Money and Finance

On Monday July 20, 2015, I added 16 shares of Ventas at $64.00/share to my taxable account. I'm doubling down on my earlier conviction.

- Harris Corporation (hrs) Increases The Dividend

This morning Harris Corporation (HRS) announced an increase in the quarterly dividend. The payment increased from $0.42 to $0.47 or 11.9%. The new dividend rate is payable on September 23rd to shareholders of record as of September 9th. This...

- Loyal3 $500 Buy

In the past week I bought the following stocks in my Loyal3 account. Ticker $ invested Cost WalMart ...

- Mini Buy: Ventas

I bought 10 shares of Ventas this morning at 65.17/share for a total of $658.70. This is my initial position with VTR and will be looking to buy more as the market goes down. I wish I had more cash but my employer has been cutting overtime. My...

- Recent Buy - Omega Healthcare Investors (ohi)

Hi Everyone, The buys keep coming! It's been a real busy start to the year and things are not slowing down. I just got a raise at work, my wife is getting a new job that could potentially earn us a fair bit more money and we recently...

- Snh - Senior Housing Properties - Added To My Watch List

I was reading my fellow investors blogs and noticed this stock on My Dividend Pipeline watch list. SNH - Senior Housing Properties. What I like/dislike about this stock 1. it's a REIT and gives a nice yield of 6.5%. 2. This company owns...

Money and Finance

Recent Buy: Ventas

Rationale:

