Money and Finance

So, my previous post was about whether or not you were ready to open a joint account with your special someone.

Let's say you are ready. How then shall you proceed?

Let's find out :) I'll take you through the basic steps, and let you know what you need to have with you. It's really quite straightforward!

Firstly, you do not need to bring a set amount of cash with you to open an account. Here I'm assuming you prefer to open an account with POSB as their minimum amount is $500 and DBS is $1000.

A fall below fee of $2 per month is imposed on you if your average daily balance < S$500 / S$1000!

The fall below fee is waived for customers up to 21 years old or 62 years old and above :)

So you have to make your way down to any POSB Branch with your Identity Card (IC) and your partner! Note that you both need to be of legal age!

For me, I opened a Joint-Alternate account under POSB eSavings which comes with a debit card each for yourself and your partner, complete with internet banking services.

You will of course, have the option of opening a Joint Alternate (Means that both you and your partner can make any transaction /withdrawal etc) or Joint All (Means both you and your partner need to make a trip down to make any transaction) which would be a safer choice if you don't entirely believe in the need for either one of you to make any transaction etc etc.

Once you decided, it's pretty little work on your part. Key in your preferred PIN number for your debit cards, you can have different PIN numbers, no problem!

- Life Goes On In The World's Most Expensive Country

Hello everyone, it's been quite some time since my last post. Have been catching up with my studies, going for army check-ups and everything else that goes on in a life of a polytechnic student. I recently received an email from Hady, who found...

- Get A Free Taxi Ride- On Me.

Hello Readers, How often do you get to have a free taxi ride in Singapore? Doubtless, not a lot of times. Uber is the newest taxi app on the blog, in the ever increasing successful attempts to get a cab any time you need one. Instead of calling 6 different...

- How Much Do You Need To Save For A Decent Wedding In Singapore?

In my previous blogpost I talked about having a plan in mind as you begin planning and saving for the future. For my future, marriage is definitely one of the main points in my life. http://teenageinvesting.blogspot.sg/2014/09/is-having-no-money-really-reason-not-to.html...

- Why Every Singaporean Should Have An Emergency Fund ; Especially Teenagers.

Emergency Funds.... what are they? Why should we have them? Many reasons. In the basic sense of the word, Emergency Funds are for emergencies. Let's say, you currently only have your savings. And suddenly, an unexpected expense occurs. Maybe you got...

- Saving During Your Growing Years

Everyone wants to be rich, don't they? This is especially true in Singapore, where the gap between the upper and middle class are increasingly widening and the costs of living are absurdly high. Everyone wants money. Some are content with having enough,...

Money and Finance

Steps to Opening Your Own Joint Account!

So, my previous post was about whether or not you were ready to open a joint account with your special someone.

Let's say you are ready. How then shall you proceed?

Let's find out :) I'll take you through the basic steps, and let you know what you need to have with you. It's really quite straightforward!

Firstly, you do not need to bring a set amount of cash with you to open an account. Here I'm assuming you prefer to open an account with POSB as their minimum amount is $500 and DBS is $1000.

A fall below fee of $2 per month is imposed on you if your average daily balance < S$500 / S$1000!

The fall below fee is waived for customers up to 21 years old or 62 years old and above :)

So you have to make your way down to any POSB Branch with your Identity Card (IC) and your partner! Note that you both need to be of legal age!

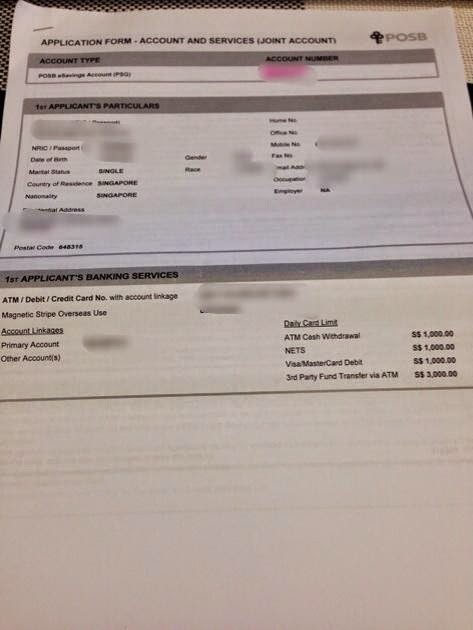

For me, I opened a Joint-Alternate account under POSB eSavings which comes with a debit card each for yourself and your partner, complete with internet banking services.

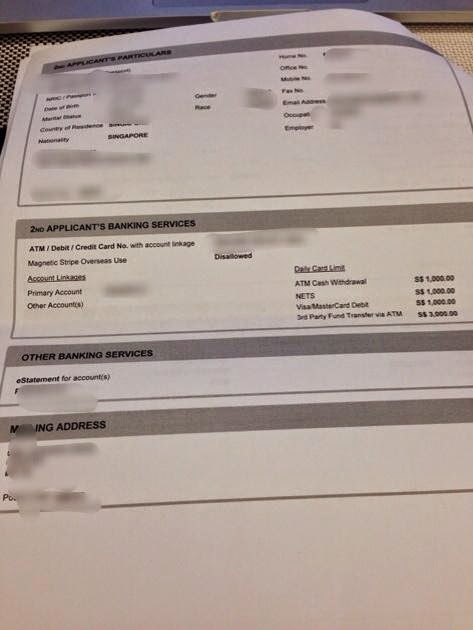

The POSB staff gave us one VISA and one MASTERCARD so that we would have a mix haha.

You will of course, have the option of opening a Joint Alternate (Means that both you and your partner can make any transaction /withdrawal etc) or Joint All (Means both you and your partner need to make a trip down to make any transaction) which would be a safer choice if you don't entirely believe in the need for either one of you to make any transaction etc etc.

Once you decided, it's pretty little work on your part. Key in your preferred PIN number for your debit cards, you can have different PIN numbers, no problem!

Details of the 1st Applicant

Details of the 2nd Applicant

After that, verify your details for one last time, both of you need to sign a form and that's it!

Your Joint Account and Debit Cards are now activated. You can proceed to transfer funds into your new account :)

You can use your individual Banking device no problem :) You'll see your new account in your iBanking account.

Aaaaaand that's it! Congratulations! Let me know if any of you have any questions!

Signing off,

Teenage Investor

- Life Goes On In The World's Most Expensive Country

Hello everyone, it's been quite some time since my last post. Have been catching up with my studies, going for army check-ups and everything else that goes on in a life of a polytechnic student. I recently received an email from Hady, who found...

- Get A Free Taxi Ride- On Me.

Hello Readers, How often do you get to have a free taxi ride in Singapore? Doubtless, not a lot of times. Uber is the newest taxi app on the blog, in the ever increasing successful attempts to get a cab any time you need one. Instead of calling 6 different...

- How Much Do You Need To Save For A Decent Wedding In Singapore?

In my previous blogpost I talked about having a plan in mind as you begin planning and saving for the future. For my future, marriage is definitely one of the main points in my life. http://teenageinvesting.blogspot.sg/2014/09/is-having-no-money-really-reason-not-to.html...

- Why Every Singaporean Should Have An Emergency Fund ; Especially Teenagers.

Emergency Funds.... what are they? Why should we have them? Many reasons. In the basic sense of the word, Emergency Funds are for emergencies. Let's say, you currently only have your savings. And suddenly, an unexpected expense occurs. Maybe you got...

- Saving During Your Growing Years

Everyone wants to be rich, don't they? This is especially true in Singapore, where the gap between the upper and middle class are increasingly widening and the costs of living are absurdly high. Everyone wants money. Some are content with having enough,...