Money and Finance

I've been looking around for another stock this past week as I knew I'd have the money to make another purchase. I wanted to buy a stock which pays in April so that limited my choices a bit. The first thing I look at are the names that I already own which might look attractive but I had a tough time finding anything that I thought was a screaming buy. Philip Morris (PM) is looking expensive as is Realty Income (O), there's still some value in Walmart (WMT) but the dividend growth has fell off. So I decided to look elsewhere and since I'm a bit light in the tech sector I looked into Cisco (CSCO).

I've been looking around for another stock this past week as I knew I'd have the money to make another purchase. I wanted to buy a stock which pays in April so that limited my choices a bit. The first thing I look at are the names that I already own which might look attractive but I had a tough time finding anything that I thought was a screaming buy. Philip Morris (PM) is looking expensive as is Realty Income (O), there's still some value in Walmart (WMT) but the dividend growth has fell off. So I decided to look elsewhere and since I'm a bit light in the tech sector I looked into Cisco (CSCO).

Cisco Systems designs, manufactures, and sells Internet Protocol (IP) based networking products and services related to the communications and information technology industry worldwide. While Cisco remains a leader in networking they continue to look forward to the future to ensure diversity of it's revenue sources. Cloud based computing and the Internet of Things (IoT) are now a major focus and Cisco has been busy making acquisitions to unlock this previously untapped market.

It's a shame I didn't consider CSCO a month ago when it was much cheaper but I think I made up for it with my Flowers Foods (FLO) purchase. Recently the company announced a 24% dividend increase and a $15 billion buyback. Cisco’s new dividend represents 35% of its free cash flow, so there should be plenty of room for future dividend growth. Assuming 10% dividend growth per year, Cisco’s annual payout will reach $1.52 per share by 2020, a 5.5% yield based on the current stock price.

I purchased 37 shares of Cisco @ $27.58

- Cisco Dividend Stock Analysis

I wanted to take a more in depth look at a company I've sold some puts on, Cisco (CSCO). Cisco is by no means a dividend champion, challenger, or even contender with only 2 years of increases, but the potential is there for rapid growth so I figured...

- Recent Option Transaction

I went ahead and sold another put option on Cisco (CSCO) this morning. This time it was a $21 strike expiring next Friday on May 18th. I sold the put for $0.55 and after commission and fees received $47.01 in option premium. Cisco was trading around...

- Think Sysco Not Cisco

Most investors today are veterans of the dotcom bubble, either they participated in it or stood by jaws gaping. Either way it had a big impact. Many people do not invest because they (rightly) think that its too hard to figure out who is the next Google,...

- Recent Buy - Walmart

Today I made another purchase as the markets took a beating. This time I picked up some more shares of retail giant Walmart (WMT). This allowed me to average down a bit. Sadly I was a couple weeks removed from the ex-dividend date so I'll miss next...

- Recent Purchase - Piedmont Natural Gas (pny)

I think that most dividend investors try and seek out the most undervalued dividend stocks to add to their portfolios when the money becomes available. While I think that is a fantastic idea I'm a bit different in that I like to keep my payments balanced...

Money and Finance

Recent Purchase - Cisco

Cisco Systems designs, manufactures, and sells Internet Protocol (IP) based networking products and services related to the communications and information technology industry worldwide. While Cisco remains a leader in networking they continue to look forward to the future to ensure diversity of it's revenue sources. Cloud based computing and the Internet of Things (IoT) are now a major focus and Cisco has been busy making acquisitions to unlock this previously untapped market.

It's a shame I didn't consider CSCO a month ago when it was much cheaper but I think I made up for it with my Flowers Foods (FLO) purchase. Recently the company announced a 24% dividend increase and a $15 billion buyback. Cisco’s new dividend represents 35% of its free cash flow, so there should be plenty of room for future dividend growth. Assuming 10% dividend growth per year, Cisco’s annual payout will reach $1.52 per share by 2020, a 5.5% yield based on the current stock price.

