Money and Finance

This week I purchased more Piedmont Natural Gas (PNY). Piedmont Natural Gas Company, Inc., an energy services company, engages in the distribution of natural gas to residential, commercial, industrial, and power generation customers in North Carolina, South Carolina, and Tennessee. It also operates energy-related businesses, including unregulated retail natural gas marketing, regulated interstate natural gas storage, and intrastate natural gas transportation.

This week I purchased more Piedmont Natural Gas (PNY). Piedmont Natural Gas Company, Inc., an energy services company, engages in the distribution of natural gas to residential, commercial, industrial, and power generation customers in North Carolina, South Carolina, and Tennessee. It also operates energy-related businesses, including unregulated retail natural gas marketing, regulated interstate natural gas storage, and intrastate natural gas transportation.

I used $1100 of new capital to purchase 32 more shares at $34.31 which added $38.44/year to my dividend income.

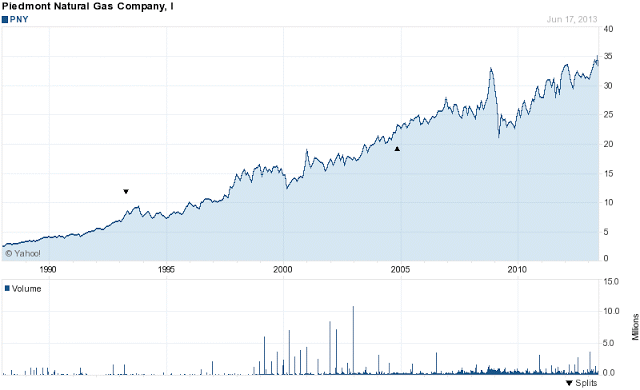

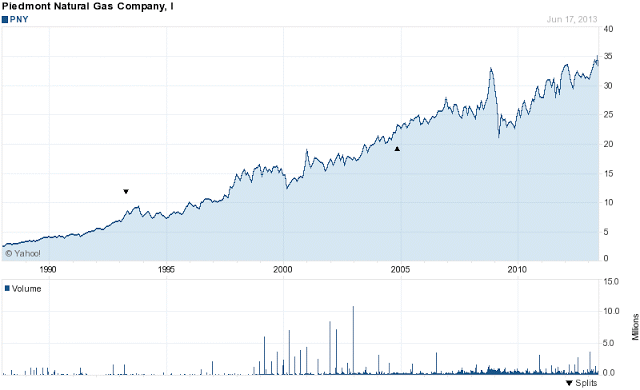

As you can see from the chart below PNY has been able to limit stock depreciation even during the last two recessions which is one reason I like PNY so much. I like to think of PNY as a defensive stock.

