Money and Finance

Hi Everyone,

Hi Everyone,

- After The Run Up There's Still Double Digit Return Potential For Johnson & Johnson

When you think of some of the greatest companies in the world one name that is sure to come up is Johnson & Johnson (NYSE:JNJ). What's not to like about a company that has earned investors 8.0% annualized total returns over the last decade, 10.8%...

- Johnson & Johnson: Quality At A Reasonable Price

I mentioned in my annual dividend growth checkup that I was underweight the health care industry and was looking to increase my exposure there. I recently added shares of one health care giant, Becton, Dickinson & Company (NYSE:BDX) (Full...

- Dividend Growth Investing At Work: Johnson & Johnson (jnj) Gives Owners A 7.1% Increase

Quick update today as I sit at the hospital with Luke! But it's one that I love, especially since Luke is doing better than last week. I love hearing about dividend increases. Like absolutely love them. There's few things that I like...

- A Closer Look At Johnson & Johnson (jnj)

As a stock holder of many different companies I find myself checking through all kinds news and analysis on the internet. This week I thought I'd share a couple of items about the Dividend Aristocrat Johnson & Johnson. Some fellow dividend bloggers...

- Recent Buy - W. P. Carey Inc. (wpc)

Hi Everyone, Well, the year has slowed down a bit with regards to buys, but the savings account has been built back up after I used them all up to pay off the student loans so hopefully I can get back to putting more money to work. With this...

Money and Finance

Recent Buy - Johnson & Johnson (JNJ)

Finally, my last purchase with funds left over from last year. I'm having mixed emotions thinking about writing this post. I'm thrilled to add more income to the portfolio but I'm fresh out of extra capital to invest at the moment which is a bit saddening. With this purchase, my wife and I have put a total of around $18,000 to work since the beginning of 2015. My goal of investing roughly $40,000 is within sight! To think that we are almost half way to our total is a great feeling. I was also able to add most of this capital before the companies started paying out their 2015 dividends so our portfolio/income goals are much better off. I thought of holding out until the market pulled back in order to invest that much capital but I just couldn't do it. I'm not a fan of sitting on capital for too long at this point in my life. Plus, after watching the market continue to make new high after new high while the so called "experts" have been calling for a pullback for 4 years I figure screw it, get my money working for me! With that being said, my next purchase was Johnson & Johnson (JNJ) so without further adieu...

I purchased 21 shares of Johnson & Johnson (JNJ) at $99.15. This purchase adds $58.80 of annual dividends to my account.

I now own 42.422 shares of Johnson & Johnson as this was an addition to a previous position which means I am invested in 33 individual companies! I may add to this position in the future, or I might just let the position compound for years to come, either way I'm happy. Forward dividends now stand at around $3,740 for the next 12 months and I just happened to buy Johnson & Johnson before the ex-dividend date so I receive all of their payouts for the year. The portfolio will be updated to reflect this purchase.

From Google Finance: Johnson & Johnson is a holding company engaged in the research and development, manufacture and sale of a broad range of products in the health care field. The business of Johnson & Johnson is conducted by more than 275 operating companies located in 60 countries, including the United States, which sell products in virtually all countries throughout the world. The Company also provides therapeutics for viral infections with the compound AL-8176, an orally administered antiviral therapy currently in Phase 2 studies for the treatment of infants with respiratory syncytial virus (RSV). It also owns two early-stage compounds for hepatitis C (HCV). The Company’s primary focus has been on products related to human health and well-being. The Company is organized into three business segments: Consumer, Pharmaceutical and Medical Devices and Diagnostics. The Company's subsidiaries operate 146 manufacturing facilities occupying approximately 21.6 million square feet of floor space.

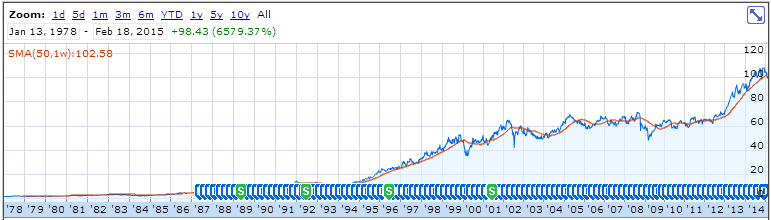

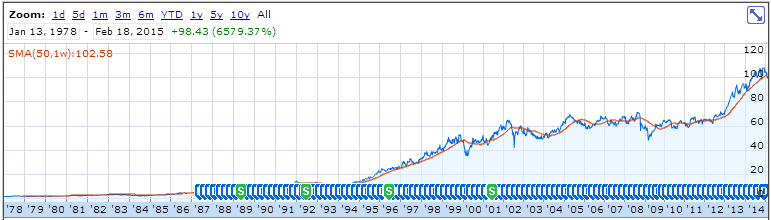

JNJ Chart:

Statistics:

P/E: 17.5

Yield: 2.81%

Market Cap: 279B

Dividend Growth Rate (5yr): 7.5%

Payout Ratio: 45%

Years of Dividend Growth: 52 years

Johnson and Johnson needs no introduction. They are a massive healthcare juggernaut and a rock solid company from a stock/investing point of view. What's not to like? I wanted to add to the healthcare portion of my portfolio more and the amount of companies I have is starting to get pretty large so I figured JNJ would be the best choice. The stock has pulled back roughly 10% from its highs, I was able to buy right before the ex-dividend date and the company has estimated EPS of $6.15 for 2015 which puts the forward PE at around 16. With the market continuing to set new highs, its rare that a company such and JNJ is priced cheaper than the overall market so I thought it was a safe pick.

You can check out all the other purchases I have made for the year on my Stock Purchases and Sells page.

You can check out all the other purchases I have made for the year on my Stock Purchases and Sells page.

So there you have it, the next building block on the path to the American Dividend Dream! What do you think, good purchase, bad purchase? What are you looking to buy next?

- After The Run Up There's Still Double Digit Return Potential For Johnson & Johnson

When you think of some of the greatest companies in the world one name that is sure to come up is Johnson & Johnson (NYSE:JNJ). What's not to like about a company that has earned investors 8.0% annualized total returns over the last decade, 10.8%...

- Johnson & Johnson: Quality At A Reasonable Price

I mentioned in my annual dividend growth checkup that I was underweight the health care industry and was looking to increase my exposure there. I recently added shares of one health care giant, Becton, Dickinson & Company (NYSE:BDX) (Full...

- Dividend Growth Investing At Work: Johnson & Johnson (jnj) Gives Owners A 7.1% Increase

Quick update today as I sit at the hospital with Luke! But it's one that I love, especially since Luke is doing better than last week. I love hearing about dividend increases. Like absolutely love them. There's few things that I like...

- A Closer Look At Johnson & Johnson (jnj)

As a stock holder of many different companies I find myself checking through all kinds news and analysis on the internet. This week I thought I'd share a couple of items about the Dividend Aristocrat Johnson & Johnson. Some fellow dividend bloggers...

- Recent Buy - W. P. Carey Inc. (wpc)

Hi Everyone, Well, the year has slowed down a bit with regards to buys, but the savings account has been built back up after I used them all up to pay off the student loans so hopefully I can get back to putting more money to work. With this...