1) here is Roadmap2retire's article on seeking alpha article

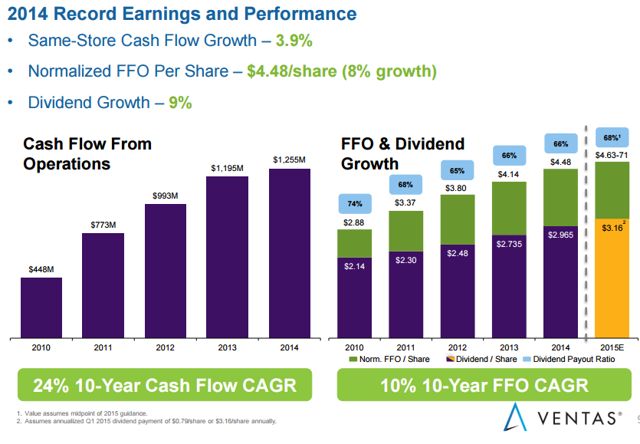

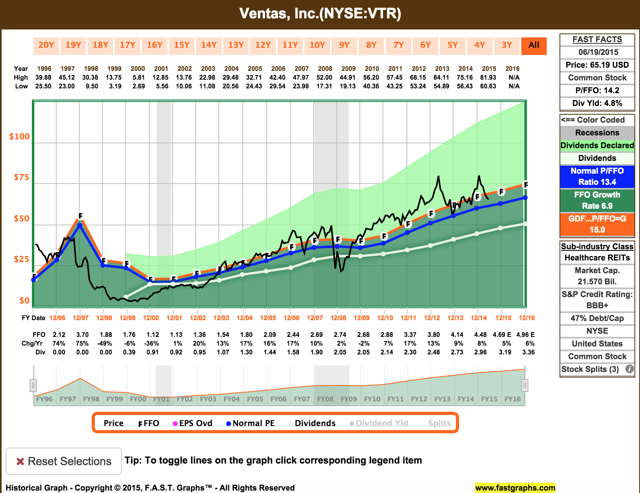

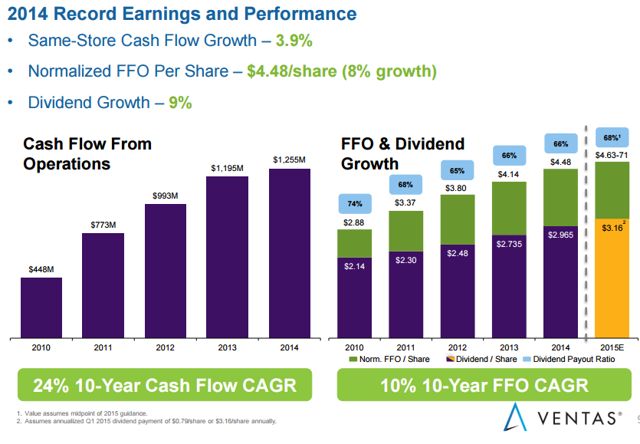

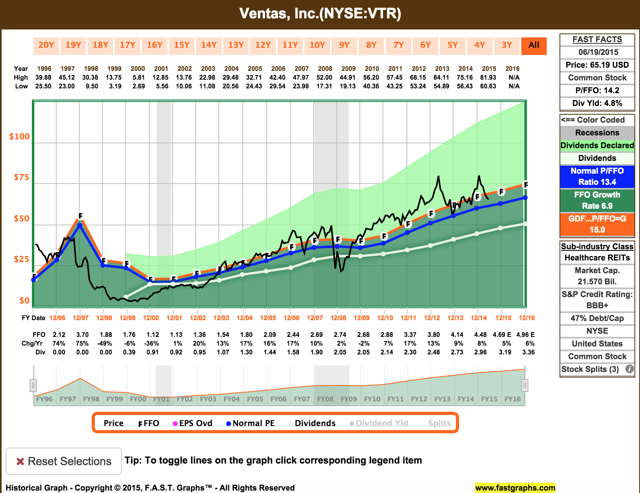

2) Constant FFO growth, constant dividend growth, and the payout ratio is actually going down.

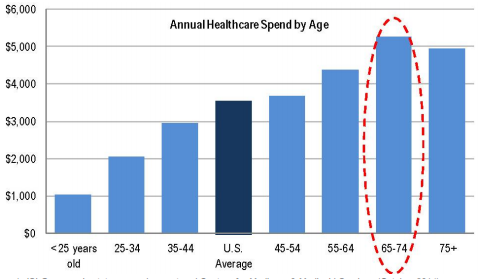

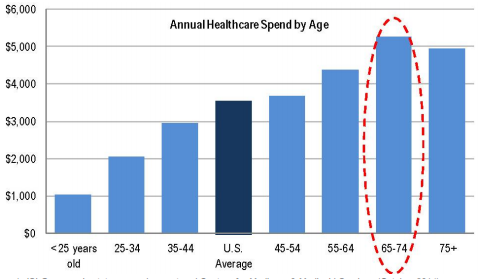

3) Increasing Healthcare cost

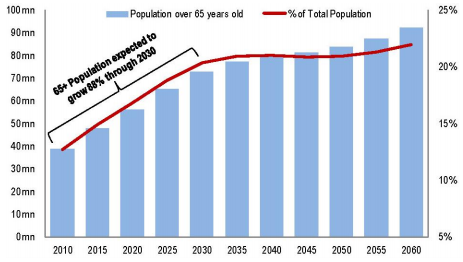

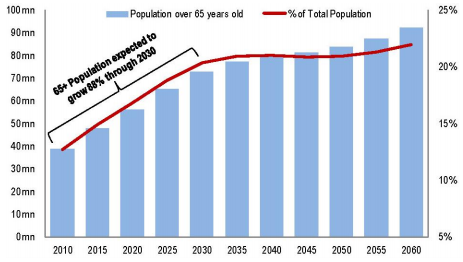

4) Increasing aging population

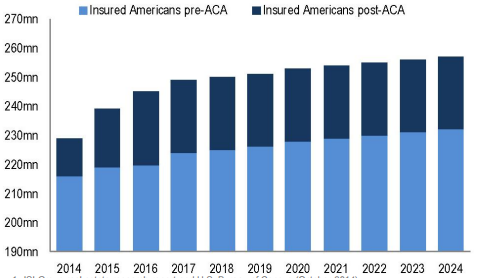

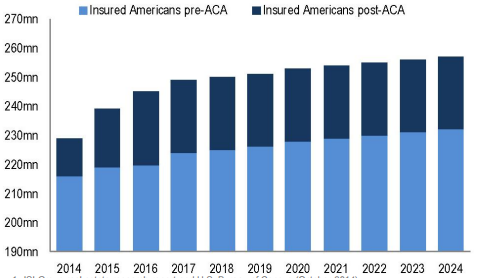

5) Increasing number of insured people under the ACA.

