Money and Finance

Hi Everyone,

Hi Everyone,

- Recent Buy - 3m Company (mmm)

Hi Everyone, My wife and I continue to be blessed with the way this year has shaped up. Personally, these buy posts make me hungrier than ever to keep saving, keep making money and keep investing. The income that we are starting to make every...

- Recent Buys - W. P. Carey (wpc) & Omega Healthcare Investors (ohi)

Hi Everyone, I have been a little MIA the past couple of weeks but this summer has been extremely busy. Wedding season continues to be in full swing, lounging by the pool, playing golf (I know, not very frugal), working my butt off and overall just...

- Recent Buy - Parker-hannifin Corp.

Hi Everyone, I fell behind a little bit with getting this post out, but its been a busy couple weeks. This purchase actually occurred on June 6th. It looks as if I'll make another purchase here pretty quickly because of the RAI/LO merger....

- Recent Buy - Digital Realty Trust, Inc (dlr)

Hi Everyone, Well, like I said with the last recent buy post, things have slowed down a bit, but this month my wife and I have now managed to purchase 2 fine companies! A third purchase may come soon after this one, so stay tuned. The student...

- Recent Buy - Johnson & Johnson (jnj)

Hi Everyone, Finally, my last purchase with funds left over from last year. I'm having mixed emotions thinking about writing this post. I'm thrilled to add more income to the portfolio but I'm fresh out of extra capital to invest...

Money and Finance

Recent Buy - Omega Healthcare Investors (OHI)

The buys keep coming! It's been a real busy start to the year and things are not slowing down. I just got a raise at work, my wife is getting a new job that could potentially earn us a fair bit more money and we recently paid off the last of my student loans. With all this movement with regards to our finances, we are still saving a good bit of money to invest and hopefully we'll be able to up our investing a bit more! With this purchase, my wife and I have put a total of around $20,000 to work since the beginning of 2015. My goal of investing roughly $40,000 is within sight! To think that we are half way to our total is a great feeling since we are just 3 months into the year. The market continues to stay at elevated levels but there was some recent weakness in REIT's because of the anticipation of rising interest rates. Well, the Fed did not raise the rates but it gave us an opportunity to buy at lower prices. With that being said, my next purchase was Omega Healthcare Investors (OHI) so without further adieu...

I purchased 51 shares of Omega Healthcare (OHI) at $39.99. This purchase adds $110.16 of annual dividends to my account.

I now own 101.651 shares of Omega Healthcare as this was an addition to a previous position which means I am still invested in 33 individual companies. I may add to this position in the future, or I might just let the position compound for years to come, either way I'm happy. Forward dividends now stand at around $3,893.98 for the next 12 months. The portfolio will be updated to reflect this purchase.

From Google Finance: Omega Healthcare Investors, Inc. (Omega) is a self-administered real estate investment trust (REIT). The Company invests in income producing healthcare facilities, long-term care facilities located throughout the United States. The Company provides lease or mortgage financing to qualified operators of skilled nursing facilities (SNFs) and assisted living facilities (ALFs), independent living facilities and rehabilitation and acute care facilities. The Company maintains a portfolio of long-term healthcare facilities and mortgages on healthcare facilities located throughout the United States. The Company’s investments are operated by a diverse group of established, middle-market healthcare operators.