I purchased 37 shares of Cisco @ $27.58

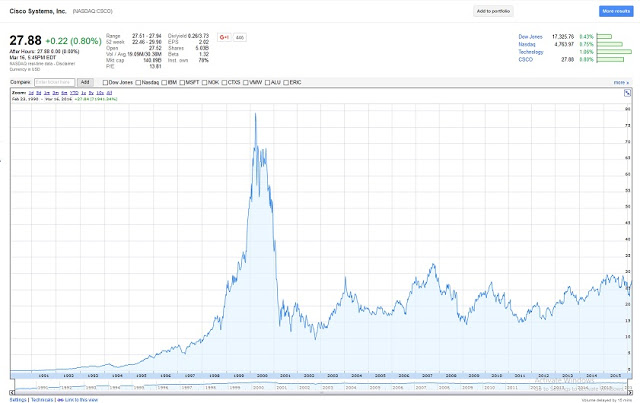

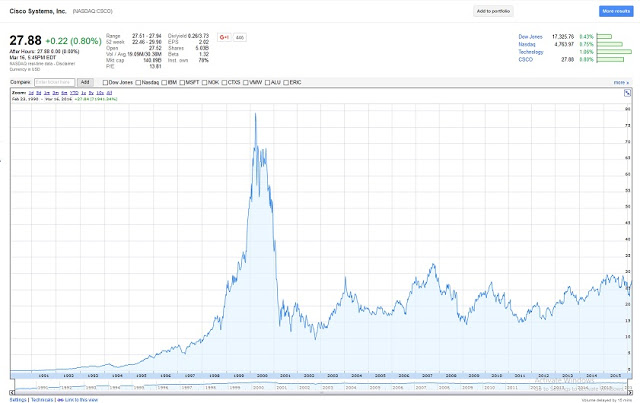

CSCO Stock Chart

CSCO Basic Statistics

- Ticker Symbol: CSCO

- Sector: Technology

- Yield: 3.8%

- Dividend Streak: 5 years

- Annualized Dividend Growth 3yr: 18%

- Payout Ratio: 42%

- P/E Ratio: 13.8

- Market cap:$140 Billion

- Website: http://www.cisco.com

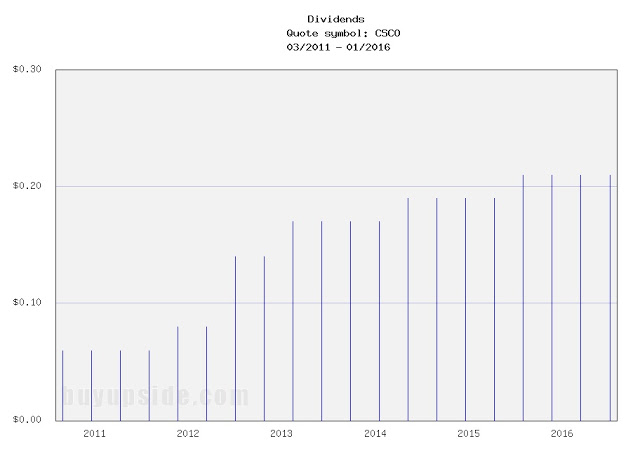

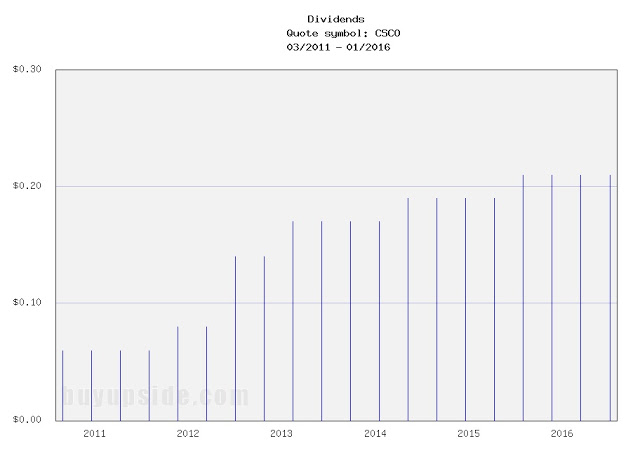

CSCO Dividend Growth Chart

- Cisco Dividend Stock Analysis

I wanted to take a more in depth look at a company I've sold some puts on, Cisco (CSCO). Cisco is by no means a dividend champion, challenger, or even contender with only 2 years of increases, but the potential is there for rapid growth so I figured...

- Recent Option Transaction

I went ahead and sold another put option on Cisco (CSCO) this morning. This time it was a $21 strike expiring next Friday on May 18th. I sold the put for $0.55 and after commission and fees received $47.01 in option premium. Cisco was trading around...

- Think Sysco Not Cisco

Most investors today are veterans of the dotcom bubble, either they participated in it or stood by jaws gaping. Either way it had a big impact. Many people do not invest because they (rightly) think that its too hard to figure out who is the next Google,...

- Recent Buy - Walmart

Today I made another purchase as the markets took a beating. This time I picked up some more shares of retail giant Walmart (WMT). This allowed me to average down a bit. Sadly I was a couple weeks removed from the ex-dividend date so I'll miss next...

- Recent Purchase - Piedmont Natural Gas (pny)

I think that most dividend investors try and seek out the most undervalued dividend stocks to add to their portfolios when the money becomes available. While I think that is a fantastic idea I'm a bit different in that I like to keep my payments balanced...