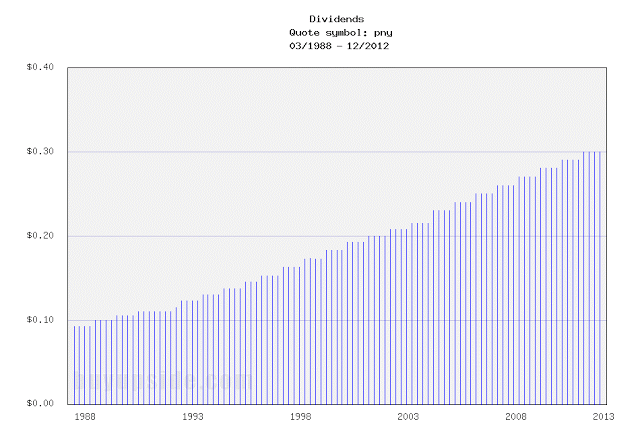

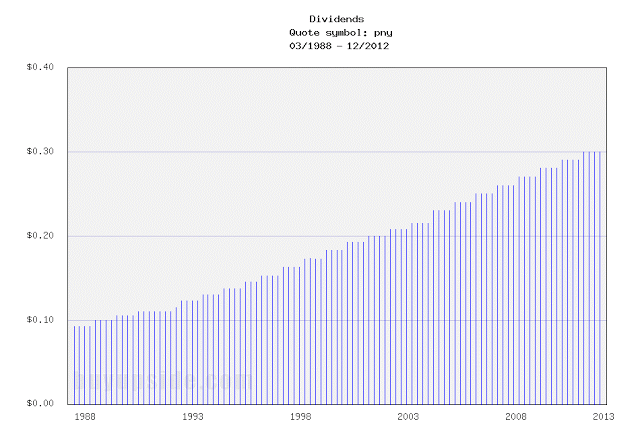

PNY currently has a P/E ratio of 17.87 with a 3.60% dividend yield and has a long tradition of consistent dividend growth although the growth is a bit lower than I like at just under 5% growth but that's not too shabby.

- Chevron Stock Analysis

As mentioned in my previous post, I'm going to try and have 1 stock analysis report for some popular dividend growth stocks come out prior to their latest earnings release this week. Today we'll look at Chevron Corporation (CVX). Chevron closed...

- Recent Buy - New Jersey Resources

This week I decided to switch some things around in the portfolio. Nothing too major but in the wake of the pending sale of Piedmont Natural Gas (PNY) to Duke energy (DUK) I decided to sell my stake in PNY. Shares jumped around 20% after the big news...

- Duke Energy Is Acquiring Piedmont Natural Gas (pny)

This morning I got word that one of my favorite dividend utilities is being purchased by Duke Energy. The deal which is a cash deal and is set to be completed by the end of the year for nearly $5 billion in cash. PNY shareholders are set...

- Recent Purchase - Piedmont Natural Gas (pny)

I think that most dividend investors try and seek out the most undervalued dividend stocks to add to their portfolios when the money becomes available. While I think that is a fantastic idea I'm a bit different in that I like to keep my payments balanced...

- Recent Buy - Wgl Holdings (wgl)

Today I added to my position in WGL Holdings (WGL). I purchased 26 shares at $42.50 which brings my total position to 66 shares. WGL has a dividend yield of 3.90% and has raised it's dividend for 37 years straight making WGL a dividend champion. ...

Money and Finance

Recent Buy - Piedmont Natural Gas (PNY)

I used $1100 of new capital to purchase 32 more shares at $34.31 which added $38.44/year to my dividend income.

As you can see from the chart below PNY has been able to limit stock depreciation even during the last two recessions which is one reason I like PNY so much. I like to think of PNY as a defensive stock.

PNY currently has a P/E ratio of 17.87 with a 3.60% dividend yield and has a long tradition of consistent dividend growth although the growth is a bit lower than I like at just under 5% growth but that's not too shabby.

- Chevron Stock Analysis

As mentioned in my previous post, I'm going to try and have 1 stock analysis report for some popular dividend growth stocks come out prior to their latest earnings release this week. Today we'll look at Chevron Corporation (CVX). Chevron closed...

- Recent Buy - New Jersey Resources

This week I decided to switch some things around in the portfolio. Nothing too major but in the wake of the pending sale of Piedmont Natural Gas (PNY) to Duke energy (DUK) I decided to sell my stake in PNY. Shares jumped around 20% after the big news...

- Duke Energy Is Acquiring Piedmont Natural Gas (pny)

This morning I got word that one of my favorite dividend utilities is being purchased by Duke Energy. The deal which is a cash deal and is set to be completed by the end of the year for nearly $5 billion in cash. PNY shareholders are set...

- Recent Purchase - Piedmont Natural Gas (pny)

I think that most dividend investors try and seek out the most undervalued dividend stocks to add to their portfolios when the money becomes available. While I think that is a fantastic idea I'm a bit different in that I like to keep my payments balanced...

- Recent Buy - Wgl Holdings (wgl)

Today I added to my position in WGL Holdings (WGL). I purchased 26 shares at $42.50 which brings my total position to 66 shares. WGL has a dividend yield of 3.90% and has raised it's dividend for 37 years straight making WGL a dividend champion. ...