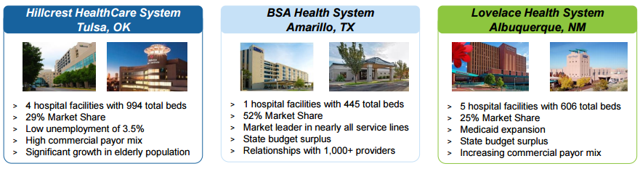

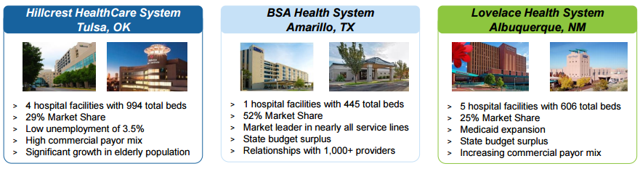

6) But I am more interested in their Hospital assets. Many of my co-workers have stated that their doctors are doubling or sometime tripling their appointments. Meaning 2-3 people are scheduled for the same doctor at the same time. After Ardent, I see Ventas making further move in the hospital business. I believe a bubble will be created from the elderly care sector. Once all the boomers are gone, will the OHI, LTC, etc's facilities be replenished with generation X? Will there be that many gen X to fill up all the facilities? I don't know. It's nice to have diversification and not have all your eggs in one basket.

7) Spinoff. Ventas is spinning off its skilled nursing facilities. I had an interesting talk with a few boomers co-workers the other day. Some have 401ks and pensions to live off but many do not. I asked them how they will survive after 65. Many said they were going to fake illnesses or dementia to enter long term care or skilled nursing facilities. Apparently, medicare will cover these two and will also cover senior housing if staying at a senior housing was due to some medical sickness. I'm not going to argue the ethics of this but their plans do work...Ventas is going to have a huge tailwind.

8) Fundamentals

- Debt to total cap: 32%

- 10 year annual growth of 9% (note VTR froze dividends during the 08-09 meltdown but did not cut dividends)

- Since 199, CAGR 29%

- 10% FFO growth since 2000.

- Est 5% FFO growth in 2005 + 10% dividend growth after spinoff.

- Dividend payout ratio of 67%

- Currently trading at fair value

I consider their buy to be a "full" position in VTR. I won't make any more buys the rest of the year unless something drastic happens. My forward 12 months dividend stands at $1,821.99 + FCISX dividends.

My next buy will be in 2-3 weeks. I'm looking to load up on some consumer staples like ADM, KO, PEP, PM, MO, HSY, etc. Or I might just make a loyal3 buy. Let's hope for more volatility until then.

- Harris Corporation (hrs) Increases The Dividend

This morning Harris Corporation (HRS) announced an increase in the quarterly dividend. The payment increased from $0.42 to $0.47 or 11.9%. The new dividend rate is payable on September 23rd to shareholders of record as of September 9th. This...

- Loyal3 $500 Buy

In the past week I bought the following stocks in my Loyal3 account. Ticker $ invested Cost WalMart ...

- Mini Buy: Ventas

I bought 10 shares of Ventas this morning at 65.17/share for a total of $658.70. This is my initial position with VTR and will be looking to buy more as the market goes down. I wish I had more cash but my employer has been cutting overtime. My...

- Recent Buy - Omega Healthcare Investors (ohi)

Hi Everyone, The buys keep coming! It's been a real busy start to the year and things are not slowing down. I just got a raise at work, my wife is getting a new job that could potentially earn us a fair bit more money and we recently...

- Snh - Senior Housing Properties - Added To My Watch List

I was reading my fellow investors blogs and noticed this stock on My Dividend Pipeline watch list. SNH - Senior Housing Properties. What I like/dislike about this stock 1. it's a REIT and gives a nice yield of 6.5%. 2. This company owns...