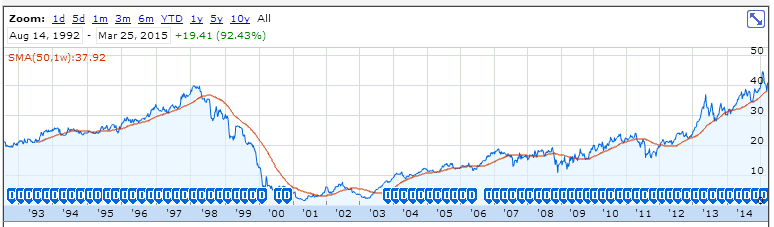

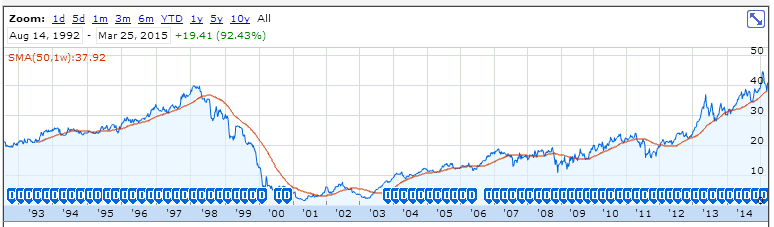

OHI Chart:

Statistics:

P/E: 14 (based on FFO of 2.85)

Yield: 5.35%

Market Cap: 5.65B

Dividend Growth Rate: 7.5%

Payout Ratio: 76% of FFO

Years of Dividend Growth: 5 years

Omega has been a great investment over the past 11 years. There was barely even a blip in the chart during the 2008-2009 recession which is a relief when thinking about the future. They are becoming a notorious quarterly dividend raiser as they are on the 12 straight quarter of raising their dividend. Do not be alarmed when you see the .36 payout that is scheduled for the 27th because they are merging with Aviv and there will be another payout of .18 next month to equal .54. Which is .01 above last quarter.

I really wanted to purchase UHT to diversify a little bit more but I did not have the funds ready and since that time, the stock has taken off. I was going to get in right before their ex-dividend date, but ohh well. Since I missed UHT, I looked at OHI and the stock has not rallied nearly as much as some of the other REIT's after the decision by the Fed not to raise rates so I pulled the trigger. The merger is expected to be accretive to earnings and also opens up OHI into new markets/states that they did not have business in before. A win win.

You can check out all the other purchases I have made for the year on my Stock Purchases and Sells page.

I really wanted to purchase UHT to diversify a little bit more but I did not have the funds ready and since that time, the stock has taken off. I was going to get in right before their ex-dividend date, but ohh well. Since I missed UHT, I looked at OHI and the stock has not rallied nearly as much as some of the other REIT's after the decision by the Fed not to raise rates so I pulled the trigger. The merger is expected to be accretive to earnings and also opens up OHI into new markets/states that they did not have business in before. A win win.

You can check out all the other purchases I have made for the year on my Stock Purchases and Sells page.

So there you have it, the next building block on the path to the American Dividend Dream! What do you think, good purchase, bad purchase? What are you looking to buy next?

- Recent Buy - 3m Company (mmm)

Hi Everyone, My wife and I continue to be blessed with the way this year has shaped up. Personally, these buy posts make me hungrier than ever to keep saving, keep making money and keep investing. The income that we are starting to make every...

- Recent Buys - W. P. Carey (wpc) & Omega Healthcare Investors (ohi)

Hi Everyone, I have been a little MIA the past couple of weeks but this summer has been extremely busy. Wedding season continues to be in full swing, lounging by the pool, playing golf (I know, not very frugal), working my butt off and overall just...

- Recent Buy - Parker-hannifin Corp.

Hi Everyone, I fell behind a little bit with getting this post out, but its been a busy couple weeks. This purchase actually occurred on June 6th. It looks as if I'll make another purchase here pretty quickly because of the RAI/LO merger....

- Recent Buy - Digital Realty Trust, Inc (dlr)

Hi Everyone, Well, like I said with the last recent buy post, things have slowed down a bit, but this month my wife and I have now managed to purchase 2 fine companies! A third purchase may come soon after this one, so stay tuned. The student...

- Recent Buy - Johnson & Johnson (jnj)

Hi Everyone, Finally, my last purchase with funds left over from last year. I'm having mixed emotions thinking about writing this post. I'm thrilled to add more income to the portfolio but I'm fresh out of extra capital to invest...