eventually own 50 shares total.

If you are interested in owning or shorting HASI, the fair market value is $13.60; low $13.50; and high $15.00.

Disclaimer: I am not a financial broker, planner, lawyer, adviser, etc. LONG HASI.

Below is a copy of HASI revenue. I'm still learning excel.

- Roth Ira Buy: Wpc

On May 11, 2015, I added 15 shares of WPC at $63.99/share for a total of 966.85 into my ROTH IRA. My Roth IRA is now maxed out for 2015. This purchase increased by forward 12 month dividend by $57.15. If you haven't please read Dividend Mantra's...

- Flip-hasi

Crazy day. 335 points down but HASI WENT UP!!!! I bought 3 shares of HASI at $17.84 for a total of $53.32. My 27th paycheck increased by $3.12. A majority of dividend investor invest in "sin stocks" like MO, PM, LMT, etc. I like investing in "get out...

- Flip Buy And New Investment Strategies

Good news! I bought another share of GE at $24.56. This increases my forward annual dividend by $0.92. This brings my total share of GE to 49. One more share and I'll be satisfied. I also bought another share of HASI at $13.89. This increases my forward...

- Dividend Increase: Hasi

Good News Everybody, From Seeking Alpha Hannon Armstrong (NYSE:HASI) declares $0.26/share quarterly dividend, 18.2% increase from prior dividend of $0.22.Forward yield 7.70%Payable Jan 9; for shareholders of record Dec. 19; ex-div...

- November Dividend

Hello Reader(s), Time to report my November Dividend since everybody else is doing it. DE 10.20T 13.34AAPL 1.41ARCP 12.58KMI 9.24TIS 5.25LTC 3.57CORR 15.21Total:...